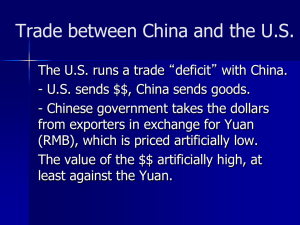

Exchange Rate and RMB Exchange Rate

advertisement