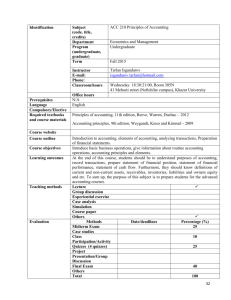

Financial Statements Financial Analysis Financial Planning

advertisement

Financial Planning and Forecasting Ing. Zuzana Čierna, PhD. Department of Finance SPU – FEM, Nitra 1 From an investor’s standpoint, predicting the future is what financial statement analysis is all about, while from management’s standpoint, financial statement analysis is useful both to help anticipate future conditions and, more important, as a starting point for planning actions that will improve the firm’s future performance. 2 Projected financial statements are used to estimate future free cash flows, which determine the company’s overall value. Thus, managers forecast free cash flows under different operating plans, forecast their capital requirements, and then choose the plan that maximizes shareholder value. Operating plans provide detailed implementation guidance, based on the corporate strategy, to help meet the corporate objectives. These plans can be developed for any time horizon. Financial plan – a document which involves current and future needs of funds and currently existing and expected future resources to cover. 3 • long-term financial plan • short-term financial plan Content of short-term FP - profit plan, - financial statement, - cash flow plan, - plan distribution of profit 4 Five-Year Operating Plan Outline 5 Percent of Sales Method A method of forecasting future financial statements that expresses each account as a percentage of sales. Once sales have been forecasted, we must forecast future balance sheets and income statements. • • • • FORECASTED INCOME STATEMENT FORECAST THE BALANCE SHEET RAISING THE ADDITIONAL FUNDS NEEDED FORECASTING FREE CASH FLOW 6 Percent of Sales Method 1.step: 2.step: 3.step: (steps) Financial analysis of current period Aims formulation for time horizon of FP Assessment of basic requirements: a) balance sheet items is most closely linked to sales b) structure of assets and liabilities of current period are adequate to the level of sales 4.step: If 3.b) is not fulfill there is necessary to make correction of balance sheet items of current period. It can be made by Financial ratios method. 7 Percent of Sales Method 5.step: 6.step: (steps) Identification of those balance sheet items, which are changed in dependence on the sales changes. Share quantification of sheet balance items on sales. Calculation of planned balance sheet items. Share of balance sheet items on sales times planned sales. Balance sheet items without dependence on sales changes are taken from current balance sheet. 8 Percent of Sales Method (steps) 7.step: Calculation of additional funds needed. Disparity between higher assets and lower liabilities. 8.step: Structure of additional funds needed in accordance with aims of financial plan. New plan of balance sheet and plan of cash flow. Control if aims of FP were fulfill. 9.step: 10.step: 9 Financial ratios method Selected financial ratios are used as „model values“. Firm wants to reach these values in future. These values can be formulated as: • specific aims of firm • average values of firms in the same sector • values of competitive firm 10 Example: We want to make a financial plan for year 2013. Expected Balance sheet 31.12.2012 Fixed assets Inventories Receivables Financial Accounts Current Assets 375 300 215 25 540 Registered Capital 475 Retained Profit 52 Liabilities to suppliers 130 Short-term bank loans 35 Wages, taxes and other liabilities 105 Short-term liabilities 270 Long-term bank loans 118 Total Assets 915 Total capital and liabilities 915 11 (1., 2.step) Expected sales in year 2012 = 1600 euro; Net income = 80 euro; Dividends = 20 euro. Expected growth of sales in 2013 is 25% in compare with sales in year 2012. Aims formulation for year 2013: 1.) 5% profitability of sales. 2.) Dividends 50% from net income. 3.) Debts from total assets – no more than 40%. 12 (3.step) Structure of assets (Expected Balance sheet 31.12.2012) are not adequate to the level of sales! We have to make correction by Financial ratios method: Selected financial ratios values of competitive firm: Inventories turnover ratio = 6 DSO = 40 Inventories turnover ratio = sales/inventories Days sales outstanding = (receivables * 365)/sales 13 (4.step) Correction of balance sheet items of current period. Model values: Inventories turnover ratio = 6 DSO = 40 We have to make correction in inventories and receivables. Inventories turnover ratio = sales/inventories = 1600/300 = 5,33 New value of inventories = 1600/6 = 266,6 270 Days sales outstanding = (receivables * 365)/sales = (215 * 365)/1600 = 41,9 New value of receivables = (40 * 1600)/365 = 175,3 180 14 (4.step) Expected Balance sheet (after correction) 31.12.2012 Fixed assets Inventories Receivables Financial Accounts Current Assets 375 270 180 90 540 Registered Capital 475 Retained Profit 52 Liabilities to suppliers 130 Short-term bank loans 35 Wages, taxes and other liabilities 105 Short-term liabilities 270 Long-term bank loans 118 Total Assets 915 Total capital and liabilities 915 15 (5., 6.step) Expected growth of sales in 2013 is 25%: 1600 + 25% = 2000 euro (1) (2) Share on sales (in current period) Planned balance sheet (% from 1600 euro) (planned sales * column 1) Financial accounts (90/1600) * 100 = 5,6 2000 * 0,056 = 112 Receivables (180/1600)*100 = 11,3 2000 * 0,113 = 226 Inventories (270/1600)*100 = 16,9 2000 * 0,169 = 338 Current assets (540/1600)*100 = 33,8 2000 * 0,338 = 676 Fixed assets (373/1600)*100 = 23,4 2000 * 0,234 = 468 Total assets (915/1600)*100 = 57,1 2000 * 0,571 = 1144 Liabilities to suppliers (130/1600)*100 = 8,1 2000 * 0,081 = 162 Short-term bank loans without dependence on sales changes are taken from current balance sheet: 35 Wages, taxes and other liabilities (105/1600)*100 = 6,6 2000 * 0,066 = 132 Short-term liabilities –– 329 Long-term bank loans without dependence on sales changes are taken from current balance sheet: 118 Registered Capital without dependence on sales changes are taken from current balance sheet: 475 Retained Profit 102 Total capital and liabilities –– 1024 16 Calculation of Retained Profit: (5.,6.step) Change in Retained profit = Net income – Dividends Retained profit of planned period = Retained profit of current period + Change in Retained profit Net income (from aims formulation: 1.) 5% profitability of sales): 100 euro (5% from planned sales 2000 euro) Dividends (from aims formulation: 2.) 50% from net income): 50 euro (50% from net income 100 euro) Change in Retained profit = 100 – 50 = 50 euro Retained profit of planned period = 52 + 50 = 102 euro 17 (7.step) Calculation of additional funds needed. Disparity between higher assets and lower liabilities. Total assets - Total capital and liabilities: 1144 – 1024 = 120 euro (8.step) Structure of additional funds needed in accordance with aims of financial plan : 3.) Debts from total assets – no more than 40%. Maximal Debts = 0,4 * Total assets (planned) = 0,4 * 1144 = 458 euro Short-term liabilities (planned) 329 Long-term bank loans 118 Total debts (planned) 447 Maximal debts – Total debts (planned) = 458 – 447 = 11 euro (maximal additional debts) 18 (8.step) Structure of additional funds needed: New long-term debt 11 New share issue (shareholder's investment) 109 Total additional funds needed 102 euro (9.step) Plan of Balance sheet 31.12.2013 Fixed assets Inventories Receivables Financial Accounts Current Assets 468 338 226 112 676 Registered Capital (475+109)=584 Retained Profit 102 Liabilities to suppliers 162 Short-term bank loans 35 Wages, taxes and other liabilities 132 Short-term liabilities 329 Long-term bank loans (118+11)=129 Total Assets 1144 Total capital and liabilities 1144 19 Plan of Cash flow (9.step) 1. Operating activities Net income ..................................................... increase in Liabilities to suppliers ..................... increase in Receivables ..................................... increase in Wages, taxes and other liabilities ..... increase in Inventories ..................................... resources from Operating activities ..................... use of resources ..................................... Total operating activities ..................................... + 100 + 32 - 46 +27 - 68 + 159 - 114 + 45 2. Investment activities increase in Fixed assets ..................................... - 93 3. Financial activities increase in Long-term bank loans ..................... New share issue ..................................... Dividends ..................................................... resources from Financial activities ..................... use of resources ..................................... Total financial activities ..................................... - 11 + 109 - 50 + 120 - 50 + 70 20 Plan of Cash flow 1. Operating activities 2. Investment activities 3. Financial activities CASH FLOW (9.step) + 45 - 93 + 70 + 22 21 Than you for your attention! 22