Popping Tags #tax

advertisement

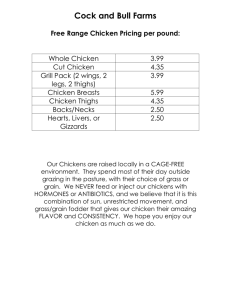

#POPATAG #TAX How to pop some tags using percent, discounts and tax without leaving your desk! TAX • Tax is a percent of the cost of an item that you must pay, in addition to the item price. • According to dictionary.com, tax is a sum of money demanded by a government for its support or for specific facilities or services, levied upon incomes, property, sales, etc. TAX Continued • When you purchase an item, you must pay sales tax. • In Brevard County, for example, the sales tax is 6%. • That means, that in addition to paying 100% of an item, you also have to pay an additional 6% of that item. • For example, if a DVD is $10.00, then in addition to you giving the store $10.00, you will also have to give them 6% of $10.00, or an additional $0.60, for a total of $10.60. TAX You want to purchase this brand new Q Piston watch for your friend’s birthday. The price is $22.79. The sales tax is 6%. $22.79 x 0.06 1.3674 (money rounds to the hundredths place, or $1.37) The tax then needs to be added back onto the original price. $22.79 + 1.37 $24.16 So even though the watch was priced at $22.79, you will need to pay $24.16 because of the tax. TAX This vintage MP3 player is for sale at the Antique Shop for $49.89. You have a $50 bill you got for winning the talent show at school for singing. Do you have enough money to buy this MP3 player including 6% sales tax? You want a cell phone so you can Tweet every time you see a cuddly kitten. It is for sale at the Antique Shop for $28.75 (because it does not have a flash). How much will it cost to purchase it with a 6% tax? TWO STEPS OR ONE STEP Flap Socks $13.49 Two Steps • Find the tax • Add the tax to the original price $13.49 (price of socks) x 0.07 (tax rate) $0.9443 $0.94 (tax for socks) $13.49 +0.94 $14.43 (price of socks ) (tax for socks) (cost of socks with tax) Tax 7% One Step You are paying 100% of the price + 7% 107% $13.49 (price of socks) x 1.07 (the whole price and tax) 9443 +134900 (the price is hidden in the 14.4343 multiplication problem) TAX & DISCOUNTS Even when an item is on sale with a discount, you still need to pay tax on the item. Which came first, the chicken or the egg? Does it matter if you find the tax first, then the discount or if you find the discount first, then the tax? The chicken cost $12.59 25% discount and 6% tax Find the tax on $12.59 Find the discount on $12.59 $12.59 x 0.06 0.7554 or 0.76 $12.59 x 0.75 $9.4425 $12.59 +$0.76 $13.35 $13.35 x 0.75 $10.01 (chicken) (tax rate) (tax) (chicken) (tax) (chicken with tax) (chicken with tax) (percent paying) (total price of chicken with tax then discount) $ 9.44 x0.06 $ 0.57 $ 9.44 + 0.57 $10.01 (chicken) (percent paying) (discounted chicken) (discounted chicken) (tax) (tax on discounted chicken) (discounted chicken) (tax) (total price of chicken with discount then tax) So how do you know which is the correct order?