Master of Science (M.S.) in Taxation

advertisement

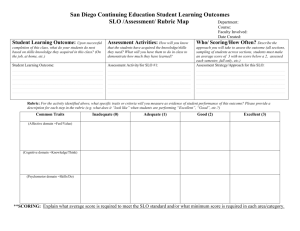

California State University, Fullerton 2012-2013 & 2013-2014 Assessment Activities & Results Survey Inspired by the mission that learning is preeminent at CSUF, and considering the newly established (January 2013) university learning goals, the Academic Senate’s Assessment and Educational Effectiveness Committee (AEEC) and the Office of Academic Programs request that each department/program provides a brief summary of the assessment activities and results for the periods of AY 2012-2013 and AY 2013-2014. The information collected will be used to establish an accurate inventory of assessment activities at CSUF, to fulfill internal and external accountability requirements, and to demonstrate CSUF’s progress in student learning assessment. We understand that parts of this survey may resemble forms you have completed in previous years. What we are particularly interested in in this survey is how the department/program learning outcomes align with the new university learning goals, and what is being done in your department/program to “close the loop” (i.e. use the assessment findings to improve student learning). We ask each department/program to return the completed survey to their respective Dean’s Office by April 15, 2014. The Dean’s Office will then compile and submit the surveys to the Office of Academic Programs. We apologize for the very tight turn-around which is directly related to the new WASC reporting requirements and timeline. Please also note that this survey is a one-time occurrence. We are in the process of establishing an assessment and educational effectiveness plan, which will allow departments/programs to better plan their assessment and related reporting activities annually. Thank you in advance for your understanding and effort. Department/Program: MS Taxation *** Thank you very much! College: __Mihaylo CBE_______________ Please email assessment@fullerton.edu if you have any questions.*** 1 California State University, Fullerton 2012-2013 & 2013-2014 Assessment Activities & Results Survey 1. Summary of department/program SLOs and related assessment activities: Please list ALL student learning outcomes (SLOs) for your department/program, based on their alignment with the newly established 6 university learning goals. These SLOs should include those for the GE program and the graduate programs(s). Please check the appropriate box if a SLO is a GE or graduate program SLO. For each SLO, please briefly describe any related assessment activities your department/program conducted in AY 2012-2013 and AY 2013-2014. These activities can include all aspects of assessment, ranging from planning data collection, data analysis, to datadriven changes or improvement at the course or program level. Feel free to adjust the number of rows based on the number of SLOs for your department/program. University Learning Goal 1. Demonstrate intellectual literacy through the acquisition of knowledge and development of competence in disciplinary perspectives and interdisciplinary points of view. Department/Program Student Learning Outcomes (SLOs) 1) Students will Demonstrate a Technical Understanding and Application of Advanced Tax Knowledge 2) Students will Demonstrate a Conceptual Understanding and Application of Advanced Tax Knowledge 3) Students will Demonstrate Advanced Research Skills Using Appropriate Professional Literature *** Thank you very much! GE SLO? Graduate SLO? (Check if yes) (Check if yes) X X X Related Assessment Activities F2012-S2013 Related Assessment Activities F2013-S2014 F12 ACCT 470 ·Exam F12 ACCT 578 •Project (Critical Thinking rubric) S14 ACCT 597 ·Project (rubric) Please email assessment@fullerton.edu if you have any questions.*** 2 California State University, Fullerton 2012-2013 & 2013-2014 Assessment Activities & Results Survey 2. Think critically, using analytical, qualitative and quantitative reasoning, to apply previously learned concepts to new situations, complex challenges and everyday problems. 1) Students will Demonstrate a Technical Understanding and Application of Advanced Tax Knowledge X F12 ACCT 470 •Exam 2) Students will Demonstrate a Conceptual Understanding and Application of Advanced Tax Knowledge X F12 ACCT 578 ·Project (Critical Thinking rubric) 3) Students will Demonstrate Advanced Research Skills Using Appropriate Professional Literature X S14 ACCT 597 •Project (rubric) X F13 ACCT ·Writing assignment (CLASS rubric) X F13 ACCT 597 ·Presentation of research project (rubric) X F13 ACCT 470 ·Team project (Rubric) 3. Communicate clearly, effectively, and persuasively, both orally and in writing. 4) Students will demonstrate effective written communication skills. 4. Work effectively as a team member or leader to achieve a broad variety of goals. 7) Students will Demonstrate Their Ability to Work Collaboratively and Effectively on Advanced Tax Issues as Part of a Team. 5) Students will demonstrate effective oral communication skills. *** Thank you very much! Please email assessment@fullerton.edu if you have any questions.*** 3 California State University, Fullerton 2012-2013 & 2013-2014 Assessment Activities & Results Survey 5. Evaluate the significance of how differing perspectives and trends affect their communities. 6. Recognize their roles in an interdependent global community. 6) Suggest an appropriate course of action to resolve ethical dilemmas related to tax issues and the accounting profession. 6) Students will be able to Suggest Appropriate Courses of Action to Resolve Ethical Dilemmas Related to Tax Issues and the Accounting Profession X F13 ACCT 470 ·Short answer question on final exam (Rubric) X F13 ACCT 470 •Short answer question on final exam (Rubric) 2. Examples of SLO assessment and “closing the loop” process (i.e. use the assessment findings to improve student learning): Please choose 3 SLOs from the list above as examples to demonstrate the process of “closing the loop” for your department/program. The process does not have to be confined to the periods of AY 2012-2013 and AY 2013-2014. For each example, please provide the following details: - Criteria for Success: The criteria or benchmark used to determine whether the SLO is met (e.g. Average score of 80% or higher on an assessment task, 75% of the students received an A in an assessment task) - Assessment Methods: The specific method(s) used to collect and analyze relevant data (e.g. student sampling strategy, quantitative and/or qualitative methods, instruments, analysis methods) - Assessment Findings: The findings regarding the corresponding SLO, as yielded by the assessment data and by judging these data against the criteria for success *** Thank you very much! Please email assessment@fullerton.edu if you have any questions.*** 4 California State University, Fullerton 2012-2013 & 2013-2014 Assessment Activities & Results Survey - Improvement Actions & Results: The specific improvement plans that reflect and address the assessment findings, and the results of the improvement plans (e.g. revisions to the curriculum resulted in higher student achievement, interventions that led to increased student satisfaction) SLO Criteria for Success 1) Students will Demonstrate a Technical Understanding and Application of Advanced Tax Knowledge Goal: 75% of raw score 3) Students will Demonstrate Advanced Research Skills Using Appropriate Professional Literature Goal: 75% of the highest possible rubric score 6) Students will be able to Suggest Appropriate Courses of Action to Resolve Ethical Dilemmas Related to Tax Issues and the Accounting Profession Goal: 75% of the raw score Assessment Methods Assessment Findings ACCT 470 - Tax Research, Overall score = 69.64% Practice and Procedures Multiple Choice questions on exam(s) ACCT 597 – Capstone Overall score = 73.07% Final project graded using project rubric *** Thank you very much! ACCT 470 - Tax Research, Practice and Procedures Ethics short answer question on the final exam, evaluated by rubric Overall score = 91.15% Improvement Actions & Results Goal was not met. Faculty will include additional citatory exercises and problems in class, develop HW assignments that directly reflect the exam, and enhance student use of tax research citation and style guide and practice packets. Goal was not met. Faculty will create lessons on how to develop thesis and problem identification, and provide resources for modeling proper thesis Results are acceptable but instructor will add more comprehensive ethical tax scenarios on assignments and exams. Coursework will be strengthened and exam questions redesigned to assess student ability to evaluate alternative courses of action in ethical tax scenarios. Please email assessment@fullerton.edu if you have any questions.*** 5 California State University, Fullerton 2012-2013 & 2013-2014 Assessment Activities & Results Survey 3. Summary of the Assessment Process in your department/program: Please briefly describe the assessment planning and implementation process (i.e. how the assessment process was planned and conducted) in your department/program. Reflect upon the process to suggest its strengths and areas of improvement. Brief summary of the assessment planning & implementation process Strengths of the assessment process Areas of improvements of the assessment process Assessment in this program is developed, reviewed, and updated by a committee of instructors teaching the respective courses. The objectives are measured with a variety of methods, including rubrics, discussion exam questions, and research projects. Recent review brought alignment to the learning objectives of all Accounting programs. With involvement directly by the instructional faculty, rubrics can be collectively developed in-house and implemented across all courses. New accrediting standards will mean the learning objectives will need to be reviewed and new areas of assessment will need to be identified and implemented in a timely manner so that the assessment system can continue. 4. Additional Comments: Please share your thoughts, insights, concerns, or any other comments regarding the assessment efforts at CSUF. *** Thank you very much! Please email assessment@fullerton.edu if you have any questions.*** 6