Individual Taxation - Massachusetts School of Law

advertisement

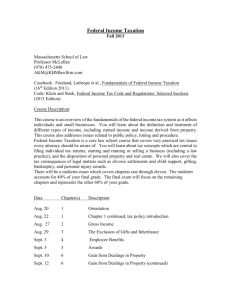

Federal Income Taxation Fall 2012 Massachusetts School of Law Professor McLellan (978) 475-2400 AmyM@LifetimeTrusts.com Casebook: Freeland, Lathrope et al., Fundamentals of Federal Income Taxation (16th Edition 2011) Code: Klein and Stark, Federal Income Tax Code and Regulations: Selected Sections (2012 Edition) Course Description: This course is an overview of the fundamentals of the federal income tax system as it affects individuals and small businesses. You will learn about the definition and treatment of different types of income, including earned income and income derived from property. This course also addresses issues related to public policy, timing and procedure. Federal Income Taxation is a core law school course that covers very practical tax issues every attorney should be aware of. You will learn about tax concepts which are central to filing individual tax returns, starting and running or selling a business (including a law practice), and the disposition of personal property and real estate. We will also cover the tax consequences of legal matters such as divorce settlements and child support, gifting, bankruptcy, and personal injury awards. There will be a midterm exam which covers chapters one through ten. The midterm accounts for 35% of your final grade. The final exam will focus on the remaining chapters and represents the other 65% of your grade. Date Chapter(s) Description Aug. 21 1 Orientation Aug. 23 1 Chapter 1 continued, tax policy introduction Aug. 28 2 Gross Income Aug. 30 3 The Exclusion of Gifts and Inheritance Sept. 4 4 Employee Benefits Sept. 6 5 Awards Sept. 11 6 Gain from Dealings in Property Sept. 13 6 Gain from Dealings in Property (continued) Date Chapter(s) Description Sept. 18 7 Life Insurance and Annuities Sept. 20 8&9 Discharge of Indebtedness, Damages and Related Receipts Sept. 25 10 Separation & Divorce Sept. 27 REVIEW Oct. 2 MIDTERM - CHAPTERS 1-10 Oct. 4 11 Other Exclusions from Gross Inc. (section A only) 12 Assignment of Income Oct. 9 14 Business Deductions (pages 328-360) Oct. 11 14 (pages 375-382, 388-393, 399-414) Oct. 16 14 Depreciation (pages 418-455) Oct. 18 15 Profit-Making, Non-Business Activities (section A only) 16 Deductions not limited to Business or Profit Activities (just section A, Rev. Ruling 69-188, Rev. Ruling 2010-25, & Cramer v. Comm’r) Oct. 23 17 Oct. 25 Restrictions on Deductions continue Chapter 17 (just skim Passive Activity rules) Oct. 30 18 Deductions for Individuals Only Nov. 1 19 Fundamental Timing Principles Nov. 6 19 Fundamental Timing Principles Nov. 8 Timing Principals- review (begin ch. 21 if time) Nov. 13 21 Capital Gains and Losses Nov. 15 21 Capital Gains and Losses Nov. 20 Assignment- Tax Return (due November 27) Nov. 22 No Class- Thanksgiving Nov. 27 27 Computations and Review of IRS Form 1040 IRS Audits and Professional Responsibility (just skim chapter 28, sections B & D only) Nov. 29 Review