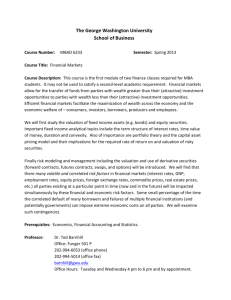

Valuation, Liquidity & Derivatives Top Challenges

advertisement

Valuation, Liquidity & Derivatives Top Challenges for US Mutual Funds in 2016 Marriott Marquis Times Square, New York - Thursday February 11th 2016 0800 - 0830 Registration – Coffee Foyer 0830 - 0900 Introduction – Ian Blance, Voltaire Advisors SEC fund valuation requirements Liquidity management rules New derivative proposals 0900 - 0930 Updated Valuation Guidance from the SEC – Ronald Feiman, Kramer Levin Naftalis & Frankel Amortized cost vs fair value Directors responsibilities 1030 - 1100 Fair Valuation in Practice – Paul Kraft, Deloitte Results of Deloitte’s Thirteenth Fair Value Pricing Survey, 2015 Managing valuation risk for what is around the corner 1000 - 1030 Coffee Foyer 0930 - 1000 SEC Guidance on Use of Pricing Services – Ian Blance, Voltaire Advisors SEC guidance on fair valuation and use of pricing services Model vendor due diligence process 1100 - 1130 Due Diligence in the New Regulatory Regime – Jayme Fagas, Thomson Reuters Understanding the new regulatory drivers The quest for transparency 1130 - 1200 KEYNOTE Fund Directors' Obligations and Best Practices in Valuation – Norm Champ, Harvard Law School Standards & recent cases What Fund’s should do to protect themselves 1200 - 1230 Panel Discussion – Latest Guidance on Mutual Fund Valuation Moderator – Ian Blance, Voltaire Advisors Ronald Feiman, Kramer Levin Paul Kraft, Deloitte Jayme Fagas, Thomson Reuters Norm Champ, Harvard Law School 1230 - 1300 Lunch 1300 - 1330 New Liquidity Management Regulation – Nathan Greene, Shearman & Sterling Changes to current liquidity rules Implications for fund operations, disclosure and reporting 1300 - 1330 Challenges in Liquidity Assessment & Management – Varun Pawar, Bloomberg Lack of uniformity & consistency in liquidity measures Data driven approaches vs bid/ask 1330 - 1400 Liquidity Management Rules for Mutual Funds and their Impact on Valuation – Chris Franzek, Duff & Phelps ‘Illiquid’ Investments and Fair Value Tension in the P*Q valuation rule 1400 - 1430 Panel Discussion – Impact of Liquidity Management regulations Moderator – Ian Blance, Voltaire Advisors Nathan Greene, Shearman & Sterling Chris Franzek, Duff & Phelps Varun Pawar, Bloomberg 1430 - 1500 Coffee Foyer 1500 - 1530 New SEC Derivative Management Proposals – Jay Baris, Morrison & Foerster Proposed derivative rules from December 2015 Likely impact on mutual fund operations 1530 - 1600 Ten Key Points from the SEC’s Proposed Derivatives Rule – Dan Ryan, PWC Lessons for mutual funds from the new proposals Forecasts of how this will pan out in the coming months 1600 - 1630 Best Practices in Derivative Pricing and Risk Management – Speaker TBC, FinCAD Mark-to-market challenges for derivative instruments Robust and transparent derivative pricing methods 1630 - 1700 Panel Discussion – Impact of Derivatives Proposals Moderator – Ian Blance, Voltaire Advisors Jay Baris, Morrison & Foerster Dan Ryan, PWC TBC, FinCAD 1700 Wrap Up & End of Workshop