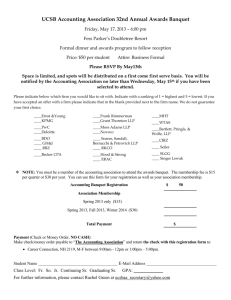

Incorporate a LLP - manoj mehta & co.

advertisement

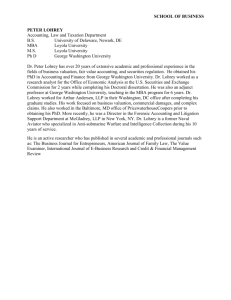

www.manojmehta.com Incorporation Checklist New Limited Liability Partnership (LLP) Fact Sheet A 'LLP' is an body corporate entity registered with the respective Registrar of LLP’s (ROLLP) of the respective states in which its registered office is located, and all the Registrars offices fall under the administration of the Ministry of Corporate Affairs, Govt. of India. A LLP is governed by the Limited Liability Partnership Act, 2008, and the regulations made there under. It has the following characteristics/benefits – (a) Minimum 2 partners, maximum unlimited, but at least 2 partners shall be designated partners (DP) who shall be individuals (incl. nominee of body corporate) out of which at least one shall be resident in India with not less than 50% share. The 2 DP’s shall be responsible for all legal compliance under the LLP Act. (b) One or more Private Limited Company or another LLP can be a partner in a LLP through its director / partner. (c) Changes in name, partners, business activity, registered office and other terms can be carried out as desired, from time to time by filing the required Forms & documents with registrar. (d) The mutual rights & duties of partners and the administration of the LLP shall be governed by an agreement or LLP Deed between partners inter-se and/or between the LLP and the partners. In the absence of any such Deed, the administration of the LLP and its partners shall be governed by the LLP Act & rules. Comparison of LLP with other business forms SN Particulars LLP 1. Liability of Limited to partner’s agreed Partners & Firm contribution & not liable for unknown acts of other partners. LLP is liable to the extent of its assets & liabilities only 2. Flexibility 3. Statutory Compliances 4. Regulation 5. Existence 6. More flexibility compared to a Firm or Company Old Partnership Firm Private Limited Company The Firm, every partner is jointly & severally liable for all acts of the firm & its partners (even the personal assets of each partner are liable) Limited to director’s share capital & not liable for unknown acts of other directors. Company is liable to the extent of its assets & liabilities only Less or no flexibility More flexibility than Firm Least and electronically regulated Cumbersome manual process More than a LLP but electronically to minimise ‘red tape’ with maximum ‘red tape’ regulated to minimise ‘red tape’ LLP Act, 2008 Indian Partnership Act, 1932 Perpetual, irrespective of death or Terminated on death retirement of partners retirement of partners Companies Act, 1956 or Perpetual, irrespective of death or retirement of directors Separate Entity Separate legal entity independent Not a separate legal entity, Separate legal entity independent of its partners, hence preferred by hence not preferred by of its management, preferred by outsiders dealing with the LLP outsiders dealing with the Firm outsiders 7. Partners / Directors Min – 2; Max – no limit Min – 2; Max – 20/10 Min – 2; Max – 50 (members) 8. Functionality Designated Partners Acting Partners Directors 9. Audit & Accounts Audit not compulsory, accounts & Audit and filing of accounts not Audit compulsory, accounts annual return to be filed applicable annual return to be filed & Incorporation Process Time line estimates mentioned below are subject to prompt receipt of details/papers from the client and proper functioning of Govt. website. The implications of these points & abbreviations are explained on pages below. Steps Particulars Step 1 Obtain a designated partners identification number (DIN) for at least 2 proposed partners, if not all (ask for our DIN Checklist) Step 2 Obtain a digital signature certificate (DSC) for any one designated partner (ask for DSC Form) Application for Approval of Name desired of the LLP. If these names are rejected by Registrar, Step 3 submit fresh names, or if alterations suggested, carry out suggested alterations & resubmit No. of Days 1 1 5 – 15 Step 4 Incorporation papers – preparing & electronic uploading of incorporation docs & pay Govt. Fees 1 Step 5 LLP Registration and Certificate of Incorporation i.e. approval by Registrar 3 Submit Partnership Agreement (LLP Deed) – drafting the LLP Deed & upload with eForm3. If Step 6 corrections suggested by Registrar, carry out these and resubmit Others Proceed for Tax, VAT, Labour etc., statutory registrations (ask for any of our specific Checklists) 3–6 --- Total timeline 12 – 20 days Manoj Mehta & Co., Chartered Accountants, Mumbai. Tel: 22005454. Email: mail@manojmehta.com Page 1 of 5 www.manojmehta.com Incorporation Checklist LLP Benefits (a) Limited Liability – the greatest benefit by far, a LLP being a separate legal entity, the personal assets of its Partners are not affected for outstanding liabilities/payments to creditors or lenders (except Govt. dues) provided the partner has not acted fraudulently. LLP is liable to the extent of its assets & liabilities. (b) Tax Benefits – being a corporate entity, an LLP can claim more tax-deductible costs and allowances from its profits compared to a sole proprietorship or partnership. Income taxes are passed through the business and reflected tax free on the partners' individual tax returns (no tax on profit distribution like dividend tax). (c) Borrowing – can accept loans and deposits from its partners, relatives, banks and even from third parties. (d) Capital – no minimum partnership capital requirements. Usual default capital is ` 50,000/-. (e) Activities – can conduct retail, wholesale, trading, manufacturing or services activities, no requirement of minimum or maximum turnover or employees/workers. The name of the LLP should end with 'LLP'. (f) Legal & regulatory requirements – simpler as the compliance process is electronic (paperless) & no need to visit Govt. Dept. or deal with officers. The act provides flexibility to devise the LLP agreement as per choice. (g) Popularity – convenient form of entity for professional firms like accountants, lawyers, engineers, artists, sportsmen, film actors or technicians etc., also suitable for Knowledge, Technology (R & D), Patent or Design enterprises, Philanthropy, Venture Capital Funds, Sahakari Sanstha’s in Agro and Handicrafts sectors. (h) Real Estate – particularly suitable for real estate & construction firms as distribution of profits to partners tax free, can accept outside loans, limited liability, simpler compliances and corporate status. (i) Hybrid vehicle – LLP has elements of both, a corporate as well as a partnership structure, it is called a hybrid between a company and a partnership and is a very popular structure worldwide and now in India. (j) Status – a LLP has an enhanced status and aesthetic value in the eyes of local & overseas customers, clients, banks, creditors, funding agencies and general public. (k) Acceptability – a LLP is a preferred as a corporate entity for awarding contracts, tenders, empanelment, providing finance etc., and has a larger image in the perception of the society. (l) Perpetual Existence – it is an entity with perpetual succession. The members or directors may change from time to time, but that does not affect the continuity of the LLP. Checklist – Incorporation of a New LLP SN Details to be provided against each of the points below -- Glossary of terms & short forms used in this Checklist ` = Indian Rupees ROLLP = Registrar of LLP, Mumbai, under MCA DP = Designated Partner MCA = Ministry of Corporate Affairs, Govt. of India DSC = Digital Signature Certificate LLPIN = Limited Liability Partnership Identification Number DIN = Designated partner’s Identification Number LLP Deed = Partnership Agreement / Deed CIN = Company Identification Number LLP Act = Limited Liability Partnership Act, 2008 (with Rules) 1. Name, address & contact details of Applicant (applicant can be any one of the partners) Name Address Town / City State Tel. No/s Email Fax PIN Website 2. Have all the partners of this proposed LLP obtained ‘DIN’? () Yes No DIN is a unique, one time identification no. assigned by MCA to any person wanting to be a Designated Partner (DP) If, Yes mention the DIN of each of the proposed DP’s under point ‘8’ below () If, No fill-up our ‘DIN Checklist’ separately for each DP & hand it to us with attachments () A Designated Partner shall be responsible for all legal compliance of the provisions of the LLP Act. Any two main Manoj Mehta & Co., Chartered Accountants, Mumbai. Tel: 22005454. Email: mail@manojmehta.com Page 2 of 5 www.manojmehta.com Incorporation Checklist partners (or even all partners) out the total no. of partners can act as designated partners. 3. Have all the designated partners obtained (DSC)? () Yes No Digital Signature Certificate or ‘DSC’ is a legally recognised method of signing documents electronically If, Yes attach the ‘DSC Tokens (USB)’ or email the ‘PFX’ soft file, with password of all the DP’s () If, No fill-up the ‘DSC Form’ (ask for DSC Form) for all the DP’s and forward it to us with the attachments specified therein () 4. Proposed names of the LLP (names desired) (a) Give upto 6 choices of desired names in order of preference, avoid multiple names if a particular name is strongly desired (you have to re-apply in case of 1st time rejection). (b) Give significance of the prefix or special words (if any) in the names. (c) The names should reflect the proposed business activities. (d) Names are subject to approval by ROLLP a. b. c. d. e. f. The name should comply with the LLP regulations; should not be similar or resemble or have phonetic resemblance, to any existing registered Company or LLP or should not be offensive, obscene or profane; should not violate IPR or trademarks; should not be a dictionary or generic word; should not imply patronage of government, royal or kingdom or indicative of a different legal constitution like society, HUF, firm, Inc., PTE, Gmbh, LLC etc. 5. Whether any word/s in proposed name is registered under If yes, provide registration certificate or receipt or Trademark or IPR Laws? () Yes ___; No ___ such other evidence of registration. 6. Proposed main objects or business activities, in full detail with description of products, processes, ancillary or related activities (use separate sheets if space provided is insufficient) 7. A. Office address of the proposed LLP: B. Proof of Office Address – self certified copies of any one proof like – (a) Property Deed; (b) Govt. Utility Bill (electric, telephone etc); (c) Bank Statement (1st page & latest transaction page); (d) Passport; (e) Election or Ration Card etc. (proofs should not be over 2 months old) (tick the Proof provided by you) If the office is owned by one of the partners or rented / leased then the documents mentioned above shall be required in respect of the owner of the premises along with owner’s Consent (ask for Consent format). 8. Details of Partners, Capital Contributions & Profit Sharing: (use extra sheets if space is insufficient) Name of Partner * Capital Designated or Profit Sharing Contribution (`) Normal Partner? DIN Number (%) a. b. c. d. e. Manoj Mehta & Co., Chartered Accountants, Mumbai. Tel: 22005454. Email: mail@manojmehta.com Page 3 of 5 www.manojmehta.com Incorporation Checklist * the capital contributions should be brought in by the partners within one month of incorporation 9. Whether any Partner of this proposed LLP is a Director in any other Company/s or Partner in any other LLP/s, details thereof (use extra sheets if space is insufficient) Other Directorships (Companies) / Partnerships (LLP’s) Name of Partner Name of the Company / LLP CIN / LLPIN No. a. b. c. d. e. 10. Do you have any specific instructions or matters which you want included in the ‘LLP Deed’ (indicative points given below)? Elaborate on these or other points, as required on a separate sheet a. Date of LLP i. Powers, duties, rights, obligations of partners b. Addresses of office, factory, branches etc. j. Admission, removal, resignation, death of any partner c. Business activities to be carried on, in detail k. Buy, sell, construct assets, immovable property d. Term of LLP partnership l. Accounts, financial year, audit, books/record etc. e. Capital of LLP with individual shares m. Indemnification of partners f. Profit sharing, remuneration, interest etc., to Partners n. Amendment of partnership deed g. Bank account/s and mode of operation o. Legal disputes & arbitration, jurisdiction h. Meetings of partners, minutes 11. Enclose Cheque / Cash / DD for incorporation costs (you may also make RTGS or NEFT payment) Have you enclosed the payment? () Yes No Please send full payment as per points 13 below, as we have to make advance disbursements. Our NEFT details – Bank of Baroda, Walkeshwar Br.; A/c. No. 06130200000115; IFSC Code – BARB0WALKES 12. LLP Kit – Copies of LLP Deed & Common Seal (these items are optional) a. Do you want 25 extra printed & bound copies of LLP Deed? () Yes No ` 4000/- b. Do you require Stainless Steel Common Seal? () Yes No ` 1100/- 13. Indicative chart of Total Incorporation Costs given below (all amounts in `) (service tax shall be extra) Partnership Capital Stamp Duty Govt. Fees Prof. Fees Total Costs Partnership Capital Stamp Duty Govt. Fees Prof. Fees Total Costs 50000 500 800 17500 18800.00 4 lakhs 4000 2400 1 lakh 1000 800 17500 19300.00 5 lakhs 5000 2400 17500 23900.00 17500 24900.00 2 lakhs 2000 2400 17500 21900.00 10 lakhs 5000 4500 17500 27000.00 3 lakhs 3000 2400 17500 22900.00 Over 10 lakhs 5000 5600 17500 28100.00 Notes: (a) Common examples of partnership capital are indicated above, it can be any rounded amount of your choice. (b) DSC charges @ 2000/- per designated partner shall be extra. (c) Add to the total costs above, the cost of LLP Kit. (d) Professional Fees relates to our incorporation services like advising, drafting of LLP Deed, structuring issues, eForm filing etc. Fill-up the above checklist with clarity and information to the fullest extent without omissions and short forms and email it to us. Kindly take careful note of the statutory compliances and the related penalties, provided below. Manoj Mehta & Co., Chartered Accountants, Mumbai. Tel: 22005454. Email: mail@manojmehta.com Page 4 of 5 www.manojmehta.com Incorporation Checklist Compliances & Penalties under LLP Law (given below are only common examples of compliances, the list is not at all exhaustive) A. Regular / Annual Compliances (annual mandatory compliances irrespective of any event) (amounts in `) SN Head Section Compliance / Filing documents with ROC Penalty for Non Compliance 1. Statement of Accounts & Solvency 34(2) LLP to file a Statement of Account & 25,000 upto 5,00,000 on LLP and 10,000 upto Solvency (annual Accounts) within 6 months 1,00,000 on every designated partner in default of year end, in eForm8 2. Annual Return 35(1) LLP to file a Annual Return within 60 days 25,000 upto 5,00,000 on LLP and 10,000 upto of year end, in eForm11 1,00,000 on every designated partner in default B. Event Based Compliances (triggered by any specific event) SN Head Section 1. Change in Designated Partners 7(3), Notice of any incoming or outgoing designated 10,000 upto 1,00,000 – on the 7(4), 9 partners to be filed within 30 days, in eForm4. If no. of LLP & every designated partner designated partner falls below 2, all the other partners who is in default shall be deemed designated partners. 2. Change of Registered Office 13(3) Notice of change in regd. office address to be filed 10,000 upto 1,00,000 – on the within 30 days, in eForm15 LLP & every designated partner who is in default 3. Change of Name 4. Changes in LLP Agreement / Deed 23(2) Notice of changes in the clauses or terms of LLP 5,000 upto 5,00,000 + 50 per day Deed to be filed within 30 days, in eForm3 – on LLP & every designated in default 6. Change in Partners 25(2) Notice of any incoming or outgoing other partners or 2,000 upto 25,000 – on LLP & changes in partner’s name, address, contacts, to be every designated partner in filed within 30 days, in eForm4 default 7. Books of Accounts , Audit 34(1) LLP to maintain books of accounts as prescribed & 25,000 upto 5,00,000 on LLP & get them audit if applicable. Audit applicable if Capital 10,000 upto 1,00,000 on every exceed 25 lakhs or turnover exceeds 40 lakhs. designated partner in default 19 Compliance / Filing documents with ROLLP Penalty for Non Compliance Notice of change in name of LLP within 30 days, in 5,000 upto 5,00,000 + 50 per day eForm15 – on & every designated partner in default _______________________ (name & signature of client) Manoj Mehta & Co., Chartered Accountants, Mumbai. Tel: 22005454. Email: mail@manojmehta.com Page 5 of 5