ACCT 6221

advertisement

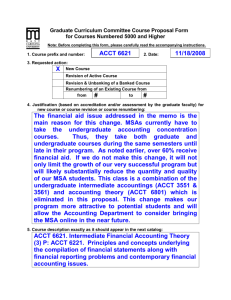

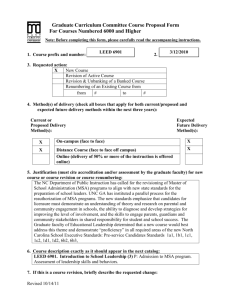

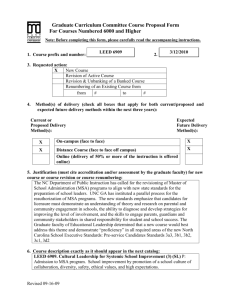

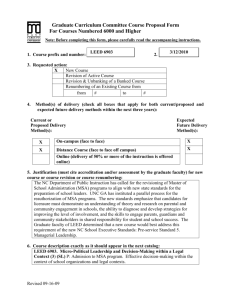

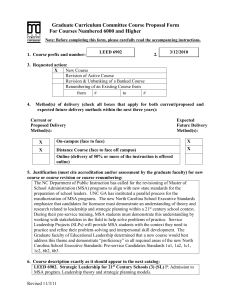

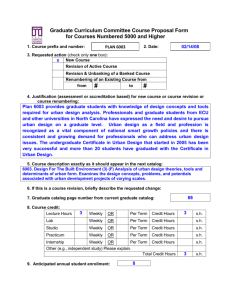

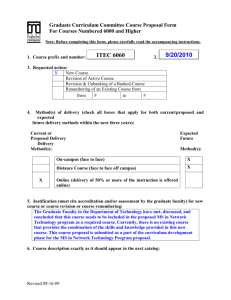

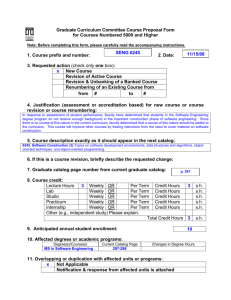

Graduate Curriculum Committee Course Proposal Form for Courses Numbered 5000 and Higher Note: Before completing this form, please carefully read the accompanying instructions. 1. Course prefix and number: ACCT 6221 2. Date: 11/18/2008 3. Requested action: X New Course Revision of Active Course Revision & Unbanking of a Banked Course Renumbering of an Existing Course from from to # # 4. Justification (based on accreditation and/or assessment by the graduate faculty) for new course or course revision or course renumbering: This course is a stand-alone general business course for graduate students entering the Masters of Accounting (MSA) program with a non-business undergraduate degree. This course covers the basics of accounting and finance. Currently, the relatively new section of the CPA exam (Business Environment and Concepts - BEC) is not covered in our program MSA. This class, in addition to ACCT 6231, will allow for coverage of the business components specifically covered on the BEC section of the CPA exam. Additionally, at this time MSAs have to take the entire MBA business core which extends the program to 60 semester hours. The MSA degree is a concentrated accounting masters degree that is designed to enable the accounting MSA to pass the CPA exam and practice as CPAs as opposed to the general business MBA program. The addition of this class and ACCT 6231 (and other changes) reduces the semester hours of the MSA to 45 semester hours. This is consistent with our regional competitors. This change makes our program more attractive to potential students and will allow the Accounting Department to consider bringing the MSA online in the near future. 5. Course description exactly as it should appear in the next catalog: ACCT 6221. Principles of Accounting and Finance (3) Generation and flow of financial information through the accounting system as well as financial control, capital budgeting, time value of money, ratio analysis, and valuation. 6. If this is a course revision, briefly describe the requested change: 7. Graduate catalog page number from current graduate catalog: 168 8. Course credit: Lecture Hours Weekly OR Per Term Credit Hours Lab Weekly OR Per Term Credit Hours s.h. Studio Weekly OR Per Term Credit Hours s.h. Practicum Weekly OR Per Term Credit Hours s.h. Internship Weekly OR Per Term Credit Hours s.h. Total Credit Hours s.h. 3 s.h. Other (e.g., independent study) Please explain. 9. Anticipated annual student enrollment: 20 10. Affected degrees or academic programs: Degree(s)/Course(s) Current Catalog Page MSA 166 Changes in Degree Hours 3 hours 11. Overlapping or duplication with affected units or programs: x Not Applicable Notification & response from affected units is attached 12. Council for Teacher Education Approval (for courses affecting teacher education): x Not Applicable Applicable and CTE has given their approval. 13. Statements of support: a. Staff x Current staff is adequate Additional Staff is needed (describe needs in the box below): b. Facilities x Current facilities are adequate Additional Facilities are needed (describe needs in the box below): c. Library x Initial library resources are adequate Initial resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition of required initial resources): d. Computer resources x Unit computer resources are adequate Additional unit computer resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition): x ITCS Resources are not needed The following ITCS resources are needed (put a check beside each need): Mainframe computer system Statistical services Network connections Computer lab for students Software Approval from the Director of ITCS attached 14. Course information (see: Graduate Curriculum Development Manual for instructions): a. Textbook(s): author(s), name, publication date, publisher, and city/state/country Revsine, R., Collins, D.W., Johnson, B. and Mittelstaedt, F. (2009). Financial Reporting and th Analysis, 4 ed. McGraw-Hill Publishing. b. Course objectives student – centered behavioral objectives for the course The student will be able to: a. Understand the development of financial statements from the beginning of the accounting system. b. Perform basic accounting and financial functions. c. Evaluate the end financial statements through the use of financial ratios and other financial means. d. Evaluate projects/cash flows through the use of capital budgeting and net present values techniques. c. Course topic outline a. The accounting profession. b. Types of accounts and the accounting function. c. Types of financial statements. d. The matching concept and adjusting process. e. Completing the accounting cycle and the closing process. f. Time value of money. g. Risk & Return (Diversification). h. Capital Budgeting (net present value/internal rate of return). i. Ratio Analysis j. Valuation of stocks and bonds k. Long-term financial planning d. List of course assignment, weighting of each assignment, and grading/evaluation system for determining a grade Course Assignments: Participation Three Exams Financial Statement Analysis Project Capital Budgeting Project Final Exam Grading Scale: 90-100% A 80-89% B 70-79% C Below 70% F 50 points 100 points each 100 points 100 points 150 points