6621

advertisement

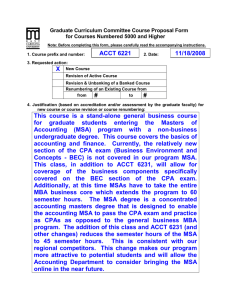

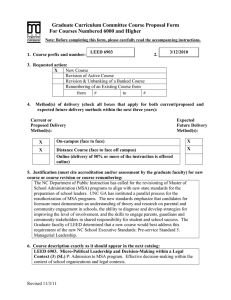

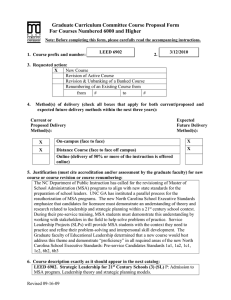

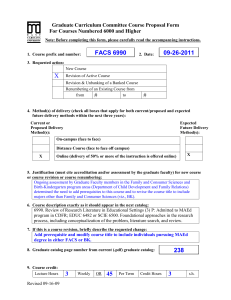

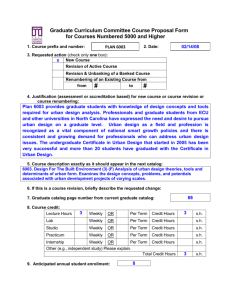

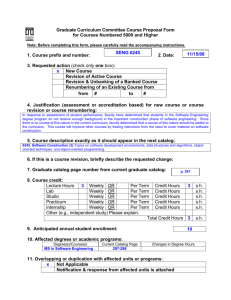

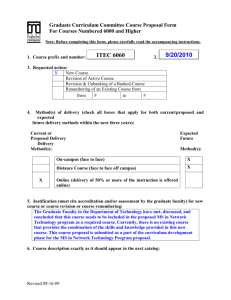

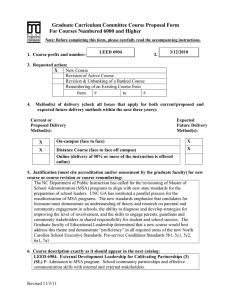

Graduate Curriculum Committee Course Proposal Form for Courses Numbered 5000 and Higher Note: Before completing this form, please carefully read the accompanying instructions. 1. Course prefix and number: ACCT 6621 2. Date: 11/18/2008 3. Requested action: X New Course Revision of Active Course Revision & Unbanking of a Banked Course Renumbering of an Existing Course from from to # # 4. Justification (based on accreditation and/or assessment by the graduate faculty) for new course or course revision or course renumbering: The financial aid issue addressed in the memo is the main reason for this change. MSAs currently have to take the undergraduate accounting concentration courses. Thus, they take both graduate and undergraduate courses during the same semesters until late in their program. As noted earlier, over 60% receive financial aid. If we do not make this change, it will not only limit the growth of our very successful program but will likely substantially reduce the quantity and quality of our MSA students. This class is a combination of the undergraduate intermediate accountings (ACCT 3551 & 3561) and accounting theory (ACCT 6801) which is eliminated in this proposal. This change makes our program more attractive to potential students and will allow the Accounting Department to consider bringing the MSA online in the near future. 5. Course description exactly as it should appear in the next catalog: ACCT 6621. Intermediate Financial Accounting Theory (3) P: ACCT 6221. Principles and concepts underlying the compilation of financial statements along with financial reporting problems and contemporary financial accounting issues. 6. If this is a course revision, briefly describe the requested change: 7. Graduate catalog page number from current graduate catalog: 168 8. Course credit: Lecture Hours Weekly OR Per Term Credit Hours Lab Weekly OR Per Term Credit Hours s.h. Studio Weekly OR Per Term Credit Hours s.h. Practicum Weekly OR Per Term Credit Hours s.h. Internship Weekly OR Per Term Credit Hours s.h. Total Credit Hours s.h. 6 s.h. Other (e.g., independent study) Please explain. 9. Anticipated annual student enrollment: 40 10. Affected degrees or academic programs: Degree(s)/Course(s) Current Catalog Page MSA 166 Changes in Degree Hours 6 hours 11. Overlapping or duplication with affected units or programs: x Not Applicable Notification & response from affected units is attached 12. Council for Teacher Education Approval (for courses affecting teacher education): x Not Applicable Applicable and CTE has given their approval. 13. Statements of support: a. Staff x Current staff is adequate Additional Staff is needed (describe needs in the box below): b. Facilities x Current facilities are adequate Additional Facilities are needed (describe needs in the box below): c. Library x Initial library resources are adequate Initial resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition of required initial resources): d. Computer resources x Unit computer resources are adequate Additional unit computer resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition): x ITCS Resources are not needed The following ITCS resources are needed (put a check beside each need): Mainframe computer system Statistical services Network connections Computer lab for students Software Approval from the Director of ITCS attached 14. Course information (see: Graduate Curriculum Development Manual for instructions): a. Textbook(s): author(s), name, publication date, publisher, and city/state/country Spiceland, Sepe, and Tomassini, (2007). Intermediate Accounting, 4th ed. McGraw-Hill Publishing. b. Course objectives student – centered behavioral objectives for the course The student will be able to: a. Understand the fundamental accounting cycle b. Prepare typical accounting financial statements. c. Understand the accounting for receivables inventory, and asset acquisitions and disposals. d. Understand the accounting for liabilities, contingencies, bonds, and long-term notes. e. Understand advanced accounting issues for leases, pensions, income taxes c. Course topic outline a. Review the accounting process. b. Balance Sheet and Financial Disclosures. c. Income Statement and Statement of Cash Flows. d. Cash and Receivables e. Inventory. f. Operational Assets: Acquisition, Disposal, Utilization g. Liabilities, Bond, and Notes h. Accounting Investments i. Accounting for Leases and Income Taxes j. Accounting Pensions and Treasury Stock k. Earnings Per Share l. Accounting Changes and Error Correction d. List of course assignment, weighting of each assignment, and grading/evaluation system for determining a grade Course Assignments: Participation Homework Four Exams Financial Statement Analysis Project Accounting Theory Paper Final Exam Grading Scale: 90-100% A 80-89% B 70-79% C Below 70% F 50 points 100 points 100 points each 100 points 100 points 150 points