Introduction to Managerial Accounting

advertisement

Chapter 13

“How Well Am I Doing?”

Statement of Cash Flows

PowerPoint Authors:

Jon A. Booker, Ph.D., CPA, CIA

Charles W. Caldwell, D.B.A., CMA

Susan Coomer Galbreath, Ph.D., CPA

13-2

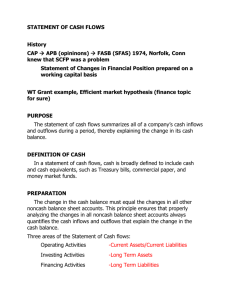

Purpose of the Statement of Cash Flows

Are cash flows

sufficient to

support ongoing

operations?

Will the company

have to borrow

money to make

needed

investments?

Can we meet

our obligations

to creditors?

Can we pay

dividends?

Why is there a

difference

between net

income and net

cash flow?

13-3

Learning Objective 1

Classify changes in noncash

balance sheet accounts as

sources or uses of cash.

13-4

Definition of Cash

The term cash on the statement of cash flows refers

broadly to both currency and cash equivalents.

Currency and

Bank Accounts

Treasury

Bills

Cash

Money Market

Funds

Commercial

Paper

13-5

Constructing the Statement of Cash Flows Using

Changes in Noncash Balance Sheet Accounts

4. Changes in

Capital Stock

5. Dividends

Paid to

Stockholders

3. Changes in

Liabilities

Net Cash

Flows for a

Period

1. Net Income

2. Changes in

Noncash

Assets

13-6

Constructing the Statement of Cash Flows Using

Changes in Noncash Balance Sheet Accounts

Net Income

Net Loss

Changes in noncash assets

Changes in liabilities*

Changes in capital stock

accounts

Dividends paid to stockholders

Sources

Always

Decreases

Increases

Uses

Always

Increases

Decreases

Increases

Decreases

Always

Total sources - Total uses = Net cash flow

* Contra asset accounts, such as the Accumulated Depreciation and

Amortization account, follow the rules for liabilities.

13-7

Constructing the Statement of Cash Flows Using

Changes in Noncash Balance Sheet Accounts

Increases in noncash asset

accounts imply uses of cash.

Example: Inventory is

purchased on credit from

a supplier.

It is implied that cash

was used to acquire the

inventory.

13-8

Constructing the Statement of Cash Flows Using

Changes in Noncash Balance Sheet Accounts

Increases in liability accounts imply

sources of cash.

Example: Inventory is

purchased on credit from

a supplier.

It is implied that an increase

in a payable has the effect

of increasing cash available

for other uses.

13-9

Constructing the Statement of Cash Flows Using

Changes in Noncash Balance Sheet Accounts

Decreases in noncash assets

accounts imply sources of cash.

Example: Accounts receivable

decreases when a company

pays its bill.

The company’s cash

increases accordingly.

13-10

Constructing the Statement of Cash Flows Using

Changes in Noncash Balance Sheet Accounts

Decreases in liability accounts

imply uses of cash.

Example: If a company

makes a payment on a

note payable.

The company’s cash balance

decreases accordingly.

13-11

A Simplified Statement of Cash Flows

Ed's Pizza Hut

Comparative Balance Sheet Account Balances

Cash

Accounts Receivable

Inventory

Land

Equipment

Accumulated Depr.

Accounts Payable

Salaries Payable

Note Payable - Joe Doe

Common Stock

Retained Earnings

3/31/2009

3/31/2008

Change

DR (CR)

DR (CR)

Incr. (Decr.)

$

71,000 $

90,000 $

(19,000)

23,000

40,000

(17,000)

322,000

300,000

22,000

68,000

100,000

(32,000)

112,000

84,000

28,000

(45,000)

(39,000)

6,000

(38,000)

(27,000)

11,000

(9,000)

(14,000)

(5,000)

(50,000)

(50,000)

(500,000)

(450,000)

50,000

(4,000)

(34,000)

(30,000)

$

- $

-

13-12

A Simplified Statement of Cash Flows

Additional Information:

There was a net loss for the year of $27,000.

Depreciation charges for the year were $6,000.

During the year, Ed sold land originally costing

$32,000 for $32,000.

During the year, Ed purchased equipment for

$28,000.

During the year, Ed paid dividends of $3,000 to the

stockholders.

Ed issued $50,000 of common stock to settle the

note due to Joe Doe.

13-13

A Simplified Statement of Cash Flows

Here is a summary of the sources

of cash for Ed’s Pizza Hut.

Ed's Pizza Hut

Sources of Cash

Decrease in A/R

$

Decrease in Land

Increase in A/P

Depreciation charges

Total sources of cash

$

17,000

32,000

11,000

6,000

66,000

13-14

A Simplified Statement of Cash Flows

Here is a summary of the uses of cash.

Ed's Pizza Hut

Uses of Cash

Net loss

Increase in Inventory

Increase in Equipment

Increase in Salaries Payable

Dividends paid

Total uses of cash

$

$

27,000

22,000

28,000

5,000

3,000

85,000

The net cash flow for Ed’s Pizza Hut is ($19,000):

$66,000 in sources minus $85,000 in uses.

13-15

A Simplified Statement of Cash Flows

Ed's Pizza Hut

Sources of Cash

Decrease in A/R

$

Decrease in Land

Increase in A/P

Depreciation charges

Total sources of cash

$

17,000

32,000

11,000

6,000

66,000

Ed's Pizza Hut

Uses of Cash

Net loss

Increase in Inventory

Increase in Equipment

Increase in Salaries Payable

Dividends paid

Total uses of cash

$

$

27,000

22,000

28,000

5,000

3,000

85,000

This simplified

approach does not

follow the format

required for

external reporting

purposes. It is for

illustrative

purposes only.

13-16

Learning Objective 2

Classify transactions as

operating, investing, or

financing activities.

13-17

The Three Sections of the Statement of Cash Flows

Operating activities are

those activities that enter

into the determination of

net income.

1. Transactions

affecting current

assets

2. Transactions

affecting current

liabilities

3. Changes in

noncurrent

balance sheet

accounts that

directly affect net

income

13-18

The Three Sections of the Statement of Cash Flows

Investing activities relate to

transactions involving the

acquiring or disposing of

noncurrent assets.

1. Acquiring or

selling property,

plant and

equipment

2. Acquiring or

selling securities

held for long-term

investments

3. Lending money

to another entity

and subsequently

collecting on the

loan

13-19

The Three Sections of the Statement of Cash Flows

Financing activities relate to

transactions involving borrowing

from creditors or repaying

creditors and engaging in

transactions with the

company’s owners.

1. Issuing stock

and purchasing

treasury stock

2. Issuing longterm debt and

repayment of debt

3. Payment of

dividends (note

that interest on

debt is classified

as an operating

activity)

13-20

Format of the Statement of Cash Flows

(Indirect Method)

Operating Activities:

Net income

Changes in current assets

Changes in noncurrent assets that affect net income (e.g., depreciation)

Changes in current liabilities (except for debts to lenders and dividends

payable)

Changes in noncurrent liabilities that affect net income

Investing Activities:

Changes in noncurrent assets that are not included in net income

Financing Activities:

Changes in the current liabilities that are debts to lenders rather than

obligations to suppliers, employees, or the government

Changes in noncurrent liabilities that are not included in net income

Changes in capital stock accounts

Dividends

13-21

Format of the Statement of Cash Flows

(Indirect Method)

Operating Activities

Investing Activities

Financing Activities

Reconciliation of the

beginning cash balance

with the ending cash

balance

Noncash Investing

and Financing

Activities

13-22

Operating Activities

Net Income or Loss

Add:

Less:

$ XXX

Decrease in current noncash assets

XXX

Increase in current liabilities

XXX

Depreciation charges

XXX

Losses

XXX

Increase in current noncash assets

(XXX)

Decrease in current liabilities

(XXX)

Gains

(XXX)

Cash Flows from Operating Activities

$ XXX

Includes those activities that affect current

assets, current liabilities, or net income.

13-23

Operating Activities

Sources of cash are added to and

uses of cash are subtracted from net

cash provided by operating

activities.

Impact on Net Cash Provided by Operating Activities

Sources of Cash

Uses of Cash

(Add to Net Income)

(Subtract from Net Income)

Current

Noncash Assets

Current

Liabilities

Decreases

Increases

Increases

Decreases

13-24

Operating Activities

Net Income or Loss

Add:

Less:

$ XXX

Decrease in current noncash assets

XXX

Increase in current liabilities

XXX

Depreciation charges

XXX

Losses

XXX

Increase in current noncash assets

(XXX)

Decrease in current liabilities

(XXX)

Cash Flows from Operating Activities

$ XXX

Impact on Net Cash Provided by Operating Activities

Gains Sources of Cash

(XXX)

Uses of

Cash

(Add to Net Income)

(Subtract from Net Income)

Current

Noncash Assets

Current

Liabilities

Decreases

Increases

Increases

Decreases

13-25

Operating Activities

Net Income or Loss

Add:

Less:

$ XXX

Decrease in current noncash assets

XXX

Increase in current liabilities

XXX

Depreciation charges

XXX

Losses

XXX

Increase in current noncash assets

(XXX)

Decrease in current liabilities

(XXX)

Gains

(XXX)

Impact on Net Cash Provided by Operating

Activities

Sources of Cash

Uses of Cash

$ XXX

(Subtract from Net Income)

Decreases

Increases

Increases

Decreases

Cash Flows from

Operating Activities

(Add to Net Income)

Current

Noncash Assets

Current

Liabilities

13-26

Operating Activities

Net Income or Loss

Add:

Less:

$ XXX

Decrease in current noncash assets

XXX

Increase in current liabilities

XXX

Depreciation charges

XXX

Losses

XXX

Increase in current noncash assets

(XXX)

Decrease in current liabilities

(XXX)

Gains

(XXX)

Cash Flows from Operating Activities

$ XXX

Depreciation and Amortization charges are added back

because they are decreases in noncash assets.

13-27

Operating Activities

Net Income or Loss

Add:

Less:

$ XXX

Decrease in current noncash assets

XXX

Increase in current liabilities

XXX

Depreciation charges

XXX

Losses

XXX

Increase in current noncash assets

(XXX)

Decrease in current liabilities

(XXX)

Gains

(XXX)

Cash Flows from Operating Activities

Gains are

subtracted.

$ XXX

Losses are added.

13-28

Investing Activities

Add:

Proceeds from sale of land,

buildings, equipment, or other

noncurrent assets

Receipt of principal from

investments

Less:

Payments to acquire land,

buildings, equipment, or other

noncurrent assets

Payments to acquire

investments

Net Cash Flows from Investing Activities

$ XXX

XXX

(XXX)

(XXX)

$ XXX

Includes transactions that involve the

acquisition or disposal of noncurrent assets.

13-29

Financing Activities

Add:

Proceeds from borrowings

Proceeds from issuing capital

stock

Proceeds from sale of bonds

Less:

Principal payments on

borrowed funds

Payments related to bond

maturities

Dividend payments

Net Cash Flows from Financing Activities

$ XXX

XXX

XXX

(XXX)

(XXX)

(XXX)

$ XXX

Includes transactions involving receipts

from or payments to creditors and owners.

13-30

Cash Flows: Gross or Net?

For investing and

financing activities,

items on the

statement of cash

flows should be

presented in gross

amounts rather

than in net

amounts.

Example:

• Assume Macy’s

purchases $50 million

in property during the

year and sells other

property for $30

million.

• Instead of showing the

net change of $20

million, the company

must report the gross

amounts of both

transactions.

13-31

Operating Activities: Direct or Indirect Method?

Two Formats for Reporting Operating Activities

Direct Method

Indirect Method

Reports the

cash effects of

each operating

activity

Starts with accrual

net income and

adjusts it to the

cash basis

No matter which format is used, the same amount of net

cash provided by operating activities is generated.

13-32

Learning Objective 3

Prepare a statement of cash

flows using the indirect method

to determine the net cash

provided by operating activities.

13-33

Statement of Cash Flows: Indirect Method

Ed's Pizza Hut

Comparative Balance Sheet Account Balances

Cash

Accounts Receivable

Inventory

Land

Equipment

Accumulated Depr.

Accounts Payable

Salaries Payable

Note Payable - Joe Doe

Common Stock

Retained Earnings

3/31/2009

3/31/2008

Change

DR (CR)

DR (CR)

Incr. (Decr.)

$

71,000 $

90,000 $

(19,000)

23,000

40,000

(17,000)

322,000

300,000

22,000

68,000

100,000

(32,000)

112,000

84,000

28,000

(45,000)

(39,000)

6,000

(38,000)

(27,000)

11,000

(9,000)

(14,000)

(5,000)

(50,000)

(50,000)

(500,000)

(450,000)

50,000

(4,000)

(34,000)

(30,000)

$

- $

-

Let’s revisit the

comparative

balance sheet

account balances

for Ed’s Pizza Hut.

13-34

Statement of Cash Flows: Indirect Method

Refresh your memory regarding the

following additional information.

There was a net loss for the year of $27,000.

Depreciation charges for the year were $6,000.

During the year, Ed sold land originally costing

$32,000 for $32,000.

During the year, Ed purchased equipment for

$28,000.

During the year, Ed paid dividends of $3,000 to

the stockholders.

Ed issued $50,000 of common stock to settle the

note due to Joe Doe.

13-35

Step 1 of 8

Ed's Pizza Hut

Statement of Cash Flows Worksheet

Source Cash Flow

AdjustChange

or Use?

Effect

ments

Assets (except cash and cash equivalents)

Current assets

Accounts receivable

Inventory

Noncurrent assets

Land

Equipment

Contra Assets, Liabilities, and Stockholders' Equity

Contra assets

Accumulated depreciation

Current liabilities

Accounts payable

Salaries payable

Noncurrent liabilities

Notes payable

Stockholders' equity

Common stock

Retained earnings

Net loss

Dividends

Total (net cash flow)

Adjusted

Effect

Classification

List each account

appearing on the

comparative balance

sheets except for cash

and cash equivalents

and retained earnings.

13-36

Step 2 of 8

Ed's Pizza Hut

Statement of Cash Flows Worksheet

Source Cash Flow

AdjustChange

or Use?

Effect

ments

Assets (except cash and cash equivalents)

Current assets

Accounts receivable

$

(17,000)

Inventory

22,000

Noncurrent assets

Land

(32,000)

Equipment

28,000

Contra Assets, Liabilities, and Stockholders' Equity

Contra assets

Accumulated depreciation

6,000

Current liabilities

Accounts payable

11,000

Salaries payable

(5,000)

Noncurrent liabilities

Notes payable

(50,000)

Stockholders' equity

Common stock

50,000

Retained earnings

Net loss

(27,000)

Dividends

3,000

Total (net cash flow)

Adjusted

Effect

Classification

Compute the change

from the beginning

balance to the ending

balance for each

account.

13-37

Step 3 of 8

Ed's Pizza Hut

Statement of Cash Flows Worksheet

Source Cash Flow

AdjustAdjusted

ClassifiChange

or Use?

Effect

ments

Effect

cation

Assets (except cash and cash equivalents)

Current assets

Accounts receivable

$

(17,000) Source

Inventory

22,000

Use

Noncurrent assets

Land

(32,000) Source

Equipment

28,000

Use

Contra Assets, Liabilities, and Stockholders' Equity

Contra assets

Accumulated depreciation

6,000 Source

Current liabilities

Accounts payable

11,000 Source

Salaries payable

(5,000)

Use

Noncurrent liabilities

Notes payable

(50,000)

Use

Recall that the transaction

Stockholders' equity

involving the Notes Payable and

Common stock

50,000 Source

Common Stock was noncash.

Retained earnings

Net loss

(27,000)

Use

Dividends

3,000

Use

Total (net cash flow)

Code each entry on

the worksheet as a

source or use of

cash.

{

13-38

Step 4 of 8

Ed's Pizza Hut

Statement of Cash Flows Worksheet

Source Cash Flow

AdjustChange

or Use?

Effect

ments

Assets (except cash and cash equivalents)

Current assets

Accounts receivable

$

(17,000) Source $

17,000

Inventory

22,000

Use

(22,000)

Noncurrent assets

Land

(32,000) Source

32,000

Equipment

28,000

Use

(28,000)

Contra Assets, Liabilities, and Stockholders' Equity

Contra assets

Accumulated depreciation

6,000 Source

6,000

Current liabilities

Accounts payable

11,000 Source

11,000

Salaries payable

(5,000)

Use

(5,000)

Noncurrent liabilities

Notes payable

(50,000)

Use

(50,000)

Stockholders' equity

Common stock

50,000 Source

50,000

Retained earnings

Net loss

(27,000)

Use

(27,000)

Dividends

3,000

Use

(3,000)

Total (net cash flow)

$ (19,000)

Adjusted

Effect

Classification

Code sources

of cash as

positive

numbers and

uses of cash

as negative

numbers.

13-39

Step 5 of 8

Ed's Pizza Hut

Statement of Cash Flows Worksheet

Source Cash Flow

AdjustAdjusted

ClassifiChange

or Use?

Effect

ments

Effect

cation

Assets (except cash and cash equivalents)

Current assets

Accounts receivable

$

(17,000) Source $

17,000

$

17,000

Inventory

22,000

Use

(22,000)

(22,000)

Noncurrent assets

Land

(32,000) Source

32,000

32,000

Equipment

28,000

Use

(28,000)

(28,000)

Contra Assets, Liabilities, and Stockholders' Equity

Contra assets

Accumulated depreciation

6,000 Source

6,000

6,000

Current liabilities

Accounts payable

11,000 Source

11,000

11,000

Salaries payable

(5,000)

Use

(5,000)

(5,000)

Noncurrent liabilities

Notes payable

(50,000)

Use

(50,000)

50,000

We -need to make an adjustment

Stockholders' equity

for the noncash transaction

Common stock

50,000 Source

50,000

(50,000)

relating

to Notes Payable and

Retained earnings

Net loss

(27,000)

Use

(27,000)

(27,000) Common Stock.

Dividends

3,000

Use

(3,000)

(3,000)

Total (net cash flow)

$ (19,000) $

$ (19,000)

{

Make any

necessary

adjustments,

including

adjustments

for gains and

losses. The

net effect of

these should

equal zero.

13-40

Step 6 of 8

Ed's Pizza Hut

Statement of Cash Flows Worksheet

Source Cash Flow

AdjustAdjusted

Change

or Use?

Effect

ments

Effect

Assets (except cash and cash equivalents)

Current assets

Accounts receivable

$

(17,000) Source $

17,000

$

17,000

Inventory

22,000

Use

(22,000)

(22,000)

Noncurrent assets

Land

(32,000) Source

32,000

32,000

Equipment

28,000

Use

(28,000)

(28,000)

Contra Assets, Liabilities, and Stockholders' Equity

Contra assets

Accumulated depreciation

6,000 Source

6,000

6,000

Current liabilities

Accounts payable

11,000 Source

11,000

11,000

Salaries payable

(5,000)

Use

(5,000)

(5,000)

Noncurrent liabilities

Notes payable

(50,000)

Use

(50,000)

50,000

Stockholders' equity

Common stock

50,000 Source

50,000

(50,000)

Retained earnings

Net loss

(27,000)

Use

(27,000)

(27,000)

Dividends

3,000

Use

(3,000)

(3,000)

Total (net cash flow)

$ (19,000) $

$ (19,000)

Classification

Operating

Operating

Investing

Investing

Operating

Operating

Operating

Operating

Financing

Classify

each

entry as

operating,

investing,

or

financing

activity.

13-41

Step 7 of 8

Ed's Pizza Hut

Statement of Cash Flows

For the Period Ending 3/31/2009

Operating Activities

Net Loss

$ (27,000)

Add: Decrease in A/R

17,000

Increase in A/P

11,000

Increase in Depr. Charges

6,000

Less: Increase in Inventory

(22,000)

Decrease in Salaries Payable

(5,000)

Net Cash Provided by Operating Activities

(20,000)

Investing Activities

Proceeds from sale of Land

32,000

Purchase of equipment

(28,000)

Net Cash Provided by Investing Activities

4,000

Financing Activities

Dividends paid

(3,000)

Net change in cash

$ (19,000)

Copy the data

from the

worksheet into

the Statement of

Cash Flows

section by

section.

13-42

Step 8 of 8

Ed's Pizza Hut

Statement of Cash Flows

For the Period Ending 3/31/2009

Operating Activities

Net Loss

$

Add: Decrease in A/R

Increase in A/P

Increase in Depr. Charges

Less: Increase in Inventory

Decrease in Salaries Payable

Net Cash Provided by Operating Activities

Investing Activities

Proceeds from sale of Land

Purchase of equipment

Net Cash Provided by Investing Activities

Financing Activities

Dividends paid

Net change in cash

Cash, beginning

Cash, ending

$

(27,000)

17,000

11,000

6,000

(22,000)

(5,000)

(20,000)

32,000

(28,000)

4,000

(3,000)

(19,000)

90,000

71,000

Prepare a cash

reconciliation at

the bottom of the

statement.

13-43

Statement of Cash Flows: Indirect Method

Ed's Pizza Hut

Statement of Cash Flows

For the Period Ending 3/31/2009

Operating Activities

Net Loss

$

Add: Decrease in A/R

Increase in A/P

Increase in Depr. Charges

Less: Increase in Inventory

Decrease in Salaries Payable

Net Cash Provided by Operating Activities

Investing Activities

Proceeds from sale of Land

Purchase of equipment

Net Cash Provided by Investing Activities

Financing Activities

Dividends paid

Net change in cash

Cash, beginning

Cash, ending

(27,000)

17,000

11,000

6,000

(22,000)

(5,000)

(20,000)

32,000

(28,000)

4,000

(3,000)

(19,000)

90,000

$71,000

In addition, on the

face of the

statement or in a

supplemental

schedule, disclose

the issuance of

$50,000 of stock

to a creditor, a

noncash financing

activity.

13-44

Interpretation of the Statement of Cash Flows

Examine the operating activities

section carefully.

▫ Ed’s Pizza Hut generated a negative

net cash provided by operating

activities of $20,000. This is usually a

sign of fundamental difficulties.

▫ Ultimately, a positive cash flow is

necessary to avoid liquidating assets

or borrowing money to pay for day-today activities.

13-45

Learning Objective 4

Compute free cash flow.

13-46

Free Cash Flow

Free cash flow measures a company’s

ability to fund its capital expenditures and

dividends from its net cash provided by

operating activities.

Free Cash Flow =

Net Cash Provided by

Operating Activities

-

Capital

Expenditures

-

Dividends

13-47

Free Cash Flow

Using the equation shown on the prior slide,

the free cash flow for Ed’s Pizza Hut of

($51,000) is computed like this . . .

Net Cash Provided by

Capital

Free Cash Flow =

- Expenditures - Dividends

Operating Activities

$

(51,000) = $

(20,000) - $

28,000 - $ 3,000

Appendix 13A

The Direct Method of Determining

the Net Cash Provided by

Operating Activities.

PowerPoint Authors:

Jon A. Booker, Ph.D., CPA, CIA

Charles W. Caldwell, D.B.A., CMA

Susan Coomer Galbreath, Ph.D., CPA

13-49

Learning Objective 5

Use the direct method to

determine the net cash

provided by operating

activities.

13-50

Computing Net Cash Provided by

Operating Activities

The direct method computes net cash provided

by operating activities by reconstructing the

income statement on the cash basis from top to

bottom.

However

The amount of net cash provided by operating

activities under the direct method will always

agree with the amount computed using the

indirect method.

13-51

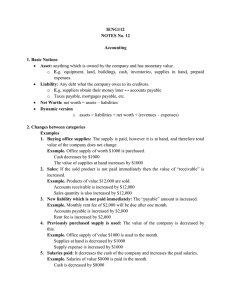

Similarities and Differences

in Handling Data

Revenue or Expense Item

Sales revenue (as reported)

Adjustments to a cash basis:

1 Increases in accounts receivable

2 Decreases in accounts receivable

Cost of goods sold (as reported)

Adjustments to a cash basis:

3 Increase in merchandise inventory

4 Decrease in merchandise inventory

5 Increase in accounts payable

6 Decrease in accounts payable

Operating expenses (as reported)

Adjustments to a cash basis:

7 Increase in prepaid expenses

8 Decrease in prepaid expenses

9 Increase in accrued liabilities

10 Decrease in accrued liabilities

11 Period's depreciation, depletion and

amortization charges

Income tax expense (as reported)

Adjustments to a cash basis:

12 Increase in accrued taxes payable

13 Decrease in accrued taxes payable

14 Increase in deferred income taxes

15 Decrease in deferred income taxes

Add (+) or

Deduct (-) to

Adjust to a

Cash Basis

+

+

+

+

+

-

+

+

Adjustments for accounts that

affect revenue are the same in

the direct method and indirect

methods.

Adjustments for accounts that

affect expenses are handled in

opposite ways for the direct and

indirect methods.

13-52

Direct Method: Gains and Losses

Regarding gains and

losses on sale of assets,

no adjustments are

needed at all under the

direct method.

13-53

The Direct Method

Ed's Pizza Hut

Comparative Balance Sheet Account Balances

Cash

Accounts Receivable

Inventory

Land

Equipment

Accumulated Depr.

Accounts Payable

Salaries Payable

Note Payable - Joe Doe

Common Stock

Retained Earnings

3/31/2009

3/31/2008

Change

DR (CR)

DR (CR)

Incr. (Decr.)

$

71,000 $

90,000 $

(19,000)

23,000

40,000

(17,000)

322,000

300,000

22,000

68,000

100,000

(32,000)

112,000

84,000

28,000

(45,000)

(39,000)

6,000

(38,000)

(27,000)

11,000

(9,000)

(14,000)

(5,000)

(50,000)

(50,000)

(500,000)

(450,000)

50,000

(4,000)

(34,000)

(30,000)

$

- $

-

Let’s revisit the

comparative

balance sheet

account

balances for

Ed’s Pizza Hut.

13-54

The Direct Method

Ed's Pizza Hut

Income Statement

For the Year Ended 3/31/2009

Sales

$

1,000,000

Cost of goods sold

750,000

Gross margin

250,000

Operating expenses

277,000

Net loss

$

(27,000)

Let’s assume

that Ed’s Pizza

Hut prepared

this income

statement.

13-55

The Direct Method

Step 1: Translate sales revenue into cash

collected from customers.

Sales (as reported)

Add: Decrease in accounts receivable

Cash collected from customers

$

$

1,000,000

17,000

1,017,000

13-56

The Direct Method

Step 2: Translate cost of goods sold into

cash disbursements for purchases.

Cost of goods sold (as reported)

$

Add: Increase in inventory

Less: Increase in accounts payable

Cash paid for purchases

$

750,000

22,000

(11,000)

761,000

13-57

The Direct Method

Step 3: Translate operating expenses into cash

paid for operating expenses.

Operating expenses (as reported)

Add: Decrease in salaries payable

Less: Increase in depreciation

Cash paid for operating expenses

$

$

277,000

5,000

(6,000)

276,000

There is not an adjustment needed for

income taxes because Ed’s Pizza Hut has

a net loss of $27,000.

13-58

The Direct Method

Ed's Pizza Hut

Statement of Cash Flows

For the Period Ending 3/31/2009

Operating Activities

Cash received from customers

$ 1,017,000

Cash paid for purchases

(761,000)

Cash paid for operating expenses

(276,000)

Net cash flow from operations

(20,000)

Investing Activities

Proceeds from sale of land

32,000

Purchase of equipment

(28,000)

Net cash flow from investing activities

4,000

Financing Activities

Dividends paid

(3,000)

Net change in cash

(19,000)

Cash, beginning

90,000

Cash, ending

$

71,000

Notice that the

net cash

provided by

operating

activities agrees

with that

computed using

the indirect

method.

Appendix 13B

The T-Account Approach to Preparing

the Statement of Cash Flows

PowerPoint Authors:

Jon A. Booker, Ph.D., CPA, CIA

Charles W. Caldwell, D.B.A., CMA

Susan Coomer Galbreath, Ph.D., CPA

13-60

T-Account Approach: Statement of Cash Flows

Ed's Pizza Hut

Comparative Balance Sheet Account Balances

Cash

Accounts Receivable

Inventory

Land

Equipment

Accumulated Depr.

Accounts Payable

Salaries Payable

Note Payable - Joe Doe

Common Stock

Retained Earnings

3/31/2009

3/31/2008

Change

DR (CR)

DR (CR)

Incr. (Decr.)

$

71,000 $

90,000 $

(19,000)

23,000

40,000

(17,000)

322,000

300,000

22,000

68,000

100,000

(32,000)

112,000

84,000

28,000

(45,000)

(39,000)

6,000

(38,000)

(27,000)

11,000

(9,000)

(14,000)

(5,000)

(50,000)

(50,000)

(500,000)

(450,000)

50,000

(4,000)

(34,000)

(30,000)

$

- $

-

13-61

T-Account Approach: Statement of Cash Flows

Additional Information:

There was a net loss for the year of $27,000.

Depreciation charges for the year were $6,000.

During the year, Ed sold land originally costing

$32,000 for $32,000.

During the year, Ed purchased equipment for

$28,000.

During the year, Ed paid dividends of $3,000 to the

stockholders.

Ed issued $50,000 of common stock to settle the

note due to Joe Doe.

13-62

T-Account Approach

Here is a summary of the sources

of cash for Ed’s Pizza Hut.

Ed's Pizza Hut

Sources of Cash

Decrease in A/R

$

Decrease in Land

Increase in A/P

Depreciation charges

Total sources of cash

$

17,000

32,000

11,000

6,000

66,000

13-63

T-Account Approach

Here is a summary of the uses of

cash for Ed’s Pizza Hut.

Ed's Pizza Hut

Uses of Cash

Net loss

$

Increase in Inventory

Decrease in Salaries Payable

Increase in Equipment

Dividends paid

Total uses of cash

$

27,000

22,000

5,000

28,000

3,000

85,000

The net cash flow for Ed’s Pizza Hut is ($19,000):

$66,000 in sources minus $85,000 in uses.

13-64

T- Account Approach

Cash

Provided

Used

27,000 Net loss

3,000 Cash dividends paid

13-65

T-Account Approach

Cash

Provided

Decrease in accounts receivable

Used

17,000

27,000 Net loss

22,000 Increase in inventory

3,000 Cash dividends paid

13-66

T-Account Approach

Cash

Provided

Decrease in accounts receivable

Used

17,000

27,000 Net loss

22,000 Increase in inventory

Sale of land

32,000

3,000 Cash dividends paid

13-67

T-Account Approach

Cash

Provided

Decrease in accounts receivable

Depreciation charges

Proceeds from sale of land

Used

17,000

6,000

27,000 Net loss

22,000 Increase in inventory

32,000

28,000 Purchase of equipment

3,000 Cash dividends paid

13-68

T-Account Approach

Cash

Provided

Decrease in accounts receivable

Depreciation charges

Increase in accounts payable

Proceeds from sale of land

Used

17,000

6,000

11,000

27,000 Net loss

22,000 Increase in inventory

5,000 Decrease in salaries payable

32,000

28,000 Purchase of equipment

3,000 Cash dividends paid

13-69

T-Account Approach

What about the $50,000 issuance of common

stock to settle the note payable to Joe Doe?

No Effect in the Cash

Account.

However, this transactions would be disclosed in

a supplemental schedule that accompanies the

statement of cash flows.

13-70

T-Account Approach

Cash

Provided

Decrease in accounts receivable

Depreciation charges

Increase in accounts payable

Used

17,000

6,000

11,000

Proceeds from sale of land

32,000

27,000

22,000

5,000

20,000

28,000

3,000

19,000

Net loss

Increase in inventory

Decrease in salaries payable

Net cash used in operations

Purchase of equipment

Cash dividends paid

Net decrease in cash

The net effect of these transactions on the

cash account is as shown.

Notice, the net decrease in cash is $19,000.

13-71

The Statement of Cash Flows

Ed's Pizza Hut

Statement of Cash Flows

For the Period Ending 3/31/2009

Operating Activities

Net Loss

Add: Decrease in A/R

Increase in A/P

Increase in Depr. Charges

Less: Increase in Inventory

Decrease in Salaries Payable

Net Cash Provided by Operating Activities

Investing Activities

Proceeds from sale of Land

Purchase of equipment

Net Cash Provided by Investing Activities

Financing Activities

Dividends paid

Net change in cash

Cash, beginning

Cash, ending

$ (27,000)

17,000

11,000

6,000

(22,000)

(5,000)

(20,000)

32,000

(28,000)

4,000

(3,000)

(19,000)

90,000

$ 71,000

In addition, on the

face of the

statement or in a

supplemental

schedule, disclose

the issuance of

$50,000 of stock

to a creditor, a

noncash financing

activity.

13-72

End of Chapter 13