Chapter 13 - Bellevue College

advertisement

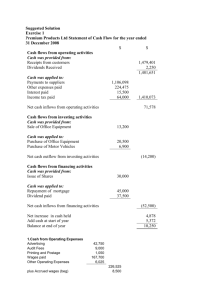

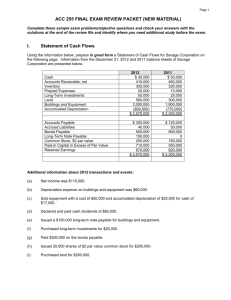

Chapter 13 The Statement of Cash Flows Objectives State the Cash Flow’s primary purpose, its usefulness Discuss & understand operating, investing, and financing activities, and noncash. Analyze a company’s cash flow statement. Prepare one using: the indirect method Note: you are not responsible to know the worksheet or direct method. (appendix 13A and 13B) NOTE: SUPPLEMENTARY MATERIAL – Product Life Cycle and Cash Flow. Warning: Not in book!!! The Primary Purpose of the Statement of Cash Flows Is... To provide information about: • cash receipts, • cash payments, and • the net change in cash resulting from: operating, investing, and financing activities of a company during a period. Categories of Cash Flows Cash Flows are subdivided into three categories: Operating – Cash Receipts and Cash Disbursements from day to day transactions. These transactions are generally from the Income Statement and affect Current Assets and Current Liabilities Investing – Cash Receipts and Cash Disbursements from the purchase and sale of Long-Term Assets Financing – Cash Receipts and Cash Disbursements from Long-term Debt and Equity Questions the Statement of Cash Flow Answers Operating Activities... Include: The cash effects of transactions that create revenues and expenses and Enter into determination of net income. Involve Income Statement Items Investing Activities... Include: Purchasing and disposing of investments and productive long-lived assets using cash and Lending money and collecting the loans. Involve Investments and LongTerm Asset Items Financing Activities... Include: Obtaining cash from issuing debt and repaying the amounts borrowed and Obtaining cash from stockholders and paying them dividends. Involve Long-Term Liability and Stockholders’ Equity Items Types of Cash Flows Operating Activities Cash inflows: • From sale of goods or services • From interest received and dividends received • To receive cash on account Cash outflows: • To suppliers for inventory • To pay down accounts payable • To employees for services • To government for taxes • To lenders for interest • To others for expenses Types of Cash Flows Investing Activities Cash inflows: • From sale of property, plant, and equipment • From sale of debt or equity securities of other entities • From collection of principal on loans to other entities Cash outflows: • To purchase property, plant, and equipment • To purchase debt or equity securities of other entities • To make loans to other entities Types of Cash Flows Financing Activities Cash inflows: • From issuance of equity securities (company's own stock) • From issuance of debt (bonds and notes) Cash outflows: • To stockholders as dividends • To redeem long-term debt or reacquire capital stock (treasury stock). Operating Activities - ALERT Some cash flows relating to investing or financing activities are classified as operating activities. For example... • Receipts of investment revenue (interest and dividends) and • Payments of interest to lenders • Sale or Purchase of Trading Securities Significant Noncash Activities... That do not affect cash are NOT reported in the body of the statement of cash flows. Are reported: • Separately--bottom of CF statement or • Separately--note to the financial statements. Significant Noncash Activities... 1. Issuance of common stock to purchase assets. 2. Conversion of bonds into common stock. 3. Issuance of debt to purchase assets. 4. Exchanges of plant assets. For IFRS, non cash items must be reported in notes. Classification of Cash Flows Accrual Basis versus Cash Basis of Accounting Accrual Basis – Recognizes Revenues at the time the earnings process is complete, and expenses at the time they are incurred, regardless of cash flow. Cash Basis– Recognizes Revenues when the Cash is Received, and Expenses at the time the Cash is Paid. Financial Statements are prepared using the Accrual Basis of Accounting The Statement of Cash Flows – Requires that the Accrual Basis be converted to the Cash Basis of Accounting. This Can be Done either: Directly – by examining each item on the Income Statement, or Indirectly – By Adjusting Net Income for the changes in the Non-Cash Balance Sheet Accounts. Why Report the Causes of Changes in Cash? Because investors, creditors, and other interested parties want to know what is happening to a company’s most liquid asset, CASH Statement of Cash Flows Helps Users Evaluate 1. Future cash flows? 2. Pay Dividends and meet obligations? 3. Reasons for differences between net income and net cash provided (used) by operating activities 4. What happened in investing and financing? Usefulness and Format Format of the Statement of Cash Flows Order of Presentation: 1. Operating activities. 2. Investing activities. 3. Financing activities. The cash flows from operating activities section always appears first, followed by the investing and financing sections. Example: Cash Flow Stmt Joe's Manufacturing COMPANY CASH FLOW STATEMENT DEC. 31, 2001 CASH FLOW FROM OPERATING ACTIVITIES NET INCOME $ ADJUSTMENTS TO RECONCILE NET INCOME TO NET CASH: (Increase)/Decrease in Accounts Receivable (30,000) Increase/(Decrease) in Accounts Payable 4,000 NET CASH PROVIDED BY OPERATING ACTIVITIES (26,000) 9,000 CASH FLOW FROM INVESTING ACTIVITIES Purchase of Equipment NET CASH USED BY INVESTING ACTIVITIES (10,000) (10,000) CASH FLOW FROM FINANCING ACTIVITIES Issuance of Common Stock Payment of cash Dividends NET CASH USED BY FINANCING ACTIVITIES 50,000 (15,000) 35,000 35,000 NET INCREASE IN CASH 34,000 CASH AT THE BEGINNING OF THE PERIOD - CASH AT THE END OF THE PERIOD $ 34,000 NONCASH INVESTING AND FINANCING ACTIVITIES Issuance of Bonds Payable to purchase land. $ 130,000 Format of the Statement of Cash Flows During its first week, Duffy & Stevenson Company had these transactions. 1. Issued 100,000 shares of $5 par value common stock for $800,000 cash. 2. Borrowed $200,000 from Castle Bank, signing a 5-year note bearing 8% interest. 3. Purchased two semi-trailer trucks for $170,000 cash. 4. Paid employees $12,000 for salaries and wages. 5. Collected $20,000 cash for services provided. Classification SO 2 Distinguish among operating, investing, and financing activities. Format of the Statement of Cash Flows During its first week, Duffy & Stevenson Company had these transactions. Classification 1. Issued 100,000 shares of $5 par value common stock for $800,000 cash. 2. Borrowed $200,000 from Castle Bank, signing a 5-year note bearing 8% interest. Financing 3. Purchased two semi-trailer trucks for $170,000 cash. Investing 4. Paid employees $12,000 for salaries and wages. Operating 5. Collected $20,000 cash for services provided. Operating Financing SO 2 Distinguish among operating, investing, and financing activities. Sources of Information for the Statement of Cash Flows Comparative balance sheet Current income statement Additional information Small EXAMPLE…. Statement Of Cash Flows Indirect Method The transactions of Joe’s Repair Company for the year ended 2000 are used to illustrate the preparation of a statement of cash flows . Joe’s Repair Company started in January 1, 2000, when it issued 50,000 shares of $1 par value common stock for $50,000 cash. The company rented its office space and furniture and performed consulting services throughout the first year. Steps in Preparing Statement of Cash Flows STEP #1 Determine the NET CHANGE in CASH Increase? Decrease? $34,000 - 0 = $34,000 INCREASE JOE’S Repair COMPANY Comparative Balance Sheet December 31, 2000 Assets Cash Accounts receivable Equipment Total Liabilities and stockholders’ equity Accounts payable Common stock Retained earnings Total Dec. 31, 2000 Change Increase/Decrease $34,000 30,000 Jan. 1, 2000 $0 0 10,000 $74,000 0 $0 10,000 increase $4,000 50,000 20,000 $0 0 0 $4,000 increase 50,000 increase 20,000 increase $74,000 $0 $34,000 increase 30,000 increase Income Statement and Additional Information COMPUTER SERVICES COMPANY Income Statement For the Year Ended December 31, 2000 Revenues Operating expenses Income before income taxes Income tax expense Net income $85,000 40,000 45,000 10,000 $35,000 Additional Information: (a) Examination of selected data indicates that a dividend of $15,000 was declared and paid during the year. (b) The equipment was purchased at the end of 2000. No depreciation was taken in 2000. Steps in Preparing Statement of Cash Flows STEP #2 Determine the NET CHANGE PROVIDED by Operating Activities You must analyze the Income Statement and some of the Balance Sheet net changes (current assets and liabilities) to convert Net Income (accrual) to a cash basis. (You might need additional information also). Determine Net Cash Provided/Used Operating Activities By Adjust net income for items that did not affect cash. Net income must be converted because earned revenues may include credit sales that have not been collected in cash and expenses incurred that may not have been paid in cash. Determine Net Cash Provided/Used By Operating Activities Receivables, payables, prepayments, and inventories must be analyzed for their effects on cash. Determine Net Cash Provided/Used By Operating Activities Joe’s Repair Company (JRC) had revenues of $85,000 in its first year of operations. However, JRP collected only $55,000 in cash. Accrual basis revenue was $85,000, cash basis revenue would be $55,000. The increase in accounts receivable of $30,000 must be deducted from net income. (If accounts receivable decrease, the decrease must be added to net income). Determine Net Cash Provided/Used Operating Activities (con’t) By Accounts payable - When accounts payable increase during a year, operating expenses are higher (accrual) than they are on a cash basis. For JRP, operating expenses reported in the income statement were $40,000. Since Accounts Payable increased $4,000, $36,000 ($40,000 – $4,000) of the expenses were paid in cash. So. . . . an increase in accounts payable must be added to net income, (a decrease subtracted). JOE’S REPAIR COMPANY Statement of Cash Flows--Indirect Method (Partial) For the Year Ended December 31, 2000 Cash flows from operating activities Net income $35,000 Adjustments to reconcile net income to net cash provided by operating activities: Increase in accounts receivable $(30,000) Increase in accounts payable 4,000 (26,000) Net cash provided by operating activities $ 9,000 Steps in Preparing Statement of Cash Flows STEP #3 Determine the NET CHANGE PROVIDED by Investing and Financing Activities You must analyze the some of the Balance Sheet net changes (long term assets and long term liabilities and equity) to see their effects on cash. Determine Net Cash Provided/Used Investing and Financing Activities By No data are given for the increases in Equipment of $10,000 and Common Stock of $50,000. Assume any differences involve cash. The increase in equipment is from a purchase of equipment for $10,000 cash. This purchase is reported as a cash outflow in the investing activities section. The increase of common stock results from the issuance of common stock for $50,000 cash. It is reported as an inflow of cash in the financing activities section of the statement of cash flows. Determine Net Cash Provided/Used Investing and Financing Activities Reasons for the increase of $20,000 in the Retained Earnings. Net income increased retained earnings by $35,000. REPORTED IN THE OPERATING ACTIVITIES SECTION. The additional information indicates that a cash dividend of $15,000 was declared and paid. REPORTED IN THE FINANCING ACTIVITIES SECTION. By Joe’s Repair COMPANY Statement of Cash Flows--Indirect Method (Partial) For the Year Ended December 31, 2000 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Increase in accounts receivable $(30,000) Increase in accounts payable 4,000 Net cash provided by operating activities Cash flows from investing activities Purchase of equipment Cash flows from financing activities Issuance of Common Stock $50,000 Payment of cash dividends (15,000) Net cash provided by financing activities $35,000 (26,000) $ 9,000 (10,000) 35,000 BIGGER EXAMPLE…. COMPUTER SERVICES COMPANY Comparative Balance Sheet December 31 Assets Cash Accounts receivable Inventory Prepaid Expenses Land Building Accumulated depreciation-building Equipment Accumulated depreciation-equipment Total 2011 $55,000 20,000 15,000 5,000 130,000 160,000 2010 $33,000 30,000 10,000 1,000 20,000 40,000 Change Increase/Decrease $22,000 increase 10,000 decrease 5,000 increase 4,000 increase 110,000 increase 120,000 increase (11,000) 27,000 (5,000) 10,000 6,000 increase 17,000 increase (3,000) $398,000 (1,000) $138,000 2,000 increase COMPUTER SERVICES COMPANY Comparative Balance Sheet December 31 Liabilities and Stockholders’ equity Accounts payable Income tax payable Bonds payable Common stock Retained earnings Total 2011 2010 $28,000 6,000 130,000 70,000 164,000 $398,000 $12,000 8.000 20,000 50,000 48,000 $138,000 Change $16,000 increase 2,000 decrease 110,000 increase 20,000 increase 116,000 increase COMPUTER SERVICES COMPANY Income Statement For the Year Ended December 31, 2001 Revenues Cost of goods sold Operating expenses $507,000 $150,000 111,000 Depreciation expense 9,000 Loss on sale of equipment 3,000 Interest expense 42,000 315,000 Income from operations Income tax expense Net income 192,000 47,000 $145,000 Illustration 13-14 Second-Year Operations Additional Information: (1) The company declared and paid a $29,000 cash dividend. (2) The company obtained land through the issuance of $110,000 of long-term bonds. (3) An office building costing $120,000 was purchased for cash; equipment costing $25,000 was also purchased for cash. (4) The company sold equipment with a book value of $7,000 (cost $8,000 less accumulated depreciation $1,000) for $4,000 cash. (5) The company issued common stock for $20,000 cash. (6) Depreciation expense was $6,000 for the building and $3,000 for the equipment. Determine the Net Increase or Decrease in Cash Cash increased $22,000 ($55,000-$33,000) Determine Net Cash Provided/Used Operating Activities By Adjust net income for items that did not affect cash. For example: Add back non-cash expenses (depreciation, amortization, depletion Deduct Gains Add back Losses Changes in Current assets Changes in Current liabilities Determine Net Cash Provided/Used Operating Activities By Depreciation expense – The company reported depreciation expense of $9,000. Depreciation and other charges that do not require the use of cash, such as amortization of intangible assets are added to net income. Computer Services Company Statement of Cash Flows (Partial) For the Year Ended December 31 Cash flows from operating activities Net Income $145,000 Adjustments to reconcile net income to net cash provided by operating activities : Depreciation expense $9,000 INDIRECT METHOD Determine Net Cash Provided/Used Operating Activities By Loss on Sale of Equipment – The company reported a $3,000 loss on the sale of equipment (book value $7,000 less cash proceeds $4,000). The loss reduced net income but did not reduce cash. The $3,000 loss is added to net income in determining net cash provided by operating activities. Computer Services Company Statement of Cash Flows (Partial) For the Year Ended December 31 Cash flows from operating activities Net Income $145,000 Adjustments to reconcile net income to net cash provided by operating activities : Depreciation expense $9,000 Loss on sale of equipment 3,000 INDIRECT METHOD Determine Net Cash Provided/Used By Operating Activities Current Assets Accounts Receivable - Accounts receivable decreases during the period because cash receipts are higher than revenues reported on an accrual basis. The decrease of $10,000 must be added to net income, as a cash inflow. Why? You collected the cash! COMPUTER SERVICES COMPANY Comparative Balance Sheet December 31 Assets Cash Accounts receivable Inventory Prepaid Expenses Land Building Accumulated depreciation-building Equipment Accumulated depreciation-equipment Total 2011 $55,000 20,000 15,000 5,000 130,000 160,000 2010 $33,000 30,000 10,000 1,000 20,000 40,000 Change Increase/Decrease $22,000 increase 10,000 decrease 5,000 increase 4,000 increase 110,000 increase 120,000 increase (11,000) 27,000 (5,000) 10,000 6,000 increase 17,000 increase (3,000) $398,000 (1,000) $138,000 2,000 increase Computer Services Company Statement of Cash Flows (Partial) For the Year Ended December 31 Cash flows from operating activities Net Income $145,000 Adjustments to reconcile net income to net cash provided by operating activities : Depreciation expense $9,000 Loss on sale of equipment 3,000 Decrease in accounts receivable 10,000 INDIRECT METHOD Determine Net Cash Provided/Used Operating Activities By Inventory- Inventory increases during a period when merchandise purchases exceed the cost of goods sold. Or, you spent cash on inventory that you haven’t “expensed” yet through cost of goods sold. The increase of $5,000 in inventory must be deducted from net income as it is a cash outflow. Computer Services Company Statement of Cash Flows (Partial) For the Year Ended December 31 Cash flows from operating activities Net Income $145,000 Adjustments to reconcile net income to net cash provided by operating activities : Depreciation expense $9,000 Loss on sale of equipment 3,000 Decrease in accounts receivable 10,000 Increase in inventory (5,000) INDIRECT METHOD Determine Net Cash Provided/Used By Operating Activities Prepaid Expenses - Prepaid expenses increase during a period because cash paid for expenses is greater than expenses reported on an accrual basis. The increase of $4,000 in prepaid expenses must be deducted from net income. Computer Services Company Statement of Cash Flows (Partial) For the Year Ended December 31 Cash flows from operating activities Net Income $145,000 Adjustments to reconcile net income to net cash provided by operating activities : Depreciation expense $9,000 Loss on sale of equipment 3,000 Decrease in accounts receivable 10,000 Increase in inventory (5,000) Increase in prepaid expenses (4,000) INDIRECT METHOD Determine Net Cash Provided/Used By Operating Activities Accounts Payable - The increase of $55,000 in accounts payable must be added to net income. Why? This means the company received more inventory (and other items) than it actually paid for). Cash inflow COMPUTER SERVICES COMPANY Comparative Balance Sheet December 31 Liabilities and Stockholders’ equity Accounts payable Income tax payable Bonds payable Common stock Retained earnings Total 2011 2010 $28,000 6,000 130,000 70,000 164,000 $398,000 $12,000 8.000 20,000 50,000 48,000 $138,000 Change $16,000 increase 2,000 decrease 110,000 increase 20,000 increase0 116,000 increase Determine Net Cash Provided/Used By Operating Activities Taxes Payable – The decrease of $2,000 in accounts payable must be subtracted from net income. Why? This Income means the company owed money, but then paid some of it – Cash outflow Computer Services Company Statement of Cash Flows (Partial) For the Year Ended December 31 Cash flows from operating activities Net Income Adjustments to reconcile net income to net cash provided by operating activities : Depreciation expense Loss on sale of equipment Decrease in accounts receivable Increase in inventory Increase in prepaid expenses Increase in accounts payable Decrease in income taxes payable Net Cash provided by operating activities INDIRECT METHOD $145,000 $9,000 3,000 10,000 (5,000) (4,000) 16,000 (2,000) $172,000 Determine Net Cash Provided/Used By Investing Activities Study the balance sheet to determine changes in noncurrent assets. Changes in each noncurrent account are analyzed using selected transaction data to determine the effect, if any, the changes had on cash. Determine Net Cash Provided/Used By Investing Activities Land - Land of $110,000 was purchased through the issuance of long-term bonds. Although the exchange of bonds payable for land has no effect on cash, it is a significant noncash investing and financing activity that must be disclosed. COMPUTER SERVICES COMPANY Comparative Balance Sheet December 31 Assets Cash Accounts receivable Inventory Prepaid Expenses Land Building Accumulated depreciation-building Equipment Accumulated depreciation-equipment Total 2011 $55,000 20,000 15,000 5,000 130,000 160,000 2010 $33,000 30,000 10,000 1,000 20,000 40,000 Change Increase/Decrease $22,000 increase 10,000 decrease 5,000 increase 4,000 increase 110,000 increase 120,000 increase (11,000) 27,000 (5,000) 10,000 6,000 increase 17,000 increase (3,000) $398,000 (1,000) $138,000 2,000 increase Determine Net Cash Provided/Used By Investing Activities Building - An office building was acquired using cash of $120,000. This transaction is a cash outflow reported in the investing activities section. Determine Net Cash Provided/Used By Investing Activities Equipment - The equipment account increased $17,000. The additional information provided, reveals that this was a net increase resulting from two transactions (1) a purchase of equipment for $25,000 (2) sale of equipment costing $8,000 for $4,000. The purchase of equipment should be shown as a $25,000 outflow of cash and the sale of equipment should be shown as a cash inflow of $4,000. COMPUTER SERVICES COMPANY Comparative Balance Sheet December 31 Assets Cash Accounts receivable Inventory Prepaid Expenses Land Building Accumulated depreciation-building Equipment Accumulated depreciation-equipment Total 2011 $55,000 20,000 15,000 5,000 130,000 160,000 2010 $33,000 30,000 10,000 1,000 20,000 40,000 Change Increase/Decrease $22,000 increase 10,000 decrease 5,000 increase 4,000 increase 110,000 increase 120,000 increase (11,000) 27,000 (5,000) 10,000 6,000 increase 17,000 increase (3,000) $398,000 (1,000) $138,000 2,000 increase Reminder – sale of Long Term Asset Cash Accumulated Depreciation Loss on Sale of Equipment Equipment 4,000 1,000 3,000 8,000 Equipment Beg. Balance 10,000 Purchase 25,000 End Balance 27,000 Equipment sold 8,000 Computer Services Company Statement of Cash Flows (Partial) For the Year Ended December 31 Cash flows from operating activities Net Income Adjustments to reconcile net income to net cash provided by operating activities : Depreciation expense Loss on sale of equipment Decrease in accounts receivable Increase in inventory Increase in prepaid expenses Increase in accounts payable Decrease in income taxes payable Net Cash provided by operating activities Cash flows from Investing activities Purchase of building Purchase of equipment Sale of equipment Net Cash Flow from Investing INDIRECT METHOD $145,000 $9,000 3,000 10,000 (5,000) (4,000) 16,000 (2,000) $172,000 (120,000) (25,000) 4,000 (141,000) Determine Net Cash Provided/Used By Financing Activities Bonds Payable - The bonds payable account increased by $110,000. The issuance of bonds for land is a noncash transaction reported in a separate schedule at the bottom of the statement of cash flows. COMPUTER SERVICES COMPANY Comparative Balance Sheet December 31 Liabilities and Stockholders’ equity Accounts payable Income tax payable Bonds payable Common stock Retained earnings Total 2011 2010 $28,000 6,000 130,000 70,000 164,000 $398,000 $12,000 8.000 20,000 50,000 48,000 $138,000 Change $16,000 increase 2,000 decrease 110,000 increase 20,000 increase0 116,000 increase Determine Net Cash Provided/Used By Financing Activities Common Stock- increased by $20,000. The additional information notes that this was for cash. Determine Net Cash Provided/Used By Financing Activities Retained Earnings - Retained Earnings increased by $116,000. The increase is a net of (1) Net income of $145,000 that increased Retained Earnings and (2) dividends of $29,000 that decreased Retained earnings. Net income is converted to net cash provided by operations. Payment of the dividend is a cash outflow that is reported as a financing activity. Free Cash Flow Free Cash Flow = + Cash from Operating Activities - Capital Expenditures - Cash Dividends Free Cash Flow means the cash left over from operations after adjustment for capital expenditures and dividends. COMPUTER SERVICES COMPANY CASH FLOW STATEMENT DEC. 31, 2011 CASH FLOW FROM OPERATING ACTIVITIES NET INCOME ADJUSTMENTS TO RECONCILE NET INCOME TO NET CASH: Depreciation Expense Loss on sale of equipment (Increase)/Decrease in Accounts Receivable $ $ 9,000 3,000 10,000 (Increase)/Decrease in Inventory (5,000) (Increase)/Decrease in Prepaid Expenses Increase/(Decrease) in Accounts Payable (4,000) 16,000 Increase/(Decrease) in Income Tax Payable NET CASH PROVIDED BY OPERATING ACTIVITIES 145,000 (2,000) 27,000 172,000 CASH FLOW FROM INVESTING ACTIVITIES Purchase of Land Purchase of Building (120,000) Purchase of Equipment Sale of Equipment (25,000) 4,000 NET CASH USED BY INVESTING ACTIVITIES CASH FLOW FROM FINANCING ACTIVITIES Issuance of common stock Payment of cash Dividends (141,000) 20,000 (29,000) NET CASH USED BY FINANCING ACTIVITIES (9,000) NET INCREASE IN CASH 22,000 CASH AT THE BEGINNING OF THE PERIOD 33,000 CASH AT THE END OF THE PERIOD $ 55,000 NONCASH INVESTING AND FINANCING ACTIVITIES Issuance of Bonds Payable to purchase land. $ 110,000 Supplementary Material Cash Flow and the Product Life Cycle For Computer Services… Free Cash Flow: $172,000 -141,000* -29,000 $ 2,000 *this calculation subtracts the proceeds from the Sale of Equipment from Capital Expenditure Supplementary Material Cash Flow and the Product Life Cycle The Product Life Cycle A series of phases all products go through The phases are often referred to as the: introductory phase growth phase maturity phase decline phase. The phase a company is in affects its cash flows. Introductory Phase To support asset purchases the company may issue stock or debt. Expect: cash from operations to be negative cash from investing to be negative. cash from financing to be positive. Growth Phase The company is striving to expand its production and sales. Expect: small amounts of cash to be generated from operations. cash from investing to be negative. cash from financing to be positive Maturity Phase Sales and production level-off Expect: cash from operations to exceed investing needs cash from investing to be neutral cash from financing to be negative Decline Phase Sales and production decline Expect: cash from operations to decline cash from investing to possibly become positive cash from financing to possibly become negative Be prepared to…. Review a Cash Flow Statement Discuss WHERE a company appears to be in the Product Life Cycle, based on evidence in its Cash Flow Statement Mystery Company…. Period Ending Dec 26, 2009 Dec 27, 2008 Dec 29, 2007 6,796,000 6,999,000 6,934,000 Total Cash Flow From Operating Activities Investing Activities, Cash Flows Provided By or Used In Total Cash Flows From (2,401,000) (2,667,000) (3,744,000) Investing Activities Financing Activities, Cash Flows Provided By or Used In Total Cash Flows From (2,497,000) (3,025,000) (19,000) (153,000) (4,006,000) Financing Activities Effect Of Exchange Rate Changes 75,000 Change In Cash and Cash 1,879,000 1,154,000 Equivalents To the best of your ability….what stage in the Product Life Cycle is this company? (741,000) Possible answer Cash from Ops is positive Cash from Investing is negative This is strong evidence the company is growing, investing in new stores, manufacturing plants, new equipment or buildings That cash from financing is negative is confusing, however, it could mean that this is an established company that is paying back creditors and also paying dividends, but still expanding. And its strong positive cash flow from operations is a sign of growth and overall financial strength And the company is….. End of Chapter 13 Good Bye and Good Luck.