Lec 15

advertisement

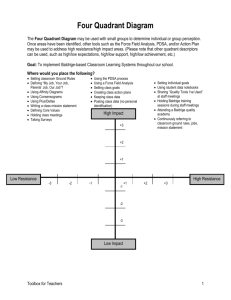

Lecture 15 Strategy Analysis And Choice Grand Strategy Matrix • Popular tool for formulating alternative strategies • All organizations (or divisions) can be positioned in one of four quadrants • Based on two evaluative dimensions: Competitive position – Market growth – RAPID MARKET GROWTH 1. 2. 3. 4. 5. 6. WEAK COMPETITIVE POSITION 1. 2. 3. 4. 5. Quadrant II Market development Market penetration Product development Horizontal integration Divestiture Liquidation 1. 2. 3. 4. 5. 6. 7. Quadrant III Retrenchment 1. Concentric diversification 2. Horizontal diversification 3. Conglomerate diversification 4. Liquidation SLOW MARKET Quadrant I Market development Market penetration Product development Forward integration Backward integration Horizontal integration Concentric diversification Quadrant IV Concentric diversification Horizontal diversification Conglomerate diversification Joint ventures GROWTH STRONG COMPETITIVE POSITION Grand Strategy Matrix Quadrant I Excellent strategic position • Concentration on current markets and products • Take risks aggressively when necessary • Grand Strategy Matrix Quadrant II • Evaluate present approach seriously • How to change to improve competitiveness • Rapid market growth requires intensive strategy Grand Strategy Matrix Quadrant III • Compete in slow-growth industries • Weak competitive position • Drastic changes quickly • Cost and asset reduction indicated (retrenchment) Grand Strategy Matrix Quadrant IV Strong competitive position • Slow-growth industry • Diversification indicated to more promising growth areas • Formulation Framework Stage 3: The Decision Stage Quantitative Strategic Planning Matrix (QSPM) QSPM Quantitative Strategic Planning Matrix • Only technique designed to determine the relative attractiveness of feasible alternative actions QSPM Quantitative Strategic Planning Matrix • • • Tool for objective evaluation of alternative strategies Based on identified external and internal crucial success factors Requires good intuitive judgment QSPM Quantitative Strategic Planning Matrix • List the firm’s key external opportunities & threats; list the firm’s key internal strengths and weaknesses • Assign weights to each external and internal critical success factor QSPM Quantitative Strategic Planning Matrix • Examine the Stage 2 (matching) matrices and identify alternative strategies that the organization should consider implementing • Determine the Attractiveness Scores (AS) QSPM Quantitative Strategic Planning Matrix • Compute the total Attractiveness Scores • Compute the Sum Total Attractiveness Score QSPM Key External Factors Economy Political/Legal/Governmental Social/Cultural/Demographic/ Environmental Technological Competitive Key Internal Factors Management Marketing Finance/Accounting Production/Operations Research and Development Computer Information Systems Strategic Alternatives Weight Strategy 1 Strategy 2 Strategy 3 QSPM Limitations: • Requires intuitive judgments and educated assumptions • Only as good as the prerequisite inputs QSPM Positives: • Sets of strategies examined simultaneously or sequentially • Requires the integration of pertinent external and internal factors in the decision-making process Cultural Aspects of Strategy Choice Culture: • The set of shared values, beliefs, attitudes, customs, norms, personalities, heroes, and heroines that describe a firm Cultural Aspects of Strategy Choice Culture: • Successful strategies depend on degree of support from a firm’s culture Politics of Strategy Choice Politics in organizations: • • • Management hierarchy Career aspirations Allocation of scarce resources Politics of Strategy Choice Political tactics for strategists: • • • • • Equifinality Satisfying Generalization Focus on Higher-Order Issues Provide Political Access on Important Issues Role of A Board of Directors Duties and Responsibilities: 1. 2. 3. 4. Control and oversight over management Adherence to legal prescriptions Consideration of stakeholder interests Advancement of stockholders’ rights Key Terms • • • • • • • • Aggressive quadrant Attractiveness Scores (AS) Board of Directors Boston Consulting Group (BCG) Matrix Business portfolio Cash cows Champions Competitive Advantage (CA) Key Terms • • • • • • • • • Competitive quadrant Conservative quadrant Culture Decision stage Defensive quadrant Directional vector Dogs Environmental Stability (ES) Financial Strength (FS) Key Terms • • • • • • • • • Grand Strategy Matrix Halo error Industry Strength (IS) Input stage Internal-External (IE) Matrix Long-term objectives Matching Matching stage Quantitative Strategic Planning Matrix (QSPM) Key Terms • • • • • • • Question marks Relative market share position SO strategies ST strategies Stars Strategic Position and Action Evaluation (SPACE) Matrix Strategy-formulation framework Key Terms • • • • • Sum total attractiveness scores Threats-Opportunities-WeaknessesStrengths (TOWS) Matrix Total Attractiveness Scores (TAS) WO strategies WT strategies Thank You