Price Sensitivity Questions - University of Colorado Boulder

advertisement

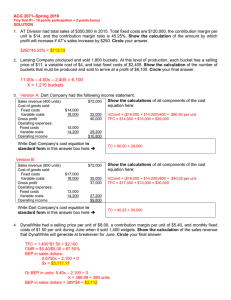

Types of BEP Type I: BEP of a price change Type II: BEP of a fixed-cost investment BEP Analysis Type III: BEP of the change in variable cost Type IV: BEP of Cannibalization 1 Example: Type III BEP Sun Manufacturing sells bookcases at a price of $100 a piece. Variable costs per unit are $50. Suppose that the unit variable costs have changed to $60, what will be the percentage increase in sales volume in order to make the profit remains the same? 2 Formula for Type III BEP Analysis Break-Even Point = ( Unit Contribution_oldVC ) -1 Unit Contribution_newVC 3 Solution Margin at the old unit variable cost is $50 Margin at the new unit variable cost is $40 BEP = 50 40 -1= 25% To make sure the profit remains the same, the sales volume has to go up by 25%. 4 Types of BEP Type I: BEP of a price change Type II: BEP of a fixed-cost investment BEP Analysis Type III: BEP of the change in variable cost Type IV: BEP of Cannibalization 5 Example: Type IV BEP Sun Manufacturing sells bookcases at a price of $100 a piece. Variable costs per unit are $50. Suppose that the company is considering introduce a new brand that sells $120 and costs $60 each, what will be the percentage of sales for the new brand that is coming from the existing brand, so that the profit remains the same? 6 Formula for Type IV BEP Analysis Break-Even Rate = ( Unit Contribution_old offering Unit Contribution_new offering ) 7 Solution Margin of the existing product is $50 Margin of the new product is $60 BEP = 50 60 = 83.3% To make sure the profit remains the same, the new product can take up to 83.3% of the market share from the existing product. 8 Chapter 7 Price Levels 9 The Pricing Strategy Pyramid Price Level Price setting Pricing Policy Negotiation Tactics & Pricing Setting Procedures Value Communication Communication, Value Selling Tools Price Structure Metrics, Fences, Controls Value Creation Economic Value, Offering Design, Segmentation Price Setting Process Preliminary Segment Pricing Optimization Implementation Set baseline prices based on type of value assessment and initial differential value capture rate Refine preliminary prices with iterative process balancing tradeoffs between price, cost, and market response Set final prices and ensure acceptance among customers and organization through effective change management approach Key Questions: How much of the differential value should be captured for each segment? How much time and effort should I invest in assessing the value of my products? How should I adjust segment prices to account for different price sensitivities? Key Questions: What tradeoffs should I make between long-term strategic objectives and short-term market responses to price changes? What types of analytical techniques are best suited to my product and market conditions? How can I estimate customer response to potential price changes? Key Questions: What tradeoffs should I make between long-term strategic objectives and short-term market responses to price changes? What types of analytical techniques are best suited to my product and market conditions? How can I estimate customer response to potential price changes? 11 Preliminary Segment Pricing Positive Differentiati on Negative Differentiation Key question: How much differential value should be captured in each segment? Competitive Reference The answer to this question can differ substantially across segments based on strategic considerations and differences in price sensitivity 12 Price Setting Illustration 13 Three Generic Pricing Strategies Skim Penetration Neutral 14 Conditions for Different Pricing Strategies SKIM PENETRATION NEUTRAL COSTS CUSTOMERS COMPETITION 15 Pricing Strategy SKIM COSTS CUSTOMERS COMPETITION PENETRATION NEUTRAL Low CMs Low Volumes Changes in Unit Price Drive Profit Large BE Sales Changes At or near capacity High CMs High volumes Changes in volume drive profitability Small BE Sales Changes Excess capacity Costs similar to competitors Sufficient CM to finance adv, etc. Little excess capacity Incremental capacity is expensive Low Price Sensitivity -Reference Price Effect -Price Quality Effect -Difficult Comparison Effect High price sensitivity -Total Expend Effect -Large Part of EndBenefit Little differentiation Customers are more sensitive to other elements of the marketing mix Limited threat of opportunism Limited opportunity for scale economies Sustainable differentiation Low threat brands Sustainable cost & resource advantage Competitors not willing to retaliate Financial strength Aggressive small share brands Avoid threat of retaliation Large share brands with a lot to lose Sustainable mktg mix advantages Oligopolies 16 Categorize These Pricing Strategies How would you categorize the pricing strategies for the following products and retailers? (S=skim, N=neutral, P=penetration) Pepperidge Farm Cookies Suave Shampoo Land O' Lakes Butter T.J. Maxx (Clothing) L'Oreal Hair Coloring Bloomingdales Sears _______ _______ _______ _______ _______ _______ _______ 17 Analytical Approaches to Profitability Analysis High Number of Transactions Automated Price Automated Price Optimization Optimization System System Spreadsheet Spreadsheet- based basedBreak Break- even evenAnalysis Analysis Simulation Simulation Modeling Modeling/ /Risk Risk Analysis Analysis Low High Low Frequency of Price Changes 18 Analyzing Profitability Using the Breakeven Sales Change Approach Contribution Margin % Change in Price 5% 10% 20% 30% 40% 50% 60% 70% 80% 90% 35% -88% -78% -64% -54% -47% -41% -37% -33% -30% -28% 25% -83% -71% -56% -45% -38% -33% -29% -26% -24% -22% 15% -75% -60% -43% -33% -27% -23% -20% -18% -16% -14% 5% -50% -33% -20% -14% -11% -9% -8% -7% -6% -5% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% -5% NA 100% 33% 20% 14% 11% 9% 8% 7% 6% -15% NA NA 300% 100% 60% 43% 33% 27% 23% 20% -25% NA NA NA NA 167% 100% 71% 56% 45% 38% -35% NA NA NA NA 700% 233% 140% 100% 78% 64% 19 Risk Analytic Approach to Profitability Analysis Overlay Chart Comparative Risk Profiles Frequency Comparison .036 Premium Branding Premium Branding Strategy Strategy .027 .018 .009 Discount Pricing Discount Pricing Strategy Strategy .000 19,000,000.00 21,500,000.00 24,000,000.00 26,500,000.00 29,000,000.00 20 Determinants of Price Sensitivity The Reference Price Effect The Difficult Comparison Effect The Switching Cost Effect The Price-Quality Effect The Expenditure Effect The End-Benefit Effect The Fairness Effect The Framing Effect The Shared-Cost Effect 21 Price Sensitivity Illustration For each of the following purchase decisions, what factors are likely to affect the consumer's price sensitivity? A diamond engagement ring Automobile repairs Food for meals at home Which university to attend A company car Draperies for your new home Text books Health insurance plan Souvenirs Vacation resort 22 Price Sensitivity Discussion Questions What can a company do to decrease its customer's price sensitivity? Would all of the company's customers be likely to react in the same way? 23 Price Sensitivity Discussion Questions Would a company ever want to do anything to increase its customers' price sensitivity? Why? What steps might it take? 24 Price Sensitivity Discussion Questions Which of the following statements are always true, sometimes true, never true? Why? (a) Price elasticity is generally the same for all brands in a product category. (b) Advertising increases price sensitivity. (c) As a product category matures, the consumers become more price sensitive. (d) Each consumer has different price sensitivities for different products. 25 Price Sensitivity Questions The gasoline service stations in Rochester, New York convinced the City Council to ban signs displaying gasoline prices Why would they want to do this? What effect do you think this law had on gasoline prices? Why? 26 Price Sensitivity Questions Despite the fact that rental rates for commercial space and labor costs are generally higher in big cities than in small towns, the prices of many products--such as stereo equipment and clothing--are higher in small towns than in large cities. 27 Price Sensitivity Discussion Questions Many local rental car agencies rent late model cars at substantially lower prices than national companies such as Hertz and Avis. Despite their higher prices, the national companies still retain most of the market (a) Explain why most renters patronize the national car rental companies despite their higher prices. How have the national companies encouraged this price insensitivity? (b) If you were a small, local company, what factors would you look for to identify the price-sensitive segment of renters likely to be attracted to your lower price? (c) If you were a small company trying to become national, how might you overcome the low price sensitivity of customers to induce them to try your cars and evaluate the quality of your service? 28 Next Lecture Price and Promotion 29