growth - National Food Policy Capacity Strengthening Programme

advertisement

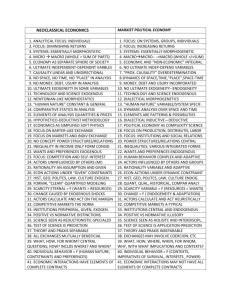

FOOD SECURITY Concepts, Basic Facts, and Measurement Issues June 26 to July 7, 2006 Dhaka, Bangladesh Rao 3a: Foundations of Economic Development • Learning: Trainees are expected to develop knowledge of the basic determinants of economic growth and the dualities that arise. The focus will be on basic concepts and relations rather than on any technical presentation. Brief Contents • growth: role of investment, imports and structural change • determinants of investment, import capacity and structural change • trickle-down growth versus pro-poor growth • growth and distribution interactions and sources of their complementarity • aggregate demand, inequality and growth • exogenous versus endogenous growth Three Fundamental “Dualities” of Economic Development. • 1. Growth & Structural Change: no ED without structural change. – • No rise in quantities (e.g., growth of income) without changing relationships among parts (changes in structure e.g., rise in industry, etc.) 2. Distribution & Growth: growth and distribution are NOT separable (i.e., ARE causally related) – – Economic reasons: incentives, capabilities Political reasons: governance, politics, distribution of decision-making power Three Fundamental “Dualities” of Economic Development. • 3. Demand- & Supply-Side Causes: – – Not just definitional sense: ex post facto, growth must be growth both of demand and supply. But also causal sense: ex ante growth can and does have causes on both sides. Long-Term Growth and Structural Change • Growth in developing countries depends on 3 primary factors: – Investment in physical and human capital – Imports of capital goods and modern intermediates: vehicles of higher-productivity technologies and technical knowledge; – Structural change involving shifts of both capital and labour from less productive to more productive sectors. On Capital Accumulation or Investment • There is a systematic positive relationship between the national investment rate and the national per capital income level. • Moreover, investment rates and income growth are positively related. • As for human capital, per capita income as well as income growth are positively associated with literacy at all levels (primary, secondary and tertiary). • THUS, investment is important for economic growth but low initial income levels tend to keep investment down. On Import Capacity • Import capacity Depends on competitiveness of exports. Also, stability of imports depends on stability of export earnings. – The ratio of trade (exports plus imports) to GDP rises with per capita income levels. – Primary exports (including agricultural exports) are half or more of total in low-income countries. – Growth in trade ratios during last 25 years has been more rapid in the high-income group than in the middle- or lowincome groups. – The ratio of trade taxes (import tariffs and export taxes) to trade is considerably higher in low-income than in high-income countries. – Capital flows (both FDI and financial flows of loans and portfolio capital) are greater for middle-income group than for the low-income group. – The barter terms of trade for developing countries as a group, and primary exporters in particular, have suffered significant declines and persistent instability. On Import Capacity • Thus, import capacity is important for growth but low initial income levels tend to keep export competitiveness and hence import capacity down; low income levels also tend to produce instability in import capacity. On Structural Change • Structural change involves: – shift from primary production (agriculture etc.) to secondary (industry) – within industry and within services (banking, transport, insurance, etc.) from traditional to more modern forms of organisation and technology On Structural Change • IN SUM: – Increased investment requires both increased savings and greater import capacity. But both are limited by low per capita income. In short, savings and import capacity are related to income levels through economic structure. – A lot of labor tends to be under-employed. This can decline only with the growth of investment and national income. – Deliberate policies are needed to transform economic structure in order to accelerate growth rather than wait for growth to transform the economic structure. • Trade diversification, import substitution, reduced vulnerability Growth & Distribution: Independent or Connected? • Trickle-down growth vs. Pro-Poor Growth • Trickle-down: Growth is the best instrument for poverty reduction – Galbraith on horses and birds on highways • PPG: – BOTH growth rapid enough to improve the “absolute” condition of the poor AND pro-poor enough to improve the “relative” position of the poor – BOTH equalize at start of process (initial conditions) AND equalize during growth process (growth with distribution) Growth & Distribution: Interactions? • TRENDS & Explanations: – Norm of rising inequality in rich and poor countries during the last 15-20 years – Why? technical change; trade liberalization, capital mobility and bargaining power, weakened fiscs and reduced state role – Kuznets Hypothesis? – Initial inequality tends to strongly reduce subsequent growth Growth & Distribution: Interactions? • INTERACTIONS : – Saving & Capital-Intensity – Delayed Demographic Transition – Content or Nature of Inequality Growth & Distribution: Interactions? • Two areas of inspiration for PPG policies: – 1. Policies to correct market failures in the utilization and allocation of capital (between physical and human capital, formal and informal sectors, capital-intensive and labor-intensive techniques, public and private capital) – 2. Policies to reduce initial inequalities Some Sources of Growth-Equality Complementarity • CONCEPT: Inequality-reducing or pro-poor or trickle-up growth • Key is redistribution weakens structural constraints on the utilization of labor, on raising workers’ capacities and skills, and on efficient allocation of capital. – In the long run, the incomes of both the poor and non-poor are likely to rise i.e., a process of trickle-up growth. Some Aspects of Equality-Complementary Growth (ECG) • • • • Unequal Access to Productive Capital Land Inequality Natural Resource Depletion Credit Constraints on Human Capital Accumulation Macro Economics: Orthodox VS Heterodox Views • Standard macro policies aim for one and one thing only: macro stability but PPG macro policies must also recognize distribution and growth effects • Standard approach neatly divides stabilization from long-term growth (with distribution just after-thought) but PPG approach sees growth effects of stabilization and recognizes role for distribution • Demand VS Supply Sides: investment drives growth ("S-side") but growth drives investment (D-side)! Aggregate Demand, Inequality & Growth • QUESTION In any capitalist economy, savers and investors tend to be separated. So how does macro equilibrium (D=S) come about? • S-side ANSWER: by the interest rate. Saving given by HH plans. Investment must adjust to saving supply. So saving supply determines investment demand. • D-side ANSWER: by income and employment (in SR) and growth and distribution (in LR). Saving mainly from profits. Investment itself determined by (expected) profit rate. If investment rises, savings follows as income distribution shifts to profits. So investment demand determines saving supply. Aggregate Demand, Inequality & Growth • So change (policy or not) that reduces inequality stimulates effective demand. So both growth increases and inequality decreases. Endogenous vs. Exogenous Growth • "Exogenous" means "determined outside the system". Most growth theories have been of the exogenous kind in that the key sources of growth such as the labor force, the appetite for investment and technical progress are all given outside the system. – e.g., "gravitational force" for Newton, velocity of light for Einstein • "Endogenous" means "determined inside the system". Yet, paradoxically, for Adam Smith himself, the key growth source was endogenous - due, in fact, to the sheer movement of the system itself. Endogenous vs. Exogenous Growth • Arguments – Productivity growth depends on Specialization – Specialization depends on Size of Market – Size of Market Depends on Productivity • The entire argument, as in the figure, is a closed “circle.” Can lead to self-sustained virtuous cycle OR low-level vicious traps. Figure 3.1: Increasing Returns & Endogenous Growth A.Smith--A.Young Thesis of Increasing Returns A.Smith--A.Young Thesis of Increasing Returns With Exogenous Population (N0) With Endogenous Population (N=f(y)) Division of Labor Size of Market = y.N0 Per Cap Income (y) Division of Labor Productivity Size of Market = y.N N Productivity Per Cap Income (y)