A-102a Target Buyer Conclusions & Recommendation

advertisement

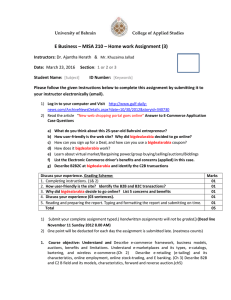

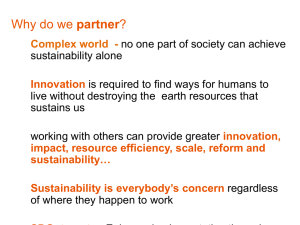

Acquisition Project Update Name, Title [Your Company Here] Date Here Your Logo Here Your Copyright here, Year Project Focus Identify and evaluate trends in integration of software systems using business process workflow approach Evaluate potential candidates for participation in [Product] spin-off Validated opportunities for engagement scenarios with specific potential partners Your Logo Here Your Copyright here, Year Methodology Used two assessment and qualification levels Initial on-site meeting to validate progress, attain direction and continue refinement Basis: Determine receptiveness in the market place for a process-centric Integration product Broad view of target product categories Your Logo Here Your Copyright here, Year 4 perspectives of analysis Partnering activity and trends among players in the 5 categories Profiling on acquisition, investment and merger activity Expanded scope to conduct company vision and product review Confirmed breadth and depth of vision for integration Your Logo Here Your Copyright here, Year Research Highlights 4 Value Characteristics for our product line: Vision, process centric, lack of tool, competitive positioning Still first to market with pure “business, process, workflow integration product” solution for our value characteristics Market focus is on trading marketplaces and [product category] TAC’s focus is on supporting [product] tasks Tool vendors are most active in competitive investments Primary target partner in enterprise space are also acquisition candidates Your Logo Here Your Copyright here, Year Insights to Partner Strategy Most aggressive partnering (through acquisitions) in first half of 2003 occurred among leading organizations (in TAC segments) Leaders think as enablers and partner with many organizations in and around their vertical in order to create their market space rather than fill existing apparent holes Leaders recognize the value of investing in, acquiring, partnering with niche players that extend their portfolio in a competitive direction Leaders create market spaces and enjoy first-to-market advantage by delivering enabling technology and devices ahead of the existence of well-developed vertical applications and content partnerships Your Logo Here Your Copyright here, Year Business Drivers Consolidation pressures to retain leading position in the segment. Broadening of [product market] concept on customer side requires expanding functionality and updating architecture to enable ASP model Partnering with key customers and vendors to share costs, development and marketing efforts Result provides instant referenceable customer(s) upon release of a new product or service, thus increasing probability of success Partnering with well-known / name-brand suppliers and device manufacturers to jointly offer solutions the marketplace can take advantage of Return on investment. Most have established investment pools, the firms try to control the entire channel by investing in / acquiring key channel organizations Leaders have developed partner support groups to provide hands-on technical and business guidance to organizations that want to utilize their technology, ensuring that opportunities are fully exploited Your Logo Here Your Copyright here, Year Trend analysis level 1 Category Acquisition Acquired by other Merger Investment Most active Share ASF 8 1 0 0 BEA 75% CRM 3 1 0 0 PeopleSoft 50% B2B ecommerce 0 5 0 0 I2 Techn. 40% Commerce One 40% EAI 5 0 0 1 Silverstream 90% SI 9 3 1 1 Computer Associates 14% Sierra Sys. 14% Your Logo Here Your Copyright here, Year Trend analysis level 2 Category # of entries # with vision # with product “available” candidates ASF 5 2 1 Broadvision CRM 12 3 0 Siebel PeopleSoft Clarify B2B 7 3 0 Oracle Onyx e-commerce Ariba EAI 18 6 2 Vitria Candle Crossworlds Macola SI 34 1 0 Bluestone Your Logo Here Your Copyright here, Year Trend analysis level 3 Category “available” candidates # of activities Direction of interest ASF Broadvision 2 acquisitions CRM Siebel 1 acquisition E-commerce CRM PeopleSoft 2 acquisitions CRM and CRM Clarify Acquired by Nortel B2B e-commerce Oracle 0 E-commerce B2B e-commerce Onyx 0 E-commerce B2B e-commerce Ariba 1 acquisition Trading tech. EAI Vitria 0 Partnering EAI Candle 0 Partnering EAI Crossworlds 0 Partnering EAI Macola 0 Partnering Bluestone 0 Partnering SI Your Logo Here Your Copyright here, Year Trend analysis level 4 Category Range value of deal Preference Candidate Preference ASF Unavail Unavail. Broadvision Equity CRM 450 M / equity Equity Siebel 444M CRM PeopleSoft Unavail CRM Clarify Unavail Oracle - B2B e-commerce Onyx - B2B e-commerce Ariba Equity Vitria - EAI Candle - EAI Crossworlds - EAI Macola - Bluestone - B2B e-commerce EAI SI < 10M / equity 28M – 1.3B 1M – 1.3B - Cash Cash Your Logo Here Your Copyright here, Year Implications for [Your Company] First to market opportunity for NEWCO within [market] Business drivers are aligned with revenue and stated market penetration objectives Number 2 position in ASF and EAI category likely to be receptive to partnering offer that provides opportunity to differentiate Mixed partnerships will leverage NEWCO’s efforts and ensure market penetration BUT: Partnering trends show preference for acquisitions to control competitive functionality, not shared access! Partners in NEWCO should therefore be carefully selected to avoid competitive complications Your Logo Here Your Copyright here, Year Primary Partner Targets eCRM, B2B trading exchanges and EAI tool vendors Ariba, Bluestone Consulting and Broadvision are the clear choices BEA Systems is the leader in EAI space, others are lagging by substantial lengths Tibco in the infrastructure arena System Integrators are secondary, but should be involved for distribution to verticals The time is NOW , and the window of opportunity is short Your Logo Here Your Copyright here, Year CRM Trends Products are moving to the web. Concept is broadening to view the relationship from the perspective of the consumer. New entrants are using ASP models and are fully webenabled Distinct split between enterprise and mid-market offerings. New entrants are addressing small to mid market needs Shifting concepts about consumer interaction cause shift in product (company) positioning Offerings are beginning to implement self-service model Connectivity beyond the HR and marketing systems still not implemented PeopleSoft expanding from HR to include CRM, Call Center capability through Vantive Nortel Networks expanding to include CRM for the enterprise through Clarify Your Logo Here Your Copyright here, Year ASF Trends Partnering focused more on extending capabilities and assuring compatibility BEA Systems Serious direction setting in component and consulting partnering Serious commitment to EJB and middleware integration - 6 of 6 partnerships in this area “The automation workflow co.” acquisition will accelerate development of sophisticated workflow modules Vignette Up and comer in ASF – acquiring its way into number 2 position through Oberon integration Commitment to EAI and infrastructure – purchased On Display Lack of stated vision with respect to business level process integration tools Broadvision Partnering with ASP and “Advocate Partners” in addition to traditional VAR, consulting and technology Focus on streamlining and improvement of efficiency through e-commerce solutions Your Logo Here Your Copyright here, Year EAI Trends Partnering activity was mostly acquisition oriented. Most energy is spent on enabling IT to provide integration services to business departments through messaging, app. server and other solutions. TibCo Hitachi Software division has strong Business Process integration knowledge and capability No product comparable with [our product] Candle Expanding from strong middleware position to include process and application integration capability No acquisitions, partnerships with strong enterprise level application vendors (Siebel, Clarify etc.) Only EAI to provide serious Business Process modeling capability Strong integration tool, IT developer focussed No acquisition and investment activity, extensive partnering activity Crossworlds Focus on software development, not ready to ship product Your Logo Here Your Copyright here, Year B2B e-commerce Trends Onyx Only b2b with business process integration vision among B2B vendors today. Partnering predominantly with front office e-commerce type companies No acquisitions or investments during review period Ariba Significant press coverage through IBM – i2 deals Heavy partnering activity during fall winter/spring 2000 Only one acquisition in this period CommerceOne Acquiring to enhance portfolio of technologies and functionality Partner orientation toward global system integrator I2 Technologies Almost no content partners Just announced (March) big deal with IBM and Ariba for Automotive marketplace implementation Your Logo Here Your Copyright here, Year SI Company Trends Most organizations appear to be ‘stuck’ in providing integration services to IT, certainly in the mid-market segment Bluestone Consulting Most active in partnering for strategic positioning, possibly because closer to a software developer than a pure integrator. Only one with explicitly stated vision of integration from a business process perspective Comprehensive Systems orientation, no specific vertical Sierra Systems Actively acquiring, but focused on specific vertical: geographic mapping and planning systems Computer Associates Acquiring capability to develop e-commerce presence through “bizworks” product line Significant size deals: Sterling Software (4B in equity), Platinum Technology Your Logo Here Your Copyright here, Year Specific Observations Number of firms with explicit statement of vision and product for BPI is relatively small. BUT: each category has a leader that has developed specific functionality similar to [product], leaving others to catch up Most activity is concentrated on acquisitions as a way to jockey for position Most EAI energy is spent on enabling IT to provide integration services to business departments through messaging, app. server and other solutions. Firms with well-developed business / partner development & support organizations and investment funds will dominate the market Providers of enabling tools, data and technology MUST creatively partner to help propagate end-user / vertical applications that utilize their product or be swept aside by those who do Your Logo Here Your Copyright here, Year Lack of Action=Lost Opportunity In this highly competitive marketplace, first-to-market advantage will only be held by firms delivering enabling technology that provides real world solutions Caused by the direction set by the leaders in each category, there is natural demand for [product] like capability to hold on to, and bypass the current secondary position many of the candidate are in The key players in the market MUST ACT NOW or forever lose out on these opportunities, and potentially, on survival Your Logo Here Your Copyright here, Year Recommendations [Our Company] Should: Recommended target partners Recommended Target Acquisition Companies Dual strategy partners in both categories to ensure viability with lowest risk Timeframe here Your Logo Here Your Copyright here, Year