PPT

advertisement

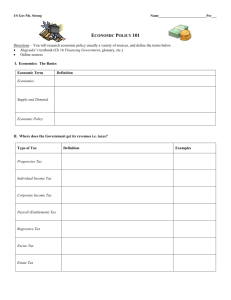

Chapter 17 (Chapter 36) The Federal Budget: Taxes and Spending MODERN PRINCIPLES OF ECONOMICS Third Edition Outline Tax Revenues Spending Is Government Spending Wasted? The National Debt, Interest on the National Debt, and Deficits Will the U.S. Government Go Bankrupt? Revenues and Spending Undercount the Role of Government in the Economy 2 Introduction “There are 10^11 stars in the galaxy. That used to be a huge number. But it's only a hundred billion. It's less than the national deficit! We used to call them astronomical numbers. Now we should call them economical numbers.” ― Richard P. Feynman, Nobel Prize winner in physics http://www.usdebtclock.org/ 3 Introduction Since the mid-1950s, the federal government has spent about 20% of GDP and has raised about 18% of GDP. That equals $3.5 trillion in spending in 2013. This chapter answer the questions: • Where does the money come from? • Where does the money go? • For how long can the U.S. government keep spending more than it raises in taxes? 4 Tax Revenues As of 2013, the federal government was taking in about $2.8 trillion a year. That works out to nearly $9,000 for every man, woman, and child in the U.S. Three sources account for more than 90% of the revenue: • Individual income tax. • Social Security and Medicare taxes. • Corporate income tax. 5 Tax Revenues U.S. Federal Tax Receipts (2013) 6 Definition Marginal tax rate: the tax rate paid on an additional dollar of income. Average tax rate: the total tax payment divided by total income. 7 Income Tax Individual income tax is the single largest source of revenue for the federal government. The marginal tax rate is the tax rate paid on an additional dollar of income. • For incomes less than $18,150, the marginal tax rate is 10%. • For income earned greater than $457,600, the marginal tax rate is 39.8%. In 1960, the lowest marginal tax rate was 20% and the highest rate was 91%. 8 Income Tax It is the marginal rate that determines things like the incentive to work additional hours. The average tax rate is your total tax payment divided by your total income. If income = $50,000, you pay: • 10% on the first $18,150, or $1,815. • 15% on the next $31,850 ($50,000 − $18,150), or $4,778. Average tax rate: $6,593/$50,000×100 = 13.2%. 9 Income Tax U.S. Marginal and Average Tax Rates (Married, Filing Jointly, 2014) 10 Self-Check If the tax rate is 10% on income up to $30,000 and 15% on income up to 60,000, what is the average tax rate for someone earning $55,000? a. 12%. b. 12.27%. c. 12.5%. Answer: b: (10% x 30,000) + (15% x 25,000) = 6,750/55,000 x 100 = 12.27%. 11 Income Tax Some income is exempt from taxation. Each person generally gets one tax exemption for him- or herself, one for a spouse, and one for each child or dependent. In 2014, for example, each exemption let you have $3,950 of income tax free. The tax system also allows deductions for expenses like home mortgage interest, donations to charity, state and local taxes, and very high medical expenses. 12 Income Tax Income received from interest, dividends, and capital gains is also taxed. Dividends - stockholders’ share of the profits. Marginal Tax Rate = 15% for most people. Marginal Tax Rate = 5% for low income people. Capital Gains - the difference between the price an asset was purchased at and its selling price. Marginal Tax Rate = 15%. Capital losses can offset income from capital gains. 13 Taxes on interest, dividends, and capital gains • Political debate about how investment income should be taxed. Democrats—favor higher tax rates. • Why?: Rich people (who invest more than the poor) should bear a higher share of the burden. Republicans—favor lower tax rates. • Why?: Lower taxes provide incentive to invest and create economic growth. • The Capital Gains Tax: an appropriate tax on lazy fatcats? Or stifling the engine of growth? 14 Income Tax The alternative minimum tax (AMT), started in 1969, was meant to ensure that it would not be possible for anyone to avoid all income tax. • People were making over $100,000 and not paying taxes! Big Problem: AMT not indexed to inflation Taxpayers make two computations and pay whichever is higher. • What they owe under the standard tax code. • What they owe under the AMT, a flat rate with no deductions. 15 Definition Alternative minimum tax (AMT): A separate income tax code that began in 1969 to prevent the rich from not paying income taxes. It was not indexed to inflation and is now an extra tax burden on many upper middle class families. 16 Social Security and Medicare Taxes Almost all workers in the United States pay the Federal Insurance Contributions Act (FICA) tax. The FICA tax funds Social Security payments. The FICA tax is 6.2% of your wages on the first $117,000 of income. Employers pay a 6.2% tax on the same earnings. Research shows that much of the burden of the FICA tax falls on workers, not on employers. In reality, economic research shows that the employer’s payment is mostly taken out of the worker’s prospective wage; in other words, if your employer didn’t have to pay the FICA tax, your wages would be higher. 17 Social Security and Medicare Taxes Medicare is partly financed out of general revenues and partly financed out of special payroll taxes. Employers pay 1.45% and workers pay another 1.45%. Again, workers pay much of the employer's premium in the form of lower wages just like in the case of AMT. Self-employed individuals pay the full 2.9% themselves (same with FICA). 18 Self-Check Medicare and Federal Insurance Contributions Act (FICA) taxes are paid by: a. Workers. b. Workers and employers. c. Workers and self-employed individuals. Answer: b – they are paid by workers and employers. 19 Corporate Income Tax The corporate income tax rate in the U.S. is 35%, one of the highest rates in the world. Some profitable corporations manage to define their income and expenses in such a way that they don’t pay any corporate income tax at all. The corporate income tax is paid initially by shareholders and bondholders, who earn a lower rate of return on their investments. More generally, the rate of return will fall on all forms of capital. GE’s special legislation – no income tax 20 Definition A flat tax: has a constant tax rate. A progressive tax: has higher tax rates on people with higher incomes. 21 Definition A regressive tax: has higher tax rates on people with lower incomes. 22 Distribution of Federal Taxes Households with incomes in the bottom 20% pay less than 5% of their total income in federal taxes. Those with incomes in the top 20% pay an effective tax rate of around 25%. The U.S. tax system is progressive. • People with higher income pay a higher percentage of their income in tax than people with lower income. Other non-income taxes can be regressive (e.g. taxes on food) 23 Distribution of Federal Taxes What are the political chances for a flat tax? Eliminating the mortgage deduction would result in lower house prices and other side effects… • Costs would fall mainly on the middle class, i.e. the majority of the voters … What do you think? 24 Distribution of Federal Taxes Who Pays Federal Taxes? Source: Congressional Budget Office, 2013. 25 Self-Check A progressive tax means that people with higher incomes: a. Pay a higher tax rate. b. Pay a lower tax rate. c. Pay a lower rate, but higher dollar amount. Answer: a – pay a higher tax rate. 26 State and Local Taxes In addition to federal taxes, most people pay state and local taxes. States raise more of their revenues, about 20% on average, from sales taxes. Since everyone pays sales taxes regardless of income, state and local taxation as a whole is less progressive than income taxation. It depends on the state. 27 Spending Almost two-thirds of the U.S. federal budget is spent on just four programs: • Social Security • Defense • Medicare • Medicaid Interest on the national debt and various unemployment insurance programs and welfare programs are also large. 28 Spending U.S. Federal Spending (2013) 29 Social Security Social Security is the single largest government program in the world, in dollars paid. In 2013, $807.8 billion was paid to over 61 million beneficiaries. Current payments are paid out of current taxes. • There is no “lockbox” • This is no fund of $$ with your name on it, only IOUs • SS essentially pushed government spending forward for the first 80 years • Tremendous political benefits from this spending 30 Social Security The average retiree receives $1,200 a month. Social Security benefits are defined by a complex formula depending on years worked, average earnings, marital status, the year you retire, and at what age. No doubt that Congress will make “adjustments” to pay-out formulas in the future Why not “means-test” SS benefits? SS is not a tax, but a supplemental retirement program 31 Social Security The program was getting very expensive, so in 1983 the full retirement age began to increase. The Social Security tax rate increased from 2% in 1940 to 12.4% today. Social Security has become less generous: • A single male retiring in 1975 received $46,807 more in benefits than he paid in taxes. • The same male retiring in 2010 receives only $8,286 more in benefits than he pays. 32 Social Security Different individuals are treated differently depending on their wealth, life expectancy, marriage status, and other factors. Social Security redistributes wealth across income classes – for medium- and high-wage workers it is a net cost. Married people with nonworking spouses get 50% more than singles. Anyone with greater life expectancy gets a bigger benefit. Net benefits are declining over time 33 Defense The United States spends much more on its military than does any other country in the world. Under a broader definition of defense, spending is around $750 billion annually. 34 Medicare and Medicaid Medicare reimburses the elderly for many of their medical expenses. (FREE HEALTHCARE!) In fiscal year 2013, Medicare spending amounted to $585 billion. Medicaid covers the poor and the disabled. In 2013, Medicaid expenditures were around $265 billion, paid for jointly by federal and state governments. The Affordable Care Act of 2010 modifies the American health insurance system. 35 Welfare Spending Other than defense, the largest programs are Social Security and Medicare, which transfer wealth to the elderly, not to the poor. Most welfare payments fall into a few categories. Personal welfare payments are made to poor households with children. The largest is Temporary Assistance for Needy Families, which subsidizes a portion of rent. The Earned Income Tax Credit (EITC) pays poor people based on their earnings. 36 Welfare Spending Unemployment insurance (UI) makes payments to people who are out of work. It is not restricted to the poor. UI is a large program that can expand rapidly during recessions. Just $31.4 billion was spent on UI in 2007. That number increased to $155 billion in 2010 before falling to $72 billion in 2013. 37 Everything Else All other federal spending programs include: Farm subsidies. Spending on roads, bridges, and infrastructure. The Disaster Relief Fund. The Small Business Administration. The Food and Drug Administration. Federal courts. Federal prisons. The FBI. Foreign aid. Border security. NASA. The National Institutes of Health. The National Science Foundation. Financial assistance to students. The wages of all federal employees. 38 Self-Check The largest amount of federal government spending goes to: a. Social security. b. Defense. c. Medicare. Answer: a – the largest amount of federal spending goes to social security (23.4%). 39 Is Government Spending Wasted? Government spending can be ineffective due to weak incentives and lack of information. When the U.S. spent over a hundred billion dollars on reconstruction efforts in Afghanistan and Iraq, many billions went to waste or fraud. The U.S. government lacked information about local wants and needs. The ultimate boss – the American taxpayer – could not easily monitor how the money was being spent. 40 Is Government Spending Wasted? It is difficult to cut spending on big programs without cutting benefits. Most waste is due to problems of information and incentives that are difficult to solve. Most of the money is being spent on the big programs, which are well-known and well monitored. If we want more spending, taxes must rise. If we want lower taxes, spending and benefits must fall. 41 National Debt Budget Cuts Visualized: http://www.wimp.com/budgetcuts/ US Debt - Visualized in physical $100 bills (2:10) https://www.youtube.com/watch?feature=player_embedded&v =iTBODoBaCns What Are the Dangers of Too Much Debt? (3:08) https://www.youtube.com/watch?v=ID4xay5RITY&feature=yo utu.be Debt Limit – A Guide to US Federal Debt (3:08) https://www.youtube.com/watch?v=Li0no7O9zmE&feature=pl ayer_embedded 42 Definition National debt held by the public: All federal debt held by individuals, corporations, and governments other than the U.S. federal government. 43 Interest on the National Debt A better measure of our current debt is the national debt • which is all federal debt held by individuals, corporations, state or local governments, foreign governments, and other entities other than the federal government itself. As of 2014, the national debt held by the public was nearly $13 trillion. GDP is about $17 trillion, so the U.S. has a debtto-GDP ratio of over 70%. This debt-to-GDP ratio is not excessive but the national debt is rising very quickly. 44 The National Debt The Debt-to-GDP Ratio, 1940–2013 45 Interest on the National Debt Every year, the government must pay interest to the bondholders who lent it money. In 2014 the federal government paid about $184 billion in interest payments. As the U.S. economy recovers, interest rates will increase, and interest on the debt will increase. Interest on the debt will also increase as the debt-to-GDP ratio increases. If interest rates return to “normal,” debt service will rise to over $1 trillion/year, perhaps higher 46 Definition Deficit: The annual difference between federal spending and revenues. 47 Deficits The national debt is the total amount of money owed by the federal government at a given point. It is a cumulative total of previous obligations. The deficit is the yearly difference between what the government is spending and what the government is collecting in revenues. When spending is greater than revenues, the government must borrow to make up the deficit, or difference. 48 Deficits Spending, Revenues, and Deficits of the U.S. Government as a 49 Percentage of GDP, 1960–2013 Self-Check The annual difference between federal revenues and spending is called: a. The national debt. b. Government borrowing. c. The deficit. Answer: c – the deficit. 50 The Future Will the US Government Go Bankrupt? The Congressional Budget Office (CBO): “under any plausible scenario, the federal budget is on an unsustainable path…” Isn’t the Debt “money we owe ourselves?” Maybe in the past, but not anymore 51 The Future Many economists are worried about the future debt-to-GDP ratio, largely due to demographics and increasing health-care costs. The increase in the number of elderly people means higher Social Security and Medicare payments. An even bigger problem is rising health-care costs per person. This will require some combination of increased taxes, reduced spending, or higher debt. 52 The Future Increased taxes will probably be in the form of higher inflation, via partial monetarization of the debt/deficits US dollar “Reserve Currency” status will likely be lost Standard of living will drop in the US • Greek standard of living dropped 30-40% The good news? Many European countries and Japan will precede the US into “bankruptcy” 53 Government Spending Government Spending in the United States Today Is Lower than in Most Other Developed Countries 54 The Role of Government Government spending is one measure of how government affects the economy, but it is not complete or fully accurate. For example, the Environmental Protection Agency has a budget of about $9 billion yet both its costs and its benefits are much higher. Until 1973 the United States ran a military draft. Drafted soldiers are relatively cheap, but the draft involves a significant opportunity cost. 55 Takeaway The federal government has revenues and spending of over $3.5 trillion. The majority of tax revenues comes from individuals in the form of individual income taxes and tax on wages. Around 20% of spending is on defense. About one-third of the federal budget goes for Social Security and Medicare payments. 56 Takeaway It is likely that federal expenditures will rise in the future, mostly because of rising health-care expenditures. One question is whether and how federal revenues will rise to keep the budget sufficiently close to balancing. 57