Chapter 30 Tools & Techniques of Life Insurance Planning 30

advertisement

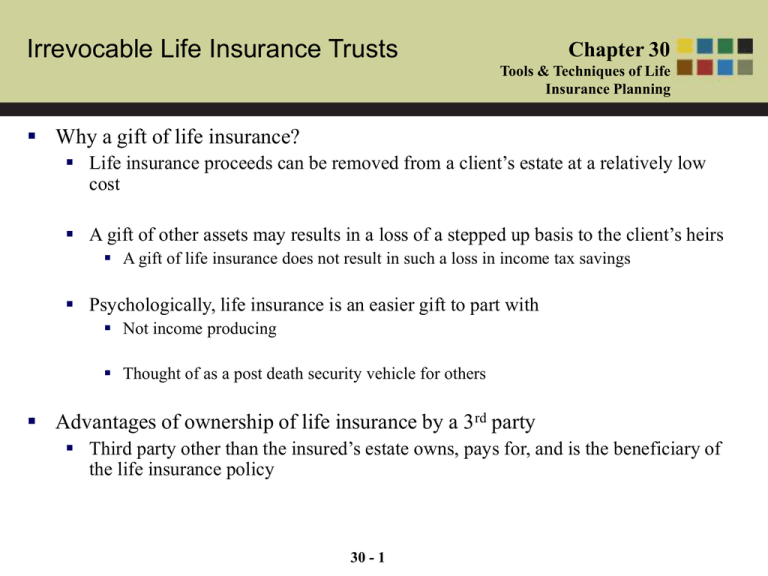

Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Why a gift of life insurance? Life insurance proceeds can be removed from a client’s estate at a relatively low cost A gift of other assets may results in a loss of a stepped up basis to the client’s heirs A gift of life insurance does not result in such a loss in income tax savings Psychologically, life insurance is an easier gift to part with Not income producing Thought of as a post death security vehicle for others Advantages of ownership of life insurance by a 3rd party Third party other than the insured’s estate owns, pays for, and is the beneficiary of the life insurance policy 30 - 1 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Advantages of ownership of life insurance by a 3rd party (cont’d) Next best alternative Transfer existing policy by gift to insured’s spouse, or other trusted person Transfer policy to an irrevocable life insurance trust (ILIT) Lowers the overall tax burden Provides means of creating estate liquidity Liquidity for the estate without causing inclusion of the proceeds in the insured’s estate If policy is owned or transferred to the insured’s children No estate tax is imposed until the next generation (to the extent the children have not used the money) 30 - 2 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Disadvantages of ownership of life insurance by a 3rd party To avoid federal estate tax the client must give up direct control of the policy The transfer must be complete and permanent An absolute assignment or total change of ownership must be made if a presently existing policy is to be removed from the client’s estate Unpredictable events can drastically change the way or the parties the client would prefer to own coverage on his life Unstable marriage Insured may not get along with the children Spouse could pre-decease the insured Tax laws could change Business reverses or opportunities may suggest a need for the insurance cash values 30 - 3 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Why make a gift to an irrevocable life insurance trust? Federal estate tax can be avoided at the client’s death and spouse’s death State death taxes can be saved in the same manner as federal estate taxes Little to no gift taxes are required to create and shelter life insurance from transfer taxes No probate expenses, delays, or uncertainties with respect to the transfer of assets in an irrevocable life insurance trust Trustee can use trust assets to provide estate liquidity, prevent a forced sale of a family business, valuable real estate, or a securities portfolio, and keep treasured property in the family 30 - 4 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Why make a gift to an irrevocable life insurance trust? (cont‘d) Significant income and capital can be provided for the surviving spouse Without causing inclusion in the surviving spouse’s estate The irrevocability of the trust generally translates into protection from the claims of creditors Irrevocable trusts generally provide protection from a surviving spouse’s rights of dower, courtesy, or right of election under state law A gift of a policy to a ILIT gives the insured more control over the ultimate distribution of the policy and its proceeds, than would an outright policy gift Sprinkle and spray powers for the trustee are highly advantageous 30 - 5 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Why make a gift to an irrevocable life insurance trust? (cont’d) GSTT problems can be reduced or eliminated by judicious use of the GSTT annual exclusion and GSTT exemption Using the ILIT as a vehicle to provide wealth replacement for the heirs Insure the estate tax savings for clients who establish GRITs, GRATs, GRUTs, or charitable lead trusts in the event they die before the trust term ends Achievement of adequate financial security for those of modest means through the leverage of life insurance General professional management, protection from creditors, postponement of receipt of inheritance, and avoidance of guardianship of minors 30 - 6 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Disadvantages to ownership of life insurance by an irrevocable trust Client must give up Income produced by the trust Use and enjoyment of the property The right to name, add, subtract, or change the size or terms of a beneficiary’s interest The right to regain assets placed into the trust The ability to alter, amend, revoke, or terminate the trust Considerations Client can discontinue premiums or let the policy lapse and start over with a new trust 30 - 7 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Disadvantages to ownership of life insurance by an irrevocable trust (cont’d) Considerations (cont’d) Trust language could be drafted to give the trustee the authority to make distributions to the beneficiaries prior to the client’s death Client could purchase the policies back from the trust for their fair market value Special power of appointment given to the insured’s spouse, an adult child, or someone the insured implicitly trusts Power to appoint trust property to anyone other than the insured-grantor, his estate, or creditors of his estate Name grantor’s spouse as original holder of the power but provide the power would pass to a contingent holder: If spouse dies first If spouse is no longer married to the grantor If the spouse no longer has the legal or mental capacity to exercise the power 30 - 8 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Disadvantages to ownership of life insurance by an irrevocable trust (cont’d) Considerations (cont’d) Have a provision that would permit the trustee to collapse the trust and distribute it’s assets to the beneficiaries Trustee could be given a power to sprinkle or spray income and principal among a class of persons Trust could provide that if the grantor dies within three years of transferring the life insurance policy to the trust, the proceeds would be paid to the insured-grantor’s executor Proceeds could then be channeled to the spouse and qualify for the marital deduction Noninsured spouse could create a split dollar agreement with the trust in which the spouse retains access to the policy cash values 30 - 9 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Disadvantages to ownership of life insurance by an irrevocable trust (cont’d) Up front and continuing cash costs May be termination fee if the trust is terminated before the life insurance policies have matured Potential loss of the donor’s contributions out the back door of the trust Crummey powers Where the annual exclusions cannot shield the annual premium outlays, use of the unified credit and then payment of gift tax 30 - 10 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Irrevocable Trusts – What it is and how it works Two ways an irrevocable trust becomes a life insurance trust Absolute assignment of policies to the trust Trust created and cash contributions made to the trust Trust purchases life insurance on the grantor ILIT may be funded or unfunded Funded – assets other then the life insurance have been placed in the trust Trust agreement should specify (a) what should happen if trust funds are insufficient to pay the insurance premiums and (b) what should happen if there is an excess of income Unfunded – trust contains only life insurance policies 30 - 11 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Irrevocable Trusts – What it is and how it works (cont’d) Tax objectives of trust Make maximum amount of income and capital available to surviving spouse Avoid inclusion of the proceeds in both spouses’ estates To accomplish these tax objectives, the draftsperson of the trust inserts certain provisions that Allow trustee to sprinkle income or spray capital to spouse and children; and/or Give spouse “all of the income for life and as much principal as necessary for her health, education, maintenance, and support”; and State “when she dies, my surviving spouse can appoint the remainder of the trust assets among our then living children” 30 - 12 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Irrevocable Trusts – What it is and how it works (cont’d) Caution – if the provisions of the trust required the trustee to pay to the insured’s estate any cash needed to pay debts, expenses, and taxes This provision would result in federal estate tax inclusion of all amounts that could be so expended Solution – trust provision authorizing, but not directing, trustee to Lend money to estate at an appropriate interest rate Purchase assets from the estate at their fair market value Estate should realize little to no gain on the sale because appreciated assets receive a stepped up basis at death Trustee takes that asset with a basis that is stepped up to its purchase value 30 - 13 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Mechanics Attorney drafts and client signs the irrevocable trust document Trustee then applies for the policy on the insured’s life Alternatives Plan A Client applies for the policy as policyowner Client transfers ownership of the policy to the trust by an absolute assignment In a “nonprepaid” case, an informal application is submitted, and once the policy’s issues status is known, the trust is established, and then the trust formally applies for the policy Plan B Client applies for term insurance Once the trust is established, trustee applies for a new form of permanent policy and the term policy can be lapsed 30 - 14 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Mechanics (cont’d) Alternatives (cont’d) Plan C (the “substitute application”) Applicant, owner, and policy date of a recently issued policy (less than a year old) are changed to coincide with the effective date of the trust Client can transfer existing policies to the trust via an absolute assignment Client must survive three years after the transfer in order for the proceeds to be excludable from his gross estate Selection of a trustee Grantor-insured as trustee IRS could argue insured has retained an incident of ownership that causes the insurance proceeds to be includable in his estate 30 - 15 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Selection of a trustee (cont’d) Spouse of the grantor-insured as trustee If spouse is given a general power of appointment over the policy in the trust, the proceeds will be in the spouse’s estate Safeguards Name at least one other individual or corporate fiduciary as co-trustee Specifically exclude the surviving spouse from all potential exercises of incidents of ownership in the policy held by the trust insuring the spouse’s life Allow distributions to the surviving spouse only if and when the principal of the marital trust is exhausted Forbid any distributions to individuals that would relieve or discharge the spouse from a legal support obligation 30 - 16 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Selection of a trustee (cont’d) Spouse of the grantor-insured as trustee (cont’d) Safeguards (cont’d) Limit the surviving spouse to a special power of appointment over trust assets, but specifically exclude from this power the right to dispose of life insurance on the spouse’s own life Exclude the surviving spouse as trustee from making any decisions involving the distribution of principal or income to the spouse as a beneficiary except those limited by a health, education, maintenance, and support ascertainable standard Consider the existence of the trust during two time periods Who should be trustee during the insured’s lifetime? Who should be the trustee thereafter? 30 - 17 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on policy transfers and premium payments through Crummey powers Transferring a policy to a trust is a gift subject to the gift tax The tax depends on the value of the policy, the availability of the annual exclusion, and the unified credit If the annual exclusion is available, then up to $12,000 (in 2008) is shielded, and up to $24,000 (in 2008) if the client is married and the spouse consents to the gift Gift tax valuation rules Policy Transferred New policy transferred immediately after issue Gift Tax Value Cost (net premiums paid) Existing policy - no further premiums due In the case of a single premium or paid-up policy, cost of replacement Policy in "premium paying" stage "Interpolated terminal reserve" plus any unearned premiums paid on the date of death less any policy loans Group term life insurance At the client's option - the actual cost or Table I cost Policy is about to mature on the date of transfer IRS may value the policy at or near its face amount 30 - 18 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on policy transfers and premium payments through Crummey powers (cont’d) Minimize the gift tax exposure Borrow cash value out of policy before making gift One large policy could be split into several smaller ones and staggered gifts could be made to the trust The annual exclusion is available only for gifts of “present interest” Donee must receive the immediate, unfettered, and ascertainable right to use, possess, or enjoy the transferred property Outright transfers of a life insurance policy qualify for the annual exclusion 30 - 19 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on policy transfers and premium payments through Crummey powers (cont’d) Gift of life insurance to a trust A gift of an insurance policy to a trust will be a gift of a future interest Absent the annual exclusion, each time a client made a contribution to the trust to enable the trustee to pay premiums, the client would have to use up more of his unified credit to avoid gift taxes The solution Create a “window" through which the beneficiary could reach to take all or a portion of that annual contribution This window is called a “Crummey power” Trust must specify that each trust beneficiary to whom a Crummey power is to be granted is given an absolute but noncumulative right to withdraw a specified amount from the client’s annual contribution 30 - 20 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on policy transfers and premium payments through Crummey powers (cont’d) The solution (cont’d) Crummey power Limit to the lowest of Amount of the annual exclusion per donor/donee per year The amount actually contributed The greater of $5,000 or 5% of the value of the trusts assets at the time of the withdrawal Window must be allowed to remain open long enough to give the beneficiary a meaningful interest in the property given to the trust trustee should keep sufficient funds in the trust during the open window so that a demand can be realistically and immediately satisfied 30 - 21 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on policy transfers and premium payments through Crummey powers (cont’d) The solution (cont’d) Crummey power (cont'd) Notification should be made by the trustee to all demand powerholders of the right to make withdrawals In the case of minors, notice should be given to the parent or legal guardian There is no specific number of days during which a demand power can be exercised that assures that a demand power will create a present interest 30 days from the date of notice seems to be the shortest reasonable period If the window were opened too high (i.e., the “5 or 5 power” limit was not included) The value of any unexercised demand existing at the beneficiary’s death would be included in his estate 30 - 22 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on policy transfers and premium payments through Crummey powers (cont’d) The solution (cont’d) The “5 and 5 Power” Allowing a general power to lapse or expire is treated for gift and estate tax purposes as a release (as if the powerholder made an actual transfer of the property) The de minimis rule The gift/estate tax problems of the powerholder who doesn’t exercise the power is avoided to the extent the lapse of the power does not exceed the greater of $5,000 or 5% of the value of the trust assets at the time of the lapse When a trust is unfunded Only two sources from which the demand right can be satisfied The cash contribution made by the grantor to the trustee in order to pay premiums The life insurance policy itself 30 - 23 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on policy transfers and premium payments through Crummey powers (cont’d) When a trust is unfunded (cont’d) Conservative planners may protect the insured-grantors gift tax exclusion even further by funding the trust with other assets other than the life insurance policy Recommended course of action is for the insured-grantor to make cash contributions to the trustee that the trustee could hold for the duration of the demand period At expiration, the trustee could pay premiums with this contribution Giving the spouse a Crummey power Client may be worried that children or other donees will exercise their demand power and thus defeat the purpose of the trust by depriving the trustee of the funds from which to pay premiums The client may want to increase the number of annual exclusions 30 - 24 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on policy transfers and premium payments through Crummey powers (cont’d) When a trust is unfunded (cont’d) Giving the spouse a Crummey power (cont’d) Limit power to annual amount not exceeding $5,000 or 5% of the trust fund Higher powers would invite IRS inclusion of the policy proceeds in the spouse’s estate If the grantor’s spouse has a requisite beneficial interest in the trust, the IRS could argue that the lapse of the spouse’s demand power is equivalent to the release of a general power of appointment IRC 2041(a)(2) – decedent’s gross estate includes the value of property subject to a general power of appointment that was released or exercised before the decedent’s death , if the result of the release or exercise is the creation of a retained interest described in IRC Sections 2035, 2036, 2037, or 2038 30 - 25 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Gift, estate, and income tax problems related to Crummey powers Where premium outlays will exceed the greater of $5,000 a year or 5% of trust assets in the year of the grantor’s contribution Client opens the window too much By allowing the general power to lapse, the beneficiary who could have taken the cash but didn’t, is making a taxable gift to anyone who has interests in the trust that are enlarged by the lapse The gifts are gifts of a future interest and are ineligible for the gift tax annual exclusion The Crummey beneficiary who permitted the withdrawal to lapse would be required to file a gift tax return and may have to use part of his unified credit or pay a gift tax 30 - 26 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Gift, estate, and income tax problems related to Crummey powers (cont’d) Policies with large premiums – minimizing the problem Use a limited pay type policy Example – A ten pay policy would be complete in ten years. Amount saved in estate taxes would be considerable compared to the relatively small gift taxes paid during the ten year period Use vanishing premium type arrangement Increase the number of legitimate powerholders Add testamentary control Can exercise power of appointment by will only Prevents taxable gift when Crummey power lapses Two ways – general or special power of appointment 30 - 27 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Gift, estate, and income tax problems related to Crummey powers (cont’d) General testamentary power technique Each beneficiary given a general testamentary power of appointment over his share of the trust Each beneficiary can choose who will receive that share of the trust if the beneficiary doesn’t live to get it That right can be exercised only at death and only by a specific provision in the beneficiary’s will referring to the general power in the trust The trust provides that if the beneficiary doesn’t properly exercise the power, then the property will pass to the other beneficiaries in the trust Downsides Property subject to this power will be in powerholder’s estate Equates to a loss of control by the client-grantor 30 - 28 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Gift, estate, and income tax problems related to Crummey powers (cont’d) Special testamentary power of appointment technique Grant each beneficiary only a limited power of appointment If the beneficiary dies, his share will pass to whomever he provides by will within a client-specified class, such as the powerholder’s siblings The powerholder’s choices are limited by the client-grantor Downsides Property subject to the power will be in the powerholder’s estate if the powerholder does before the trust ends Powerholder’s controlled ability to shift property rights equates to a loss of control by the client-grantor 30 - 29 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Gift, estate, and income tax problems related to Crummey powers (cont’d) Use a hanging power The powerholder is allowed to make a withdrawal each year equal to his share of the client’s contribution, up to the maximum annual exclusion The right to that aliquot share is cumulative To the extent no withdrawal is made in a given year, the balance hangs over and can be used in a following year Example - Client contributes $10,000 to trust with one powerholder Right to first $5,000 lapses, the right to withdraw the remaining $5,000 would continue By the second year $10,000 worth of contributions would have lapsed, but $10,000 worth of excess contributions are now available as credits against future years 30 - 30 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Gift, estate, and income tax problems related to Crummey powers (cont’d) Use a hanging power (cont’d) 30 - 31 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Gift, estate and income tax problems related to Crummey powers (cont’d) Use a hanging power (cont’d) If the beneficiary dies while amounts remain available at the beneficiary’s demand, whatever is subject to that demand is included in the powerholder’s estate Beneficiaries could frustrate the client’s intent by making withdrawals of large amounts Client’s should carefully select powerholders who are mature enough to understand the client’s objectives and the potential consequences of their actions IRS has disallowed a hanging power written as a tax savings clause as adverse to public policy The single beneficiary trust Providing separate trusts or separate trust shares If client is willing to give up flexibility 30 - 32 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Gift, estate, and income tax problems related to Crummey powers (cont’d) The single beneficiary trust (cont’d) Disadvantages Trustee cannot make discretionary trust distributions to persons other than the beneficiary, since there is only one beneficiary All income and principal must be payable to the estate of the beneficiary if the beneficiary dies before the trust pays out all its principal Each beneficiary must be given a testamentary general power of appointment over his trust share Trust assets cannot be sprinkled or sprayed to the person who needs it or deserves it most Property will pass as if owned by the beneficiary, possibly to a person objectionable to the client 30 - 33 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Gift, estate, and income tax problems related to Crummey powers (cont’d) The single beneficiary trust (cont’d) Disadvantages (cont’d) Property will be includable in the beneficiary’s estate The property may be distributed (due to the untimely death of the beneficiary) prior to the date expected by the client Grant withdrawal rights to secondary/contingent beneficiaries The “Cristofani Case” Contingent beneficiaries given withdrawal rights and were entitled to principal only to the extent the prior beneficiaries had not exhausted the trust IRS argued that this level of powerholders had such a remote chance of actually receiving assets from the trust that there must have been some implied understanding between them and the client-grantor that they would not make such a withdrawal The tax court disagreed – powerholders had absolute legal right of withdrawal 30 - 34 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on premium payments through methods other than Crummey powers Split Gifts Having the nondonor spouse agree to be treated if he had made one-half of the gifts made by the donor spouse Election for split gifts is made on the gift tax return for the year in which the gift is made Permanent withdrawal rights The powerholders’ rights do not lapse and therefore grow each year Larger premiums can be paid and sheltered by the annual gift tax exclusion Downside As the value of the property that can be taken grows, so does the beneficiary’s temptation to make a withdrawal. 30 - 35 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Reducing or eliminating gift taxes on premium payments through methods other than Crummey powers (cont’d) All out maximum transfers Example Client transfers $200,000 (doubled to $400,000 with gift splitting) in 2008 Excess over $24,000 will not qualify for the annual exclusion, so client must use his unified credit to avoid a current gift tax liability Once at least $200,000 of assets are in the trust, the greater of $5,000 or 5% is $10,000 So, from this point forward, the client can make gift tax free gifts of the maximum exclusion amount Even if the beneficiary doesn’t exercise his withdrawal rights, no taxable gift occurs because the entire contribution is shielded by the de minimis greater of $5,000 or 5% trust principal rule Downside Client must be willing to use all or a large portion of his unified credit 30 - 36 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning What the attorney should consider in drafting The right of the Crummey power beneficiaries to make withdrawals extends to contributions to the trust from all sources The amount subject to the Crummey power should be limited to the smallest amount that will protect the client’s annual contributions Require the trustee to give return receipt requested notice of any additions to principal and keep the right of withdrawal open for at least 30 days Require the beneficiary exercise the withdrawal right well within the policy’s grace period for payment Require that the beneficiary exercise withdrawal rights in writing 30 - 37 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning What the attorney should consider in drafting (cont’d) Allow any power given to a minor beneficiary to be exercised on his behalf by a guardian Terminate the power of withdrawal upon the insured’s death Name backup powerholders so that, if a primary Crummey powerholder dies, the annual exclusion is not lost Have the grantor irrevocably renounce all rights in any policies or other assets in the trust Be sure the noninsured spouse pays no premiums and contributes no premiums, policies, or other assets to the trust 30 - 38 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning What the attorney should consider in drafting (cont’d) The trustee should be given a duty to collect proceeds and indemnification for costs involved in a suit if required Give the trustee the right to take one or more policy death benefits under the settlement options provided by the insurer In community property states, the grantor should indicate that any insurance contributed to the trust was the separate property of the grantor Do not require that the trustee purchase life insurance or apply contributions to the trust to be used to buy life insurance or pay life insurance premiums Trustee must act independently in the purchase of the insurance and not as the client’s agent or at the client’s direction 30 - 39 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning What the attorney should consider in drafting (cont’d) Do not allow the client to sign the policy application as applicant or owner Do not allow the trustee to merely endorse the client’s contribution to the trust each year and send them on to the insurance company How to avoid the transfer within three years of death rule Be sure the client never owns the policy Suggest to the independent trustee the advantages of owning a policy on the life of the “to be insured,” but let that party make the decision and take all the action to put the policy into effect Authorize, but do not require, the purchase of life insurance 30 - 40 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning How to avoid the transfer within three years of death rule (cont’d) Expand the authority of the trustee to purchase life insurance on the life of anyone on whom the trust beneficiaries have an insurable interest Specifically deny the insured the power to acquire any rights in a policy currently owned by the trust Permit, but do not require, that the trustee pay premiums A client’s gift of existing life insurance must be made with no strings attached Be sure that facts indicate that the trustee is not acting mechanically as the agent of the client If possible, during the first three years, have the trustee pay premiums from a source other than the insured. 30 - 41 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning How to avoid the transfer within three years of death rule (cont’d) Be sure that the trustee physically obtains and retains possession of all polices assigned to the trust Authorize the trust to enter into a special arrangement with the client’s corporation or other business enterprise or a third party for splitting premium dollars and policy ownership Avoiding transfer for value rules with a trust The transfer was to the insured, if the trust was defective If the irrevocable trust was a partner of the insured, the transfer falls within one of the exceptions Section 1035 exchanges should not cause a new three year period to commence for estate tax purposes under Section 2035 30 - 42 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Structuring the trust for “what ifs” Escape or failsafe contingency provision Requires the trustee to hold any insurance proceeds that are included in the grantor’s estate, and to pay them out in a manner that qualifies the proceeds for the estate tax marital deduction As a general power of appointment or as a QTIP deduction Clause could obtain the marital deduction by providing for Outright payment of the insurance proceeds to the surviving spouse Income interest to the surviving spouse coupled with a general power of appointment Payment of the proceeds to a trust the surviving spouse can revoke at will 30 - 43 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Allocation of the federal estate tax The IRC allows the insured to specify, by an allocation clause in his will, who will bear the burden of any estate tax Income tax implications Grantor trusts Income taxed to the grantor and any deductions, gains, losses, or credits realized by the trust can be used by the grantor What will cause the trust to be considered a grantor trust? Retention by the client or the client’s spouse of a reversionary interest in the income or principal in the trust Only if the actuarial value of the retained reversionary income is greater than 5% of the value of the income or principal that may revert Retention of the power to control the beneficial enjoyment of the income or principal of the trust 30 - 44 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Income tax implications (cont’d) What will cause the trust to be considered a grantor trust? (cont’d) Retention of certain administrative powers Power to purchase, deal with, or dispose of the income or principal of the trust for less than adequate and full consideration Power to borrow income or principal without adequate interest or security Related or subordinate trustee lends income or principal without adequate collateral or reasonable rate of interest If someone other than the trustee can vote corporate stock held by the trust, or has the power to control the investment of stock or securities held by the trust, or has the power to reacquire the principal of the trust by substituting property of equal value 30 - 45 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Income tax implications (cont’d) What will cause the trust to be considered a grantor trust? (cont’d) Retention of the power to revoke the trust by the client or a nonadverse party If trust income is, or in the discretion of the client or a nonadverse party, may be Distributed to the client or his spouse Held or accumulated for future distribution to the client or his spouse Used to pay premiums on a policy on the life of the client or his spouse Used to discharge a legal obligation of the client or his spouse 30 - 46 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning How to handle last-to-die insurance in an irrevocable trust Reasons to use these policies Payment of proceeds often tracks with the estate’s need for cash Lower outlay than if the same amount of coverage were obtained by the older insured Guidelines Do not name either spouse as a life beneficiary of the trust Do not name either spouse as trustee IRC 2035 Only if (a) both spouses die with the three year period following the transfer, and (b) the transferor spouse is the second to die The life insurance proceeds will be includable under the three year rule 30 - 47 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning How to handle last-to-die insurance in an irrevocable trust (cont’d) Guidelines (cont’d) Situations where last-to-die policies are not indicated Where client wants to pass significant wealth to someone other than the surviving spouse Where there is no surviving spouse Where the surviving spouse is not a U.S. citizen and a QDOT is contra indicated Where the funds needed to maintain the surviving spouse’s standard of living will require significant capital 30 - 48 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning How to handle group term life in an irrevocable trust Group term life is an ideal transfer where It makes a significant estate tax savings possible at a minimal gift tax cost Considerable psychological advantage Employee feels cost is low since “little of current value” is given up Special problems Assignability Obtaining the annual exclusion Community property issues 30 - 49 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Community property issues Community property states Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, and Washington. Wisconsin is a quasi-community property state Life insurance Acquired by one or both spouses during the marriage while domiciled in a community property state is typically considered community property Each spouse is the owner of one-half of the policy Adverse consequences Noninsured spouse’s interest in the community property may be includable in her estate A noninsured nongrantor has made a gift of her interest if community property was used to pay premiums on the policy 30 - 50 Irrevocable Life Insurance Trusts Chapter 30 Tools & Techniques of Life Insurance Planning Community property issues (cont’d) Life insurance (cont’d) To avoid inclusion in estate, do not Give either spouse a life income in the trust Convert the insurance, prior to the transfer to the trust, to separate property of the insured 30 - 51