Document

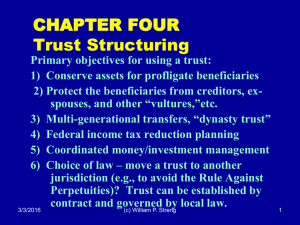

advertisement

Asset Protection & Estate Management OUTLINE: By N. Richard Grassano CPA 5/15/2015 1) Estate Gift Limits 2) Trusts (Revocable & Irrevocable) 3) FLP 4) Advanced Asset Protection Vehicles 2015 Estate & Gift Tax Exclusions $5,430,000 Estates per person $14,000 Gifts (form 709) Tax Rate = 40% * Form 706 Required upon first death to achieve exclusion portability ** There are ways of gifting above $14,000 without a tax effect. (i.e. 529 Plans) Direct Educational Gifts Too * Complicated Calculations of Exemptions / Credits / Exclusions ** Necessary to use the remaining $10,860.00 for a couple Typical Simple A/B Trusts A B C C Often times obvious & overlooked I. II. III. IV. After splitting ownership of jointly owned assets reversible trusts are created When 1st spouse passes, trust becomes irrevocable with income rights to surviving spouse Avoids most probate, but 706 still required (portability) Eventually both trusts pass to beneficiaries No Creditor Protection w/ Revocable Trusts HOWEVER simple isn’t always safest “TRUST” NEEDS – 1. Grantor 2. Trustee 3. Beneficiary (NORMALLY) Revocable / Irrevocable Trusts Revocable Trust • Designed to eliminate probate • DOES NOT eliminate estate taxes • Extension of your will Irrevocable trust • Selected assets are transferred to an INDEPENDENT Trustee • NOT part of your estate, and therefore are NOT subject to estate taxes • Probate is eliminated • Protection from creditors • Grantor can be named a beneficiary Family Limited Partnership OWNER G.P. (normally) 1% GENERAL PARTNER HEIRS Receives: - Limited Partnership Units - General Partnership Units Contributes: - Property & Other Assets FAMILY PARTNERSHIP or LLC Controls Partnership Limited 99% NON FAMILY PARTNER Control Companies / Assets COMPANIES / ASSETS Useful for gifting also! Can be used to spread income to family and reduce some lawsuit expense G.P. controls entity L.P. possess discounted estate values Can be used for professional practices for “safe assets” Issue: Most FLPs are organized so judges can force distributions Definition: “Safe Assets” are assets that cannot create a lawsuit on its own We Are A Litigious Society Our system allows anyone to sue anyone for anything It has become a way of life for some groups… How to protect yourself I. Taint your assets II. Create extreme expense for discovery III. Create a “team” plan – the sooner the better (Attorney, Accountant, Fin. Advisor) IV. Never be the aggressor Utilizing the proper “ownership” of assets can eliminate 98% of the problem. The “Deal” Hint: May have Foreign Components! Living Trust (A or B) FLP High Risk S-Corp LLC / S-Corp Holding Co. Goodwill of Practice FLP Safe Assets LLC 2 Owns Building & Equip. LLC Owns Home LLC Other Real Estate Inv. NOTES: Since living trust owns holding corp, it owns every asset represented beneath. Other “Protected” Assets I. II. III. IV. Pension Assets Life Insurance Policies Annuities Jointly Owned Assets Take Home Message • There are no one-size-fit-all plans in estate planning (that work…) • Countless mechanisms exist to help steer the outcome YOU desire • Make yourself an unappealing target to your rivals, creditors, and the IRS…