MIS Report on Cisco Systems and NAB

advertisement

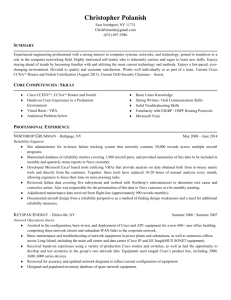

Cisco Systems and National Australia Bank MIS 204 Michael Reynolds Amanda Grove Who Cares about Cisco Systems? ► Founded by Stanford University computer scientists in 1984. ► In 1990 the company grew at a double digit rate. ► Now Cisco has 85% of the Internet routing and switching equipment market. Why Cisco Prospered at first… ► Adapted the first multiple-protocol software. ► Cisco was the first to create the commercially successful multi-protocol router to allow previously incompatible computers to communicate using different network protocols. ► Products first started hitting the internet in 1995 and by 2000 Cisco Systems were selling 50 million products a day online. ► Internet Protocol Two main Cisco Systems Strategies ► First: The company outsourced most of its production. ► Second: The significant portion of its growth was through acquiring and investing in other companies especially suppliers. 555 Billion to 100 Billion??? ► In 2000 Cisco was briefly worth $555 billion. ► April 2001 it declined in value to nearly $100 billion. ► The stock price peaked at over $80 per share in July 2000 ► The stock price bottomed out at less than $14 per share in April 2001 Cisco Systems Internet Sales ► Customers use the Cisco Connection Online (CCO) to configure, price, route, and submit orders electronically to Cisco. ► 50% of the orders entered on CCO are sent directly to the manufacturers, then shipped directly to the customers. ► Delivery went from taking 6-8 weeks to less than 3 Cisco Sales Database ► Cisco’s sales database is updated THREE times daily. ► Engineering managers receive email alerts if a big problem occurs that is not solved within one hour. Business to Business Supply Chain Extranet ► Cisco created Manufacturing Connection Online for business transactions between manufacturers/suppliers with Cisco Sytems ► Manufacturers could purchase supplies, make reports or submit forecasts and inventory information ► Inventories for Cisco’s suppliers were reduced by 45% after the formation of this extranet Cisco’s Decline Starting in Spring 2000 ► Cisco projected its sales to double over the next year so they made the “necessary” orders. ► Telecommunications market was falling (dotcoms etc.) but Cisco wanted to expand as it had before (mid 90’s) ► Year ended with 40% decline in telecommunication sales (largest market) ► 6,000 employees released Ending in April 2001 National Australia Bank and Computers Errors ► 1998-National Australia Bank (NAB) was the largest bank in Australia. ► NAB bought HomeSide Lending Inc. for around $1.2 billion. HomeSide was located in Jacksonville, FL and was the 6th largest home loan servicing company in the US (about 2 million). Problems from the beginning ► In 2001 the US Federal Reserve lowered short term interest rates indirectly causing long term rates to fall especially for HomeSide. ► Several of these long term interest rates included mortgage rates so HomeSide customers were refinancing at dangerously low rates. ► HomeSide and NAB cost themselves a $288 million after-tax write-down that year. HomeSide Computer Forecasting Software Fails ► HomeSide developed a model to forecast their income of loan servicing. ► This forecast model was connected to another model and both had to use the same type of rates (either both net or both gross). ► BIG MISTAKE: one model was using gross rate while the other was using net rate. ► Complete overstatement was made in projection for the 2 years Costs for NAB ► $1.2 Billion to buy HomeSide ► $288 Million write down in beginning of 2001 ► $400 Million write down in July 2001 ► $760 Million for forecasting error 1999-2001 ► Sold HomeSide for $1.9 Billion to Washington Mutual, the US largest savings and loans company ► 2006 Money Magazine named NAB “Bank of the Year” References ► Case Study. “Cisco Systems and Australia National Bank”. Binder in the Library. ► Former VP of Sales for Commercial East Area Lou McElwain ► Wikipedia Encyclopedia http://en.wikipedia.org/wiki/National_Austra lia_Bank