Chapter 17 (5E) - ucsc.edu) and Media Services

advertisement

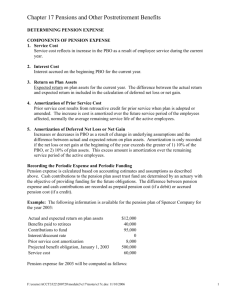

Chapter 17 PENSIONS AND OTHER POSTRETIREMENT BENEFITS McGraw-Hill /Irwin © 2009 The McGraw-Hill Companies, Inc. Slide 2 Nature of Pension Plans For a pension plan to qualify for special tax treatment must meet the to following 1. Pension plans itprovide income requirements: individuals during their retirement years. 1. 2.Cover 70% of employees. Thisat is least accomplished by setting aside fundsdiscriminate during an employee’s 2. Cannot in favor ofworking highly years so thatemployees. at retirement, the compensated accumulated plus earnings from 3. Must be funded funds in advance of retirement investing those fundstrust are available to through an irrevocable fund. replacemust wages. 4. Benefits vest after a specified period of service. 5. Complies with timing and amount of contributions. 17-2 Slide 3 Types of Pension Plans Defined contribution pension plans promise fixed annual contributions to a pension fund (say, 10% of the employees' pay). The employee chooses (from designated options) where funds are invested – usually stocks or fixed-income securities. Retirement pay depends on the size of the fund at retirement. 17-3 Slide 4 Types of Pension Plans Defined benefit pension plans promise fixed retirement benefits defined by a designated formula. Typically, the pension formula bases retirement pay on the employees' (a) years of service, (b) annual compensation [often final pay or an average for the last few years], and sometimes (c) age. Employers are responsible for ensuring that sufficient funds are available to provide promised benefits. 17-4 Slide 5 Defined Contribution Pension Plans Plan Characteristics Contributions are defined by agreement. Employer deposits an agreed-upon amount into an employeedirected investment fund. Employee bears all risk of pension fund performance. 17-5 Slide 6 Defined Contribution Pension Plans Accounting for these plans is quite simple. Let’s assume that the annual contribution is to be 3% of an employee’s salary. If an employee earned $110,000 during the year, the company would make the following entry: Date Description Pension expense Cash Debit Credit 3,300 3,300 ($110,000 × 3% = $3,300) 17-6 Slide 7 Defined Benefit Pension Plans Plan Characteristics Employer is committed to specified retirement benefits. Retirement benefits are based on a formula that considers years of service, compensation level, and age. Employer bears all risk of pension fund performance. 17-7 Slide 8 Defined Benefit Pension Plan A pension formula might define annual retirement benefits as: 1 1/2 % x Years of service x Final year’s salary By this formula, the annual benefits to an employee who retires after 30 years of service, with a final salary of $100,000, would be: 1 1/2 % x 30 years x $100,000 = $45,000 17-8 Slide 9 The Pension Obligation 1. Accumulated benefit obligation (ABO) The actuary’s estimate of the total retirement benefits (at their discounted present value) earned so far by employees, applying the pension formula using existing compensation levels. 2. Vested benefit obligation (VBO) The portion of the accumulated benefit obligation that plan participants are entitled to receive regardless of their continued employment. 3. Projected benefit obligation (PBO) The actuary’s estimate of the total retirement benefit (at their discounted present value) earned so far by employees, applying the pension formula using estimated future compensation levels. (If the pension formula does not include future compensation levels, the PBO and the ABO are the same.© 2008 The McGraw-Hill Companies, Inc. 17-9 Slide 10 Projected Benefit Obligation The PBO is a more meaningful measurement because it includes a projection of what the salary might be at retirement. Jessica Farrow was hired by Global Communications in 1998. She is eligible to participate in the company's defined benefit pension plan. The benefit formula is: Annual salary in year of retirement × Number of years of service × 1.5% Annual retirement benefits Farrow is expected to retire in 2037 after 40 years of service. Her retirement period is expected to be 20 years. At the end of 2007, 10 years after being hired, her salary is $100,000. The interest rate is 6%. The company’s actuary projects Farrow’s salary to be $400,000 at retirement. 17-10 Slide 11 Projected Benefit Obligation Step 1. Use the pension formula to determine the retirement benefits earned to date. $400,000 × 10 × 1.5% $ 60,000 per year Step 2. Find the present value of the retirement benefits as of the retirement date. The present value (n=20, i=6%,) of the retirement annuity at the retirement date is $688,195 ($60,000 × 11.46992). Step 3. Find the present value of the retirement benefits as of the current date. The present value (n=30, i=6%,) of the retirement benefits at 2007 is $119,822 ($688,195 × .17411). This is the PBO. 17-11 Slide 12 Projected Benefit Obligation If the actuary’s estimate of the final salary hasn’t changed, the PBO a year later at the end of 2008 would be $139,715. Step 1. Use the pension formula to determine the retirement benefits earned to date. $400,000 × 11 × 1.5% $ 66,000 per year Step 2. Find the present value of the retirement benefits as of the retirement date. The present value (n=20, i=6%,) of the retirement annuity at the retirement date is $757,015 ($66,000 × 11.46992). Step 3. Find the present value of the retirement benefits as of the current date. The present value (n=29, i=6%,) of the retirement benefits at 2008 is $139,715 ($757,015 × .18456). This is the PBO. 17-12 Slide 13 Changes in the PBO The PBO changes as a result of: Cause Effect Frequency Service Cost + Interest Cost + Prior Service Cost Loss or Gain on PBO Retiree Benefits Paid + + or - Each period Each period (except the first period of the plan) Only if the plan is amended (or initiated) that period Whenever revisions are made in the pension liability estimate Each period (unless no employees have yet retired under the plan) 17-13 Slide 14 Changes in the PBO The PBO changes as a result of: Cause Effect Frequency Service Cost + Each period Each period (except the first period Service Interest Cost cost + is the increase in the PBO of the plan) attributable to employee service performed Prior Service Only if the plan is amended (or + during the period. Cost initiated) that period Loss or Gain on Whenever revisions are made in the + or PBO pension liability estimate Retiree Benefits Each period (unless no employees Paid have yet retired under the plan) 17-14 Slide 15 Changes in the PBO The PBO changes as a result of: Cause Effect Frequency Service Cost Interest Cost Prior Service Interest cost Cost Loss or Gain on PBO Retiree Benefits Paid + Each period Each period (except the first period + of the plan) Only if the amended (or is+the interest onplan theisPBO during initiated) that period the period. Whenever revisions are made in the + or pension liability estimate Each period (unless no employees have yet retired under the plan) 17-15 Slide 16 Changes in the PBO The PBO changes as a result of: Cause Effect Frequency Service Cost + Each period Each period (except the first period Interest Cost + of the plan) Prior Service Only if the plan is amended (or + Cost initiated) that period Loss Gain oncost is theWhenever are from madeusing in the Priororservice increase revisions in the PBO + or PBO pension liability estimate the a new, more generous pension formula to determine Retiree Benefits Each period (unless no employees pension- obligation for prior years. Paid have yet retired under the plan) 17-16 Slide 17 Changes in the PBO The PBO changes as a result of: Cause Effect Frequency Service Cost + Each period Each period (except the first period Interest Cost + of the plan) Prior Service Only if the plan is amended (or + Cost initiated) that period Loss or Gain on Whenever revisions are made in the + or PBO pension liability estimate Retiree Benefits Each results period (unless employees Loss or gain -on PBO from no revising Paid have yet retired under the plan) estimates used to determine the PBO. 17-17 Slide 18 Changes in the PBO The PBO changes as a result of: Cause Effect Frequency Service Cost + Interest Cost + Prior Service Cost Loss or Gain on PBO Retiree Benefits Paid + + or - Each period Each period (except the first period of the plan) Only if the plan is amended (or initiated) that period Whenever revisions are made in the pension liability estimate Each period (unless no employees have yet retired under the plan) Retiree benefits paid are payments to retired employees. 17-18 Slide 19 Changes in the PBO The changes in the PBO for Global Communications during 2009 were as follows: ($ in millions)* PBO at the beginning of 2009+ (amount assumed) Service cost, 2009 (amount assumed) Interest cost: $400 6% Loss (gain) on PBO (amount assumed) Less: Retiree benefits paid (amount assumed) PBO at the end of 2009 $ $ 400 41 24 23 (38) 450 *Of course, these expanded amounts are not simply the amounts for Jessica Farrow multiplied by 2,000 employees because her years of service, expected retirement date, and salary are not necessarily representative of other employees. Also, the expanded amounts take into account expected employee turnover and current retirees. + Includes the prior service cost that increased the PBO when the plan was amended in 2008. 17-19 Slide 20 Pension Plan Assets Global Communications funds its defined benefit pension plan by contributing the year’s service cost plus a portion of the prior service cost each year. Cash of $48 million was contributed to the pension fund in 2009. Plan assets at the beginning of 2009 were valued at $300 million. The expected rate of return on the investment of those assets was 9%, but the actual return in 2009 was 10%. Retirement benefits of $38 million were paid at the end of 2009 to retired employees. The plan assets at the end of 2009 will be: Plan assets at the beginning of 2009 Return on plan assets (10% x $300 million) Cash contributions Less: Retiree benefits paid Plan assets at the end of 2009 $ $ 300,000,000 30,000,000 48,000,000 (38,000,000) 340,000,000 17-20 Slide 21 Funded Status of the Pension Plan OVERFUNDED Market value of plan assets exceeds the actuarial present value of all benefits earned by participants. UNDERFUNDED Market value of plan assets is below the actuarial present value of all benefits earned by participants. 17-21 Slide 22 Funded Status of Pension Plan Projected Benefit Obligation (PBO) - Plan Assets at Fair Value Underfunded / Overfunded Status This amount is reported in the balance sheet as a Pension Liability or Pension Asset. 17-22 Slide 23 Pension Expense – An Overview Components of Pension Expense + Service cost ascribed to employee service this period + Interest accrued on pension liability Expected return on the plan assets + Amortized portion of prior service cost + or - Amortization of net loss or net gain = Pension expense 17-23 Slide 24 Pension Expense Actuaries have determined that Global Communications has service cost of $41,000,000 in 2009. Global's 2009 Pension Expense Service cost Interest cost Expected return on the plan assets Amortization of prior service cost Amortization of net loss Pension expense ($ in millions) $ 41 $ 41 17-24 Slide 25 Interest Cost Interest cost is calculated as: PBOBeg × Discount rate Global had PBO of $400,000,000 on 1/1/09. The actuary uses a discount rate of 6%. Global's 2009 Pension Expense Service cost Interest cost Expected return on the plan assets Amortization of prior service cost Amortization of net loss Pension expense ($ in millions) $ 41 24 $ 65 2009 Interest Cost: PBO 1/1/09 $400,000,000 × 6% = $24,000,000 17-25 Slide 26 Return on Plan Assets The plan trustee reports that plan assets were $300,000,000 on 1/1/09. The trustee uses an expected return of 9% and the actual return is 10%. Beginning value of plan assets Rate of return Return on plan assets Beginning value of plan assets $ Adjustment (10% - 9%) Adjusted for gain on plan assets Expected return on plan assets $ 300,000,000 10% 30,000,000 300,000,000 1% Global's 2009 Pension Expense Service cost Interest cost Expected return on the plan assets Amortization of prior service cost Amortization of net loss Pension expense $ 3,000,000 27,000,000 ($ in millions) $ 41 24 (27) $ 38 17-26 Slide 27 Amortization of Prior Service Cost In 2008, Global Communications amended the pension plan, increasing the PBO at that time. For all plan participants, the prior service cost was $60 million at 1/1/08. The average remaining service life of the active employee group is 15 years. $60,000,000 PSC ÷ 15 = $4,000,000 per year Global's 2009 Pension Expense Service cost Interest cost Expected return on the plan assets Amortization of prior service cost Amortization of net loss Pension expense ($ in millions) $ 41 24 (27) 4 $ 42 17-27 Slide 28 Gains and Losses Projected Benefits Return on Plan Obligation Assets Higher than Expected Low er than Expected Loss Gain Gain Loss 17-28 Slide 29 Corridor Amount The corridor amount is 10% of the greater of . . . PBO at the beginning of the period. Or Fair value of plan assets at the beginning of the period. 17-29 Slide 30 Gains and Losses If the beginning net unrecognized gain or loss exceeds the corridor amount, amortization is recognized using the following formula . . . Net unrecognized gain or loss Corridor ־ at beginning of year amount Average remaining service period of active employees expected to receive benefits under the plan 17-30 Slide 31 Gains and Losses 2009 Net Loss Amortization ($ in millions) PBO $ 400 Fair value of plan assets 300 Net loss for 2009 55 Average service life 15 Net loss Corridor amount ($400 x 10%) Excess at the beginning of the year $ $ 55 40 15 $15,000,000 ÷ 15 years = $1,000,000 17-31 Slide 32 Recording Gains and Losses For 2009, the actual return on plan assets exceeded the expected return by $3 million. In addition, there was a $23 million loss from changes made by the actuary when it revised its estimate of future salary levels causing its PBO estimate to increase. Global would make the following journal entry to record the gain and loss: Date Description Dec 31 Loss-OCI Debit Credit 23 PBO Plan assets Gain-OCI 23 3 3 OCI = Other comprehensive income 17-32 Slide 33 Recording the Pension Expense Global's 2009 Pension Expense ($ in millions) Service cost $ 41 Interest cost 24 Expected return on the plan assets (27) Amortization of prior service cost (calculated later) 4 Amortization of net loss (calculated later) 1 Pension expense $ 43 Date Description Dec 31 Pension expense Plan assets PBO ($41 + $24) Debit Credit 43 27 65 Amortization of PSC-OCI 4 Amortization of net loss-OCI 1 17-33 Slide 34 Pension Expense Spreadsheet Income Statement AOCI ($ in millions) Note: ( )s indicates credits debits otherwise Balance, Jan. 1, 2009 Sevice cost Interest cost Expected return on assets Adjust for : Gain on assets Amortization of: Prior service cost - AOCI Net loss - AOCI Loss on PBO Prior service cost - AOCI Contributions to fund Retiree benefits paid Balance, Dec. 31, 2009 Plan PBO Assets (400) 300 Prior Service Cost 56 Net Loss 55 (41) (24) Cash 41 24 (27) 27 3 (1) 23 4 1 - 38 48 (38) (450) 340 (48) 52 74 Net Pension (Liability)/ Asset (100) (41) (24) 27 3 (3) (4) (23) - Pension Expense Asset Asset or Liability 43 (23) 48 (110) 17-34 Slide 35 Postretirement Benefits Other Than Pensions Net Cost of Benefits Estimated medical costs in each year of retirement Less: Equals: Retiree share of cost Medicare payments Estimated net cost of benefits 17-35 Slide 36 Other Postretirement Benefits 1. Expected Postretirement Benefit Obligation (EPBO) – The actuary's estimate of the total postretirement benefits (at their discounted present value) expected to be received by plan participants. 2. Accumulated Postretirement Benefit Obligation (APBO) – The portion of the EPBO attributed to employee service to date. 17-36 Slide 37 Attribution The process of assigning the cost of benefits to the years during which those benefits are assumed to be earned by employees. 17-37 Slide 38 Postretirement Benefit Expense Component Service Cost Interest Cost Expected Return on Plan Assets Prior Service Cost Losses or Gains Postretirement Benefit Expense Portion of the EPBO attributed to the current period. Increase in APBO due to the passage of time. Earnings on plan investments, if plan is funded. Amortization of compensation cost from amending the plan. Often a negative amount. Amortization of unexpected changes in either the obligation or plan assets. 17-38 Slide 39 Appendix 17: Service Method of Allocating Prior Service Cost The allocation approach that reflects the declining service pattern of employees is called the service method. The method requires that the total number of service years for all employees be calculated. This calculation is usually done by the actuary. Assume Global Communications has 2,000 employees and the company’s actuary determined that the total number of service years of these employees is 30,000. We would calculate the following amortization fraction: 30,000 2,000 = 15 average service years 17-39 End of Chapter 17 McGraw-Hill /Irwin © 2009 The McGraw-Hill Companies, Inc.