Lecture Presentation for Investments, 6e

advertisement

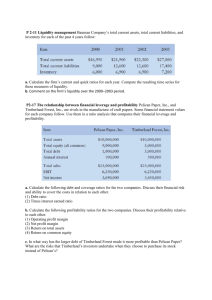

Chapter 14 ANALYSIS OF FINANCIAL STATEMENTS Major Financial Statements Corporate shareholder annual and quarterly reports must include: Balance sheet Income statement Statement of cash flows Reports filed with Securities and Exchange Commission (SEC) 10-K and 10-Q Generally Accepted Accounting Principles GAAP are formulated by the Financial Accounting Standards Board (FASB) Provides some flexibility of accounting principles Can be good for firms in different situations Can represent a challenge for analysis Financial statements footnotes must disclose which accounting principles are used by the firm Balance Sheet Shows resources (assets) of the firm and how it has financed these resources (liabilities and equity) Indicates current and fixed assets available at a point in time (snapshot) Financing is indicated by its mixture of current liabilities, long-term liabilities, and owners’ equity Income Statement Contains information on the profitability of the firm during some period of time Indicates the flow of sales, expenses, and earnings during the time period Statement of Cash Flows Integrates the information on the balance sheet and income statement Shows the effects on the firm’s cash flow of income statement items and changes in various items on the balance sheet Three sections show cash flows from Operating activities Investing activities Financing activities Alternative Measures of Cash Flow Cash flow from operations Traditional cash flow equals net income plus depreciation expense and deferred taxes Also adjust for changes in operating assets and liabilities that use or provide cash Free cash flow recognizes that some investing and financing activities are critical to ongoing success of the firm Modifies cash flow from operations to reflect necessary capital expenditures and projected divestitures Purpose of Financial Statement Analysis Evaluate management performance in Profitability Efficiency Risk Although financial statement information is historical, it is used to project future performance Analysis of Financial Ratios Ratios can often be more informative that raw numbers Puts numbers in perspective with other numbers Helps control for different sizes of firms Ratios provide meaningful relationships between individual values in the financial statements Importance of Relative Financial Ratios In order to make sense of a ratio, we must compare it with some appropriate benchmark or benchmarks Examine a firm’s performance relative to: The aggregate economy Its industry or industries Its major competitors within the industry Its own past performance (time-series analysis) Comparing to the Industry Norms Most popular comparison Industries affect the firms within them differently, but the relationship is always significant The industry effect is strongest for industries with homogenous products Can also examine the industry’s performance relative to aggregate economic activity Comparing to the Firm’s Major Competitors Industry averages may not be representative A firm may operate in several distinct industries Several approaches: Select a subset of competitors for the comparison group Construct a composite industry average from the different industries in which the firm operates Comparing to the Firm’s Own Past Performance Determine whether it is progressing or declining Helpful for estimating future performance Consider trends as well as averages over time Five Categories of Financial Ratios 1. Common size statements 2. Internal liquidity (solvency) 3. Operating performance Operating efficiency Operating profitability 4. Risk analysis Business risk Financial risk External liquidity risk 5. Growth analysis Common Size Statements Normalize balance sheets and income statement items to allow easier comparison of different size firms A common size balance sheet expresses accounts as a percentage of total assets A common size income statement expresses all items as a percentage of sales Evaluating Internal Liquidity Internal liquidity (solvency) ratios indicate the ability to meet future short-term financial obligations Current Ratio examines current assets and current liabilities Quick Ratio adjusts current assets by removing less liquid assets Cash ratio relates cash (ultimate liquid asset) to current liabilities Evaluating Internal Liquidity Receivables turnover examines the management of accounts receivable Inventory turnover relates inventory to sales or cost of goods sold (CGS) Cash conversion cycle is a good overall measure of liquidity and indicates the net delay between cash inflow and cash outflow Evaluating Operating Performance Operating efficiency ratios Examine how management uses its assets to generate sales; considers the relationship between various asset categories and sales Total asset turnover ratio indicates the effectiveness of a firm’s use of its total asset base to produce sales Net fixed asset turnover reflects utilization of fixed assets. This number can look temporarily bad if the firm has recently added greatly to its capacity in anticipation of future sales Operating Profitability Ratios Operating profitability ratios measure The rate of profit on sales (profit margin) The percentage return on capital Examine how management is doing at controlling costs so that a large proportion of the sales dollar is converted into profit Gross profit margin measures the rate of return after cost of goods sold Operating Profitability Ratios Operating profit margin measures the rate of profit on sales after operating expenses Operating profit is sometimes called Earnings before interest and taxes (EBIT) Net profit margin relates net income to sales Since Net Sales is in the denominator of all of the three previous ratios, the common size income statement gives all of these ratios at once Operating Profitability Ratios Return on total capital relates the firm’s earnings to all capital invested in the business Return on owner’s equity (ROE) indicates the rate of return earned on the capital provided by the stockholders after paying for all other capital used The DuPont System divides ROE into several ratios that collectively equal ROE while individually providing insight Operating Profitability Ratios An extended DuPont System provides additional insights into ROE The extended DuPont System shows that there are five components of return on equity (ROE): 1. 2. 3. 4. 5. Operating profit margin Total asset turnover Interest expense rate Financial leverage multiplier Tax retention rate Risk Analysis Risk analysis examines the uncertainty of income for the firm and for an investor Total firm risks can be decomposed into two basic sources: Business risk: The uncertainty in a firm’s operating income, highly influenced by industry factors Financial risk: The added uncertainty in a firm’s net income resulting from a firm’s financing decisions (primarily through employing leverage). External liquidity analysis considers another aspect of risk from an investor’s perspective Business Risk Variability of the firm’s operating income over time Can be measured by calculating the standard deviation of operating income over time or the coefficient of variation In addition to measuring business risk, we want to explain its determining factors. Business Risk Two primary determinants of business risk Sales variability The main determinant of earnings variability Cost Variability and Operating leverage Production has fixed and variable costs Greater fixed production costs cause greater profit volatility with changes in sales Fixed costs represent operating leverage Greater operating leverage is good when sales are high and increasing, but bad when sales fall Financial Risk Interest payments are deducted before we get to net income These are fixed obligations Similar to fixed production costs, these lead to larger earnings during good times, and lower earnings during a business decline Fixed financing costs are called financial leverage The use of debt financing increases financial risk and possibility of default while increasing profitability when sales are high Financial Risk Two sets of financial ratios help measure financial risk Balance sheet ratios Earnings or cash flow available to pay fixed financial charges Acceptable levels of financial risk depend on business risk A firm with considerable business risk should likely avoid lots of debt financing Financial Risk Proportion of debt (balance sheet) ratios Long-term debt can be related to: Equity (L-t D/Equity) How much debt does the firm employ in relation to its use of equity? Total Capital [L-t D/(L-t D +Equity)] How much debt does the firm employ in relation to all long-term sources of funds? Total debt can be related to: Total Capital [Total Debt/(Ttl. Liab.–Non-int. Liab.)] Assessment of overall debt load, including short-term Financial Risk Earnings or Cash Flow Ratios Relate operating income (EBIT) to fixed payments required from debt obligations Higher ratio means lower risk Interest Coverage or Times Interest Earned Ratio May also want to calculated coverage ratios that reflect other fixed charges Financial Risk Cash flow ratios Fixed financing costs such as interest payments must be paid in cash, so these ratios use cash flow rather than EBIT to assess the ability to meet these obligations Relate the flow of cash available from operations to: Interest expense Total fixed charges The face value of outstanding debt External Liquidity Risk Market Liquidity is the ability to buy or sell an asset quickly with little price change from a prior transaction assuming no new information External market liquidity is a source of risk to investors Analysis of Growth Growth Rates can be calculated for balance sheet accounts and for income statement items Sustainable growth potential can be analyzed Important to both creditors and owners Creditors interested in ability to pay future obligations For owners, the value of a firm depends on its future growth in earnings, cash flow, and dividends g = ROE x Retention rate The retention rate is one minus the firm’s dividend payout ratio Anything that impacts ROE (profitability, asset management, and leverage) would also be a determinant of future growth Analysis of Non-U.S. Financial Statements Statement formats will be different Differences in accounting principles Ratio analysis will reflect local accounting practices The Quality of Financial Statements “Quality financial statements” reflect reality rather than use accounting tricks or one-time adjustments to make things look better than they are High-quality balance sheets typically have Conservative use of debt Assets with market value greater than book No liabilities off the balance sheet The Quality of Financial Statements High-quality income statements Reflect repeatable earnings Gains from nonrecurring items should be ignored when examining earnings High-quality earnings result from the use of conservative accounting principles that do not overstate revenues or understate costs The Value of Financial Statement Analysis Financial statements, by their nature, are backward-looking An efficient market will have already incorporated these past results into security prices, so why analyze the statements? Analysis provides knowledge of a firm’s operating and financial structure This aids in estimating future returns Uses of Financial Ratios Stock valuation Identification of corporate variables affecting a stock’s systematic risk (beta) Assigning credit quality ratings on bonds Predicting insolvency (bankruptcy) of firms Financial Ratios and Stock Valuation Models Stock valuation often considers discounted cash flow analysis Estimate cash flows Estimate an appropriate discount rate A number of financial ratios can be useful in arriving at estimates for each of these inputs Price ratio analysis for a stock Sometimes we estimate the value of a stock through various price ratios such as P/E Would need to estimate variables such as expected growth rate of earnings and dividends Financial Ratios and Systematic Risk A firm’s systematic risk (as measured by beta) is related to a number of financial statement variables Financial Ratios and Bond Ratings Changes in bond ratings are linked to changes in various financial statement variables Predicting such changes in ratings before they occur can increase the return on a bond or stock portfolio Financial Ratios and Insolvency (Bankruptcy) Certainly, analysts and investors are concerned with the possibility of bankruptcy A number of variables have a rather strong relationship to the bankruptcy experience of firms in the past Can use financial statement analysis to identify firms where insolvency is a likely outcomes Limitations of Financial Ratios Always consider relative financial ratios Accounting treatments may vary among firms, especially among non-U.S. firms Firms may have have divisions operating in different industries making it difficult to derive industry ratios Are the results consistent? Ratios outside an industry range may be cause for concern