Investing - Mr. Catalano

advertisement

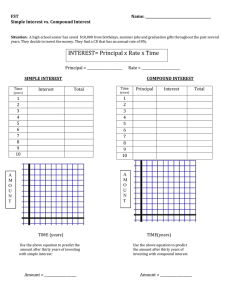

Investing 101 Having Your Money Work For YOU Saving vs. Investing • List 2 ways you can save on one post-it and 2 ways you can invest on the other. • Stick on board when finished Learning Targets • Calculate simple and compound interest, and rate of return • Understand the factors to consider when evaluating an investment Basic Principle of Investing • Assets: Any item of economic value owned by an individual or corporation, which could be converted to cash. Basic Principle of Investing So investing means to… • Buy assets that appreciate in value. Two most important factors for successful investing: Time $ Knowledge Would you rather have a million dollars now or a penny doubled every day for thirty days? Day Day Day Day Day Day Day Day Day Day 1: $.01 2: $.02 3: $.04 4: $.08 5: $.16 6: $.32 7: $.64 8: $1.28 9: $2.56 10: $5.12 Day Day Day Day Day Day Day Day Day Day 11: 12: 13: 14: 15: 16: 17: 18: 19: 20: $10.24 $20.48 $40.96 $81.92 $163.84 $327.68 $655.36 $1,310.72 $2,621.44 $5,242.88 Day Day Day Day Day Day Day 21: 22: 23: 24: 25: 26: 27: $10,485.76 $20,971.52 $41,943.04 $83,386.08 $167,772.16 $335,544.32 $671,088.64 Day 28: $1,342,177.28 Day 29: $2,684,354.56 Day 30: $5,368,709.12 Simple vs Compound interest Simple Interest means interest paid only on the original principle amount. Example… • You deposited $100 dollars into a bank account that pays 5% interest every year. • = Principle x Rate x Time • You will have $105 after year one • $110 after year two • $115 after year three • $120 after year four Compound Interest • The interest earned not only on the original principal, but also on all interests earned previously Example • You deposited $100 dollars into a bank account that pays 5% interest compounded every year. How much will you have in four years? http://www.econedlink.org/lessons/index.php?lid=603&type=educator Rule of 72 • Divide 72 by the interest rate of a investment to find the amount of years it takes to double your money. Example: • Savings Account is paying 5% interest • 72/5 = 14.4 years to double your money Factors to consider when selecting an investment…. Basic Factor: Return • The income produced by an investment • Income or loss / Initial investment = Return % • Example: Bought stock at $10 Sold stock at $15 Return = 50% Basic Factor: Return Another Example: • Bought stock @ $75 per share • Sold stock @ $120 per share What is the return? Income or loss / Initial investment = Return % Who wants to win some money? Risk vs. Return The greater the risk, the greater the return Basic Characteristics Volatility • The degree to which an investment’s return or value may change. Risk vs. Return • How much risk should one take???? • Factors – Age – Income – Savings – Goals – Personal Tolerance Basic Factor: Liquidity Liquidity • The ease at which an investment can be converted to cash. Diversification • Strategy of making a variety of investments in order to reduce your exposure to risk. Don’t put all your eggs in one basket! Review • Compound interest is a powerful force • Major factors to consider when choosing an invest include… – Return – Risk – Liquidity – Volatility – Diversification