Lecture: Development Challenges Arne Bigsten

advertisement

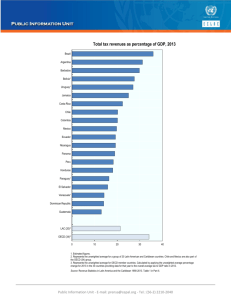

Lecture Development Challenges Arne Bigsten Master of Development Economics 8/11-2011 1 Overview of the lecture • 1. The dual economy model and structural change • 2. Africa’s development since 1960 in a global perspective • 3. Changes in poverty • 4. Prospects for growth in Africa • 5. The financial crisis and Africa • 6. Industry in development policy 2 1. The dual economy model and structural change • Corden-Findlay (1975) – a open-economy version of the Harris-Todaro model of migration • Wage distortion and unemployment • Investment, technical progress and growth • Policy implications • Informal sector growth 3 2. Africa’s development since 1960 in a global perspective • Import substitution and control regimes 60s, 70s • Structural adjustment policies 80s, 90s • Achieved a measure of economic stabilization with improvements in terms of budget balance, monetary policy control, a liberalization of the foreign exchange market, and implemented a range of structural reforms such as privatisation of much of the state owned firms. • Economies recovered slowly from about 1995. 4 Table 1: Regional Population and GDP shares and relative income levels 2007 Population GDP Relative GDP Relative GDP share share per capita per capita PPP (World=100) (World=100) High income 0.160 0.738 4.622 3.637 East Asia & 0.289 0.080 0.276 0.497 Pacific - China 0.199 0.059 0.294 0.539 Europe & Central 0.067 0.058 0.858 1.148 Asia* Latin America & 0.085 0.066 0.781 0.998 Caribbean Middle East & 0.047 0.016 0.329 0.721 North Africa South Asia 0.121 0.026 0.115 0.253 Sub-Saharan 0.121 0.016 0.128 0.198 Africa Note: * The old Eastern Bloc excluding high income states. GDP share – current US$, Relative GDP – current US$. Relative PPP – Constant 2005 US$. Source: WDI, 2009 5 Table 2: Annual per capita income growth 1961-2007 (% per year) 1961-1970 1971-1980 1981-1990 1991-2000 2001-2007 High income 4.18 2.68 1.88 1.57 2.41 East Asia & Pacific 2.45 4.54 7.09 8.09 5.83 - China 2.41 4.37 9.28 9.68 7.77 Europe & Central Asia -0.94 5.79 Latin America & Caribbean 2.58 3.25 1.63 2.13 -0.83 Middle East & North Africa 4.48 2.60 1.75 2.61 0.24 South Asia 1.95 0.66 3.20 5.42 3.21 Sub-Saharan Africa 2.33 0.84 -0.45 2.44 -1.06 World 3.28 1.91 1.37 1.82 1.39 Source: WDI 2009 6 Table 3: Sectoral value added as % of GDP 1975-2007 in SSA and China 1965 1970 1975 1980 1985 1990 1995 Sub-Saharan Africa Agriculture 21.85 19.65 20.02 18.50 18.01 18.83 17.95 Industry 31.02 30.86 32.68 36.84 34.49 32.14 29.15 - manufacturing 17.50 17.86 17.63 16.58 16.47 17.60 15.77 Services 47.14 49.48 47.31 44.64 47.49 49.24 52.91 China Agriculture 37.94 35.22 32.40 30.17 28.44 27.12 19.96 Industry 35.09 40.49 45.72 48.22 42.89 41.34 47.18 - manufacturing 29.23 33.75 38.13 40.23 34.73 33.66 33.65 Services 26.97 24.29 21.88 21.60 28.67 31.54 32.86 Source: WDI 2009 2000 2005 2007 16.53 29.38 14.52 54.10 17.00 31.19 13.11 51.81 15.27 31.98 14.48 52.88 15.06 45.92 32.12 39.02 12.59 11.13 47.68 48.50 32.18 39.72 40.37 7 Table 4: Shares of global export of goods and services by region, 1960-2007 1960 1970 1980 1990 2000 2005 2007 0.761 0.804 0.793 0.813 0.790 0.740 High income 0.022 0.035 0.065 0.077 0.102 0.115 East Asia & Pacific 0.006 0.009 0.026 0.035 0.064 0.077 - China 0.041 0.039 0.055 0.061 Europe & Central Asia Latin America & Caribbean 0.059 0.046 0.044 0.043 0.052 0.050 0.050 0.022 0.029 0.015 0.017 0.021 0.021 Middle East & North Africa 0.020 0.012 0.007 0.009 0.011 0.015 0.017 South Asia 0.042 0.033 0.035 0.014 0.014 0.017 0.018 Sub-Saharan Africa Source: WDI 2009 8 Table 5: Export of goods and services as share of GDP 1960-2007 1960 1965 1970 1975 1980 High income 11.98 12.05 14.13 17.25 19.39 East Asia & Pacific .. .. 7.68 10.34 16.90 - China .. .. 2.61 4.59 10.65 Europe & Central Asia .. .. .. .. .. Latin America & Caribbean 10.59 10.04 9.76 10.82 13.04 Middle East & North Africa .. 18.02 18.06 30.82 24.80 South Asia 5.87 4.74 5.27 6.70 7.60 Sub-Saharan Africa 25.51 24.14 21.81 25.35 31.86 World 12.14 12.06 13.37 16.44 18.74 1985 19.52 15.19 9.94 .. 16.02 18.51 6.52 28.26 18.91 1990 18.86 24.37 19.04 20.69 16.88 23.42 8.63 26.35 18.99 1995 20.65 29.38 23.07 26.42 18.43 25.78 12.49 27.72 21.07 2000 23.96 35.85 23.33 35.35 20.29 26.77 14.21 32.48 24.55 2005 25.80 45.63 37.43 35.06 24.45 35.18 19.39 32.75 26.97 2007 . 47.94 41.87 34.28 24.04 36.05 20.56 34.46 .. Source: WDI, 2009. The share of manufacturing exports in merchandise export in Africa was 13.24 % in 1975 and 30.24 in 2000. In China it was 26.43 in 1985 and then 88.23% in 2000 and 93.19 in 2007. 9 Table 6: Life-expectancy at birth 1960-2007 1960 1965 1970 High income 68.7 69.8 70.7 East Asia & Pacific 38.9 55.3 59.1 - China 36.3 57.4 61.7 Europe & Central Asia .. .. 67.2 Latin America & Caribbean 56.2 .. 60.4 Middle East & North Africa 47.1 .. 52.4 South Asia 42.6 46.4 48.9 Sub-Saharan Africa 41.1 .. 45.1 World 50.2 58.3 59.1 Source: WDI, 2009 1975 72.3 62.9 65.1 67.4 .. .. 53.1 .. 63.3 1980 73.4 63.5 65.5 67.3 64.6 58.1 54.8 48.6 62.6 1985 74.6 65.1 66.7 68.2 66.6 61.3 57.1 49.9 64.0 1990 75.7 66.9 68.3 68.9 68.3 64.1 59.0 50.4 65.3 1995 76.5 68.6 69.8 67.2 70.0 66.1 60.7 50.1 66.2 2000 77.9 70.3 71.4 68.3 71.5 67.8 62.1 49.5 67.3 2007 79.4 72.1 73.0 69.7 73.1 70.0 64.5 50.8 68.8 10 Table 7: Gross savings by region 1970-2007 (% of GDP) 1970 1975 1980 1985 High income .. 22.41 22.76 21.64 East Asia & Pacific 26.32 29.60 31.95 31.32 - China 27.36 30.95 33.78 34.59 Europe & Central Asia .. .. .. .. Latin America & Caribbean 19.41 22.72 20.28 18.92 Middle East & North Africa .. .. .. .. South Asia 14.60 15.45 16.70 21.11 Sub-Saharan Africa .. .. 23.42 19.43 World .. 22.55 22.86 21.89 Source: WDI 2009 1990 21.76 35.67 39.99 .. 19.85 .. 21.20 14.79 22.24 1995 20.74 38.26 42.69 20.65 17.79 25.06 25.33 14.23 21.49 2000 21.59 35.17 36.83 23.82 17.28 27.61 24.55 14.85 22.12 2005 19.47 44.79 51.21 22.82 21.00 30.40 32.59 15.12 21.25 2007 .. 48.19 54.80 23.19 22.32 32.97 36.32 16.72 .. 11 Table 8: Gross capital formation by region 1970-2007 (% of GDP) 1970 1975 1980 1985 1990 High income 23.64 23.33 24.08 21.83 22.61 East Asia & Pacific 23.38 28.02 28.21 27.96 27.38 - China 24.23 29.37 29.09 29.64 25.86 Europe & Central Asia .. .. .. .. 22.46 Latin America & Caribbean 19.66 23.49 22.83 17.56 18.78 Middle East & North Africa 21.93 30.39 27.85 26.55 23.27 South Asia 13.94 15.78 18.31 19.79 21.83 Sub-Saharan Africa .. 25.33 22.67 18.92 18.18 World 23.04 23.46 24.08 21.85 22.59 1995 20.91 33.81 34.35 19.21 18.14 22.31 23.22 17.00 21.35 2000 21.43 30.62 34.11 19.97 18.72 21.92 22.16 16.32 21.65 2005 20.47 36.71 42.19 20.29 18.76 23.19 28.71 18.26 21.32 2007 .. 35.90 40.89 22.96 20.32 24.33 31.46 20.91 .. Source: WDI 2009 12 Table 10: Foreign aid by region (% of GNI) 1970 1975 1980 High income 0.02 0.03 0.02 East Asia & Pacific 1.09 0.86 0.90 - China .. .. 0.03 Europe & Central Asia .. .. .. Latin America & Caribbean 0.62 0.36 0.30 Middle East & North Africa 3.00 4.55 3.20 South Asia 1.65 2.61 2.23 Sub-Saharan Africa 1.88 2.55 2.91 World 0.24 0.31 0.31 Source: WDI 2009 1985 0.03 0.72 0.31 .. 0.50 1.57 1.43 4.53 0.26 1990 0.02 1.16 0.57 0.32 0.48 3.70 1.49 6.24 0.27 1995 0.01 0.76 0.48 1.17 0.36 1.58 1.09 5.94 0.23 2000 0.01 0.51 0.15 1.13 0.25 0.99 0.70 4.08 0.18 2005 0.00 0.32 0.08 0.25 0.26 4.02 0.90 5.40 0.24 2007 0.00 0.20 0.04 0.19 0.19 1.83 0.72 4.45 0.19 13 Figure 1: Net ODA of DAC Members 1990-2007 and DAC Secretariat Projections (Billion USD) 14 Figure 2: Debt outstanding, total long-term (US$) 2.50E+11 1.50E+11 1.00E+11 5.00E+10 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 0.00E+00 1970 Million US$ 2.00E+11 15 Table 11: Total debt service (% of GNI) 1970 1975 East Asia & Pacific .. .. Europe & Central Asia 1.04 0.59 - China .. .. Latin America & Caribbean 3.26 3.45 Middle East & North Africa .. 1.19 South Asia 1.46 1.09 Sub-Saharan Africa 1.57 1.87 Source: WDI 2009 1980 .. 2.50 .. 6.52 4.61 1.17 .. 1985 4.03 6.93 0.81 7.31 3.93 1.93 .. 1990 4.78 .. 1.97 4.14 6.25 2.84 .. 1995 4.14 2.75 2.10 4.67 7.13 3.85 4.79 2000 4.37 6.88 2.29 9.16 4.83 2.57 4.23 2005 2.77 8.15 1.22 6.42 3.91 2.78 3.40 2007 1.96 7.21 0.99 4.44 2.69 3.15 2.19 16 3. Poverty • The most important goal for development is poverty reduction. This can be done by economic growth and/or income redistribution. • • • • How to measure welfare and economic development? Per capita income Income distribution Poverty • UNDP’s Human Development Index; a composite index which basically combines log per capita income, life expectancy, litracy. Shares of global GDP (PPP-measure) 1000 1500 1820 1870 1913 1950 1973 1998 W Europe 8.7 17.9 23.6 33.6 33.5 26.3 25.7 20.6 W Offshoots 0.7 0.5 1.9 10.2 21.7 30.6 25.3 25.1 Japan 2.7 3.3 3.0 2.3 2.6 3.0 7.7 7.7 67.6 62.1 56.2 36.0 21.9 15.5 16.4 29.5 Latin America 3.9 2.9 2.0 2.5 4.5 7.9 8.7 8.7 E Europe & former USSR 4.6 5.9 8.8 11.7 13.1 13.1 12.9 5.3 11.8 7.4 4.5 3.7 2.7 3.6 3.3 3.1 Asia (excl. Japan) Africa 25 26 Human Development index – 2009 ranking • • • • • • • • • • • • • • • • • • • • • • • • • Norway TOPP Australia Iceland Canada Ireland Netherlands Sweden France Switzerland Japan Luxembourg Finland United States Austria Spain Denmark Belgium Italy Liechtenstein New Zealand United Kingdom Germany Singapore Hong Kong, China (SAR) Greece • • • • • • • • • • • • • • • • • • • • • • • • Togo Botten Malawi Benin Timor-Leste Côte d'Ivoire Zambia Eritrea Senegal Rwanda Gambia Liberia Guinea Ethiopia Mozambique Guinea-Bissau Burundi Chad Congo (Democratic Republic of the) Burkina Faso Mali Central African Republic Sierra Leone Afghanistan Niger Table 4: Median values of Gini coefficient by region Region 1960s 1970s 1980s 1990s Eastern Europe 22.76 21.77 24.93 28.60 South Asia 31.67 32.32 32.22 31.59 OECD and High Income 32.86 33.04 32.20 33.20 Countries East Asia and the Pacific 34.57 34.40 34.42 34.80 Middle East and North 41.88 43.63 40.80 39.72 Africa Sub-Saharan Africa 49.90 48.50 39.63 42.30 Latin America 53.00 49.86 51.00 50.00 • Millenniemålen och andra nya initiativ • • • Millennium Development Goals to be Reached 2015 Endorsed in the Millennium Declaration, September 2000 Eradicate extreme poverty and hunger – – • Achieve universal primary education – • Halt and reverse the spread of HIV/AIDS. Halt and reverse the spread of malaria and tuberculosis. Ensure environmental sustainability – – – • Reduce by three quarters the maternal mortality ratio. Combat HIV/AIDS, malaria and other diseases – – • Reduce by two thirds the under-five mortality rate. Improve maternal health – • Eliminate gender disparity at all levels of education. Reduce Child Mortality – • Ensure boys and girls alike complete primary schooling. Promote gender equality and empower women. – • Halve the proportion of people with less than dollar a day. Halve the proportion of people who suffer from hunger. Integrate sustainable development into country policies and reverse loss of environmental resources. Halve the proportion of people without access to potable water. By 2020, to have achieved a significant improvement in the lives of at least 100 million slum dwellers. Develop a global partnership for development. – – – – – – – Develop further an open, rule-based predictable, non-discriminating trading and financial system including a commitment to good governance, development, and poverty reduction - both nationally and internationally. Address the special needs of the Least Developed Countries. Address the special needs of landlocked and small island developing countries. Deal comprehensively with the debt problems of developing countries through national and international measures in order to make debt sustainable in the long term. In cooperation with developing countries, develop and implement strategies for decent and productive work for youth. In cooperation with the pharmaceutical companies, provide access to affordable drugs in developing countries. In cooperation with the private sector, make available the benefits of new technologies, especially information and communications. • PRSPs - anti-poverty programs • United Nations Millennium Project (2005) coordinated by Jeffrey Sachs. • Big Push of investment supported by a huge increase in foreign aid. • The emphasis is on investment in core infrastructure, human capital, and governance to lay the foundation for economic development and private-sector led growth. • Poverty trap story • • • • • • • • • • • • • Commission for Africa (2005), initiated by Prime Minister Blair Puts stronger priority on the need for improved governance. Build transparent and accountable budgetary processes Systems that can manage and prevent conflicts. Investment in people via the development of good systems for education, health delivery, and water and sanitation. Combat the spread of HIV/AIDS. Investment climate. Massive infrastructure investments to integrate African economies. Development strategies should focus on agriculture and the development of small scale enterprises to reach poor groups. African countries need to enhance their capacity to trade, while the rich countries must reduce barriers to African exports, particularly for agricultural goods. The quality of aid is crucial and it requires good governance on the part of the recipient countries and improved aid quality on the part of the donors (bilateral as well as multilateral). Complete debt cancellation is recommended for the poorest countries. Problems with a massive scaling-up of aid to Africa? 4. Prospects for growth in Africa • Johson, Ostry, Subramanian (2007), NBER • Conventional – geography, fractionalisation, corruption hinders growth. • Optimistic – can be improved with the help of aid. • Africa has done badly apart from some growth spurts. How can it achieve sustained growth? • No unified theory for this. • But three plausible views about what creates crises and derails growth. 33 • 1. Weak economic and political institutions • 2. Greater propensity to experience conflict and social strife • 3. Bad macroeconomic policies • (+ 4-5). Poor education and health. • What is the threshold at which any of these indicators signal a potential problem with sustained growth? • One plausible benchmark – recent experience of countries which started with weak institutions (and low income levels) but nevertheless were able to sustain high growth rates. 34 • 12 such countries post 1945. • All had rapid growth of exports – and in most cases this was of manufactures. • Here – a study of whether African countries are on their way to break away from the poverty path. • Not so bad: • Institutions have improved • Macroeconomic stability better. 35 • But .. • In terms of specific economic institutions (World Bank: Doing Business indicators) there remains a wide gap E g Regulatory costs of exporting. • Some SSA countries have experienced significant real exchange rate overvaluation. • Health indicators are poorer. 36 The benchmarking exercise • Defining a sustained growth acceleration: Countries must have experienced an improvement in growth rates of at least 2 percentage points per capita, sustained growth of at least 3.5 per cent per capita for at least seven years, and higher postacceleration income level than the preacceleration peak. 37 Why did manufacturing exports matter so much after 1960? • One possibility is that manufacturing exports helps create a middle class that cares about the institutions. • Acemoglu et al Handbook (2005): Interaction between economic and political power that produces (or changes) institutions. • Trade may change the balance of power so that progressive groups get more influence. • Note that economic and political institutions improved over time in countries that experienced sustained growth. • Natural resource based growth does not seem to have the same positive effect. 38 Recent African growth experience • Broad economic institutions are not worse than they were in the 12. • Cost of doing business a problem. • Fractionalization somewhat worse. • SGs increased their manufacturing growth dramatically. • Liberal trade regime. • SGs avoided currency overvaluation – not generally so in Africa. 39 • If development and diversification is about creating incentives to invest in tradables, and given the unwillingness of African countries to pursue industrial policy, the exchange rate becomes the key instrument in pursuing this objective. • Can they feasibly sustain an undervalued exchange rate? • - distributional consequences • - capital account open (and aid) • • • • Cost of trading high Education is comparable Health status worse Poorer basic infrastructure like roads 40 Conclusions about constraints • For those who view Africa’s prospects through the perspective of the “deep” determinants of development – geography, institutions, history – the outlook seems bleak. • For other rosier because of commoditypowered upturn of certain policy levers (aid) will help. • Neither view is fully convincing 41 • Results of the benchmarking exercise: • The deep determinants are not much worse for a group of promising African states today than they were in much of East Asia in the 1960s. • There are inherent institutional weaknesses in Africa but they can be overcome as in East Asia. • “Escapes from poverty in the face of weak institutions have generally involved exports and – in almost all cases – manufacturing exports” p 37 • 1. Reduce the direct regulatory costs for exporters • 2 Avoid real exchange rate overvaluation 42 5. The financial crisis and Africa • How does the current crisis affect the African growth prospects? • Africa needs to try to live through the crisis in such a way that it can maintain the improvements that have been achieved, and to continue with the institutional and policy reforms needed. • When cutting back expenditures countries should from this perspective thus try to protect its investments in infrastructure and generally in the business environment. • However, there will have to be a trade-off here with social protection. 43 Economic policy for recovery from the crisis • The African banking system was partly isolated in the first phase of the crisis, but it suffered when the real economy started to be affected. • The impact of the crisis is negative on trade volumes and export prices. • It has reduced the capital inflows - foreign direct investment and transfers. • Domestic fiscal revenues are declining. 44 • When banks start to feel the pressure there may be a need for the Central Bank to recapitalize the banks. But there seems to be less need in African systems for the type of uncongenial monetary policy that has been implemented in the USA and Europe. • Still, the countries in Africa may need fiscal stimulus to maintain the demand in the national economy, but due to the lack of resources there are choices that have to be made. Still, aid inflows may help protect important fiscal expenditures. • These could on the one hand be in the form of social protection and food protection, but countries should at the same time seek to protect expenditures that are essential for the capacity of the countries to regain their growth momentum. • It is generally good if aid can help stabilize African economies, since even in normal times they are very vulnerable to economic shocks. It would be useful if donors can coordinate their interventions to make efficient use of their resources. 45 6. Industry in development policy • International economic integration requires a stimulus of tradables production. • Rodrik (2009, p. 18) notes that increases in the industry share is more significantly related to growth than increases in export shares overall, and therefore it is the structural change that matters and not the export orientation. • He notes that “once industry shares in GDP are controlled for, trade surpluses exert no additional positive effect on 46 economic growth” • Firms in the industrial sector are subject to learning spillovers and coordination failures and to high costs imposed by weaknesses in legal and regulatory frameworks. • It is a long-term process to fix institutions and to remove market failures is a long-term process. • Some successful countries have alleviated these constraints indirectly, by raising the relative profitability of modern activities through other means. • SSA countries can get away with undervaluing their currencies (which China has been doing so far, but which may be harder in the future). Undervaluation of the currency is a subsidy of tradables exports, while other ways of supporting tradables production affects both exports and domestic sales. 47 • Rodrik’s strategy proposal is that government should seek to enhance the relative profitability of nontraditional products that face large information externalities and coordination failures, or which suffers particularly strongly from the poor institutional environment. • Interventions such as tax exemptions, directed credit, payroll subsidies, investment subsidies, export processing zones aimed at specific firms or sectors. • One can think about ways of shifting the relative incentives in favour of tradables by reducing cost of inputs which are used intensively by modern economic activities. A typical area for intervention would be infrastructure for transport and logistic costs. • Labour is the most important non-traded input, so what happens to wages is also very important for competitiveness. 48 • Two arguments against these interventions. • 1. The government does not have enough information. • 2. And even if they had, there will be rentseeking and corruption. • Rodrik argues that there are good responses to these critical questions. First he notes that mistakes are unavoidable. Governments must recognize their mistakes and change. Industrial policy not the only area that is open to corruption. Should no policies be pursued that are open to corruption? • Attempts in this direction during the importsubstitution phase in Africa were largely a failure. So the question is whether the institutional environment in Africa good enough for Rodrik’s idea of industrial policy as a development tool? 49