emp-benefits(2)

advertisement

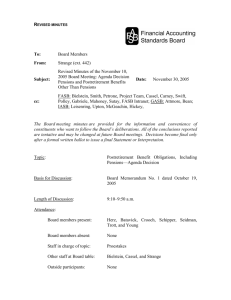

Intermediate Financial Accounting Postretirement Benefits Other than Pensions Accounting for Postretirement Benefits Identify the differences between pensions and postretirement benefits other than pensions (i.e., health-care benefits). To learn the accounting for postretirement benefits other than pensions. The Financial Statements 2 About SFAS No. 106 Postretirement benefits other than pensions include health care benefits and other welfare benefits (i.e., tuition, eye care, legal & tax services, day care, housing assistance) for retirees, their dependents and spouses. The Financial Statements 3 Accounting Practice of OPEB (Other Post Employment Benefits) Prior to SFAS 106 Only recognizes them when pay - on a cash basis. Reasons of NOT pre-funding these benefit plans: 1. The payments to pre-fund health care costs are NOT tax deductible. The Financial Statements 4 Accounting Practice of OPEB (Other Post Employment Benefits) Prior to SFAS 106 These OPEB were once perceived to be low cost employee benefits and could be changed or eliminated at will, and, therefore, Not a legal liability. 2. The Financial Statements 5 Accounting Practice of OPEB under SFAS 106 The liability of OPEB should be recognized during the employment of employee, rather than delay to their retirement. OPEB is a form of deferred compensation. Thus, the accounting treatment of OPEB is on an accrual basis, rather than on a cash basis. The Financial Statements 6 Accounting Practice of OPEB under SFAS 106 (contd.) When IBM adopted SFAS No. 106 in 3/91, it resulted in $2.3 billion charge and the first ever quarterly loss in IBM history. GE disclosed a $2.7 billion liability on 4th quarter of 1993 when adopting SFAS 106. AT&T charged $2.1 billion when adopting SFAS 106. The Financial Statements 7 Differences between Pension Benefits & Health Care Benefits Reasons why FASB does not issue one statement for both pension benefits and OPEB: Item Funding Benefit Pension Generally funded Well-defined & level dollar amount Beneficiary Retiree (may be some benefits to surviving spouse) Benefit Payable Monthly Predictability Variables are predictable Health Care Benefits Not Generally uncapped & great variability Retiree, spouse, and dependents As needed & used Utilization difficult to predict Level of Cost varies Geographically & fluctuates over time Because of the substantial differences, FASB issues different statements for these two benefits. The Financial Statements 8 Obligations under Postretirement Benefits Expected postretirement benefits obligation (EPBO): The actuarial present value as of a particular date of all benefits expected to be paid to employees and their dependents after retirement. The EPBO is NOT recorded in the F/S, but it is used in measuring periodic expense. The Financial Statements 9 Obligations under Postretirement Benefits (contd.) Accumulated postretirement benefits obligation (APBO): The actuarial present value of future benefits attributed to employees’ services rendered to a particular date. The Financial Statements 10 Obligations under Postretirement Benefits (contd.) APBO = EPBO for retirees. APBO = EPBO for active employees with full date eligibility for benefits (fully eligible for benefits). APBO < EPBO for active employees NOT fully eligible for benefits. The Financial Statements 11 Postretirement Expense (recognized on I/S) Postretirement expense (net periodic postretirement benefit cost): The annual expense that employer recognized on the income statement. It consists of many similar components used to compute annual pension expense. The Financial Statements 12 Postretirement Expense (contd.) The components are: + 1. Service cost . The portion of EPBO attributed to employee service during the period. + 2. Interest cost. The interest on APBO attributable to the passage of time. - 3. Actual return on plan assets. The Financial Statements 13 Postretirement Expense (contd.) The components are (contd.): + 4. Amortization of prior service cost. + or - 5. Gains and losses. + 6. Amortization of transition obligation. The Financial Statements 14 The Transition Amount At the adoption of SFAS No. 106, a transition amount is computed as the difference between: (1). The APBO and (2). The fair value of the plan assets plus any accrued obligation or less and prepaid cost(mostly zero at adoption) Due to most plans are unfunded, larger transition obligations occur at the adoption of SFAS No. 106. The Financial Statements 15 The Transition Amount - the Accounting Treatments A. Immediate Recognition (IR Method) Cumu. Eff. of Acct.Change1 xxx Deferred Tax Assets xxx Prepaid/Accrued Postret. Benefit Cost xxx (reported on B/S as a long-term liability) 1. The tax effect if deferred because only the actual payment for retiree benefits are tax deductible. The Financial Statements 16 The Transition Amount - the Accounting Treatments (Contd.) The Prepaid/Accrued account can only be reduced by funding, not by payments of benefits. Payments of benefits reduce the APBO which is only disclosed in the footnote, not recognized. The Financial Statements 17 The Transition Amount - the Accounting Treatments (contd.) B. Deferred recognition: Amortize the transition amount on a straight-line basis over the average remaining service period to expected retirement of the employees or 20 years if it is longer. Similar entry as for the IR method will be recorded. Once chosen, the method cannot be changed. The Financial Statements 18 Off Balance Sheet Items Related to Postretirement Benefits 1. EPBO 2. APBO 3. Postretirement plan assets 4. Unrecognized transition amount 5. Unrecognized prior service cost 6. Unrecognized net gains or losses The Financial Statements 19 Example 1 1997 Entries & work sheet Assuming on 1/1/97, Quest adapts SFAS No. 106 to account for its health care benefit plan. The following facts apply to the post retirement benefits plan for the year of 1997: 1. Plan assets at fair value on 1/1/97: $0 The Financial Statements 20 Example 1 (contd.) 2. Actual & expected returns on plan assets in 1997: $0. 3. APBO, 1/1/97 is $400,000 (Transition obligation at the adoption of 106). 4. Service costs for 1997 is $22,000. 5. Prior service cost: $0. 6. Discount rate: 8%. The Financial Statements 21 Example 1 (contd.) 7. Contributions (funding) to plan in 1997 are $38,000. 8. Benefit payments to employees from plan in 97 are $28,000. 9. An average remaining service to full eligibility: 21 years. 10. An average remaining service to retirement: 25 years. 11. Transition amount to be amortized. The Financial Statements 22 J.E. of Quest Annual Postretirement Expense Items memo record Cash Prepaid/ Accrued Cost Balance 1/1/97 400,000(Cr) (a) service cost 22,000(Dr) (b) Interest cost 32,000 (Dr) 32,000(Cr) 38,000(Cr) 38,000(Dr) (d) Benefit payments J.E. fr 1997 Balance 12/31/97 28,000(Dr) 2 16,000 (Dr) 70,000(Dr) 400,000(Dr) 22,000(Cr) 1 (c) Contributions (e) Amortization of Transition APBO Unrecognized Plan Assets Transition Amount 28,000(Cr) 16,000(Cr) 38,000(Cr) 32,000(Cr) 32,000(Cr) 426,000(Cr) 10,000(Dr) 384,000(Dr) 1. 400,000 x 8% = 32,000 2. 400,000 / 25 = 16,000 The Financial Statements 23 Example 1 (contd.) Journal entry recorded on 12/31/97 Postretirement benefit expense 70,000 Cash 38,000 Prepaid/accrued Postreti. Benefit cost 32,000 The Financial Statements 24 Example 1 -Reconciliation Schedule APBO Plan Assets Funded Status Unrecognized Transition Amo. ($426,000) cr. 10,000 dr. (416,000) cr. 384,000 dr. ($32,000) cr. The Financial Statements 25 Recognition of Gains & Losses (G/L) Gains & losses represent change in APBO or the change in value of plan assets resulting for actual experience difference from expected or from change in actuarial assumptions. The Financial Statements 26 Amortization of G/L The corridor approach applies. The corridor is the greater of 10% * APBO or 10% * market value of plan assets. If the unrecognized G/L is greater than the corridor, the excess amount needs to be amortized and included in as a component of the postretirement expense. The Financial Statements 27 Amortization of G/L (contd.) If the unrecognized G/L is less than the corridor, NO amortization of G/L is needed. If amortization is required, the minimum amortization amount is the excess gain or loss (beyond the corridor) divided by the average remaining life to expected retirement of all active employees. The Financial Statements 28 Amortization for G/L (contd.) Any systematic amortization method can be used as long as: (a) The amount amortized in any period is greater than the minimum amount calculated above; (b) the method applied consistently, and (c ) the method is applied similarly for both gains and losses. The Financial Statements 29 Example 2 1998 Entries and work sheet Continuing the Quest illustration to 1998, the following facts apply to the plan for the year of 98: 1. Actual return on plan assets: $600 2. Expected return on plan assets: $800 3. Discount rate: 8% The Financial Statements 30 Example 2 (contd.) 4. Increase in APBO due to changes in actuarial assumptions is $60,000. 5. Service cost for 1998 is $26,000. 6. Contributions (funding) to plan are $50,000. 7. Benefit payments to employees in 1998 are $35,000. The Financial Statements 31 Example 2 (contd.) 8. Average remaining service to full eligibility: 21 years. 9. Average remaining service to retirement: 25years. The Financial Statements 32 The following worksheet presents all the postretirement benefit entries and information Recorded by Quest in 98 J.E. of Quest Annual Postretirement Expense Items Cash Balance 1/1/98 Prepaid/ Accrued Cost APBO memo record Unrecognized Plan Transition Assets Amount 32000(Cr) 426000(Cr) 10000(Dr) (a) service cost 26000(Dr) 26000(Cr) 1 34080(Dr) 34080(Cr) (c) Actual Return 600(Cr) (d) Unexpected Loss 200(Cr) (b) Interest cost (e) Contributions 384000(Dr) 600(Dr) 200(Dr) 50000(Cr) 50000(Dr) (f) Benefits (g) Amortization: Transaction (h) Increase in APBOloss Unrecognized Net G/L 35000(Dr) 35000(Cr) 16000(Dr) 16000(Cr) 25280(Cr) 60000(Cr) J.E. fr 1997 75280(Dr) 50000(Cr) 57280(Cr) 511080(Cr) 25600(Dr) (d) & (h) are components of gains & losses 60000(Dr) 368000(Dr) 60200(Dr) 1. 426,000 x 8% = 34,080 The Financial Statements 33 Example 2 (contd.) Journal entry on 12/1998: Postretirement benefit expense 75,280 Cash 50,000 Prepaid/accrued cost 25,280 The Financial Statements 34 Example 2 -Reconciliation Schedule APBO ($511,080) cr. Plan Assets 25,600 dr. Funded Status (485,480) cr. Unrecognized Transition Amo. 368,000 dr. Unrecog. Gain/loss 602,000 dr. Accrued cost ($57,280) cr. The Financial Statements 35 Footnote Disclosures of Postretirement Benefits other than Pensions The disclosures for postretirement benefits other than pensions parallel with those for the pensions. Thus, refer to the disclosure notes for pensions in Chapter 17 for these disclosures. The Financial Statements 36