Game Theory of Coffee Prices

advertisement

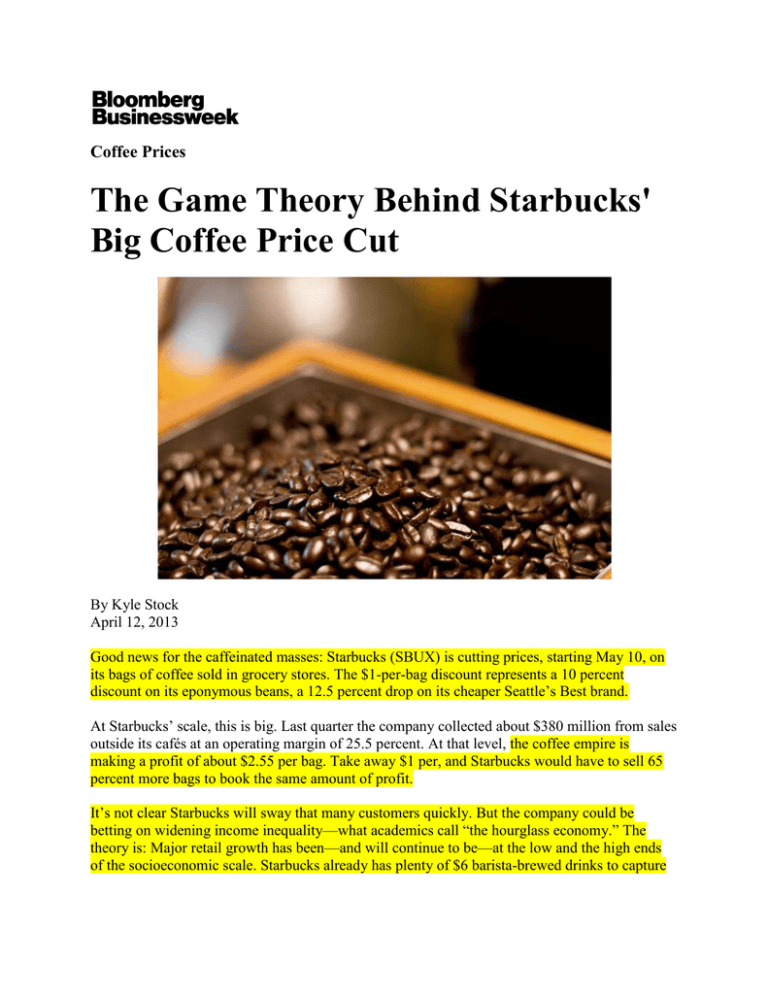

Coffee Prices The Game Theory Behind Starbucks' Big Coffee Price Cut By Kyle Stock April 12, 2013 Good news for the caffeinated masses: Starbucks (SBUX) is cutting prices, starting May 10, on its bags of coffee sold in grocery stores. The $1-per-bag discount represents a 10 percent discount on its eponymous beans, a 12.5 percent drop on its cheaper Seattle’s Best brand. At Starbucks’ scale, this is big. Last quarter the company collected about $380 million from sales outside its cafés at an operating margin of 25.5 percent. At that level, the coffee empire is making a profit of about $2.55 per bag. Take away $1 per, and Starbucks would have to sell 65 percent more bags to book the same amount of profit. It’s not clear Starbucks will sway that many customers quickly. But the company could be betting on widening income inequality—what academics call “the hourglass economy.” The theory is: Major retail growth has been—and will continue to be—at the low and the high ends of the socioeconomic scale. Starbucks already has plenty of $6 barista-brewed drinks to capture the top of that market, but a bag of $10 coffee is very much in the middle, according to Rita McGrath, a professor at Columbia Business School. Incidentally, this may also be why Starbucks isn’t cutting prices in its cafés, even after a controversial price increase in many of its shops last year. Cutting prices on its bags of coffee also takes a swing at the competition’s knees. Starbucks is a supply-chain machine. There are massive economies in its scale, and it aggressively hedges the costs of its coffee, dairy, and fuel. At the end of the year, it had $816 million in coffee beans sitting around its warehouses. And here’s where a little game theory comes into play. Coffee prices are hovering at three-year lows, a drop that prompted such brands as Folgers (SJM), Dunkin’ Donuts (DNKN), Maxwell House (KRFT), and others to cut their prices earlier this year. By committing to lower prices (and not using coupons or sales), Starbucks is sending a signal, McGrath says. It’s serious about the low end of the market; Dunkin’ Donuts, Folgers, and other competitors can either trim their margins further or give up volume. Either way, they lose. So does Starbucks, at least in the near term. But with savvy hedging and customers lining up for expensive lattes—including increasing crowds in China—it can stand the pain for a while. And it is betting it is more efficient than its competitors. As McGrath says: “If you can run economically enough to make money at the lower price, you’re simply taking money out of your competitors’ pockets.”