Career Preparedness Syllabus

advertisement

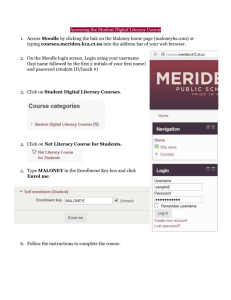

COURSE SYLLABUS Career Preparedness – Mr. Leslie eleslie@shelbyed.k12.al.us COURSE DESCRIPTION: Career Preparedness is a one-credit, full-year course that fulfills the new Alabama State Department of Education requirement for graduation in the areas of financial literacy, computer literacy, and online learning experience. The course contains financial literacy information that introduces students to the management of personal and family resources to achieve personal goals. Content provides opportunities for students to explore consumer behavior, laws, and legislation, consumer protections, consumer rights and responsibilities, consumer decision-making, advertising and promotional techniques, individual and family money management, banking services, use of credit, and income tax. The course also provides extensive career-related exploration on a web-based career training system. Using this system, students will design a 4-year academic plan for their high school career; thus meeting the online learning experience and the 4-year plan requirement for graduation. Also, this course is designed to provide students with technology fluency appropriate for the 21st century. Components of the course will provide students with the skills to conduct research and solve problems, demonstrate creative thinking, develop innovative products, and practice safe, ethical, and legal use of technology systems. This course component satisfies the graduation requirement for computer literacy. Passing this course is a requirement for graduation from High School PREREQUISITES: N/A PROGRAM: In the Business, Management, and Administration cluster, students choose one of 3 pathways; Administrative Services, Business Information Technology, or Corporate and General Management. Specific content standards tell what students should know and be able to do at the end of each course. The foundation course may be Business Technology Applications or Business Essentials. The Business, Management, and Administration cluster prepares students with the fundamental knowledge and skills for careers in planning, organizing, directing, and evaluating business functions essential to efficient and productive business operations. Instruction is flexible and focuses on quality performance in the skill areas of organization, time management, customer service, and communication. In addition, students learn ways in which technology, globalization, and regulatory issues affect the day-to-day operation of businesses. Information is also provided regarding possible credentialing or certification. COURSE GOALS: The Business, Management, and Administration cluster prepares students with the fundamental knowledge and skills for careers in planning, organizing, directing, and evaluating business functions essential to efficient and productive business operations. Instruction is flexible and focuses on quality performance in the skill areas of organization, time management, customer service, and communication. ESSENTIAL QUESTION(S): o Why is it important for people to take responsibility for their financial decisions? o What factors impact consumer purchasing decisions throughout their lifespan? o Why is it important for people to protect their personal information? o What employability skills are most important in the workplace? o What money management products and services are available to consumers? o What factors affect creditworthiness? o Why is it important to manage credit in a responsible manner? o What are the benefits and consequences of credit? o Why is it important to obtain insurance? o Why is it important to plan and prepare for retirement? COURSE OUTLINE: Students will be introduced to vital general concepts of personal finance; students will explore careers and identify their career interests long with developing a 4-year academic plan; students will discover how financial institutions are used to assist with money management; students will be exposed to the benefits and consequences of credit; students will prepare for the responsibilities of citizenship; students will perform the functions of Microsoft Office software, Internet exploration, and online learning modules and activities. CULMINATING PRODUCTS: FBLA/DECA/FCCLA/FFA project ASSESSMENT PROCEDURES: Your grade will be determined using the “total points” method. Each graded activity will be worth a pre-determined amount of points. Points you earn will be divided into the maximum possible number of points to determine your grade. Assessments will be in oral and/or written form. GRADING SCALE: A = 90-100 B = 80-89 C = 70-79 D = 60-69 F = 59 and below MAKE UP WORK / LATE WORK Late Work – work not submitted when directed will be accepted with the following deduction 1 Day late = 10% deduction 3 Days late = 20% deduction 4 Days or more = 40% deduction Make up work will be accepted with the possibility of full credit for up to 3 days per day of excused absence. After 3 days, Late work deductions apply. Make up work for unexcused absences will not be accepted and will result in a “0” Students who need lab time to make up work should see me to set up a time before or after school. I am available every day from 7:00 AM – 3:45 PM (or later). CTSO: FBLA / DECA / FCCLA / FFA MOODLE: Most Assignments for each day will be posted on Moodle. Moodle can be accessed from any computer connected to the internet by going to the Shelby County Board of Education Website and clicking on “Students” I, _____________________________________________ hereby acknowledge receipt of this syllabus and understand its contents and agree to abide by its intent. _____________________________________________ Student _____________________________________ Parent ___________________ Date