Chapter 24

advertisement

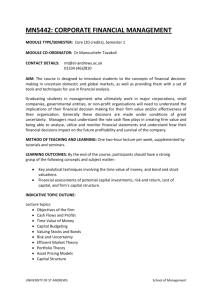

Chapter Twenty-four Leasing Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-1 Chapter Organisation 24.1 24.2 24.3 24.4 24.5 24.6 24.7 24.8 24.9 The Nature of Leases Types of Leases A Brief Look at Accounting for Leases Taxation and Leases An Evaluation of Leasing The Role of the Residual Value Setting Lease Premiums Alleged Advantages and Disadvantages of Leasing Summary and Conclusions Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-2 Chapter Objectives • Understand the characteristics of the different • • • • • types of leases. Explain how leases are recorded in a firm’s accounting records. Identify the tax implications of leases. Evaluate a lease by calculating the net advantage of leasing (NAL). Explain the calculation of lease premiums. Discuss the advantages and disadvantages of leases. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-3 Leasing versus Buying Buy Sass buys asset and uses asset; financing raised by debt Manufacturer of asset Lease Sass leases asset from lessor; the lessor owns the asset Manufacturer of asset Sass arranges financing and buys asset from manufacturer Sass 1. Uses asset 2. Owns asset Sass leases asset from lessor Lessor 1. Owns asset 2. Does not use asset Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright Lessee (Sass) 1. Uses asset 2. Does not own asset 24-4 Leasing • What is a lease? – A lessee (user) enters an agreement in which they make lease payments to the lessor (owner) in return for the use of the leased property/asset. • Who are the major providers of lease finance in Australia? – Finance companies and banks. • What assets are leased? – Any asset including photocopiers, cars, construction equipment, computers, shop/office fittings and equipment. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-5 Types of Leases • Operating lease • Financial lease – – Sale and leaseback agreement Leveraged lease Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-6 Operating Leases • Short-term lease. • Cancellable prior to the expiry date at little or no cost. • Lessor is responsible for maintenance and upkeep of asset. • The sum of the lease payments does not provide for full recovery of the asset’s costs. • Includes telephones, televisions, computers, photocopiers, cars. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-7 Financial Leases • Long-term lease. • Non-cancellable (without penalty) prior to expiry • • • • date. Lessee is responsible for the maintenance and upkeep of the asset. Lease period approximates asset’s economic life. The sum of the lease payments exceeds the asset’s purchase price. Includes specialist equipment, heavy industrial equipment. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-8 Residual Value Clause • Lease continues for its full term Lessee can purchase the asset for its residual value, return the asset to the lessor (paying any shortfall from residual value) or renew the lease. • Lease is cancelled during its initial term Lessee must pay outstanding premiums (less interest component) plus residual value of asset. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-9 Types of Financial Leases • Sale and leaseback agreements Companies sell an asset to another firm and immediately lease it back. Enables the company to receive cash and yet maintain use of the asset. • Leveraged leases The lessor arranges for funds to be contributed by one or more parties—form of risk-sharing and transferring tax benefits. Often used to finance large-scale projects. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-10 Leasing and the Statement of Financial Position A. Statement of Financial Position with Purchase (company finances $100 000 truck with debt) Truck Other assets Total assets $100 000 100 000 $200 000 Debt Equity Debt plus equity $100 000 100 000 $200 000 B. Statement of Financial Position with Operating Lease (co. finances truck with an operating lease) Truck Other assets Total assets $ 0 100 000 $100 000 Debt Equity Debt plus equity $ 0 100 000 $100 000 C. Statement of Financial Position with Financial Lease (co. finances truck with a financial lease) Assets under financial lease $100 000 Other assets 100 000 Total assets $200 000 Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright Obligations under financial lease Equity Debt plus equity $100 000 100 000 $200 000 24-11 Criteria for a Financial Lease • AAS17 ‘Accounting for Leases’ states that a financial lease occurs where substantially all risks and benefits pass to the lessee. • A financial lease must be disclosed on the Statement of Financial Position if at least one of the following criteria is met: – – the lease term is 75 per cent or more of the estimated economic life of the asset the present value of the lease payments is at least 90 per cent of the fair market value of the asset at the start of the lease. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-12 Leasing and Taxation • Lease premiums paid under a lease contract are tax deductible. • Any payment relating to the ultimate purchase of the asset is not deductible. • The residual payment does not qualify as a tax deduction. • Any profit made on the asset previously leased is subject to capital gains tax. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-13 Example—Lease versus Buy Macca Co. has to decide whether to borrow the $15 000 needed to purchase a new gadget machine (with a borrowing cost of 10 per cent) or to lease the machine for $4000 per annum. If purchased, the asset could be depreciated using the straight-line method over the three-year life. The company tax rate is 30 per cent. Under the lease agreement, Macca Co. would be responsible for maintaining the machine. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-14 Example—Lease versus Buy: Repayment Schedule Repayment 15 000 / 1 - 1 / 1.10 / 0.10 3 $6032 Year Principal Outstanding Interest @ 10% Total amount owing Repayment 1 2 3 15 000 10 468 5 483 1 500 1 047 548 16 500 11 515 6 031 6 032 6 032 6 032 Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright Principal carried forward 10 468 5 483 nil 24-15 Example—Lease versus Buy: Tax Subsidises Borrowing Year 1 2 3 Depreciation Deduction 5 000 5 000 5 000 Interest Deduction 1 500 1 047 548 Total deductions 6 500 6 047 5 548 Total PV of tax subsidies (30%) Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright PV of Deductions 5 909 4 997 4 168 $15 074 $ 4 522 24-16 Example—Lease versus Buy: Tax Subsidises Leasing Year 1 2 3 Lease Premium 4 000 4 000 4 000 Total PV of tax subsidies (30%) Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright Present Value 3 636 3 306 3 005 $9 947 $2 984 24-17 Example—Lease versus Buy: Net Advantage of Leasing Opportunit y cost PV of lease payments - Borrowing cost $4 000 2.4869 - $15 000 ($5 052) NAL Net tax savings - Opportunit y cost $2 984 - $4 522 - $5 052 - $1 538 $5052 $3 514 The advantage is greater than zero so Macca Co. should lease. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-18 Residual Value • The residual value is the amount for which the asset may be purchased by the lessee from the lessor at the end of the lease term. • The salvage value is the amount the asset can be sold for in the market place by the lessee (once they have acquired the asset). • In the previous example, assume a residual value of $2000 and a salvage value of $1500. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-19 Example—Lease the Asset with Residual Value Salvage value Residual value Loss on leasing Tax savings in year 3 PV of tax savings Add tax subsidies Total tax subsidies (A) Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright $1 500 $2 000 ($500) $150 $113 $2 984 $3 097 24-20 Example—Borrow to Purchase the Asset with Residual Value Salvage value Depreciated value Gain on salvage Tax payable in year 3 PV of tax payable Add tax subsidies Total tax subsidies (B) Net tax savings (A-B) Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright $2 000 Nil $2 000 ($600) ($451) $4 522 $4 071 ($974) 24-21 Net Advantage of Leasing Opp cost PV lease pay. PV residual value - Borrowing cost $4 000 2.4869 $2 000 / 1.10 - $15 000 3 ($3 550) NAL Net tax savings - Opportunit y cost $974 - $3 550 $2 576 Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-22 Setting Lease Premiums Lease premiums are paid in advance in Australia. Lease premium in advance Asset valu e - PV residual value 1 PV annuity factor for t - 1 payments Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-23 Example—Lease Premiums KAZ Co. has started a four-year lease of a photocopier which has a $70 000 purchase price. Had the company purchased the copier, the interest rate quoted on borrowings was 1.5 per cent per month. KAZ has agreed with the lessor to a residual value of $10 000 at the end of four years. What will be the amount of the lease premiums? Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-24 Solution—Lease Premiums Lease premium Asset valu e - PV residual value 1 PV annuity factor for t - 1 payments 70 000 - 10 000 1.015 1 1 - 1 / 1.015 / 0.015 48 47 65 106 / 1 33.5532 $1884.22 Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-25 Advantages of Financial Leases • No restrictions on future borrowing. • Can be tailored to suit firm’s needs. • Eliminates the need to raise extra capital. • No unnecessary financial outlay. • May be excluded from the Statement of Financial Position. • Facilitates financing capital additions on a piecemeal basis. • Is an allowable cost under government contracting. • Offers tax advantages. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-26 Advantages of Operating Leases • Frees up capital for alternative uses. • Increases the company’s working capital. • Provides greater control due to greater certainty in • • • • future outlays. Assures more competent upkeep of asset. Avoids the risk of obsolescence. Avoids the equipment disposal problem. Future outlays cost less in real terms due to inflation. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-27 Disadvantages of Leasing • Interest cost often higher. • May not offer the right to the residual value of the asset. • Allows the acquisition of assets without submitting formal capital expenditure procedures. • May cause distortions in the evaluation of interfirm and interdivision performance. • Lacks the prestige associated with ownership. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-28 Good Reasons for Leasing • Taxes may be reduced by leasing. • The lease contract may reduce certain types of uncertainty that might otherwise decrease the value of the firm. • Leasing reduces the impact of obsolescence of an asset on a firm. • Transaction costs may be lower for a lease contract than for buying the asset. • Leasing may require fewer (if any) restrictive covenants than secured borrowing. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-29 Bad Reasons for Leasing • The perception of 100 per cent financing. • The apparent low cost. • Using leasing to artificially enhance accounting income. Copyright 2004 McGraw-Hill Australia Pty Ltd PPTs t/a Fundamentals of Corporate Finance 3e Ross, Thompson, Christensen, Westerfield and Jordan Slides prepared by Sue Wright 24-30