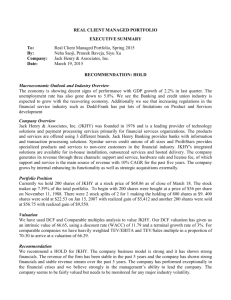

Jack Henry & Associates

advertisement

Jack Henry & Associates Radityo Ardi Nugraha John Sun RCMP Position Purchase Date: Nov 11, 1999 # Shares purchased: 200 Stock splits date: Mar 3, 2000 and Mar 5, 2001 Currently owned shares: # shares: 800 Base Price: $9.00 Constitutes 5% of all current holdings Stocks Facts Current Shares Price: $22.20 Market Cap: $2.01B 52wk Range: $17.40 - $23.77 P/E (ttm): 22.59 Div & Yield: 0.22 (1.00%) Company History In 1976, Jack Henry and Jerry Hall found Jack Henry & Associates in Monet, Missouri In 1985, Jack Henry & Associates became public, traded at NASDAQ In 1992 had a mission to expand its customer base and breadth of offerings through strategic development and acquisition of additional technology solutions By 1995 Jack Henry offered ATM and imaging solutions, and outsourced data processing solutions. Company History (cont.) Started in 1992, in order to grow, Jack Henry began to acquire companies that provided complementary products and services to its own core customer base and companies that offered products and services to a broader range of client types and sizes. In fiscal year 2005, Jack Henry acquired 8 companies, which are: Tangent Analytics, LLC ($4M), RPM Intelligence, LLC ($6.2M), SERSynergy ($34.5M), TWS Systems, Inc. ($10.9M), Optinfo, Inc. ($15.1M), Verinex Technologies, Inc. ($35m), Select Payment Processing, Inc. ($12M), and Banc Insurance Services, Inc.($6.7M) In fiscal year 2006, Jack Henry acquired Profitstar Inc ($19.3M). Jack Henry counts over 8,700 financial institutions as customers Company Business Provides data processing solutions to small banks and credit unions (assets under $30 billion). Customers either install systems in-house or outsource their operations to Jack Henry. 3 sources of revenue: Software licensing Support and Service Hardware Business Description Core Systems Can be used in-house or outsourced. Provide core processing functionality: deposits, loans, etc. 5 core systems: Silverlake System: for banks with $500 million to $30 billion in assets CIF 20/20: for banks with less than $1 billion in assets Core Director: for banks with less than $1 billion in assets (Windows-based) Episys: for credit unions with greater than $50 million in assets Cruise: for credit unions with less than $50 million in assets Business Description (cont.) Complementary Products Allow the company to offer customtailored, integrated suites of software solutions. Expose the company to high-growth areas, like security, risk management, online bill pay, and electronic funds transfer. Product offering expanded through acquisitions. Business Description (cont.) Examples of complementary products Synapsis: Relationship management (customer profiling, referral tracking, etc.) NetTeller: Online home banking system with real-time account information and transaction capabilities. Remote Deposit Capture: Peforms image capture, storage, and processing for paper checks. PassPort: Drives and monitors ATM networks. Biodentify: Biometric fingerprint security. Centurion Disaster Recovery: Disaster recovery protection Major Competitors Fidelity national Information Services (FIS) with $6.7B Mkt. Cap Fiserv Inc. (FISV) with $7.6B Mkt. Cap Macro Economic Overview GICS Sector: Information Technology Sub-industry: Application Software Stable industry outlook. Spending expected to accelerate slow growth (around 5%) Commoditization of software industry. Competition from international (Indian, Eastern European) developers. Peer Group: Accounting and Financial Software Consolidation: Number of commercial banks has declined by 4% annually over past five years. Credit unions have consolidated at the same rate. Sarbanes-Oxley compliance a major information technology hurdle and source of IT spending. Year 5/11/2006 11/11/2005 5/11/2005 11/11/2004 5/11/2004 11/11/2003 5/11/2003 11/11/2002 5/11/2002 11/11/2001 5/11/2001 11/11/2000 5/11/2000 11/11/1999 Price Stock Market Performance Share Price History 80 70 60 50 40 30 20 10 0 Stock Market Performance (cont.) Revenue by Segment Hardware – comprises a smaller percentage of total revenues due to low margins and stiff competition from other players License – Grows as a slowing rate as trends in bank consolidation limits new customers Support – Grows to be a majority of Revenue due to higher margins and crossselling potential / higher growth ceiling. Revenue by Segment Revenue by Segment $1,400,000.00 $1,200,000.00 Revenues $1,000,000.00 $800,000.00 Hardware Support and service License $600,000.00 $400,000.00 $200,000.00 $0.00 1999 2000 2001 2002 2003 2004 2005 Year 2006 2007 2008 2009 2010 2011 Profit by Segment Gross Profit by Segment $700,000.00 $600,000.00 Gross Profit $500,000.00 $400,000.00 Gross Profit hardware Gross Profit services Gross Profit license $300,000.00 $200,000.00 $100,000.00 $0.00 1999 2000 2001 2002 2003 2004 2005 Year 2006 2007 2008 2009 2010 2011 Modeling and Forecasting 2-tier modeling approach Full model from 2007-2011 Reduced Model from 2011-2015 (8%) Terminal Growth = 4% 3 Scenarios – Upside, Base case, Downside Modeling and Forecasting Upside: No setback, steady revenue growth matching highest historical rate Overhead costs as % of revenue declines at historical rate to a resonable terminal rate Associated acquisitions and business costs grow at a slower rate Modeling and Forecast Base Case: Semi-steady revenue growth – some setbacks/periods of economic decline Overhead costs remain constant as % of revenues Acquisitions and business costs grow at slowing historical rate to a reasonable terminal rate Modeling and Forecasting Downside: 2007, 2008 general economic slow down, marked by a period of revenue decline and much lower margins Recovers by 2009 Growth rates slow at a faster rate as revenues increase YoY. Sensitivity Analysis Revenue Projections 0.2 0.18 0.16 0.14 % Growth 0.12 Downside 0.1 Basecase Upside 0.08 0.06 0.04 0.02 0 2002 2003 2004 2005 2006 2007 Year 2008 2009 2010 2011 DCF Valuation Final Year (2006) Free Cash Flow = $126,682 Caused by dramatic decline in working capital Not likely to continue as a trend DCF Valuation Upside - $23-24 Base Case - $16-18 Downside - $13+ “Fair Value” - $15-21 Recommendation JKHY currently trades at 22.27 Above high end of DCF “fair value” projections Sell 400 shares at market to recover our investment. Remain long 400 shares as company is still a well-managed, but fully valued opportunity.