Document

AC122.01: Unit 4 Seminar

June 29, 2011

School of Business and Management

Agenda

• Welcome

• Seminar Rules

• Chapter 3 Social Security Taxes

Questions

Seminar Rules by Greg Rose

1.

If I type *BREAK* everybody quit typing, OK? Type “OK” if you get this one!

2.

When asking questions, please RAISE YOUR HAND (TYPE //).

Otherwise you might interrupt a stream of dialogue.

3.

Please do NOT start side conversations.

4.

Do not interject “I agree” or “good point” because this clutters the seminar. We assume you agree and think the point is good!

5.

Don`t worry about typos. Be clear as you can and refrain from smileys and slang – use proper English.

• Assignments Grading

Payroll Accounting 2011

Bernard J. Bieg and Judith A. Toland

CHAPTER 3

SOCIAL SECURITY TAXES

Developed by Lisa Swallow, CPA CMA MS

Coverage under FICA

FICA (1935)

Federal Insurance Contributions Act

Tax paid both by employees and employers

6.2% OASDI plus 1.45% HI

SECA (1951)

Self-Employment Contributions Act

Tax upon net earnings of self-employed

(6.2% + 6.2%) = 12.4% OASDI plus (1.45% + 1.45%) = 2.9% HI

3 issues

Are you an EE or an independent contractor?

Is service rendered considered employment?

Is compensation considered taxable wages?

• http://www.ssa.gov/employer

Independent Contractor (SECA) vs. Employee (FICA )

Employer “employs one or more individuals for performance of services in U.S.”

IRS uses common-law test to determine status

Certain occupations specifically covered

Agent- and commission-drivers of food/beverages or dry cleaning

Full-time life insurance salespersons

Full-time traveling salespersons

Individual working at home on products that employer supplies and are returned to furnished specifications

More Specific Situations

Government employees

– certain exemptions from OASDI/HI depending upon date of hire

Military personnel - certain types of pay exempt from FICA

In-patriates - may be exempt from FICA (20 countries)

Family employees

– in certain situations, children may be exempt from FICA

Household employees

If they make cash wages of $1,700 or more per year

Must pay if domestic employee, like a nanny, is under your control

Additional exemptions inmates, medical interns, student nurses and workers serving temporarily in case of emergency

Independent Contractor

Persons may be classified as independent contractors if they conduct an independent trade or business

Hiring agent does not pay/withhold FICA on worker classified as independent

Independent contractor liable for his/her own social security taxes on net earnings

If ER misclassifies EE, penalties will accrue to the ER

If EE did report the earnings on his/her federal tax return, the penalty is voided

What are Taxable Wages?

Cash

Wages and salaries

Bonuses and commissions

Cash value of meals/lodging provided (but only if for employee’s convenience)

Fair market value of noncash compensation, examples include:

Gifts (over certain amounts)

Stock options

Fringe benefits like personal use of corporate car

Prizes

Premiums on group term life insurance > $50,000

What are Taxable Wages?

Tips greater than $20 or more per month

EE can report tips to ER using Form 4070

ER calculates FICA on tips and withholds from regular paycheck on these reported tips

Must withhold on first paycheck after tips are reported

ER must match FICA on reported tips

“Large employers” (11+ employees) must allocate

[(Gross receipts x .08) – reported tips]

Don’t have to withhold FICA on allocated tips, only reported tips

Have to show allocated tip income on W-2

ER files Form 8027 at year-end with IRS showing food/beverage receipts and reported tips

ER can claim a credit for SS/Medicare taxes paid on employees’ tips on Form 8846

Specifically Exempt Wages

Meals/lodging for employer’s convenience

Sick pay

After 6 consecutive months off ( personal injury)

Sick pay by 3 rd party (insurance company/trustee) with specific stipulations for ER match

Pay for difference between employees’ salary and military pay for soldiers/reservists activated more than 30 days

Employer contribution to pension plan

Employer-provided nondiscriminatory education assistance

Job-related educational expenses not subject to FICA

Payments for non-job related expenses up to $5,250

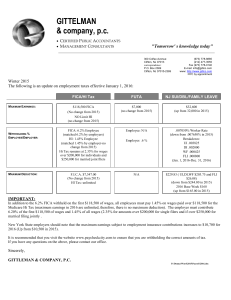

FICA Taxable Wage Base

OASDI wages cap at $106,800 for 2010

HI wages never cap

The Patient Protection & Affordable Care Act of 2010 created additional

.9% HI tax on taxpayers receiving wages in excess of $200,000

($250,000 if married filing jointly) beginning in 2013.

Facts: Tamara earn $132,000/year; paid semimonthly on the

15 th and 30 th ; determine FICA for October 30th payroll

First must find prior payroll YTD gross $132,000/24 =$ 5,500.00

$5,500.00 x 19 payrolls (before today)= $104,500.00

How much will be taxed for OASDI?

$106,800.00 – $104,500.00 = $2,300.00

OASDI tax is $2,300.00 x 6.2% = $142.60

HI tax is $5,500.00 x 1.45% =$ 79.75

Total FICA is $142.60 + $79.75 =$ 222.35

Example 3-2B

a.

9 th paycheck

OASDI

322.40

HI

75.40

a.

106,800 – (8 x 5,200) = 65,200

21 st paycheck 173.60

75.40

106,800 – (20 x 5,200) = 2,800 Remaining taxable income for

OASDI a.

24 th paycheck 0 75.40

119,600 (23 x 5,200) >106,800 This indicates that the worker has reached the cap on taxable income for OASDI

Another Example - Calculating

FICA

Facts: Ahmed earns $175,000/year; paid first of every month; determine FICA for August 1 payroll

What do we calculate first?

$175,000/12 = $14,583.33 per paycheck

YTD gross prior to current payroll =$14,583.33 x 7 =

$102,083.31

$106,800.00 – $102,083.31 = $4,716.69 taxed for OASDI

$4,716.69 x 6.2% = $292.43 OASDI tax

$14,583.33 x 1.45% = $211.46 HI tax (remember - no cap!)

Total FICA = $292.43 + $211.46 =$ 503.89

Remember - the ER has withheld $503.89 from the employee’s paycheck and must match this amount

Example 3-3B

Eric Sherm began working as a part time waiter on April

1, 2011 at Yardville Restaurant. The cash tips of $475 that he received during April were reported on Form

4070, which he submitted to his employer on May 1.

During May, he was paid wages of $630 by the restaurant. Compute: a. The amount of FICA taxes that the employer should withhold from Sherm’s wages during May.

Example 3-3B

b. The amount of the employer’s FICA taxes on Sherm’s wages and tips during May.

OASDI a. $68.51

b. $68.51

HI

$16.02

$16.02

( $475 tips + $630 paid wages = $1,105)

$1,105 X .062 = $68.51

$1,105 X .0145 = $16.02

Tax Holiday

Hiring Incentives to Restore

Employment Act of 2010 provides relief for employer’s share of OASDI tax

On wages paid 3/19/10 - 12/31/10

For qualified employees only

Full-time or part-time

Retention credit also available if remain employed for 52 consecutive weeks

Example 3-

6B

Amanda Autry and Carley Wilson are partners in A & W Gift shop, which employs the individuals listed below. Paychecks are distributed every Friday to all employees. Based on the information given, compute the amounts listed below for a weekly payroll period.

Name

/Position

Salary OASDI

Taxable

Earnings

OASDI

Tax

Kelly Simon,

Office

Jim Tress,

Sales

May Aha,

Delivery

Amanda

Autry, Partner

$650/wk $650.00

$3,450/

Month

$796.15

$520/ wk $520.00

$1,900/ wk

0.00

Carley Wilson

Partner

$1,900/ wk

0.00

$40.30

$49.36

$32.24

0.00

0.00

Totals $1,966.15

$121.90

Employers $121.90

Employer’s 28.51

HI Taxable

Earnings

HI Tax

$650.00

$796.15

$520.00

0.00

0.00

$9.43

$11.54

$7.54

0.00

0.00

$1,966.15

$28.51

Name

/Position

Salary OASDI

Taxable

Earnings

Kelly Simon,

Office

Jim Tress,

Sales

May Aha,

Delivery

Amanda

Autry, Partner

$650/wk

$1,900/ wk

$650.00

$3,450/

Month

$796.15

$520/ wk $520.00

0.00

Carley Wilson

Partner

$1,900/ wk 0.00

OASDI Tax HI Taxable

Earnings

HI Tax

$40.30

$49.36

$32.24

0.00

0.00

Employers

OASDI Tax

Totals

$121.90

$1,966.15

$121.90

Employer’s

HI Tax

28.51

$650.00

$796.15

$520.00

0.00

0.00

$1,966.15

$9.43

$11.54

$7.54

0.00

0.00

$28.51

SECA and Independent Contractors

EE and ER portion of FICA if net earnings exceed $400

Net Earnings = Net income + distributive share of partnership income

If you own more than one business - offset losses and income and calculate FICA based on combined net income

Can have W-2 and self employment income

Count both towards calculating cap of $106,800 for OASDI

Report on Schedule C “Profit or Loss from Business”

Also file Schedule SE “Self-Employment Tax”

Must include SECA taxes in quarterly estimated payments

Calculating FICA with W-2 and

Self-Employed Earnings

Facts: Celia’s W-2 = $107,768 and her self-employment income = $14,500; how much is FICA on $14,500?

No OASDI because capped on W-2

HI = $14,500 x 2.9% = $420.50

Total FICA = $420.50

Calculating FICA with W-2 and

Self-Employed Earnings

Facts: Felipe’s W-2 = $78,000 and his self-employment income = $36,000; how much is FICA on $36,000?

OASDI ($106,800 - 78,000) = $28,800 taxable OASDI wages x 12.4% = $3,571.20

HI = $36,000 taxable HI wages x 2.9% =

$1,044.00

Total FICA $3,571.20 + 1,044.00 =

$4,615.20

Example 3-8B

George Parker was paid a salary of $74,700 during 2011 by Umberger

Company. In addition, during the year, Parker started his own business as a public accountant and reported as net business income of $38,900 on his income tax return for 2011. Compute the following: a.

The amount of FICA taxes that was withheld from his earnings during 2011 by Umberger.

b.

Parker’s self employment taxes on the income derived from the public accounting business for 2011 a . OASDI: $74,700 X .062 = $4,631.40

HI: $74,700 X .0145 = $1,083.15 b.

OASDI $106,800 - $74,700 = $32,100 X .124 = $3,980.40

HI: $38,900 X .029 = $1,128.10

Depositing FIT & FICA

FICA & FIT always deposited together

Each November, IRS notifies ER whether they will be a monthly or semiweekly depositor for next calendar year

Monthly - pay FICA and FIT by 15th of following month

Semiweekly

If payroll was W-F, deposit by next Wednesday

If payroll was S-T, deposit by next Friday

Amount deposited may be affected by safe harbor rule (see p. 3-19) or

One day - $100,000 or more of federal payroll tax liability, taxpayer has until close of next banking day

or

No deposit required - owe less than $2,500 in entire quarter, wait and pay when 941 report is filed

Different requirements for agricultural and household employees

*New employers are monthly depositors unless $100,000+ of liability triggers one-day rule

Credit Against Required 941 Deposits

Consolidated Omnibus Budget Reconciliation Act

(COBRA) gives involuntarily terminated employees option to continued coverage under company’s group health insurance

Can continue coverage up to 15 months

Government subsidizes 65% of this cost

Company is ‘reimbursed’ its 65% by taking a deduction on Form 941

Employee pays 35%

How to Deposit FIT/FICA Electronically

EFTPS (Electronic Federal Tax Payment

System)

Most employers must use EFTPS – major exception is for businesses owing $2500 or loss in quarterly tax liabilities

Enroll in EFTPS Online at http://www.eftps.gov

All new employers automatically pre-enrolled

Two methods

ACH debit method – withdraw funds from employer’s bank account and route to Treasury

ACH credit method – employer instructs his/her bank to send payment directly to Treasury

How to Deposit FIT/FICA by Coupon

The use of Federal Tax Deposit

Coupons, Form 8109 ended 01/11/2011

All Federal tax deposits must be made electronically

Take to Treasury Tax & Loan institution or mail to Financial Agent at Federal Tax Deposit

Processing in St. Louis, MO

Timely deposits requires postmarking two days before due date but no Form 8109 coupons as of

2011

How to Report and Reconcile FIT/FICA

File Form 941 (Employer’s Quarterly Federal Tax Return)

Download at www.irs.gov/formspubs/ or call 1-800-829-3676

Due on last day of month following close of quarter

January 31, April 30, July 30, October 31

If that falls on weekend or legal holiday, file next business day

Payments made with 941if taxes for quarter are less than $2,500 or making monthly deposit (attach 941-V)

Electronic filing options available for employers who meet requirements

Complete an e-file application & then electronically submit 941 or apply for a PIN on IRS website and file electronically through third-party transmitter

Employer’s Annual Federal Tax Return

Employers who owe $1,000 or less per year may file Form 944

Employer must have made timely deposits for prior two years

Can also be used by new employers paying wages of

$4,000 or less per year

Employer should contact IRS and express interest

Employer may chose to file Form 941 quarterly instead

– need to notify IRS

Can correct errors on previously filed Form 941 by filing Form 941-X

Types of Penalties

Failure-to-comply penalties will be added to tax and interest charges; negligence can also result in fines/imprisonment

Interest set quarterly, based on short-term Treasury bill rate

Penalties imposed for following:

Not filing employment tax returns on time

Not paying full taxes when due

Not making timely deposits

Not furnishing W-2s to employees on timely basis

Not filing information returns with IRS on time

Writing bad checks

Note: IRS estimates a full 30% of all employers incur penalties for insufficient/late deposits of payroll taxes!!

![20-Jan-15 Year Maximum taxable earnings OASDI tax rate [2] HI tax](http://s3.studylib.net/store/data/008737622_1-9c9a9f87a888df5096400a73b940d298-300x300.png)