Week 7

advertisement

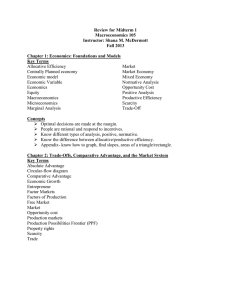

The benchmark of perfect competition Defining perfect competition Modelling market interactions Welfare and efficiency The benchmark of perfect competition We have seen : How much consumers choose of a given good, for all levels of price Through consumer choice theory How much producers produce of a good, for all levels of price Through the model of the firm We now need to work out : How this supply and demand interact to provide the market price and quantity We need a model of the market ! The benchmark of perfect competition The interaction of supply and demand The 5 conditions of perfect competition Short run and long run in perfect competition Surplus and welfare The interaction of supply and demand Reminder: the demand curve Price 2.50 2.00 1.50 1.00 0.50 0 1 2 3 4 5 6 7 8 9 10 11 Quantity The interaction of supply and demand The demand function depends on: x p1 , pothers , I i 1 i The market price of the good The income of consumers (BC) The preferences of consumers (IC) The price of other goods (S or C) Expectations (future endowments) The interaction of supply and demand A change in… ..brings the following effect on the demand curve … Price A movement on the curve Income A movement of the curve itself Preferences A movement of the curve itself Price of other goods A movement of the curve itself N˚ of consumers A movement of the curve itself Expectations A movement of the curve itself The interaction of supply and demand Price Increase in demand Fall in demand 0 Quantity The interaction of supply and demand Reminder: the supply curve Price 2.50 2.00 1.50 1.00 0.50 0 1 2 3 4 5 6 7 8 9 10 11 Quantity The interaction of supply and demand The supply function depends on: s1i p1 , pinputs , ni The market price of the good The price of inputs (cost function) Technology (production function) N˚ of producers Expectations The interaction of supply and demand A change in… ..brings the following effect on the supply curve … Price A movement on the curve Price of inputs A movement of the curve itself Available techologies A movement of the curve itself N˚ of producers A movement of the curve itself Expectations A movement of the curve itself The interaction of supply and demand Price Fall in supply 0 Increase in supply Quantity The interaction of supply and demand Price S 3.00 Equilibrium 2.50 2.00 1.50 1.00 D 0.50 0 1 2 3 4 5 6 7 8 9 10 11 12 Quantity The interaction of supply and demand Price 3.00 Excess supply S 2.50 2.00 1.50 1.00 D 0.50 0 1 2 3 4 5 6 7 8 9 10 11 12 Quantity The interaction of supply and demand Price S 2.00 1.50 rationing 0 D 1 2 3 4 5 6 7 8 9 10 11 12 Quantity The interaction of supply and demand Price 1. An increase in demand (through exterior cause)… S 2.50 New equilibrium 2.00 2. ... increases the price ... Initial Equilibrium DD12 0 3. ... and the amount sold 7 10 Quantity The interaction of supply and demand Price 1. A fall in supply ... S2 S1 New equilibrium 2.50 2.00 Initial equilibrium 2. ...increases prices... D 4 7 3. ...and reduces the quantity sold. Quantity The benchmark of perfect competition The interaction of supply and demand The 5 conditions of perfect competition Short run and long run in perfect competition Surplus and welfare The 5 conditions of perfect competition 1. 2. 3. 4. 5. Perfect competition is defined by the following 5 conditions: Large number of agents (Atomicity) Homogeneous products Free entry and exit from the market Perfect information Perfect mobility of inputs All 5 are required for an optimal coordination of supply and demand The 5 conditions of perfect competition Let’s detail what these conditions imply: Large number of producers (Atomicity) There are many producers and consumers None is large enough to individually influence the market outcome Homogeneous products On any given market, the good is exactly the same regardless of who produced it. Consumers have no preferences w.r.t. producers The 5 conditions of perfect competition Free entry and exit from the market Agents are free to enter and exit markets in response to changing market conditions There are no barriers to entry or exit Perfect information Agents constantly are constantly informed, without delay, of the changing market conditions Agents also know all perfectly all the characteristics of the goods: No hidden defects, etc. The 5 conditions of perfect competition Perfect mobility of inputs Similar to the “no barriers to entry” condition Inputs can change markets freely If even a single one of these conditions fails to hold, then we have imperfect competition Clearly, this set of conditions is never met in reality !! But the concept of perfect competition is important as a benchmark for assessing the different kinds of imperfect competition. The benchmark of perfect competition The interaction of supply and demand The 5 conditions of perfect competition Short run and long run in perfect competition Surplus and welfare SR and LR in perfect competition Profit of the firm: TR TC The profit maximisation condition finds output q such that : TR TC 0 0 q q q mR mC 0 mR mC What it mR equal to in perfect competition? SR and LR in perfect competition Total revenue is simply equal to the quantity sold times the price at which the output is sold: TR p q Marginal revenue is the sum of: The extra quantity produced ∂q times the price The effect of the increase on the market price TR p q p q TR p q But the atomicity assumption guarantees that this second effect is zero !!! TR mR p q SR and LR in perfect competition Firm-market equilibrium Firm level Market level Price Price Zero profits in equilibrium mC S AC d=mR p D q quantity Q Quantity SR and LR in perfect competition Firm-market equilibrium Firm level Market level Price Price Positive profits in SR p q TC mC Imagine a positive demand shock (ex: new “fashion”) S AC d2=mR2 p2 d=mR p Total Cost q q2 quantity D Q Q2 D2 Quantity SR and LR in perfect competition Firm-market equilibrium Firm level Market level Price Price Return to zero profits in LR mC Positive profits attract firms to the market (free entry + perfect information) S AC S2 d2=mR2 p2 d=mR p D2 q q2 quantity Q2 Q3 Quantity SR and LR in perfect competition Price Zero profits in LR equilibrium mC AC d=mR p q The significance of zero-profits quantity Remember that total costs include the opportunity cost Zero economic profits does not mean zero accounting profits It means that the accounting profits are equal to the opportunity cost i.e the reward for producing is “fair” SR and LR in perfect competition Efficiency: Price Zero profits in LR equilibrium mC AC d=mR p q quantity At equilibrium, P=mc=AC All the increasing returns to scale opportunities are used up, but decreasing returns to scale have not yet appeared Firms are producing at the most efficient point Resources are allocated efficiently: the smallest amount of resources possible is allocated to the production The benchmark of perfect competition The interaction of supply and demand The 5 conditions of perfect competition Short run and long run in perfect competition Surplus and welfare Surplus and welfare What is “surplus” ? It measures the net benefit to the consumers of purchasing the good... ...or the net benefit to the producer of selling the good It is the difference between: The reservation price of the agents : the “willingness to pay” for consumers and the marginal cost for producers The price the good is exchanged on the market. Surplus and welfare But how it is worked out ? Reminder: the demand function is derived from the utility function (in fact from the indifference curves which map the utility function) Actually, very simply !! It contains information about preferences, i.e. what a given good/bundle is worth to the consumer in terms of utility The same is true for the supply curve: It contains information about the marginal cost of production, i.e. the value of the good under which producers will not produce Surplus and welfare Example: Auction vs market Price 1st unit bought by the most “desperate” consumer: The one willing to pay the most 2.50 2nd unit bought by the second most “desperate” consumer: The one willing to 2.00 pay the most from the remaining agents 1.50 But on a market, all 8 units are available at p = 1. 1.00 0.50 D 0 1 2 3 4 5 6 7 8 9 10 11 Quantity Surplus and welfare Consumer surplus P Consumer surplus Effect of a fall in price on the surplus of existing consumers P1 P2 Surplus of new consumers who can now afford the good D Q1 Q2 Q Surplus and welfare Producer surplus P Effect of an increase in price on the surplus of existing producers S P2 Surplus of new producers who can now supply the good P1 Producer surplus Q1 Q2 Q Surplus and welfare Global surplus under perfect competition P S P* D Q* Q