here - Grosse Pointe Public Schools

advertisement

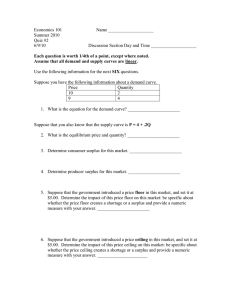

Handout # Name _____________________________________ Hour _______ Final Exam Review – 40 pts Due on Exam Day Vocabulary: Define the following terms Unit 1: Personal Finance Credit Deduction Diversification FDIC FICO Score Tax Base Unit 2: Economics and Choice (Ch.1-3) Capitalism Communism Cost Benefit Analysis Efficiency Free Rider Macroeconomics Microeconomics Open Opportunity Public Goods Unit 4: Supply and Demand (Ch. 4-6) Complementary goods Demand Curve Disequilibrium Equilibrium Price Law of Diminishing Marginal Utility Price Ceiling Price Floor Shortage Supply Surplus Variable Costs Unit 5: Market Structures (Ch. 7) Barrier to Entry Economies of Scale Merger Monopolistic Competition Monopoly Non-price Competition Perfect Competition Predatory Pricing Unit 6: Business Organizations (Ch. 8) Bond Modified Free Enterprise Franchise Public Corporation Unit 7: Measuring Economic Performance (Ch 12-13) Aggregate Demand Depression Gross Domestic Product (GDP) Elasticity of Demand Inflation Unit 8: Gov’t in Economy & Int’l Trade (Ch. 10, 15-17) Budget Deficit Budget Surplus Economic Interdependence Federal Debt Ceiling European Union (EU) Protectionist Policies Trade Barrier Questions: write all answers in complete sentences Unit 1: Personal Finance 1. Why would someone make a long term investment? A short term investment? 2. What are the three guidelines for investing? 3. What are the least risky and riskiest investments? 4. What is the difference between credit cards and debit cards? 5. What is a sin tax 6. What is a regressive tax? Give an example Unit 2: Economics and Choice (Ch.1-3) 7. What are the four factors of production? 8. What does “No such thing as a free lunch” mean? 9. What is the difference between positive and normative economics? 10. What is the invisible hand? 11. Describe elements of a market economy. 12. What is a circular flow model? Identify the sectors, markets and how goods and money flow. 13. What are the goals of producers? 14. What is an externality? What is the difference between a positive and negative externality? Unit 4: Supply and Demand (Ch. 4-6) 15. Draw a supply and demand curve. Label all parts. For what is each used? What do the points represent? 16. Where is equilibrium on a supply and demand curve? 17. What are factors that influence supply? 18. What are the factors that influence demand? 19. How does lowering prices affect producers and consumers? 20. What happens to price when supply increases? Decreases? 21. What happens to price when demand increases? Decreases? Unit 5: Market Structures (Ch. 7) 22. Name and describe the different types of monopolies. 23. Why is market allocation illegal? Unit 6: Business Organizations (Ch. 8) 24. Name and describe the different types of business organizations. Unit 7: Measuring Economic Performance (Ch. 12-13) 25. What does a change in GDP measure? 26. What is a business cycle? What are the four periods of the business cycle? 27. Name and describe the three different indicators that measure economic performance. 28. What is the underground economy? 29. What are the criteria for something to be included in a particular year’s GDP? 30. What are the types of unemployment? Unit 8: Gov’t in Economy and Int’l Trade (Ch. 10, 15-17) 31. What is the Federal Reserve System? 32. Explain expansionary and contractionary fiscal policy. 33. In what two ways does the government influence the economy? 34. Why are imports good for consumers? 35. What factors contribute to a deficit? 36. What is the difference between comparative and absolute advantage? 37. What is NAFTA? 38. Why do countries import goods? 39. What is the purpose of the WTO?