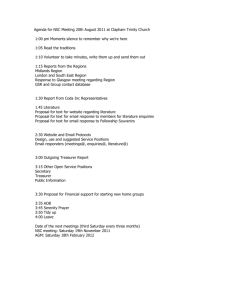

Workplace Strategy Utility Division 6-21-10

advertisement

Workplace Strategy Utility Division Meeting Jim Johnson June 21, 2010 ® Future Vision for Workplace Recent Council Legacy as a Membership Organization, a Workplace Safety Trainer, Supplemented by Surveys and Assessments Vision of Council as a Workplace Safety Leader: • With knowledge and practices based on data and statistical analysis • Led by surveys, assessments, and measurement • Supported by membership • Supplemented by training and resources Strategic Objectives Safety Focus Financial • Reduce workplace injuries - 5 year goal of 400 lives saved and 480,000 injuries prevented • Strong year over year growth - Revenue from surveys, assessments, online, workbench an increasing % of total • Reduce non-fatal injuries by risk category - Overexertion, slips, trips, falls • Meeting target return on revenue - Strategy for reinvesting in advocacy and enhancements to workplace business • Reduce fatal injuries by risk category - Motor vehicle, falls from heights • Long term objective of exceeding $10MM revenue (scale) • Impact safety off the job • Recognition as the number one provider for midsized and small market segments Target Market • Advocate for small and mid-sized (<1,000 employee) bringing best practices and effective tools - Research, Campbell, World Class Team, Customer best practices, data studies • Increase impact by reaching more organizations and more workers • Safety partner for large organizations where we can support and enhance - National leadership in applying best practices Journey to Safety Excellence • Leadership, Engagement and Culture - Employee perception surveys - Leadership workshops • Safety Management Systems - System assessments - Best practices and skill/knowledge transfer • Risk Reduction - Improvement action management - Non-fatal and fatal target risk solutions • Performance Measurement - Safety workbench guiding safety process 3 Tools for the Journey to Safety Excellence Measure/Re-measure (Survey & Assess) “Baseline & Improvement over Baseline” Capture Lessons Learned “Enhance Best Practices” Leadership, Engagement & Culture Safety Management Systems Risk Reduction Performance Measurement Implement Plans & Manage Improvement “Close the Gap” Determine Gaps & Set Goals “Vision for What Could Be” Develop Improvement Plans “Apply Best Practices” 4 Competition Safety market is highly fragmented . . . Competitor Safety Revenue Bureau Veritas DuPont Safety Resources Marsh-Risk Consulting Practice Major Players 510,929,000 200,000,000 112,400,000 $823,329,000 ATC Associates Inc. ESIS Inc. Liberty Mutual Group-Commercial Market E4Safety Professionals L.L.C. Safety Management Group Regional Reporting Inc. Safety Resources Large Players 52,741,832 28,750,000 19,700,000 14,670,000 12,585,350 12,000,000 10,494,696 $150,941,878 Gallagher Bassett Services Inc. F.A. Richard & Associates Inc. dba FARA Risk Consultants Inc. FDRsafety L.L.C. PSRG Inc. CAS-Claims Administrative Services Inc. National Safety Council Conner Strong Risk Control Zurich Services Corp. Strategic Safety Associates/MoveSMART Bickmore Risk Services & Consulting Applegate Associates, A Safegate Co. Meadowbrook Inc. Network Safety Consultants Inc. Safety Alert Network Inc. PMA Management Corp. Medium Players 7,940,000 7,865,000 7,200,000 6,500,000 5,500,000 3,835,290 3,500,000 3,260,000 2,960,000 2,847,035 2,830,082 2,100,000 2,069,000 1,275,000 1,250,000 1,222,245 $62,153,652 Safety Revenue Competitor Chubb Services Corp. Five Star Risk Management Services Safety Dynamics Group Safety Consulting Inc. Easy Safety Solutions Reliability Group Loss Control Associates Inc. RPF Associates AcceptableRisk CompManagment Inc. Risk Services Other Total Small 860,000 800,000 458,000 400,000 375,000 350,000 290,000 220,000 215,000 200,001 459,407,469 $463,575,470 Estimated Workplace Safety Market Training and Consulting $1,500,000,000 Small (?) MM Major (3) $ MM Large (7) MM Medium (16) MM Source: Business Insurance Annual Listing of Safety Consultants (August 24, 2009) 5 The Environment Issues Opportunities • Current NSC market approach is highly transactional . . . Commodity products • New leadership and recognition of need for increased investment • Training content is underinvested . . . Go forward investment resources are limited • Workplace is the foundation of NSC . . . High brand recognition • Online capability for training is significantly behind competitors . . . NSC 0% Web delivery, some competitors 100% • Profitable and high quality existing business for survey . . . Potential for consulting • No electronic delivery of product • Widely divergent operating models for independent chapters • COC training delivery model costly . . . Few trainers, high travel • Larger competitors focused less on midsized and small organizations • Insurance companies and brokers have pulled back from small and medium sized customers . . . Focus on risk assessment for underwriting • NSC COCs in states with high worker populations (CA, TX, GA, N.FL, IL) and strong distribution network through membership base and Independent Chapters • Increasing recognition of the value in measurement, data, and software solutions (“workbench”) • Strong potential for partnerships that add high value 6 Strategic Objectives Core Strategic Offering Survey / Assess / Consult Determining where you are and where you need to go • Existing survey and safety system assessment • Gap and goal definition • Improvement plans • Alignment of resources • Call center “Safety Help Desk” Knowledge / Skill Transfer • Increase online content with long-term Developing capabilities to support the improvement process Managing the improvement process goal of blended learning in classrooms, onsite and online • Modular content, mix and match to individual needs including blended • Develop leadership & behavioral workshops Tools – Safety Workbench Software Solution • • • • • Data capture and management tool Guides business process for safety Assists with benchmarking Measures performance Manages improvement, tracks compliance Approach for Execution • Survey product is best in class Improve follow through with customer needs Grow midsized and small through increased automation • Enhance assessments Provide self-assessment in Workbench as well as onsite • Consult to support improvement process Preferred Provider Network for on-site work and support • Partner with an online provider for immediate offerings and revenue • Partner with a leadership / behavioral provider and develop co-branded offering • Leverage online partner resources for NSC content conversion • Currently negotiating with Summit and BST, Terms & Conditions TBD • Partner with a software company • Design fixed functionality for small / midsized organizations and customize for large • Leverage partner to host technology • Terms & Conditions TBD Knowledge, Value, Relationship 7 Strategy Implementation 2011 Survey / Assess / Consult • Continued strong growth • Assessment update/process • Marketing/sales push Knowledge / Skill Transfer • Partnership contract • OSHA 10/30 hour online • OSHA compliance online • Complete course / content plan • ASC initial online transition • Special projects (e.g. USMC) Tools - Safety Workbench Software Solution • Partnership contract • Safety / business process • Pilot (COC) • Congress rollout PPO • • • • Contracts and negotiated rates in place Certified, tested Metrics established Quality control Center of Excellence (Advocacy) • Knowledge management and sharing plan • Technology plan 2012 Survey / Assess / Consult • Build volume of midsized and small customers • Increase use of online admin of surveys • Growth of SMS assessment business, online & onsite (provider) Knowledge / Skill Transfer • Progress with course/content plan • Continued ASC online transition • Emergence of adaptable, blended models • Conversion to e-product vs. warehousing of hard product • Virtual symposiums and webinars Tools - Safety Workbench Software Solution • Building volume, initial renewals • Benchmarking tools • Strengthen tie to supporting offerings (content, training) PPO • • • • Monthly provider tracking First contract renewals Metrics updated Provider forum (webcast) Center of Excellence • Pilot (COC) • Advisory Board (World Class Team) • Incorporation of valued outcomes from Campbell and Executive Edge Track 2013 2014 Survey / Assess / Consult • Confidence in renewable customer base • Refinement / expansion of SMS assessment tools • Continued increase as % of total workplace revenue Survey / Assess / Consult • Significant % of total workplace revenue • Recognition as high quality, trusted, reliable partner with consulting based on data driven best practices Knowledge / Skill Transfer • Online continues to increase as % of total training revenue • E-product continues to increase as % of total product revenue • Evidence of adaptations to evolving technology Knowledge / Skill Transfer • Online a significant % of total training revenue • Solid onsite, dedicated training business • Classroom managed as a quality compliment to online and onsite Tools - Safety Workbench Software Solution • Emerging as major revenue line • Track record of renewals and new subscriptions • Continued enhancements Tools - Safety Workbench Software Solution • Substantial subscriber base with strong renewal and net gain • Significant other revenue driven from tools (e.g. training) • User conference PPO • • • Continued growth in revenue served Incremental NSC staff growth to manage provider teams and customer business Possible industry specialization, technical specialization Center of Excellence • Online with hit tracking • Quality control plan for content management • Statistical studies from workbench data • Basis for advocacy work PPO • Global network recognized by the NSC brand and distinguished for quality, trust, reliability Center of Excellence • Continued growth in use • Recognition as among the best in class for similar offerings • Recognized as a preeminent source of best practice, reliable solutions and results driven advocacy. 8 Online Training and “Safety Workbench” partnerships New Products Online Training Partnership Evaluate NSC classroom courses in relation to providers online course content and create plan for online development OSHA 10 hour / 30 hour construction / industry training (Spanish for industry) for immediate offering OSHA compliance series for immediate offering Evaluate other partner courses for potential offering Evaluate potential for use of partner’s Learning Management System Create branded web site and define business process (online orders, payment, etc.) Final agreements and terms and conditions by June 1, 2010 “Safety Workbench” Partnership Service Bureau model (NSC as primary license holder and administrator) Annual subscription, standard pricing and member discount (renewable revenue) Net growth goals from high percent retention and new subscribers No partner cost based on revenue share model Call center model for phone consultation, preferred providers for onsite consultation Potential for additional revenue through aligned resources and training Data for research, push of analysis reports to add value, offer of additional functionality for additional fee Partner selection and terms and conditions targeted for July 1, 2010 Attempt to complete pilot and obtain initial subscriptions with formal rollout at Congress 9 New Products Preferred Provider Organization Provider contract prepared and ready for use Government, Western, Central, Northeast and Southeast candidates identified Continued identification of additional quality providers Coordination with International for global provider network Re-qualify existing providers Negotiate rates and finalize contracts Annual contract renewal with updated rates negotiated Develop quality control program and evolve NSC safety consultant role for provider oversight 10 Questions? 11 12