discussion monopoly

advertisement

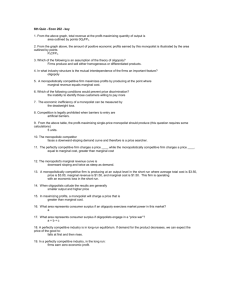

8. The following table shows revenue, costs, and profits, where quantities are in thousands, and total revenue, total cost, and profit are in millions of dollars: Price $100 90 80 70 60 50 40 30 20 10 0 Quantity (1,000s) 0 100 200 300 400 500 600 700 800 900 1,000 Total Revenue $0 9 16 21 24 25 24 21 16 9 0 Marginal Revenue ---$9 7 5 3 1 -1 -3 -5 -7 -9 Total Cost $2 3 4 5 6 7 8 9 10 11 12 Profit $-2 6 12 16 18 18 16 12 6 -2 -12 a. A profit-maximizing publisher would choose a quantity of 400,000 at a price of $60 or a quantity of 500,000 at a price of $50; both combinations would lead to profits of $18 million. b. Marginal revenue is always less than price. Price falls when quantity rises because the demand curve slopes downward, but marginal revenue falls even more than price because the firm loses revenue on all the units of the good sold when it lowers the price. c. Figure 2 shows the marginal-revenue, marginal-cost, and demand curves. The marginalrevenue and marginal-cost curves cross between quantities of 400,000 and 500,000. This signifies that the firm maximizes profits in that region. Figure 2 d. The area of deadweight loss is marked “DWL” in the figure. Deadweight loss means that the total surplus in the economy is less than it would be if the market were competitive, because the monopolist produces less than the socially efficient level of output. e. If the author were paid $3 million instead of $2 million, the publisher would not change the price, because there would be no change in marginal cost or marginal revenue. The only thing that would be affected would be the firm’s profit, which would fall. f. To maximize economic efficiency, the publisher would set the price at $10 per book, because that is the marginal cost of the book. At that price, the publisher would have negative profits equal to the amount paid to the author. Figure 3 5. a. The table below shows total revenue and marginal revenue for the bridge. The profitmaximizing price would be where revenue is maximized, which will occur where marginal revenue equals zero, because marginal cost equals zero. This occurs at a price of $4 and quantity of 400. The efficient level of output is 800, because that is where price is equal to marginal cost. The profit-maximizing quantity is lower than the efficient quantity because the firm is a monopolist. Price $8 7 6 5 4 3 2 1 0 Quantity 0 100 200 300 400 500 600 700 800 Total Revenue $0 700 1,200 1,500 1,600 1,500 1,200 700 0 Marginal Revenue ---$7 5 3 1 -1 -3 -5 -7 b. The company should not build the bridge because its profits are negative. The most revenue it can earn is $1,600,000 and the cost is $2,000,000, so it would lose $400,000. c. If the government were to build the bridge, it should set price equal to marginal cost to be efficient. Since marginal cost is zero, the government should not charge people to use the bridge. Figure 7 d. Yes, the government should build the bridge, because it would increase society's total surplus. As shown in Figure 7, total surplus has area ½x 8 x 800,000 = $3,200,000, which exceeds the cost of building the bridge. Price Discrimination 13. a. Figure 11 shows the cost, demand, and marginal-revenue curves for the monopolist. Without price discrimination, the monopolist would charge price PM and produce quantity QM . Figure 11 b. The monopolist's profit consists of the two areas labeled X, consumer surplus is the two areas labeled Y, and the deadweight loss is the area labeled Z. c. If the monopolist can perfectly price discriminate, it produces quantity QC, and has profit equal to X + Y + Z. d. The monopolist's profit increases from X to X + Y + Z, an increase in the amount Y + Z. The change in total surplus is area Z. The rise in the monopolist's profit is greater than the change in total surplus, because the monopolist's profit increases both by the amount of deadweight loss (Z) and by the transfer from consumers to the monopolist (Y). e. A monopolist would pay the fixed cost that allows it to discriminate as long as Y + Z (the increase in profits) exceeds C (the fixed cost). f. A benevolent social planner who cared about maximizing total surplus would want the monopolist to price discriminate only if Z (the deadweight loss from monopoly) exceeded C (the fixed cost) because total surplus rises by Z − C. g. The monopolist has a greater incentive to price discriminate (it will do so if Y + Z > C) than the social planner would allow (she would allow it only if Z > C). Thus if Z < C but Y + Z > C, the monopolist will price discriminate even though it is not in society's best interest. Monopolistic Competition 8. a. If there were many suppliers of diamonds, price would equal marginal cost ($1,000), so the quantity would be 12,000. b. With only one supplier of diamonds, quantity would be set where marginal cost equals marginal revenue. The following table derives marginal revenue: Price (thousands of dollars) Quantity (thousands) Total Revenue (millions of dollars) 8 7 6 5 4 3 2 1 5 6 7 8 9 10 11 12 40 42 42 40 36 30 22 12 Marginal Revenue (millions of dollars) ---2 0 –2 –4 –6 –8 –10 With marginal cost of $1,000 per diamond, or $1 million per thousand diamonds, the monopoly will maximize profits at a price of $7,000 and a quantity of 6,000. Additional production beyond this point would lead to a situation where marginal revenue is lower than marginal cost. c. If Russia and South Africa formed a cartel, they would set price and quantity like a monopolist, so the price would be $7,000 and the quantity would be 6,000. If they split the market evenly, they would share total revenue of $42 million and costs of $6 million, for a total profit of $36 million. So each would produce 3,000 diamonds and get a profit of $18 million. If Russia produced 3,000 diamonds and South Africa produced 4,000, the price would decline to $6,000. South Africa’s revenue would rise to $24 million, costs would be $4 million, so profits would be $20 million, which is an increase of $2 million. d. Cartel agreements are often not successful because one party has a strong incentive to cheat to make more profit. In this case, each could increase profit by $2 million by producing an extra 1,000 diamonds. However, if both countries did this, profits would decline for both of them. 5. a. Figure 4 illustrates the market for Sparkle toothpaste in long-run equilibrium. The profitmaximizing level of output is QM and the price is PM. Figure 4 b. Sparkle's profit is zero, because at quantity QM, price equals average total cost. c. The consumer surplus from the purchase of Sparkle toothpaste is areas A + B. The efficient level of output occurs where the demand curve intersects the marginal-cost curve, at QC. The deadweight loss is area C, the area above marginal cost and below demand, from QM to QC. d. If the government forced Sparkle to produce the efficient level of output, the firm would lose money because average total cost would exceed price, so the firm would shut down. If that happened, Sparkle's customers would earn no consumer surplus. 8. a. Tap water is a perfectly competitive market because there are many taps and the product does not differ across sellers. b. Bottled water is a monopolistically competitive market. There are many sellers of bottled water, but each firm tries to differentiate its own brand from the rest. c. The cola market is an oligopoly. There are only a few firms that control a large portion of the market. d. The beer market is an oligopoly. There are only a few firms that control a large portion of the market. 6. Suppose that an industry is characterized as follows: C 100 2Q2 MC 4Q P 90 2Q MR 90 4Q a. Firm total cost function Firm marginal cost function Industry demand curve Industry marginal revenue curve . If there is only one firm in the industry, find the monopoly price, quantity, and level of profit. If there is only one firm in the industry, then the firm will act like a monopolist and produce at the point where marginal revenue is equal to marginal cost: MC=4Q=90-4Q=MR Q=11.25. For a quantity of 11.25, the firm will charge a price P=90-2*11.25=$67.50. The level of profit is $67.50*11.25-100-2*11.25*11.25=$406.25. b. Find the price, quantity, and level of profit if the industry is competitive. If the industry is competitive then price is equal to marginal cost, so that 90-2Q=4Q, or Q=15. At a quantity of 15 price is equal to 60. The level of profit is therefore 60*15-100-2*15*15=$350. c. Graphically illustrate the demand curve, marginal revenue curve, marginal cost curve, and average cost curve. Identify the difference between the profit level of the monopoly and the profit level of the competitive industry in two different ways. Verify that the two are numerically equivalent. The graph below illustrates the demand curve, marginal revenue curve, and marginal cost curve. The average cost curve hits the marginal cost curve at a quantity of approximately 7, and is increasing thereafter (this is not shown in the graph below). The profit that is lost by having the firm produce at the competitive solution as compared to the monopoly solution is given by the difference of the two profit levels as calculated in parts a and b above, or $406.25-$350=$56.25. On the graph below, this difference is represented by the lost profit area, which is the triangle below the marginal cost curve and above the marginal revenue curve, between the quantities of 11.25 and 15. This is lost profit because for each of these 3.75 units extra revenue earned was less than extra cost incurred. This area can be calculated as 0.5*(60-45)*3.75+0.5*(45-30)*3.75=$56.25. The second method of graphically illustrating the difference in the two profit levels is to draw in the average cost curve and identify the two profit boxes. The profit box is the difference between the total revenue box (price times quantity) and the total cost box (average cost times quantity). The monopolist will gain two areas and lose one area as compared to the competitive firm, and these areas will sum to $56.25. P MC lost profit MR Demand Q 11.25 15 2. Consider two firms facing the demand curve P = 50 - 5Q, where Q = Q1 + Q2. The firms’ cost functions are C1(Q1) = 20 + 10Q1 and C2(Q2) = 10 + 12Q2. a. Suppose both firms have entered the industry. What is the joint profit-maximizing level of output? How much will each firm produce? How would your answer change if the firms have not yet entered the industry? If both firms enter the market, and they collude, they will face a marginal revenue curve with twice the slope of the demand curve: MR = 50 - 10Q. Setting marginal revenue equal to marginal cost (the marginal cost of Firm 1, since it is lower than that of Firm 2) to determine the profit-maximizing quantity, Q: 50 - 10Q = 10, or Q = 4. Substituting Q = 4 into the demand function to determine price: P = 50 – 5*4 = $30. The question now is how the firms will divide the total output of 4 among themselves. Since the two firms have different cost functions, it will not be optimal for them to split the output evenly between them. The profit maximizing solution is for firm 1 to produce all of the output so that the profit for Firm 1 will be: 1 = (30)(4) - (20 + (10)(4)) = $60. The profit for Firm 2 will be: 2 = (30)(0) - (10 + (12)(0)) = -$10. Total industry profit will be: T = 1 + 2 = 60 - 10 = $50. If they split the output evenly between them then total profit would be $46 ($20 for firm 1 and $26 for firm 2). If firm 2 preferred to earn a profit of $26 as opposed to $25 then firm 1 could give $1 to firm 2 and it would still have profit of $24, which is higher than the $20 it would earn if they split output. Note that if firm 2 supplied all the output then it would set marginal revenue equal to its marginal cost or 12 and earn a profit of 62.2. In this case, firm 1 would earn a profit of –20, so that total industry profit would be 42.2. If Firm 1 were the only entrant, its profits would be $60 and Firm 2’s would be 0. If Firm 2 were the only entrant, then it would equate marginal revenue with its marginal cost to determine its profit-maximizing quantity: 50 - 10Q2 = 12, or Q2 = 3.8. Substituting Q2 into the demand equation to determine price: P = 50 – 5*3.8 = $31. The profits for Firm 2 will be: 2 = (31)(3.8) - (10 + (12)(3.8)) = $62.20. b. What is each firm’s equilibrium output and profit if they behave noncooperatively? Use the Cournot model. Draw the firms’ reaction curves and show the equilibrium. In the Cournot model, Firm 1 takes Firm 2’s output as given and maximizes profits. The profit function derived in 2.a becomes 1 = (50 - 5Q1 - 5Q2 )Q1 - (20 + 10Q1 ), or 40Q1 5Q12 5Q1Q2 20. Setting the derivative of the profit function with respect to Q1 to zero, we find Firm 1’s reaction function: Q = 40 10 Q1 - 5 Q2 = 0, or Q1 = 4 - 2 . Q1 2 Similarly, Firm 2’s reaction function is Q Q2 3.8 1 . 2 To find the Cournot equilibrium, we substitute Firm 2’s reaction function into Firm 1’s reaction function: Q 1 Q1 4 3.8 1 , or Q1 2.8. 2 2 Substituting this value for Q1 into the reaction function for Firm 2, we find Q2 = 2.4. Substituting the values for Q1 and Q2 into the demand function to determine the equilibrium price: P = 50 – 5(2.8+2.4) = $24. The profits for Firms 1 and 2 are equal to 1 = (24)(2.8) - (20 + (10)(2.8)) = 19.20 and 2 = (24)(2.4) - (10 + (12)(2.4)) = 18.80. c. How much should Firm 1 be willing to pay to purchase Firm 2 if collusion is illegal but the takeover is not? In order to determine how much Firm 1 will be willing to pay to purchase Firm 2, we must compare Firm 1’s profits in the monopoly situation versus those in an oligopoly. The difference between the two will be what Firm 1 is willing to pay for Firm 2. From part a, profit of firm 1 when it set marginal revenue equal to its marginal cost was $60. This is what the firm would earn if it was a monopolist. From part b, profit was $19.20 for firm 1. Firm 1 would therefore be willing to pay up to $40.80 for firm 2.