Report of "UTK"

advertisement

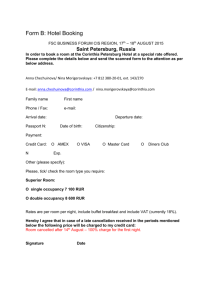

“SOUTHERN TELECOMMUNICATIONS COMPANY” PJSC Agenda of the Annual General Shareholders’ Meeting of “UTK” PJSC 30.06.2004 1. Approval of the annual report, annual financial accounts including profit and loss statement (profit and loss accounts), distribution of profits and losses of the Company according to the results of the reporting financial year (2003). 2. Determination of 2003 dividend size, form and time of payment under each category and type of shares 3. Election of the members to the Company’s Board of Directors 4. Election of the members to the Company’s Auditing Commission 5. Appointment of the Company’s Auditor for the year 2004 6. Determination of the rates of deductions for calculation of the annual remuneration to be paid to the members of the Board of Directors 7. Introduction of amendments and additions to the Company’s Charter 8. Introduction of amendments and additions to the Company’s Provisions on the Board of Directors 9. Introduction of amendments and additions into the Company’s Provisions on the Management Board 1 REPORT 10. Introduction of amendments and additions to the Company’s ANNUAL Provisions on the30.06.2004 “SOUTHERN TELECOMMUNICATIONS COMPANY” PJSC Approval of the annual report, annual financial accounts including profit and loss statement (profit and loss accounts), distribution of profits and losses of the Company according to the results of the reporting financial year (2003). Speaker – I.F. Ignatenko, General Director of “UTK” PJSC ANNUAL REPORT 2 30.06.2004 STRUCTURE OF THE REPORT General information about “UTK” PJSC The Company’s structure Significant corporate events of the year Positioning in the market Performance results Financial results Auditor’s Opinion Report of the Auditing Commission Development prospects ANNUAL REPORT 3 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY Full registered name, date of the registration http:\\www.stcompany.ru E-mail: operator@mail.stcompany.ru Tel. +7(8612) 53-20-56 Registered by the Act of the Krasnodar City Registration Chamber №494 series А Head office: 66, Karasunskaya Street, Krasnodar ANNUAL REPORT 4 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY Authorized capital Common registered nondocumentary shares Preferred registered nondocumentary shares 2 960 512 964 972 151 838 Size - 1 bln 297 mln 779 ths 384,66 rubles Par value - 0,33 ruble ANNUAL REPORT 5 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY Ownership structure 100% 90% 80% 70% 60% 50% 88,7 82,91 83,87 11,3 17,09 16,13 2001 2002 2003 40% 30% 20% 10% 0% Legal persons Individuals ANNUAL REPORT 6 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY Capital structure "Branswick UBS Warburg Nominees" CJSC 5.61% Other 20.66% "Investitsionnaya kompaniya svyazi" OJSC (“Svyazinvest” OJSC) 38.16% J.P. Morgan Chase Bank 4.65% "ABN AMRO Bank А.О." CJSC 7.12% "ING Bank (Euroasia) " CJSC 6.54% LINDSELL ENTERPRISES LIMITED – holder 1.82% "DKK" CJSC 15.44% ANNUAL REPORT 7 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY Market capitalization of inter-regional entities, USD mln 1415 1500 as at 31.10.2002 as at 01.01.2003 as at 01.01.2004 803 691 117 372 95 524 484 368 131 56 367 258 323 191 352 90 22 "North-Western telecom" OJSC "UTK" PJSC "SibirTelecom" OJSC "Central Telecom" OJSC "VolgaTelecom" OJSC "Uralsvyazinform" OJSC 0 ANNUAL REPORT 85 133 "Dalsvyaz" OJSC 480 8 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY Dynamics of UTK share prices and market indices in 2003 Average common share (CS ) price Average preferred share (PS ) price 11 max CS 10.3 cents (20.10.03) Share price, US cents 10 9 8 7 min CS 6.93 cents (27.01.03) max PS 8.83 cents (20.10.01.03) 6 5 min PS 5.1 cents (05.01.03) 4 Source: RTS database Trading volume Amount, mln$ CS 286 5.43 PS 130 2.63 Total 416 8.06 ANNUAL REPORT 9 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY ADR capitalization of “UTK” PJSC in 2003, USD mln 12 +65.3% 10,0 7,7 Jun.03 Jul.03 4,3 7,8 May.03 6 6,9 7,1 7,4 Apr.03 8 Mar. 03 10 8,5 8,9 10,8 9,5 4,7 4 2 ANNUAL REPORT Dec.03 Nov.03 Oct.03 Sep.03 Aug.03 Feb.03 Jan.03 0 10 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY Rating Agency “Standard & Poor’s” • Corporate Governance Score 5,8 5,6 5,4 5,2 5 5,6 5,2 12 February 2003 • Long-term corporate local and foreign currency credit rating 11 November 2003 В- ССС+ 27 December 2001 02 April 2003 On August 6, 2003 Standard & Poor's assigned its "ruBBB" Russia national scale rating to PJSC "Southern Telecommunications Company" ("UTK" PJSC). At the same time, Standard & Poor's assigned its "ruBBB" rating to "UTK" PJSC Russian ruble (RUR) 1.5 billion senior unsecured bond issue due 2006 ANNUAL REPORT 11 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY The Company’s Auditor «Ernst and Young Vneshaudit» CJSC • Location Building 1, 77, Sadovnicheskaya nab., Moscow, Russia • License License No. Е003246 for auditing, in particular for general and bank auditing and for auditing of insurance companies, foundations and exchanges, was granted for five years and approved by Order No. 9 of the RF Ministry of Finance dated January 17, 2003 (valid till 17.01.2008). ANNUAL REPORT 12 30.06.2004 GENERAL INFORMATION ABOUT THE COMPANY Registrar «Registrator-svyaz» CJSC • Location 15a, Kalanchevskaya Str., Moscow, 107078, Russia. Tel./fax: (095) 933-42-21. E-mail: regsw@asvt.ru • License Number: 10-000-1-00258. Date of issue: 1.10.2002 Period of validity: unlimited. Licensing body: Federal Commission for ANNUAL REPORT Securities Market of Russia. 13 30.06.2004 THE COMPANY’S STRUCTURE Board of Directors Elected on 25.06.2003 Corporate Governance Committee Budget and Investment Planning Committee Nominations and Compensation Committee Audit Committee 40 meetings were held 184 issues were considered and approved ANNUAL REPORT 14 30.06.2004 THE COMPANY’S STRUCTURE Management Board Elected on 25.06.2003 Financial and economic operations of the Company Capital construction Development of the Company’s investment program and budget for their submission to the Board of Directors for approval Determination of the priority development trends Approval of the internal documents regulating the Company’s operations Supervising accounts receivable and drawing up actions on their reduction Social and economic development 12 meetings were held 140 issues were considered and approved ANNUAL REPORT 15 30.06.2004 THE COMPANY’S STRUCTURE Auditing Commission Elected on 25.06.2003 The terms of reference of the Auditing Commission cover: checking the reliability of the data contained in the accounts and other financial documents of the Company; revealing any facts of violation of the procedure for book-keeping and submission of financial reports, established by the legal acts of the Russian Federation; checking the observance of the legal standards in tax calculation and payment; revealing any facts of violation of the legal acts of the Russian Federation, in compliance with which the Company performs its financial and economic operations; evaluating the economic advisability of financial and economic operations of the Company. ANNUAL REPORT 16 30.06.2004 THE COMPANY’S STRUCTURE Organizational structure General Shareholders’ Meeting Board of Directors Management Board General Director General Management Branches ( 10 branches of major business) Branches ( 3 branches of secondary business) ANNUAL REPORT 17 30.06.2004 THE COMPANY’S STRUCTURE Main functional blocks of the General Management organizational structure Commercial Construction Financial Security Legal Administrative Internal Audit Accounting General management Technological Economic Corporate Governance Information Personnel management ANNUAL REPORT 18 30.06.2004 THE COMPANY’S STRUCTURE The basic directions of optimization of the Company’s organizational structure are the following: Optimization of the number of structural divisions in the Company’s branches – according to management standards Establishment of effective vertical and horizontal relations between structural divisions – according to business management doctrine Optimization of the staff number in structural divisions – in conformity with scientifically proved labor standards Improvement of systems, forms and methods of management ANNUAL REPORT 19 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR General Shareholders’ Meetings Extraordinary General Shareholders’ Meeting was held on 21.01.2003. Venue: 44, Krasnaya Street, Krasnodar, Krasnodar krai Annual General Shareholders’ Meeting was held on 25.06.2003. Venue::“Health-care center “Orbita” CJSC, Olginka, Tuapse district, Krasnodar krai. ANNUAL REPORT 20 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR Corporate reorganization Change of information technologies Rearrangement of organizational structure and human resources management Increase of efficiency of accounting and economic subdivisions Creation of communication networks’ management system Reorganization of logistical support Development of business opportunities Corporate actions of general character ANNUAL REPORT 21 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR Approval of 2003 Budget Description Measure unit Fact 2002 Plan 2003 Growth rate,% Increase in number of basic telephones sets 165 775 244 596 147,5 Average number of lines Ths lines 3 211,1 3 409,8 106,2 Revenue from sales RUR mln 10 532 13 269,6 125,9 Revenues from new services RUR mln 305,6 434,5 142,2 Income per 1 line RUR 3 279,8 3 891,6 118,6 Income per 1 employee RUR 247 572 322 124,6 130,1 Number of lines per employee Lines/em ployee 75,5 82,8 109,7 Average number of employees on pay-roll people 42 541 41 194 96,8 Average wages RUR 5 099,6 6 532,3 128,1 Capex volume RUR mln 3 571 ,6 8 308, 2 232,6 Number capacity to be put into service Ths lines 374,3 513,3 137,1 ANNUAL REPORT 22 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR Participation in exhibitions and congresses, meetings with investors Russian Economic Forum in London, 3.04.2003 International Congress "Trust and Security in the Information Society", 2122.04.2003, Moscow International Investment Forums «South of Russia-2003», 6-9.04.2003, Madrid and 26-29.09.2003, Berlin ANNUAL REPORT 23 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR Participation in exhibitions and congresses, meetings with investors International Exhibition “Svyaz-Expocomm,2003», May, 2003, Moscow International Investment Forum «Days of the Krasnodar krai in Germany», May 2003, Hannover International Exhibition of telecommunications, new infocommunication technologies and their applications «Infocommunications of Russia XXI century», September, Russia World Exhibition «Telecom-2003», October, Switzerland, Geneva ANNUAL REPORT 24 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR Participation in exhibitions and congresses, meetings with investors On April 18, 2004 a meeting of "UTK" PJSC Management and top managers of the fund ‘’Templeton Russia Fund’’ headed by Mr. Mark Mobius, the Company’s shareholder, was held in Krasnodar. On 15 September 2003 a conference with analysts and investors devoted to placement of UTK series 01 bond issue to have been performed on 18.09.2003 was held in Moscow. The Company presented its plans of business development up to 2006 at the conference. ANNUAL REPORT 25 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR Actions on investor relations and development of the secondary market of shares Program on investor relations and development of the secondary market of shares in 2003 was approved by the Board of Directors on 25 April 2003. Aims: to ensure fair market value and to form the Company’s liquid securities market, to make the Company more recognizable by the participants of the investment community ANNUAL REPORT 26 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR Customer service Integrated system of sales of telecom services and advertising in the telecommunications market of the Southern federal district Set up of Unified Accounting and Service Centers Main tasks: To meet the requirements of various categories of customers for the range of telecommunications services available. To ensure a sufficiently high level of service for key customers The efficient promotion of services to the telecommunications market of the SFD taking into account the Company’s service, regional and client segment priorities ANNUAL REPORT 27 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR Personnel management The main concept of the personnel management system used by the Company is to increase business efficiency of the company by raising the effectiveness of its human resources 90% 80% 81% 91,4% 81.6% 70.92% Provision with specialists having higher education 2002 2003 Average over “Svyazinvest” OJSC Provision with specialists having secondary special education ANNUAL REPORT 28 30.06.2004 SIGNIFICANT CORPORATE EVENTS OF THE YEAR Improvement of quality management system Improvement of quality control system in accordance with ISO 9000 standards makes it possible to ensure reliable and stable operation of the Company as well as to achieve the set goal which is to provide Southern regions of Russia with full range of integrated telecom services of high quality ANNUAL REPORT 29 30.06.2004 POSITIONING IN THE MARKET Telecommunications market of the Southern federal district 55 60 51,4% 50 45 50 40 40 35 30 46,5% 45% 23,4 28,4 30 20 15,9 25 10 20 0 2001 2002 2003 Telecommunications market, RUR bln Market share of "UTK" PJSC, % Goal: to increase UTK market share to 51% ANNUAL REPORT 30 30.06.2004 POSITIONING IN THE MARKET Telecommunications market of the Southern federal district 19,8% 26,0% 5,2% 7,4% 41,7% 2003 19,1% 4,9% 10,8% 30,7% 34,5% 2002 0% 20% 40% 60% 80% 100% Local telephony Long-distance fixed-line telephony New services (VAS) Other services Cellular communication ANNUAL REPORT 31 30.06.2004 POSITIONING IN THE MARKET Priority development trends Traditional telecommunications services Counteraction to competitors in the market of long-distance telephony. Sale promotion of services of long-distance fixed-line telephony. Development of public switched telephone network PSTN paying special attention to business sector (high profitability, good prospects of broadening the range of provided services). Introduction of universal service cards for payment of telecommunications services. Provision of package services. Introduction of time-based billing system SPUS. New value-added services Introducing new technologies and services corresponding to the tendencies of market development and meeting the customers’ real requirements (Call-centers, intelligent services, cable TV) Making value-added services more competitive including in the spheres of customer service. Developing integrated data networks (multi-service networks) in the Southern Federal District. Introduction of universal service cards to pay for telecommunications services provided. Popularization of the pre-paid cards. Technical realization of intra-regional roaming of services. ANNUAL REPORT 32 Providing services “in package”. 30.06.2004 POSITIONING IN THE MARKET Priority development trends Tariff policy to even out tariffs in the framework of the inter-regional company, to minimize tariff differences in the consolidated company taking into account regional peculiarities; to introduce step-by-step unified tariff system for all categories of customers; to reduce cross-subsidies; to bring regulated tariffs to the level of economically justified costs on the basis of separate cost accounting and standard level of profit, their further rebalancing according to “price cap” method (limit pricing); to include investment component in tariff structure; to develop tariffs on value-added services on the basis of new technologies, using the experience of domestic and foreign operators; to elaborate various tariff plans for package services; to use flexible system of discounts with regard to customer demand, growth of volume of provided services and earnings increase. ANNUAL REPORT 33 30.06.2004 PERFORMANCE RESULTS Investment policy Capital expenditures, RUR mln 12000 310.1% 202.7% 1762,2 11075,1 3571,5 0 2001 2002 2003 Fixed assets put into operation, RUR mln 12000 267.8% 164.6% 1870 8244,9 3078,4 0 2001 2002 2003 ANNUAL REPORT 34 30.06.2004 PERFORMANCE RESULTS Investment policy Capex breakdown 29,70 26,0 35,3 31,7 25,6 18,7 2003 17,4 15,6 2002 32 27 19 22 2001 0% 20% 40% 60% Extension New construction Reconstruction Technical reequipment 80% ANNUAL REPORT 100% 35 30.06.2004 PERFORMANCE RESULTS Investment policy Allocation of capital expenditures 69,4 8,3 5,6 16,6 2,6 4 15,6 2003 77,8 2002 74 12 10 4 2001 0% 20% 40% 60% 80% 100% Local telephony Long-distance telephony Value-added services Other ANNUAL REPORT 36 30.06.2004 PERFORMANCE RESULTS Investment policy Sources of financing, % 100% 25% 75% 52% 50% 48% 87,5% 12,5% 0% 2001 Own funds 2002 2003 Borrowed funds ANNUAL REPORT 37 30.06.2004 PERFORMANCE RESULTS Investment policy Borrowed funds breakdown, % 100% 22% 15% 78% 25% 50% 0% 2001 50% 14% 33% 10% 10% 2002 2003 Bank credits Bonded loans Credits from vendors Leasing Other borrowed funds 43% ANNUAL REPORT 38 30.06.2004 PERFORMANCE RESULTS Investment policy Number capacity put into operation, ths lines 600 142.3% 161.4% 95,7 374.2 60,5 231.9 436,8 35,7 196,2 532.5 313,7 rural TN urban TN 0 2001 2002 2003 ANNUAL REPORT 39 30.06.2004 PERFORMANCE RESULTS Indicators of network development Increase in the length of long-distance (intra-zonal) telephone channels , ths channel/km 3000 168.3% 111.6% 2742,05 1459,3 1629,25 2001 2002 0 2003 Fiber-optic lines put into service, km 1500 197.1% 102.7% 668,9 686,95 2001 2002 1354,3 0 2003 ANNUAL REPORT 40 30.06.2004 PERFORMANCE RESULTS Indicators of network development STM-1/4/16/64 STM-1/4/16/64 SDH equipment manufactured by Siemens, Alcatel, Lucent Technologes, Huawei are deployed in the intra-zonal transportation network STM-1/4/16/64 ANNUAL REPORT 41 30.06.2004 PERFORMANCE RESULTS Indicators of network development Increase in the number of basic telephones, ths sets 300 296.8 178.9% 81,8 108.4% 153.1 37,5 165.8 36,1 115,5 129,7 2001 2002 215 rural TN urban TN 0 2003 Installed capacity, mln lines 5 Equipped capacity, mln lines 3,8 3,5 3,3 3,6 0 at 01.01.2003 at 01.01.2004 ANNUAL REPORT 42 30.06.2004 PERFORMANCE RESULTS Indicators of network development Equipped capacity factor,% 100 98 96 94 92 90 88 86 100% 95,1% 93,4% 95,8 92,3 94,1 93,9% 93,3 95% 90% 94,1 91,3 85% 80% 2001 2002 rural TN 2003 urban TN urban and rural TNs Digitization rate,% 100 48,4% 80 60 31,6% 45,2 39,3 7,3 11,4 50% 40% 56,3 40 20 38,7% 60% 21,9 0 30% 20% 10% 0% 2001 2002 2003 ANNUAL REPORT 43 30.06.2004 PERFORMANCE RESULTS Main economic indexes Revenue from sale of goods, works, services, RUR mln 14000 128.24% 128.15% 8218,4 10531,9 13506,6 0 2001 2002 2003 Revenue from telecommunications services, RUR mln 14000 131.7% 127.1% 7899,2 10042,4 2001 2002 13222,7 0 2003 ANNUAL REPORT 44 30.06.2004 PERFORMANCE RESULTS Main economic indexes Dynamics of revenue structure from telecommunications services, % 50.4% 2003 39.8% 6668 5250,8 52.5% 2002 36.8% 5270,6 33.0% 4297,5 0% 546 756,9 3.1% 3694,8 54.4% 2001 4.1% 305,6 771,4 3.0% 2601,8 248,1 751,8 50% 100% DLD and ILD telephony Urban and rural TNs Value-added services Other telecommunications services ANNUAL REPORT 45 30.06.2004 PERFORMANCE RESULTS Main economic indexes Revenues from value-added services (VAS), RUR mln 1000 4,1% 800 3,0% 600 400 3,1% 178.7% 123.2% 200 248,1 5,0 4,0 3,0 546,1 305,6 2,0 Revenues from VAS, RUR mln Share in tariff revenues,% 1,0 0 0,0 2001 2002 2003 Dynamics of revenues from value-added services 350 300 250 200 150 100 50 0 2500 2000 1500 2002, RUR mln 2003, RUR mln Growth rate, % 1000 500 IN TV ISDN VPN IP Internet 0 ANNUAL REPORT 46 30.06.2004 PERFORMANCE RESULTS Main economic indexes Costs , RUR mln 14000 130.29% 132.43% 6058 8022,8 10452,9 0 2001 2002 2003 Dynamics of costs structure, % 33.8% 10.5% 10.3% 9.3% 14.3% 32.8% 10.9% 8.8% 9.9% 14.25% 31.4% 11.4% 10.5% 11.3% 13.7% Wages and salaries Unified income tax Depreciation charges Materials Payments to Rostelecom Electricity charges Taxes Other Security Insurance Training Advertising costs 2003 2002 2001 0% 100% ANNUAL REPORT 47 30.06.2004 PERFORMANCE RESULTS Main economic indexes EBITDA in comparable conditions, RUR bln 5 27,2% 4 23,3% 20,3% EBITDA, RUR bln 3 2 2,23 EBITDA margin,% 3,15 2,14 1 0 0% 2001 2002 2003 Cost price of one ruble of revenue, RUR 0,77 0,76 0,74 0,7 2001 2002 2003 ANNUAL REPORT 48 30.06.2004 PERFORMANCE RESULTS Main economic indexes Business efficiency 46000 329,3 45828 247,6 42541 40992 179,3 350 Staff number, people 300 250 Revenue per one employee, RUR ths 200 150 100 50 36000 0 2001 2002 2003 Growth rates of revenues and business efficiency, % 50% 38,10% 28,10% 32,71% 27,90% Growth rate of business efficiency,% Growth rate of revenue,% 0% 2002 2003 ANNUAL REPORT 49 30.06.2004 PERFORMANCE RESULTS Main economic indexes Business efficiency Revenue per one line, RUR 600 3279,80 3000 400 2681,10 413,40 489,90 539,10 2002 2003 200 0 2000 85 DLD/ILD traffic per one line, minutes 3948,50 4000 2001 2002 2003 Number of lines per one employee, lines/employee 83,40 2001 75,50 66,90 65 2001 2002 2003 ANNUAL REPORT 50 30.06.2004 PERFORMANCE RESULTS Main economic indexes Business efficiency 126,4% 6000 121,4% 123,6% Tariff revenue per one line, RUR 122,3% Costs per one line, RUR Revenue growth rate, % 3866 3127 Costs growth rate,% 3056 2498 0 2002 2003 ANNUAL REPORT 51 30.06.2004 FINANCIAL RESULTS Structure and history of balance sheet accounts, RUR bln 35 Assets 31 13,1 1,90 11,20 +5.0 +38% 18,1 4,8 +12.9 +71.3% 2,40 26,2 15,70 0 2001 35 2002 Non-current assets 2003 Current assets Liabilities 31 12,5 +0.7 18,1 13,1 9,1 0 11,8 1,6 2,5 3,8 2,5 2001 2002 Borrowed funds 5,2 Accounts payable +12.2 13,3 2003 Own funds ANNUAL REPORT 52 30.06.2004 FINANCIAL RESULTS Structure and history of balance sheet accounts, RUR bln Assets 18,1 2,40 15,70 31 4,80 +12.9 +71.3% Non-current assets 13% 87% 26,20 2002 2003 Current assets Other non-current assets Intangible assets 79,8% 2002 5 Inventories Accounts receivable (due in more than 12 months) Accounts receivable (due in less than 12 months) Cash and cash equivalents Short-term financial investments 2003 89,6% 0 84% 2003 Non-current assets Fixed assets 10 20 25 30 30,4% 62,4% 2002 15 Current assets 16% 44,1% 0 1 46,7% 2 3 4 ANNUAL REPORT 5 6 53 30.06.2004 FINANCIAL RESULTS Structure and history of balance sheet accounts, RUR bln Liabilities 31 18.1 65% 21% 14% +0.7 11,8 5,20 16,6% 13,30 +12.2 3,80 2,50 12,5 40,4% 2002 Own funds Accounts payable Borrowed funds 43% 2003 Credits and loans Borrowings Long-term Borrowings Bonds Leasing, commercial credit Short-term Bills of credit 2003 59,7% 2003 53,5% 2002 2002 0 5 10 15 20 0 2 4 6 8 10 ANNUAL REPORT 12 14 54 30.06.2004 FINANCIAL RESULTS Net assets of the Company As at 01.01.2003 1. Net assets (RUR ths) As at 01.01.2004 12 017 083 12 766 438 1 297 779 1 297 779 63 200 64 889 4. Net assets/authorized capital ratio (ROE) (line.1/line.2) (%) 925,9 983,7 5. . Net assets/sum of authorized capital and reserve fund ratio (line.1/(line.2+line.3) (%) 882,9 936,9 2. Authorized capital (RUR ths) 3. Reserve fund (RUR ths) + RUR 749.4 mln ANNUAL REPORT 55 30.06.2004 FINANCIAL RESULTS Dynamics of profit, RUR mln sales income Pre-tax profit Pre-tax profit in comparable conditions 3054 2509 2274 4500 3500 2500 1500 2160 1665 1460 1247,3 1389,6 500 -500 2001 2002 2003 4500 3500 Net profit Net profit in comparable conditions 2500 1500 978 1562 781,9 1080 871,1 500 -500 2001 2002 2003 ANNUAL REPORT 56 30.06.2004 FINANCIAL RESULTS Main directions of retained earnings distribution 1600000 Increase of share capital RUR 1080 mln Covering the losses of the reporting year 1400000 1200000 1000000 Creating a special stock fund of employees 800000 67.8% Dividend payment 600000 400000 Creating reserves 32.2% Retained earnings balance 200000 0 2001 2002 Reporting period 2003 ANNUAL REPORT 57 30.06.2004 FINANCIAL RESULTS Dividend payment, RUR 0,2 0,18908 0,18908 0,1607 0,11114 0,0812 0,0812 0 2001 2002 2003 Ordinary shares Preference shares ANNUAL REPORT 58 30.06.2004 AUDITOR’S OPINION AUDITOR’S OPINION on 2003 Financial accounts of “UTK” PJSC by “ERNST AND YOUNG VNESHAUDIT” CJSC In our opinion, in 2003 the bookkeeping procedure related to preparing the Financial accounts of "Southern Telecommunications Company" PJSC complied with the requirements of Federal Law “On Accounting” No. 129-FZ of November 21, 1996, and the above accounts prepared in compliance with the said Law reliably represent in all material aspects the financial standing of "Southern Telecommunications Company" PJSC as of December 31, 2003 and its business results for the period from January 1, 2003 till December 31, 2003 inclusive. ANNUAL REPORT 59 30.06.2004 REPORT OF THE AUDITING COMMISSION In the opinion of the members of the Auditing Commission based on the results of the audit of the Company’s business operations in 2003 and its 2003 financial accounts, financial accounts of “Southern Telecommunications Company” PJSC are prepared in the way to present, in all material respects, the assets and liabilities of "Southern Telecommunications Company" PJSC as of 31 December 2003 and its financial results for the year 2003 in compliance with the Federal Law “On Accounting” No. 129-FZ of November 21, 1996 and the normative documents of the Ministry of Finance of the Russian Federation (Orders № 34n of 29.07.98 (amended and restated), № 43n of 06.07.99, № 67n of 22.07.2003). ANNUAL REPORT 60 30.06.2004 DEVELOPMENT PROSPECTS Telecommunications development Number capacity to be put into operation, ths lines Increase in number of basic telephones, ths sets Digitization rate, % 75,4% 800 700 600 500 80 67,2% 58,2% 670 680 594 70 60 50 400 300 40 390 376 30 336 200 20 100 10 0 0 2004 2005 2006 ANNUAL REPORT 61 30.06.2004 DEVELOPMENT PROSPECTS Economic indexes Revenue, RUR bln Net profit, RUR bln Revenue share from value-added services, % 30 14 10,9% 25 11,9% 26,4 20 15 7,9% 12 10 21,1 8 17 6 10 4 5 1,35 1,97 2,87 0 2 0 2004 2005 2006 ANNUAL REPORT 62 30.06.2004 DEVELOPMENT PROSPECTS Priority trends Introduction of the procedure of obligatory feasibility study in order to determine the potential customers’ demand Formation of package services for VIP- and corporate clients Bringing state-regulated tariffs on telecom services to economically justified levels taking into account their investment component. Making up and realization of the annual Program on measures to promote the Company’s. Improvement of the system of sales and customer service Creation of universal payment system for telecom services using unified service cards. Development of integrated transportation networks. inter-regional multi-service and Searching the ways to reduce losses from unprofitable services ANNUAL REPORT 63 30.06.2004 DEVELOPMENT PROSPECTS Strategic aims and goals Strengthening the Company’s leading position in the region in order to achieve 51% of the total revenue of telecommunications sector of the Southern federal district by the year 2006 Ensuring annual growth of sales volume by 20% and increase of the Company’s capitalization per line Technical re-equipment and development of communication networks of all levels, reaching digitization rate of 75% by 2006 Creating common information space and integrating in the global information community Realization of the integrated Program on the reorganization of the merged operators in all directions by the year 2006 Increasing operating profit per one line ANNUAL REPORT 64 30.06.2004 “SOUTHERN TELECOMMUNICATIONS COMPANY” PJSC Approval of the annual report, annual financial accounts including profit and loss statement (profit and loss accounts), distribution of profits and losses of the Company according to the results of the reporting financial year (2003). Speaker – I.F. Ignatenko, General Director of “UTK” PJSC ANNUAL REPORT 65 30.06.2004 “SOUTHERN TELECOMMUNICATIONS COMPANY” PJSC Agenda item №2 Determination of 2003 dividend size, form and time of payment under each category and type of shares Speaker – S.G. Fefilova, Deputy General Director of “UTK” PJSC ANNUAL REPORT 66 30.06.2004 Determination of 2003 dividend size 2003 net profit amounted to RUR 1,080 million RUR 348.4 million were allocated to dividend payment under all categories of shares 68% Ordinary shares 32% RUR 108.0 mln Preference shares ANNUAL REPORT 67 30.06.2004 Determination of 2003 dividend size Ordinary registered nondocumentary shares Preference registered nondocumentary shares Number of shares, units Amount of dividend, RUR ths Dividend per one share, RUR 2 960 512 964 240 396 0.0812 972 151 838 108 043 0.11114 ANNUAL REPORT 68 30.06.2004 Determination of form and time of 2003 dividend payment under each category and type of shares It is proposed to pay the following 2003 dividend: 1. preference share dividend amounting to 0.11114 (naught point one one one one four) ruble per one share. Dividend should be paid in cash prior to August 29, 2004; 2. ordinary share dividend amounting to 0.08120 (naught point zero eight one two zero) ruble per one share. Dividend should be paid in cash prior to December 15, 2004. ANNUAL REPORT 69 30.06.2004 “SOUTHERN TELECOMMUNICATIONS COMPANY” PJSC Agenda item №3 Election of the members to the Company’s Board of Directors Speaker – I.F. Ignatenko, General Director of “UTK” PJSC ANNUAL REPORT 70 30.06.2004 Board of Directors of “Southern Telecommunications Company” PJSC (elected at the General Shareholders’ Meeting held on 25 June 2003, Minutes №14) № Name Post held 1 Stanislav Petrosovich Avdiyants Executive Director – Director of the Department for Economic and Tariff Policy, “Svyazinvest” OJSC 2 Vadim Yevgenyevich Belov Deputy General Director, “Svyazinvest” OJSC 3 Mikhail Borisovich Vasilyev Head of the Representative Office of “NCH Advisors Inc.” 4 Igor Vilgelmovich Volkovyski Head of Administrative Department of the Board of the Presidential Plenipotentiary in the Southern Federal District 5 Vladimir Lukich Gorbachev 1st Vice-chairman of the the RF State Duma Committee for Energy, Transport and Communications 6 Denis Viktorovich Kulikov Expert, Investor Protection Association (non-commercial organization) , “Svyazinvest” OJSC 7 Alexander Leonidovich Merzlenko Vice-president, “Renaissance-Capital” Ltd. 8 Georgy Alekseevich Romsky Deputy General Director, “Svyazinvest” OJSC 9 Stanislav Nikolaevich Panchenko Deputy General Director, “Svyazinvest” OJSC 10 Irina Petrovna Ukhina 11 Andrei Anatolyevich Tshepilov Deputy Director, Department of Corporate Governance, “Svyazinvest” OJSC ANNUAL REPORT 71 Chief specialist, Securities Department, “Svyazinvest” OJSC 30.06.2004 Information about the candidates to the Board of Directors of “UTK” PJSC № Name Post held 1 Stanislav Petrosovich Avdiyants Executive Director – Director of the Department for Economic and Tariff Policy, “Svyazinvest” OJSC 2 Vadim Yevgenyevich Belov Deputy General Director, “Svyazinvest” OJSC 3 Mikhail Borisovich Vasilyev Head of the Representative Office of “NCH Advisors Inc.” 4 Igor Vilgelmovich Volkovyski Head of Administrative Department of the Board of the Presidential Plenipotentiary in the Southern Federal District 5 Vladimir Lukich Gorbachev 1st Vice-chairman of the the RF State Duma Committee for Energy, Transport and Communications 6 Vladimir Vladimirovich Dudchenko Head of Analytical Department, Representative Office of “NCH Advisors Inc.” 7 Dmitry Georgievich Yefimov Head of the Independent Directors Group, Investor Protection Association (noncommercial organization) , “Svyazinvest” OJSC 8 Ivan Fyodorovich Ignatenko General Director, "UTK" PJSC 9 Denis Viktorovich Kulikov Expert, Investor Protection Association (non-commercial organization) , “Svyazinvest” OJSC 10 Andrey Vladimirovich Morozov Legal expert, Representative Office of “NCH Advisors Inc.” in Moscow (consulting) 11 Stanislav Nikolaevich Panchenko Deputy General Director, “Svyazinvest” OJSC 12 Iliya Vladimirovich Ponomaryov Head of the section, Department of Economic Planning and Budget, “Svyazinvest” OJSC 13 Georgy Alekseevich Romsky Deputy General Director, “Svyazinvest” OJSC 14 Elena Vladimirovna Umnova Director, Finance Department, “Svyazinvest” OJSC 15 Irina Petrovna Ukhina Deputy Director, Department of Corporate Governance, “Svyazinvest” OJSC ANNUAL REPORT 16 Andrei Anatolyevich Tshepilov Chief specialist, Securities Department, “Svyazinvest” OJSC 72 30.06.2004 Agenda item №4 Election of the members to the Company’s Auditing Commission Speaker – T.V. Rusinova, Chief Accountant of “UTK” PJSC ANNUAL REPORT 73 30.06.2004 Auditing Commission of “UTK” PJSC (elected at the Annual General Shareholders’ Meeting held on 25 June 2003, Minutes №14) № Name Post held 1 Natalia Vladimirovna Boyarskikh Chief accountant, “Kubanelectrosvyaz”, branch of "Southern Telecommunications Company" PJSC 2 Lyubov Aleksandrovna Greseva Senior specialist, Department for Internal Audit and Economic Analysis, “Svyazinvest” OJSC 3 Vladimir Vladimirovich Kozin Director, Department for Direct Investments and Property, “Svyazinvest”OJSC 4 Irina Viktorovna Prokofieva Director of the Department for Internal Audit and Economic Analysis, “Svyazinvest” OJSC 5 Kirill Viktorovich Frolov Chief specialist, Department for Internal Audit and Economic Analysis, “Svyazinvest” OJSC ANNUAL REPORT 74 30.06.2004 On 5 March 2004 UTK Board of Directors approved the resolution to nominate the following candidates to the Company’s Auditing Commission (Minutes №35) № Name Post held 1 Lyubov Aleksandrovna Greseva Senior specialist, Department for Internal Audit and Economic Analysis, “Svyazinvest” OJSC 2 Lyubov Yurievna Podgornaya Head of the section for Internal Audit, "UTK" PJSC 3 Irina Viktorovna Prokofieva Director of the Department for Internal Audit and Economic Analysis, “Svyazinvest” OJSC 4 Natalia Valerievna Uzlova Deputy head of the business accounting section, “Svyazinvest” OJSC 5 Natalia Petrovna Utina Head of the section, Department for Economic Planning and Budget, “Svyazinvest” OJSC ANNUAL REPORT 75 30.06.2004 Agenda item №5 Appointment of the Company’s auditor for the year 2004 Speaker – T.V. Rusinova, Chief Accountant of “UTK” PJSC ANNUAL REPORT 76 30.06.2004 Agenda item №6 Determination of the rates of deductions for calculation of the annual remuneration to be paid to the members of the Board of Directors Speaker – S.G. Fefilova, Deputy General Director of “UTK” PJSC ANNUAL REPORT 77 30.06.2004 It is proposed to approve the following rates of deductions for calculation of the annual remuneration to be paid to the members of the Board of Directors: 1. 0.17% of the Company’s EBITDA for the reporting year as per the Company’s IAS financial accounts 2. 0.23% of the Company’s net profit allocated to dividend payment according to the financial results of the reporting year ANNUAL REPORT 78 30.06.2004