Group Capital Adequacy

advertisement

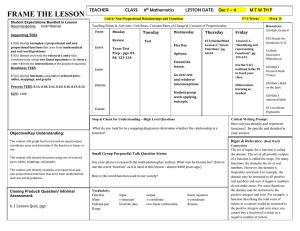

Regional Seminar for Insurance Supervisors in Latin America on Supervision of Insurance Groups Group-wide Solvency and Fungibility of Capital Jeffery Yong Senior Financial Sector Specialist, FSI 19 November 2013 Restricted Agenda Overview of group capital adequacy Approaches to group capital adequacy assessment Components of group capital requirements Considerations for group capital resources Restricted 2 Objectives of Capital Adequacy Requirements Insurers Supervisor • Absorb significant unforeseen losses to reduce: • likelihood of failure • losses to policyholders in the event of failure • Have different degrees of supervisory intervention ULTIMATE AIM: Policyholder obligations continue to be met as they fall due including in adversity Restricted 3 ICP 17 Capital Adequacy The supervisor establishes capital adequacy requirements for solvency purposes so that insurers can absorb significant unforeseen losses and to provide for degrees of supervisory intervention. Group-wide requirements do not replace legal entity/solo requirements Aim: to avoid overstating capital adequacy of insurance legal entities due to multiple gearing, leverage, group risks etc. Restricted 4 Overview of Capital Adequacy Components Supervisory Reporting Public Financial Reporting Capital = Assets less Liabilities Assessment Value of assets for supervisory purposes Assets Technical provisions Group Capital requirements Group Capital resources Margin over current estimate Liabilities Liabilities* Current estimate Regulatory capital requirements Insurer’s financial position Assets Liabilities * Assuming nil Other Liabilities Restricted 5 Lessons from the 2007 Financial Crisis - AIG “… AIG failed and was rescued … because its enormous sales of CDS were made without … setting aside capital reserves … a profound failure in corporate governance, particularly its risk management practices.” “If (the CDS) had been regulated as insurance contracts, AIG would have been required to maintain adequate capital reserves… AIG would have been prevented from acting in such a risky manner.” Source: US Financial Crisis Inquiry Commission Restricted 6 Definition of an “Insurance Group” Holding Company Insurer A Special Purpose Entity Bank A Hedge Fund Supermarkets Participation Reinsurer Insurer B Influence Risk exposure Interconnectedness Restricted 7 Sources of Group Risk Governance • Conflict of interest - risk appetite, shareholders versus policyholders • Incompetent Board and Management • Lack of ability to impose regulatory requirements Financial • Financial contagion – regulated entities supporting non-regulated entities/parent (liquidity) • Intra-group transactions and exposures • Risk concentration Group Structure • Complex organisational structure – non-regulated entities • Regulatory arbitrage • Reputational contagion • Lack of transparency Restricted 8 Double/Multiple Gearing and Intra-group Creation of Capital Group Capital Adequacy 700 1500 Parent Bank 800 With multiple gearing 5500 4000 Participation=500 Invest 900 Asset Liab. Cap.Req. Surplus 100 900 Participation=500 Invest Insurer Capital Resources 8100 Liab. Cap.Req. Surplus Cap.Req. Surplus Without multiple gearing 100 100 500 Securities Firm 800 +800 +400 =2000 800 9000 Asset 1500 +900 +500 =2900 400 4000 3500 Asset Liab. Cap.Req. Surplus 1500 +900 +500 -500 -500 =1900 Capital Resources 800 +800 +400 =2000 Cap.Req. Deficit Aim: Avoid over-estimating the solvency position of an insurance legal entity through multiple use of the same capital and minimise contagion from large intra-group holding of capital May occur via downstream/upstream/sidestream capital Restricted 9 Excessive Leverage Use proceeds to buy shares (Non-) Regulated Parent Insurer Issues debt Investors Risks to insurer: Undue stress placed on insurer due to obligation of parent to service capital instrument Ineligible (low quality) capital transformed into eligible (high quality) capital – regulatory arbitrage Restricted 10 Examples of Intra-group Transactions and Exposures (ITEs) Committed facility Letter of credit Guarantee Subordinated loan Letter of comfort • A form of credit extension where the lender agrees to lend up to a pre-defined specific sum • Can be used by a parent to provide liquidity to subsidiaries • Legal commitment, usually issued by a bank, that guarantees payment under specified conditions • Can be used to provide capital support, particularly internal reinsurance • A bond that guarantees timely payment of interest and repayment of principal to the buyers of a debt security • Can be used to support non-rated subsidiaries • A type of loan that is junior to other debts should a company be wound up • Can be used to provide capital support • A letter issued to a lender by a parent acknowledging the approval of a subsidiary's attempt for financing • Not legally binding, but provides reassurance from the parent Restricted 11 Risks Arising from ITEs Pressure on insurers Contagion - capital, income transferred out - failure of one group entity can adversely affect other (insurance) entities Capital quality - replace high quality capital Supervisory challenge - opaque and complex structure Regulatory arbitrage - evade capital requirements Restricted 12 Agenda Overview of group capital adequacy Approaches to group capital adequacy assessment Components of group capital requirements Considerations for group capital resources Restricted 13 General Approaches to Setting Group Capital Adequacy Requirements O R G A N I S AT I O N A L P E R S P E C T I V E Legal Entity Focus Group Level Focus SUPERVISORY PERSPECTIVE More weight • Capital adequacy assessed for on groupall relevant legal entities wide taking into account group supervision impact • Results binding for host and group-wide supervisors • Capital adequacy assessed as though the group behaves as a single integrated entity More weight • Capital adequacy assessed for on legal all relevant legal entities entity taking into account group supervision impact • Non-binding results - host supervisors apply insurance legal entity capital adequacy requirements • Capital adequacy assessed as though the group behaves as a single integrated entity • Results binding for host and group-wide supervisors • Non-binding results - host supervisors apply insurance legal entity capital adequacy requirements Restricted 14 Factors to Consider in Selecting an Approach Legal Authority Supervisory Role Supervisory Philosophy Insurance Group Structures Supervisory Cooperation Arrangements Restricted 15 Group Capital Adequacy Assessment Techniques Consolidation Techniques Deduction Aggregation Restricted 16 Sample Group 8 40 32 315 275 Asset Liab. Cap.Req. Surplus Parent Bank Insurer Securities Firm Non-regulated Entity 5 22 2 12 10 150 7 Liab. 120 203 Cap.Req. Surplus 10 225 138 Asset 3 17 Asset Liab. 113 Cap.Req. Surplus Asset Liab. Cap.Req. Deficit Restricted 17 Consolidation Method Parent Bank (Consolidated) Securities Firm Insurer 5 8 40 32 12 Liab. Asset Liab. 315 + 150 + 225 + 120 = 810 Asset Cap.Req. Surplus Asset 32+10 +17+ 10=69 275 + 138 + 203 + 113 = 729 Liab. 120 203 12 81 Cap.Req. Consolidated Group 10 225 138 Cap.Req. Surplus 3 17 7 10 150 275 Asset 22 2 315 Non-regulated Entity Liab. 113 Cap.Req. Surplus Asset Liab. Cap.Req. Deficit Uses consolidated balance sheet Consolidated parent bank’s balance sheet adjusted to exclude investments in subsidiaries Issue: Group may not behave as single entity in times of stress Group Surplus Restricted 18 Aggregation Method Group Aggregation Parent Bank (Unconsolidated) 67 +12 + 22 +7 = 108 67 315 + 10 + 12 +5 = 342 275 22 12 203 138 Asset Liab. Insurer Asset Liab. Securities Firm 81 Group Surplus Suitable if: Consolidated financial statements not available 113 ITEs cannot be netted out Liab. Non-regulated Entity Capital Req. Capital resources adjusted to eliminate double gearing of down-streamed capital 120 Asset 32+10 +17+ 10=69 7 225 150 12 Capital Down- Adjusted Resources streamed Capital capital Resources Liab. Asset 10+12 +5 = 27 Issue: Recalculation of capital requirements for insurers Restricted 19 Deduction Method Parent Bank (Unconsolidated) Deduct investments in dependants Add dependant’s surplus/deficit 67 315 + 10 + 12 +5 = 342 Asset 275 Liab. 67 10 + 12 + 5 = 27 Capital Resources 2+5 -3=4 12 44 32 Adjusted Parent’s Capital Capital Req. Resources Group Surplus Analysis performed from the perspective of the parent company Assess amount and transferability of capital available to the parent and the group Uses unconsolidated financial statements Restricted 20 Factors Affecting the Choice of Techniques (Non-)Availability of financial data, e.g. consolidated financial statements Ability to identify and net out ITEs Specific circumstances of the insurance groups Regardless of the techniques followed, the outcomes should be the same if not similar. Restricted 21 Fungibility of Capital and Transferability of Assets Exchange controls Participating fund Tax Laws Reasons for Lack of Fungibility Adjust capital resources Capital holders’ rights Legal enforceability of ITEs Stress versus normal conditions Restricted 22 Partial Ownership Participation Effective Control (e.g. >50% to 100% participation) • Subsidiaries are fully consolidated • In general, excess capital recognised Shared Control (e.g. 20% to 50% participation) • Only pro-rated surplus recognised • Recognise potential need for capital support from parent if in deficit No Control/Significant Influence (e.g. <20% participation) • Treat like any other investments - apply capital requirements for similar investments • Test of significant influence - no right to board membership, no coordination of business plans Restricted 23 Minority Interest Parent + Insurer 10 Parent 100 90 Capital Capital Surplus Resources Req. 100%=40 60%=60 =>40 minority interest Insurer 40 Full Integration Capital Capital Surplus Resources Req. 100 25 100 25 Capital Capital Surplus Resources Req. 90 +25 = 115 15 Capital Particip. Capital Deficit Resources Req. Bank 75 15 40 100 +40 = 140 100 + 40 + 100 = 240 40+ 60= 100 140 100 + 40 + 60 = 200 90 +25 +25 = 140 Capital Particip. Capital Resources Req. Pro-rata Integration Surplus =0 40+ 60= 100 100 90 +25 +15 = 130 Capital Particip. Capital Resources Req. 30 Deficit Need to decide between: Full integration – may amplify surplus/deficit because minority interest regarded as available to the group Pro-rata integration Even if each entity is solvent, group solvency position may be different Restricted 24 Agenda Overview of group capital adequacy Approaches to group capital adequacy assessment Components of group capital requirements Considerations for group capital resources Restricted 25 Process of Setting Regulatory Capital Requirements Determine approach Determine PCR and MCR Aggregate risks Identify risks Calibrate capital requirements Restricted 26 General Approaches to Setting Capital Requirements Standardised Approach Internal Model Approach Features Factor-based, standardised formula Insurer’s own model embedded in business Precision Calibrated for “average” insurer risk profile Tailored to the individual insurer’s risk profile – better for groups? Complexity Easy to apply – certainty for insurers Usually more complex Supervisory Resource Less resource-intensive More resource-intensive - prior and on-going approval Supervisory Risk Conservative insurers penalised, narrow risk capture, measurement error (data, model) Cherry-picking, manipulation, errors, measurement error (data, model) Restricted 27 Identify Risks: Material and Relevant Underwriting Risk Credit Risk Market Risk Operational Risk • 1918 flu pandemic, hurricane Katrina, Fukushima earthquake • E.g.: Sum at risk X 0.23% • Enron, Lehman Brothers • E.g.: AAA Corporate bond value X 0.25% • 1930 Great Depression, Black Monday 1987, 2007 Financial Crisis • E.g.: Value of equity X 30% • Barings Bank, London Whale • E.g.: Gross premium X 3% Restricted 28 Pause for Thought – Liquidity Risk Should insurers be required to hold capital to address liquidity risk? Answer: Restricted 29 Dealing with Risks from Non-regulated Entities Capital Proxy • Determine proxy capital requirement for the non-regulated entities • Suitable only if there is a comparable regulated entity/activity Total Deduction • On the parent’s balance sheet, deduct value of investments in non-regulated entities • Assumes that non-regulated entities are unable to financially support the group Total Exclusion • Entity is excluded in group capital adequacy assessment • Usually appropriate for non-financial entities if their failure does not impact the regulated entities or the group as a whole Non-Capital Measures • Impose limits on risk exposure to non-regulated entities • Governance and risk management requirements on parent and/or insurance legal entities Restricted 31 Calibrate Regulatory Capital Requirements Confidence Level Cost Safety ? Target Criteria Shock period 0 ? 1 T=1 2 3 … Effect period n Time Horizon Risk Measure VaR TVaR Restricted 32 Example - Risk Measures Value at Risk (VaR): A measure of maximum loss at a certain confidence level over a certain period of time Tail Value at Risk (TVaR): Expected loss conditional on losses being above a given percentile over a certain period of time Probability VaR @ 99%: 1% chance of loss>$10m TVaR @ 99%: Average of worst 1% losses $10m $15m Losses Restricted 33 Diversification and Concentration of Risks Groups may have diversification benefits (product lines, geographical locations, asset classes, counterparties etc.) Reasons to limit recognition of diversification in group capital adequacy assessment: Difficult to quantify precisely especially under stress conditions Constraints on transfer of diversification benefit across group – lack of fungibility of capital Offset by concentration risk that may not be explicitly quantified Restricted 34 Group Solvency Control Levels Purpose: Timely identification and mitigation of weakening parts of an insurance group Minimise risk of contagion to insurance legal entities Trigger process of coordination among different supervisors of group entities Actions taken on: Parent (if have powers) Insurance legal entities Need to be consistent with solvency control levels of insurance legal entities – e.g., group PCR > sum of legal entity MCRs Restricted 35 Determine PCR and MCR Capital Requirements Prescribed Capital Requirement (PCR) Control level above which supervisor does not intervene on capital grounds Could be single group PCR or a set of inter-dependent PCRs Going concern basis Technical Provisions Minimum Capital Requirement (MCR) Method may be different than for MCR Control level below which strongest supervisory action is taken – group context, restructuring Ultimate safety net for policyholders Lower bound for PCR Subject to minimum bound below which insurer cannot operate viably – critical mass, nominal floor Different from accounting insolvency (assets still > liabilities) Going concern basis up until MCR level Restricted 36 Example - Solvency Control Levels Capital Adequacy Ratio = Capital Resources _ Capital Requirements 190% • Prescribed capital requirement (PCR) level • Group does not need to restore capital resources/reduce risk 160% • Submission of business plan to improve capital resources • Increased on-site supervision • Additional stress and scenario testing 130% • Replace group’s management • Limit shareholder dividends • Restrict mergers and acquisition • Increase capital in insurance legal entities 110% • Minimum capital requirement (MCR) level • Winding-up of operation Restricted 37 Practical Considerations Risk Capture Practical Considerations Recalibration Proportionality Restricted 38 Agenda Overview of group capital adequacy Approaches to group capital adequacy assessment Components of group capital requirements Considerations for group capital resources Restricted 39 Pause for Thought – Ordinary Shares What are the features of ordinary shares that make them high quality capital resources? Answer: Restricted 40 Criteria to Assess Quality of Capital Elements • • • • • Free from mandatory payments and encumbrances Fixed servicing costs can accelerate insolvency Ability to restrict repayment/dividends • • Subordination to policyholders’ rights in insolvency/winding-up Holder not entitled to repayment/dividends until policyholders’ obligations are met Encumbrances Subordination Permanence Availability Period over which capital element is available Careful on incentives to redeem – e.g. step-up coupon rate at certain date • • • Capital element fully paid, usually in cash If non-cash, assess likelihood of payment Fungibility of capital – e.g. ringfenced funds Restricted 42 Key Challenges in Setting Group Capital Adequacy Requirements Lack of legal authority and supervisor powers - non-regulated entities Cross-jurisdictional entities – cooperation with other supervisors Responsibilities and mandate of group-wide and host supervisors - different “risk tolerance” Distribution of capital among group entities and geographical locations Different valuation and capital adequacy bases for entities located in different jurisdictions Group disintegrates in times of crisis Restricted 43 Summary The additional group risks arising from an insurer being part of a group should be addressed – a legal entity view alone is not sufficient Group-wide capital adequacy assessment is crucial to supplement legal entity view of solvency Group-wide capital adequacy assessment techniques should minimise multiple gearing, intra-group creation of capital and excessive leverage Limits to fungibility of capital and transferability of assets should be recognised Restricted 44 End of Presentation Any Questions? Jeffery.Yong@bis.org www.bis.org/fsi www.fsiconnect.org Restricted 45