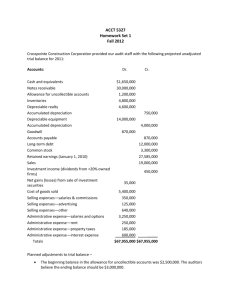

ACCT 5327 Homework Set 1 Spring 2010 Crosspointe Construction

advertisement

ACCT 5327 Homework Set 1 Spring 2010 Crosspointe Construction Corporation provided our audit staff with the following unadjusted trial balance as of December 31, 2009: Accounts: Dr. Cash and equivalents $1,650,000 Notes receivable 30,000,000 Allowance for uncollectible accounts Inventories Depreciable realty Accumulated depreciation Depreciable equipment Accumulated depreciation Goodwill Accounts payable Long-term debt Common stock Retained earnings (January 1, 2009) Sales Investment income (dividends from <20% owned firms) Net gains (losses) from sale of investment securities Cost of goods sold Selling expenses—salaries & commissions Selling expenses—advertising Selling expenses—reserve for warranties Selling expenses—other Administrative expense—salaries and options Administrative expense—rent Administrative expense—property taxes Administrative expense—interest expense Totals Cr. 1,200,000 4,800,000 4,600,000 750,000 14,000,000 4,000,000 800,000 870,000 12,000,000 3,300,000 27,185,000 17,000,000 450,000 35,000 5,400,000 350,000 125,000 70,000 640,000 3,250,000 250,000 185,000 600,000 _____ $66,755,000 $66,755,000 The audit staff has provided us with the following additional information: Planned adjustments to trial balance – The beginning balance in the allowance for uncollectible accounts was $2,500,000. The auditors believe the ending balance should be $3,000,000. Of the balance in depreciable realty, $100,000 represents land. The remainder is attributable to buildings. The firm depreciates its buildings over 30 years for GAAP, using the straight-line method. There were no new acquisitions for 2009. The firm depreciates its equipment over seven years, using the straight-line method. For tax, the equipment is 5 year property and the firm did not elect the straight-line method. There were no new acquisitions for 2009. The beginning balance in the reserve for warranties was $250,000. The auditors believe the ending balance should be the same. The firm invests most of its idle cash in short-term investments. Eighty-five percent of its dividend income was received from domestic corporations. The remaining 15 percent was received from investments in the European stock market. Other information relevant to tax accrual – “Selling expenses—other” includes meal & entertainment expenses incurred in customer development of $25,000. This account also includes charitable contributions of $600,000. “Administrative expenses—salaries and options” includes a salary of $1,450,000 paid to the firm’s president. The remainder was paid to the firm’s vice-presidents of sales, operations, and finance. None received over $1 million in straight salary. In addition to the amounts listed in the unadjusted trial balance, the firm issued nonqualified stock options to these four officers. Our audit department has determined that compensation expense should be recorded under FAS 123R in the amount of $2,850,000, to reflect the estimated market value of these options. None of the options had been exercised as of December 31. All of the firm’s construction activities take place in the United States and all of the firm’s operations constitute qualified domestic production activities for purposes of §199. 1. Compute Crosspointe’s GAAP net income before taxes for 2009. 2. Compute Crosspointe’s taxable income for 2009. 3. What will be the company’s 2009 income tax owed to the IRS? (Ignore estimated tax payments). 4. What amount will the company record as 2009 income tax expense for book (GAAP)? (For this purpose, you should compute GAAP taxable income as GAAP income before taxes plus or minus those tax deductions that will never be allowed for GAAP. Items for which the differences between book and tax are only temporary should not affect GAAP taxable income. 5. Prepare a reconciliation of the company’s book-to-taxable income. 6. What is the company’s effective tax rate (GAAP tax expense to GAAP income)?