Cost management chapter 10 16KB Oct 23 2012 10:45:33 PM

advertisement

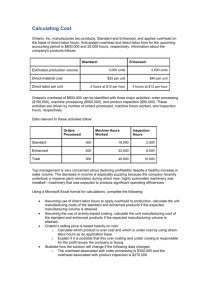

Chapter 10: Job and Order Costing: Product costing systems accumulate costs of a production process and assign them to products/services, different kinds: Job-order costing assigns costs to every job individually, appropriate if productions consists of expensive single units or small batches, used to identify profitable jobs, provide data for future jobs, managing current costs, renegotiating job contracts and to report results. Used for things like art, airplanes etc. Process costing assigns costs to a certain time period, therefore does not differentiate between single units, used for low value, indistinguishable products, e.g. soda, nails etc. Operation costing is a hybrid of the other two methods, used for similar products that are individualized for the customers, e.g. computers Basic cost flow model: Job cost opening balance + Resource TI – Resource TO = Job cost closing balance (OB + TI – TO = CB) Managing and using cost-flow info: Job-cost record records costs of all used resources for a specific job in accounts WIP account: Costs of all unfinished jobs Finished goods account: Costs of all finished, but unsold jobs Cost of sales expenses account: Cost of goods sold/shipped to customers Note: TOs usually go straight to the next account in the sequence (WIP -> FG -> COS) A material requisition form is used if raw materials are transferred to the WIP account as direct materials. Direct labour costs, including taxes and benefits -> WIP account Monthly overhead rates often differ from each other -> predetermined overhead rate (estimated indirect product costs over a year), used in a normal costing system (= applying predetermined overhead rate to jobs based on normal production capacity) Establishing POHR: 1. 2. 3. 4. 5. Identify indirect costs Estimate and sum all annual indirect costs Select cost drivers (e.g. direct labour hours) Estimate level of cost driver (e.g. 10,000 annual direct labour hours) Compute the POHR using this equation: POHR = Estimated manufacturing overhead / Estimated cost-driver level Overhead variance is the difference between applied overhead and actual overhead Actual overhead is higher -> under-applied overhead Actual overhead is lower -> over-applied overhead -> charge an immaterial overhead variance (add or subtract difference) when closing account if it is a small variance -> Allocate proportionate amounts to WIP inventory, finished goods and cost of sales if it is a big variance Reported operating income differs depending on the product-costing method used on the products: Absorption costing assigns direct material, direct labour and both fixed and variable manufacturing overhead to the finished products. Variable costing assigns direct material, direct labour and only variable manufacturing overhead. Note: Actual operational income does not change, the main difference is the time where fixed overhead costs are recognized and where they are assigned to. In variable costing, the fixed overhead for that time period is deducted from the contribution margin (which is like the gross margin in absorption costing). New, recent method: Throughput costing assigns only out-of-pocket costs (chapter 2) as direct costs and therefore removes incentive to overproduce in order to decrease the cost per unit by spreading out overhead costs over a larger number of units. The margin is called throughput margin here.