0324789416_245969

advertisement

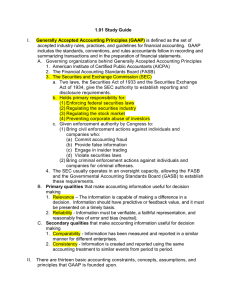

Chapter 7 Investing Activities Copyright © 2011 Thomson South-Western, a part of the Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. Investing Activities Includes acquisition of long-term – tangible & intangible assets and disposition of assets. Investment categories: Investments in long-lived operating assets Long-lived tangible fixed assets Amortizable intangible assets Non-amortizable intangible assets Investments in the securities of other firms Chapter: 07 2 Accounting for Acquisition of Property, Plant and Equipment Costs incurred to yield future benefits imply asset. Asset is recorded at Fair Value. Fair Value includes cash paid, fair value of debt incurred, fair value of lease payments. Chapter: 07 3 Cash-Flows from Acquisition of Property, Plant and Equipment When cash is paid It is a Cash outflow Reported in the investing activities section of the statement of cash flows. When debt is incurred or equity is issued It is a non-cash, investing & financing activity. Reported in a separate schedule, accompanying the statement of cash flows. Chapter: 07 4 Accounting for Research and Development Costs U.S. GAAP Internally incurred R&D costs are expensed. Externally acquired R&D are capitalized. For Industries with high R&D expenditures, U.S. GAAP requirement to expense is troublesome – because a major asset never appears on the balance sheet. IFRS Research costs are expensed. Product development costs are capitalized. Chapter: 07 5 Reporting for Research and Development Costs Reported in the statement of cash flows as operating activity. Reduces current period net income. Chapter: 07 6 Analysts Approach to R&D costs Modify financial statements If the R&D costs have a future service potential, capitalize & subsequently amortize expenditures on R&D; else, expense. When R&D costs are expensed Effect on ROA should be examined Look for volatility & growth Consolidate firms share of R&D project for joint ventures & partnerships. Chapter: 07 7 Software Development Costs Accounting: Until “technological feasibility” is achieved, all costs incurred internally are expensed. On achieving “technological feasibility” Capitalized Additional costs are subsequently amortized Area of caution for Analyst: Computer software development costs. Chapter: 07 8 Subsequent Expenditures for Enhancement or Improvements Involves additional expenditure to add or improve long-lived operating assets. Capitalize expenditures that increase service life beyond the original life of the asset. Expense repairs & maintenance to maintain expected service potential. Management judgment in this area creates opportunity for earnings management. Chapter: 07 9 Costs of Self-Construction Cost of self-constructed asset = Fair Value of all costs incurred to produce asset. Fair value includes materials, labor and overhead (variable & fixed). If internal expenditure > Cost of acquiring externally Amount = cost of external purchase Excess costs incurred are recorded as loss. Chapter: 07 10 Interest Incurred to Self-Construct Assets Avoidable interest : ‘Nil’ if a company has no debt Capitalized amount of annual interest Cannot exceed actual interest A component of Acquisition Cost Interest Expense = Actual interest – Capitalized interest Chapter: 07 11 Computation of Avoidable Interest Compute time weighted average accumulated expenditures Interest computation Interest on ‘accumulated expenditure to the extent of specific borrowing’ is calculated using ‘specific borrowing’s interest rate’ (a) Interest on ‘excess of accumulated expenditure over and above the specific borrowing’ is calculated using the ‘weighted average interest rate on other borrowings’ (b) Avoidable interest = (a) + (b) Chapter: 07 12 Cost of Acquiring Natural Resources Types of Costs Acquisition Costs • Costs of acquiring natural resources • Reclamation cost or restoration costs Chapter: 07 Exploration Costs • Costs incurred to discover the existence & location of natural resource Development Costs • Tangible costs (capitalized) • Intangible costs (expensed) 13 Accounting for Exploration Costs Successful Efforts Method Cost of successful wells are capitalized as assets; unsuccessful wells are expensed. Used by larger producers. Full Costing Method Costs of successful and unsuccessful wells are capitalized. Used by smaller producers. Chapter: 07 14 Cost of Acquiring Natural Resources for Analysts Analyst should consider the differential treatment of exploration costs. Firms disclose the method in accounting policies note to financial statements. Chapter: 07 15 Costs of Acquiring Intangible Assets U.S.GAAP & IFRS: Cost of internally developing intangibles is expensed. Intangibles acquired in a business combination have Fair values and are capitalized. Most analysts prefer immediate expensing of all intangible assets. Chapter: 07 16 Goodwill in Corporate Acquisition Acquiring firms allocate purchase price to Step 1 The fair value of identifiable tangible assets & liabilities Step 2 Identifiable intangible assets Step 3 Remainder is allocated to goodwill Chapter: 07 17 Managers’ Choice of Acquisition Costs Allocation Investing-like activities such as R&D, pretechnological feasibility software costs etc. are expensed. Managers make three primary choices: Choose an allocation method Estimated useful life and Estimated salvage value Chapter: 07 18 Managers’ Choice of Acquisition Costs Allocation (Contd.) Throughout the life of the asset, book value is tested for Impairment under U.S.GAAP & IFRS (for intangible assets with indefinite life). Appreciation only under IFRS. Managers estimate bias reported earnings To report higher earnings, useful lives or salvage value of assets are revised upward. Chapter: 07 19 Cost Allocation Methods Differences in Methods US Firms (Statement No.109) Other countries Use accelerated methods for tax purpose than for financial reporting purposes Accelerated method for both tax and financial reporting Analyst must restate the amounts. An addition to net income in the operating section of cash flows. Chapter: 07 20 Cost Allocation Methods (Contd.) Depreciation Straight-line method or accelerated method Tangible assets Amortization Straight-line method Intangible assets Depletion Natural resources Chapter: 07 Straight-line method or proportionate to consumption 21 Market Value Vs. Book Value: Impairment of Long-Lived Assets U.S.GAAP IFRS • Record impairment if: • Impairment charge = Carrying amount > Book value – [Higher Undiscounted cash of (Fair Value less flows from the asset estimated costs to • Impairment charge = sell) or (Present value Carrying Value – Fair of estimated future value cash flows)] Chapter: 07 22 Market Value Vs. Book Value: Impairment of Goodwill U.S.GAAP • Record impairment if: Carrying amount > Fair value of reporting unit • Implied goodwill = Fair value of reporting unit – Fair value of identifiable assets Chapter: 07 IFRS • Record impairment if: Carrying amount > Recoverable amount (Higher of fair value or sale) • Implied goodwill = Fair value of reporting unit – Fair value of identifiable assets 23 Long-Lived Assets Upward revaluation U.S.GAAP does not permit upward revaluations IFRS allows revaluation of both tangible & intangible longlived assets Chapter: 07 Replacement Gain/loss on disposal or sale or trade-ins is reported in operating income Cash inflow from sale of assets is reported in investing section of cash flow statement New assets must be recorded at fair Value 24 Investment in Securities Chapter: 07 25 Accounting for Minority Passive Investments Initially record investments at acquisition cost. Interest & Dividend received/receivable each year are recorded as revenue. Chapter: 07 26 Accounting for Minority Passive Investments (Contd.) Classification of Securities Debt securities Held-tomaturity Debt & Equity securities Trading securities Debt & Equity securities Available for sale Firm has a positive intent & ability to hold to maturity. Firm actively buys & sells securities to take advantage of shortterm differences in market value. Firms classify securities that do not fall into one of the other two categories as Available-for-sale. Chapter: 07 27 Accounting for Minority Passive Investments (Contd.) Debt securities held-to-maturity At amortized cost. Difference between acquisition cost and maturity value is an adjustment to interest revenue (Effective Interest rate method). Fair values are disclosed in notes. Trading security Marked-to-market. Unrealized gain or loss: As a part of Net Income. Chapter: 07 28 Accounting for Minority Passive Investments (Contd.) Sale of security: Gain or loss (Selling Price less Book Value) in Net Income. Available-for-sale Marked to market. Unrealized gain or loss: As a part of ‘other comprehensive income’ (OCI). Sale of security: Chapter: 07 Realized Gain or loss (Selling Price less Acquisition Cost) on Income Statement. 29 Accounting for Minority Passive Investments (Contd.) Unrealized holding gain or loss is recognized in current period OCI. “Other than temporarily impaired” securities Tested whether securities that experienced unrealized losses are “other than temporarily impaired”. Written down to fair value. Unrealized loss reported in net income. Chapter: 07 30 Reporting Values of Minority, Active Investments U.S.GAAP & IFRS- Equity method Balance Sheet at Acquisition cost +/- investor’s share of the net income /loss – share of dividends. Income Statement at Pro rata share of investee income minus any allocation cost of extra investment. Cash Flow Statement: Subtract share of earnings from net income and add cash dividends. Chapter: 07 31 Accounting for Minority, Active Investments (Contd.) Implied Goodwill Related Party Transactions Sales, purchases, receivables & payables must be disclosed in notes to financial statements. Profits arising from intercompany transactions should be eliminated. Reported at acquisition cost in non-IFRS statements. Chapter: 07 32 Accounting for Majority, Active Investments Accounting for corporate acquisitions - SFAS 141,141R, 160 (FASB codification topics 805 and 810) and IFRS 3. Consolidated financial statements are prepared. Business combinations can be statutory mergers and acquisitions- acquisition method. Chapter: 07 33 Accounting for Majority, Active Investments (Contd.) Goodwill Measure the fair value of the consideration transferred to acquire the company and the fair values of the identifiable assets acquired, liabilities assumed and noncontrolling interests (if any). Assign any excess consideration to goodwill or record a gain from a bargain purchase. Chapter: 07 34 Consolidated Financial Statements at the Date of Acquisition Investment in subsidiary. Subsidiary’s equity accounts. Individual assets & liabilities of subsidiary. Goodwill. Acquisition “Reserves” Management has some latitude in managing earnings, given the estimates required to establish reserves. Chapter: 07 35 Consolidated Financial Statements Subsequent to the Date of Acquisition Investment in subsidiary Subsidiary’s equity accounts Individual assets & liabilities of subsidiary Goodwill component to consolidated totals Related-party transactions eliminations Chapter: 07 36 Noncontrolling Interests Arises if an investing firm acquires less than 100% of another firm. Also termed as minority interest. Disclosure Income Statement: Is deducted from the net income of the parent. Balance Sheet: A component of shareholders’ equity of the parent. Chapter: 07 37 Noncontrolling Interests (Contd.) Subsidiary’s fair value less book value at the date of acquisition is allocated to identifiable assets and to goodwill. Fair value amortization must be reflected in consolidated net income each year. Tax effect adjustment is not necessary for noncontrolling interest as it is an after-tax net income. Chapter: 07 38 Corporate Acquisitions and Income Taxes The acquired company does not restate its assets & liabilities for tax purpose. The tax basis of assets & liabilities of the acquired company before acquisition carries over after the acquisition called nontaxable reorganization. Deferred taxes would be recognized, as a difference between fair and book values. Chapter: 07 39 Consolidation of Unconsolidated Subsidiaries and Affiliates Companies do not consolidate the financial statements of joint ventures or minorityowned affiliates. Under U.S.GAAP firms use the equity method to account for joint ventures. IFRS permits use of proportionate consolidation for joint ventures. Chapter: 07 40 Special-Purpose or Variable-Interest Entity (VIE) Can be a corporation, partnership, trust or any other legal structures for business purpose. May be passive or active. The sponsoring firm would not consolidate a VIE under the percentage of ownership criterion. Also called a bankruptcy remote entity. Chapter: 07 41 Consolidating VIE Firm must consolidate if it is the primary beneficiary of the VIE. FIN 46R- Firm is primary beneficiary if it has The direct or indirect ability to make decisions about the entity’s activities. The obligation to absorb the entity’s expected losses if they occur. The right to receive the entity’s expected residual returns if they occur. Chapter: 07 42 Income Tax Consequences of Investment in Securities For income tax purposes, investments fall into two categories. Investments in debt securities, preferred stock, and in less than 80% of the common stock. Interest or dividends, gains or losses- taxable income. Investments in 80% or more of the common stock. Chapter: 07 Consolidated tax returns are prepared. 43 Foreign Currency Translation Types of Foreign Entities A foreign entity operates as a self-contained & integrated unit (All current method) The operations of a foreign entity are a direct & integral extension of the parent company’s operations (Monetary/Non-monetary methods). Exception to these guidelines – U.S.GAAP If the foreign entity operates in a highly inflationary country (FASB Statement No.52). Chapter: 07 44 Translation Methodology-Foreign Currency is the Functional Currency Income Revenues & expenses are translated Statement at average exchange rate. Income includes realized translation gains & losses on sale of foreign unit Balance Assets & liabilities are translated at Sheet end-of-period exchange rate. Unrealized translation adjustment is included in other comprehensive income Chapter: 07 45 Translation Methodology-Foreign Currency is the Functional Currency “Translation adjustment” is a component of other comprehensive income & includes: Effect of exchange rate changes on the parent’s equity investment in subsidiaries. Change in fair value of a derivative (Firms hedge their foreign operations). Chapter: 07 46 Translation Methodology-U.S. Dollar is the Functional Currency Firms must use the Monetary or Non- monetary translation method. Monetary items include cash, marketable securities, receivables, accounts payable, short-term & long-term debt. Nonmonetary items include inventories, fixed assets, common stock, revenues and expenses. Chapter: 07 47 Translation Methodology-U.S. Dollar is the Functional Currency Income Statement Balance Sheet Chapter: 07 Revenues & Expenses are translated at average exchange rate. Cost of goods sold & depreciation are translated using historical exchange rate. Monetary assets & liabilities are translated at end-of-period exchange rate. Non-monetary assets & equities using historical exchange rate. 48 Foreign Currency Translation and Income Taxes Branch of US parent Use all-current or monetary/non-monetary translation method as appropriate. Subsidiary of US parent Dividends received are translated at exchange rate on date of remittance. Chapter: 07 49 Analyst Adjustments Whether to include change in the foreign currency translation account in earnings or in other comprehensive income? Analyst should consider how changes in exchange rates affect changes in sales levels, sales mix, and net income. Chapter: 07 50 Analyst Adjustments (Contd.) To swing the balance of factors towards use of foreign currency, management may: Decentralize decision making to foreign unit. Minimize remittances or dividends. Chapter: 07 51