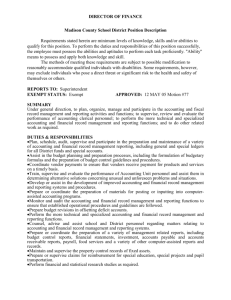

Director of Fiscal Services

advertisement

San Luis Obispo County Community College District July 2015 DIRECTOR OF FISCAL SERVICES (Management Designation) (Range 59) DEFINITION Under general direction of the Assistant Superintendent/Vice President of Administrative Services plan, organize, direct, and supervise the District fiscal activities in the areas of accounting; purchasing; cashiering; student financial records; accounting for student government, trusts and clubs; directly performs the more difficult financial record keeping and report preparation; District cash flow by fund; accounting and legal compliance of general obligation bond funds; maintenance of financial records; fiscal and financial reporting; annual audit; internal audit; budget development and control; supervise and evaluate assigned staff, and perform other related duties as required. DISTINGUISHING CHARACTERISTICS The incumbent in this position is distinguished by the requirement to provide leadership with regard to the District’s fiscal activities and independently performs professional work involving judgment in the interpretation and application of policy and procedures. The incumbent must understand and promote the connection between the functions of Fiscal Services and student learning outcomes, administrative services outcomes, and institutional effectiveness by facilitating District’s fiscal activities. This shall contribute to institutional effectiveness by assuring accuracy and compliance in financial reporting. ESSENTIAL FUNCTIONS Plan, organize, and direct a variety of programs, projects, and activities related to fiscal, accounting, financial reporting and purchasing services for the District; Provide technical expertise and information to the board, president, auditors, local, state, and federal agencies, student government and others regarding assigned functions; Assist as needed in the formulation and development of District policies; Plan, organize and direct the annual independent audit and internal audit functions: work with auditors and implement their recommendations; Plan, organize and direct the maintenance of the District’s general ledger; Compile and maintain statistical and other data and write reports; Recommend for employment, provide for training; direct, supervise, and evaluate the work performance of department staff; Organize and direct the financial operations of the District; Approve and authorize purchase orders, commercial warrants or checks, and payroll warrants; Receive all funds of the District; Maintain financial control records for state and federal aid programs and supervise the compilation of required reports; Supervise compilation of financial reports for payroll, benefits, purchasing, accounts receivable/payable, student financial records, inventory, and others; Supervise the accounting and financing duties related to the District’s general obligation bond funds, ensuring legal compliance; Supervise the reconciliation of State capital project funds and general obligation bond funds to the general ledger, make appropriate transfers, and set up receivables/liabilities at year-end; Director of Fiscal Services Page 1 of 3 Supervise the compilation of quarterly general obligation bond financial reports and present them to the Citizens’ Oversight Committee; Plan, direct, and supervise the cash management system of the District; project cash flow; reconcile District cash with county auditor's report; request cash from various state and federal sources; Assist the Assistant Superintendent/ Vice President, Administrative Services to develop and prepare the annual budgets for the District; Review and analyze budgetary and financial data; project annual budget, revenue, and expenditure; and control and authorize expenditures in accordance with established guidelines; Comply with a variety of state and federal regulations, laws, and reporting requirements; Serve on District standing committees as assigned; Recommend and administer department budget; Interpret, apply, and learn laws, rules, and regulations governing accounting and purchasing operations; Coordinate with Computer Services in planning and developing programs and procedures for integrated accounting, budget information, and record control systems; and Perform other related duties as required. QUALIFICATIONS Education: Required Bachelor’s degree from an accredited college or university in accounting, business administration or a closely related field (including at least 20 semester units in accounting). Preferred CPA License or Master’s Degree in accounting or business administration. Experience: Required Five years of varied and responsible accounting experience which shall include three years of experience in the operation of computerized accounting systems and three years of supervisory experience. Preferred Audit experience; Experience with school system or other governmental accounting and financial record keeping. Knowledge of: Generally Accepted Accounting Principles (GAAP); Principles and procedures of Governmental and Fund Accounting; Governmental Accounting and Auditing Standards (GAAS); Statements on Auditing Standards (SAS); Pertinent federal, state and local laws, codes and regulations; Computerized accounting and data processing systems as applied to accounting, budgeting, cashiering and purchasing functions; Applicable provisions of the California Education Code; California Community Colleges Budget and Accounting Manual; Director of Fiscal Services Page 2 of 3 Financial recordkeeping relationships and legal reporting requirements among San Luis Obispo County Community College School District, Cuesta College, San Luis Obispo County Office of Education, and San Luis Obispo County Government; Supervision techniques; Current technologies, personal computer, and associated office software such as word processing, spreadsheet, presentation, and/or database software; Correct usage of English, grammar, spelling, punctuation, and vocabulary; and District policies and procedures. Ability to: Perform highly responsible technical financial record keeping; Work with a computer-based financial management system; Understand and utilize a complex chart-of-accounts; Learn and interpret legal requirements and technical materials; Understand and apply federal, state, and local policies and procedures, laws and regulations as they relate to accounting; Organize and supervise the work of others; Review and interpret financial statements; Establish and maintain cooperative working relationships with those contacted in the performance of duties; and Demonstrate a sensitivity to and understanding of the diverse academic, socioeconomic, cultural, and ethnic backgrounds of staff and students and of staff and students with physical and learning disabilities. Physical ability to: Read and comprehend printed matter and text and data on computer monitors; Communicate intelligibly and effectively via speech, telephone, written correspondence, and/or email; Sit or stand for extended periods of time; Lift and/or carry 25 pounds; and Exert manual dexterity sufficient for keyboard and other office equipment operation. License and Certificates (current within the last year): Required Valid driver’s license and eligible to obtain California driver’s license upon hire. Board of Trustees Approval: 7/5/2000;12/13/2006; 06/04/2014: 08/05/2015 Director of Fiscal Services Page 3 of 3