08.Chapter Eight 2009

advertisement

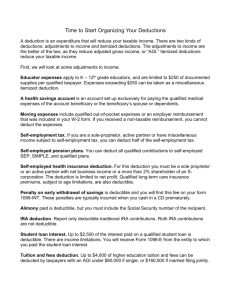

Liberty Tax Service Online Basic Income Tax Course. Lesson 8 1 Homework Chapter 7 HOMEWORK ONE: What is the amount of the earned income credit in the following situations? They have no investment income over $2,950. 1. Married filing jointly, two qualifying children, Earned Income - $16,528,AGI - $16,693 $4,824 2. Head of Household, one qualifying child, Earned Income - $26,000, AGI -$25,849 $1,274 3. Single, age 24, no qualifying child, Earned Income $8,925, AGI - $9,000 $0 4. Married Filing Separately, age 27, Earned Income $6,700, AGI - $6,723 $0 2 Homework Chapter 7 HOMEWORK TWO: Gerald T. (born 6/8/1967) and Belle M. Harrison (born 12/12/1971) are married and live at 1220 Torrence Ave. Boulder, CO, 80302. Mrs. Harrison’s niece Greta S. Borg (242-44-2224, born 7/7/2000) has lived with them all year and they provided all of her support. The Harrisons pay for after school care for Greta so Gerald can work as an optician and Belle can go to her job as a desk clerk in a motel. In 2008, they paid $300 to Tot World (EIN 22-7744333), 4349 Brunswick Blvd., Boulder, CO 80312 for Greta. Gerald and Belle did not itemize their deductions for 2008. Prepare a 2008 tax return for Gerald and Belle. 3 Homework Chapter 7 4 Homework Chapter 7 5 Homework Chapter 7 6 Homework Chapter 7 7 Homework Chapter 7 Homework 2 8 Homework Chapter 7 9 Homework Chapter 7 10 Homework Chapter 7 11 Homework Chapter 7 12 Homework Chapter 7 13 Homework Chapter 7 14 Homework Chapter 7 15 Homework Chapter 7 16 17 18 19 20 Chapter 8: Itemized Deductions Chapter Content Itemized Deductions Medical and Dental Expenses Taxes You Paid Interest You Paid Gifts To Charity Other Miscellaneous Deductions Key Ideas Objectives Compare Standard Deduction to Itemized Deductions Learn About Deductible and Nondeductible Medical and Dental Expenses Learn About Which Taxes Paid Which Are Deductible Determine What Interest Paid is Deductible Recognize Deductible Charitable Contributions Identify Other Miscellaneous Deductions 21 Itemized Deductions Itemized deductions 1. If the total amount of your itemized deductions is higher than your standard deduction, you will probably want to itemize. 2. Reduces your AGI and lowers tax liability. 3. You are subject to a limit on certain itemized deductions if your adjusted gross income (AGI) is more than $156,400 (or $78,200 if MFS). 4. Report itemized deductions on Schedule A; the amount from line 29 of Schedule A is entered on line 40 of Form 1040. 22 Itemized Deductions Deductions you may be able to claim include: Medical and dental expenses Taxes you paid Interest you paid Gifts to charity Casualty and theft losses Job expenses and most other miscellaneous deductions Other miscellaneous deductions 23 Schedule A Itemized Deductions 24 Schedule A Itemized Deductions 25 Medical and Dental Expenses You can include medical expenses you pay for YOURSELF and for: Your spouse. Dependents claimed on your return. Others who could have been claimed as dependents except they had gross income of $3,500 or more, or they filed a joint return. 26 Medical and Dental Expenses Medical and dental expenses that exceed 7.5% of your AGI are deductible. Note: You may want to determine 7.5% of your AGI before adding all of the expenses up to see if your medical expenses are likely to exceed this amount. Schedule A 27 Medical and Dental Expenses – Problem 1 Chico’s adjusted gross income is $25,000 and 7.5% of that amount is $1,875. He paid medical and dental expenses of $2,000 which he reports on Schedule A. He has $125 ($2,000 - $1,875) as deductible medical and dental expenses on Schedule A. If his medical and dental expenses had been $1,500 would he have medical deductions on Schedule A? Yes or No? 28 Medical and Dental Expenses – Problem 1 Chico’s adjusted gross income is $25,000 and 7.5% of that amount is $1,875. He paid medical and dental expenses of $2,000 which he reports on Schedule A. He has $125 ($2,000 - $1,875) as deductible medical and dental expenses on Schedule A. If his medical and dental expenses had been $1,500 would he have medical deductions on Schedule A? No Because medical and dental expenses must exceed 7.5% of AGI. 29 Medical and Dental Expenses Below are medical and dental expenses you can and cannot deduct: 30 Transportation Transportation expenses incurred primarily for, and essential to, medical care are deductible. Standard rate is 19 cents a mile for miles driven Jan 1 through Jun 30 and 27 cents a mile for miles driven Jul 1 through Dec 31 or can deduct actual out-of-pocket expenses. Do not deduct depreciation, insurance, general repair, and maintenance expenses. Deduct tolls and parking fees in either case 31 Transportation – Problem 1 Chris drove 1,000 miles for medical reasons from 1/1/2008 to 6/30/2008 and 800 miles from 7/1/2008 to 12/31/2008. He used his car and his actual expenses were: $370 for gas $10 for oil $20 for tolls and parking. Should Chris use actual expenses or standard mileage for deducting his transportation expenses? a. Actual Expenses b. Standard Mileage 32 Transportation – Problem 1 Chris drove 1,000 miles for medical reasons from 1/1/2008 to 6/30/2008 and 800 miles from 7/1/2008 to 12/31/2008. He used his car and his actual expenses were $370 for gas $10 for oil $20 for tolls and parking. Should Chris use actual expenses or standard mileage for deducting his transportation expenses? b. Standard Mileage His actual expenses total $380 ($370 gas + $10 oil). If he uses the standard mileage amount, his total expense is $406 (1,000 x 19 cents/mile = $190 plus 800 x 27 cents/mile = $216). He will use $426 ($406 plus $20 for tolls and parking) for his car expense along with his other medical expenses because it is more than the $400 ($380 plus $20 for tolls and parking) he figured for his actual expenses. 33 Transportation Other transportation expenses you can deduct are bus, taxi, train, plane fares, or ambulance services. The transportation expenses of a parent to accompany a child who requires medical care are deductible. 34 Lodging The cost of lodging and meals at a hospital or similar institution can be deducted if the main reason for being there is for medical care. You can include as part of your medical expenses the cost of lodging not provided by the medical facility if all of the following requirements are met: a. b. c. d. Lodging primarily essential to medical care Medical care provided by doctor in a medical care facility Lodging is not extravagant No significant element of personal pleasure, recreation, or vacation in the travel away from home The amount you include in medical expenses for lodging cannot be more than $50 for each night for each person. The cost of lodging for the person accompanying the patient is deductible. Meals under these circumstances are not deductible. 35 Lodging – Problem 1 Claudia took her 8-year-old son, Ramos, to a medical center to undergo tests. They stayed at a motel for three nights while the medical tests were run. The motel cost $70 per night and their meals totaled $120. How much, if any, can Claudia deduct for medical expense? a. $120 b. $0 c. $330 d. $210 36 Lodging – Problem 1 Claudia took her 8-year-old son, Ramos, to a medical center to undergo tests. They stayed at a motel for three nights while the medical tests were run. The motel cost $70 per night and their meals totaled $120. How much, if any, can Claudia deduct for medical expenses? d. $210 Claudia can deduct $210 ($70 x 3 nights) for lodging. She and Ramos each have a $50 per night limit. The $120 for meals cannot be deducted. 37 Lodging Cost of living in a retirement or nursing home is deductible for yourself, spouse, or dependent if there because of availability of medical care. Home improvements not increasing the value of your home but required for medical conditions are deductible. 38 Lodging – Problem 2 Raymond has severe asthma. His doctor recommended he add central air conditioning to his house. The equipment and installation cost $3,200. An appraiser assessed a $1,500 increase in the value of his house as a result of the air conditioning. How much, if any, can Raymond deduct for home improvements due to a medical condition? a. $3,200 b. $1,700 c. $1,500 39 Lodging – Problem 2 Raymond has severe asthma. His doctor recommended he add central air conditioning to his house. The equipment and installation cost $3,200. An appraiser assessed a $1,500 increase in the value of his house as a result of the air conditioning. How much, if any, can Raymond deduct for home improvements due to a medical condition? b. $1,700 Raymond can deduct $1,700 ($3,200-$1,500) as a medical expense this year along with any cost for operating and maintaining the central air conditioning every year for as long as it is needed medically. 40 Insurance Premiums Insurance premiums you pay for policies that cover medical care are deductible. Policies can provide payment for medical and dental expenses, prescription drugs, eyeglasses, and replacement of contact lenses. If you have long-term care insurance, the part of the premium that can be deducted on Schedule A depends on the age of the insured. 41 Weight Loss Programs Uncompensated amounts you pay for participation in a weight-loss program as a treatment for a specific disease (including obesity) diagnosed by a physician are deductible. The cost of purchasing diet food items is not deductible. Weight-loss programs to improve your general health or appearance do not qualify and are regarded as nondeductible personal expenses. 42 TAXES YOU PAID In order for a tax to be deductible by you, the tax must be imposed on you and must be paid by you during your tax year. You report deductible taxes on lines 5 through 9 of Schedule A. Schedule A 43 TAXES YOU PAID Deductible taxes include: State and local income taxes General sales taxes Real estate taxes Personal property taxes Foreign Income Taxes 44 TAXES YOU PAID State and Local Income Taxes These taxes include tax withheld from your salary, estimated payments, and the tax paid for an earlier year. 45 TAXES YOU PAID General sales taxes. You can elect to deduct state and local general sales taxes instead of state and local income taxes. You cannot deduct both. To figure your deduction you can use either of the following methods: 1. Actual state and local general sales tax and sales tax on motor vehicles or the optional sales tax table (You must keep your actual receipts showing general sales taxes paid if you use this method. 2. IRS has website for calculating sales tax http://apps.irs.gov/app/stdc/ 46 TAXES YOU PAID Real estate taxes. These are taxes on real property, such as your house or other land that you own that was not used for business. The taxes must be based on the assessed value of the property. Generally, real estate taxes are deductible when paid. With an escrow account, you can deduct the real estate tax the year the lending institution pays it. 47 TAXES YOU PAID Personal property taxes. Taxes that state and local governments charge on the value of personal property are deductible. An example is personal property taxes based on the value of your car or boat. In some states, a portion of the cost of personal vehicle registration may be deductible if part of the fee is based on the value of your car. 48 TAXES YOU PAID Foreign Income Taxes Generally, you can take either a deduction or a credit for income taxes imposed on you by a foreign country or a U.S. possession. 49 TAXES YOU PAID Taxes and fees that are generally NOT deductible include: Federal taxes such as income tax, social security (FICA), and Medicare Driver’s, marriage, hunting, or pet licenses Water and sewer taxes Taxes on alcoholic beverages, cigarettes, and tobacco Taxes on gasoline, diesel, and other motor fuels used in a non-business vehicle Utility taxes - telephone, gas, electricity, etc. Fines or penalties 50 TAXES YOU PAID 51 TAXES YOU PAID For 2008, if you are not able to use the real estate taxes paid because you do not have enough deductions to itemize, you may be able to claim up to $500 ($1,000 if MFJ) as an addition to the standard deduction. If you paid real estate taxes and are unable to itemize deductions, use the worksheet is Table 8-3 to determine the amount of your standard deduction. 52 TAXES YOU PAID 53 INTEREST YOU PAID Report interest you paid on lines 10-14 of Schedule A Amount you pay for the use of borrowed money Types include home mortgage interest and investment interest Qualified mortgage insurance premiums Schedule A 54 INTEREST YOU PAID Home Mortgage Interest Report home mortgage interest on line 10 of Schedule A if you receive a Form 1098, Mortgage Interest Statement. If you do not receive a Form 1098, report the home mortgage interest on line 11 of Schedule A. 55 INTEREST YOU PAID 56 INTEREST YOU PAID POINTS Points specifically paid for the use of money are considered prepaid interest. Generally cannot deduct full amount of points in year paid. 57 INTEREST YOU PAID You can fully deduct points in the year you pay them only if all these apply: You itemize deductions Your loan is secured by your main home Paying points is an established business practice where loan was made Points paid were not more than points generally charged in area You use cash method of accounting Points were not paid in place of amounts that ordinarily are stated separately on settlement statement You use your loan to buy or build your main home Points were computed as percentage of principal amount of mortgage Amount is clearly shown on settlement statement as points charged for mortgage Funds you provided at or before closing plus any points seller 58 paid were at least as much as points charged. INTEREST YOU PAID Points paid by the seller are deductible by the buyer. Points paid to refinance a mortgage are generally not deductible in full the year you pay them. Report points reported on Form 1098 on line 10 of Schedule A; if not reported on Form 1098, enter them on line 12 of Schedule A. 59 INTEREST YOU PAID – Problem 1 Tom and Debra Mazur bought a house costing $200,000 in 2008. They paid 2 points to the lender. The seller paid 1 point to the lender. How much can the Mazurs deduct on their 2008 return? a. $2,000 b. $4,000 c. $6,000 60 INTEREST YOU PAID – Problem 1 Tom and Debra Mazur bought a house costing $200,000 in 2008. They paid 2 points to the lender. The seller paid 1 point to the lender. How much can the Mazurs deduct on their 2008 return? c. $6,000 $6,000 in points $200,000 x 2% = $4,000 plus $200,000 x 1% = $2,000 The basis of their house is reduced by $2,000 (seller’s points they deducted) to $198,000. 61 Mortgage Insurance Premiums Premiums paid for qualified mortgage insurance are treated as deductible mortgage interest. The deduction does not apply to any contract issued before January 1, 2007 and does not apply to any amounts paid or accrued after December 31, 2010. Qualified mortgage insurance providers include the Veterans Administration, the Federal Housing Administration or the Rural Housing Administration and private mortgage insurance. Box 4 of Form 1098 may show the amount of premiums paid in 2008. 62 INTEREST YOU PAID Investment Interest Deduct investment interest to the extent of investment income. Excess of investment interest can be carried over to future years. You generally use Form 4952 to determine amount of deductible investment interest. 63 GIFTS TO CHARITY Charitable contributions can be deducted only if you make them to a qualified organization. Can be cash or non-cash. Report on lines 16-19 of Schedule A. Generally cannot exceed 50% of your AGI. Non-cash contributions are reported on line 17 of Schedule A. Refer to Table 8-5 for examples of qualified contributions and organizations and those that do not qualify. 64 GIFTS TO CHARITY Schedule A 65 GIFTS TO CHARITY 66 GIFTS TO CHARITY Property The fair market value of property you give to a charitable organization can be deducted; it is determined on the date of the gift. If property has increased in value during time you owned it, deduct your basis in it or the property’s FMV on date of gift; if property has decreased in value during the time you owned it, usually deduct its FMV (e.g. used clothing, furniture, books, appliances) Example: Ed bought land in 1996 for $8,000. He donated the land to his church in 2008 when it was worth $12,000. Ed can deduct $12,000. 67 GIFTS TO CHARITY Clothing or household items donated must be in good, used condition. An item not in good used condition can be deducted if it is more than $500 and a qualified appraisal is included. Used vehicles, boats and airplanes that have a claimed value of $500 or more must have a written acknowledgement from the organization. The deduction is the smaller of the FMV on the date of the contribution or the gross proceeds received from the sale. 68 GIFTS TO CHARITY The deduction is not limited if the organization gives or sells the vehicle to a needy individual, makes significant use of the vehicle or makes material improvements before transferring it. A used car guide can help determine the FMV of the vehicle. 69 GIFTS TO CHARITY – Problem 1 Brad donates his 2001 Jeep Wrangler, which he bought new for $22,000 in 2001. A used car guide indicates the FMV for his car is $9,950. Brad receives a Form 1098-C which shows that the car was sold for $7,000. How much can he deduct on his return? a. $9,950 b. $7,000 c. $2,950 70 GIFTS TO CHARITY – Problem 1 Brad donates his 2001 Jeep Wrangler, which he bought new for $22,000 in 2001. A used car guide indicates the FMV for his car is $9,950. Brad receives a Form 1098-C which shows that the car was sold for $7,000. How much can he deduct on his return? b. $7,000 He can deduct $7,000 and he must attach Form 1098-C to his return. 71 GIFTS TO CHARITY If your contributions of noncash items are over $500 in any year, you are required to file Form 8283, Noncash Charitable Contributions to give more information about them. 72 GIFTS TO CHARITY Limit On Deductions Amount of deduction may be limited to 20%, 30%, or 50% of AGI depending on type of property and type of charitable organization. Can carry over contributions exceeding AGI limit and deduct excess in each of next 5 years until used up 73 GIFTS TO CHARITY Record Keeping Keep records of all your cash and noncash contributions for the year; if under $250, proof can be canceled check, receipt, etc.; if $250 or more, proof must be written acknowledgment (see Publication 526 for more details). 74 OTHER MISCELLANEOUS DEDUCTIONS Casualty and theft losses, job expenses and most other miscellaneous deductions are covered in Chapter 13. Line 28 of Schedule A takes care of other miscellaneous deductions including: gambling losses up to amount of winnings, impairment-related work expenses of persons with disabilities, repayments of more than $3,000 under a claim of right. 75 Itemized Deductions KEY IDEAS Itemized deductions are reported on Schedule A of Form 1040. Itemized deductions include: Medical and dental expenses Taxes paid Home mortgage and certain investment interest paid Charitable contributions Casualty and theft losses (covered in a later chapter) Miscellaneous itemized deductions (some covered in a later chapter) 76 Itemized Deductions KEY IDEAS Medical and dental expenses that exceed 7.5 percent of adjusted gross income are deductible. Either state and local income taxes or general sales tax can be deducted, but not both. Mortgage interest can be deducted if you are legally liable for the debt. Regardless of the amount, you cannot deduct a cash contribution unless you keep as a record of the contribution a bank record, such as a cancelled check. You cannot deduct a contribution of clothing or household items unless the items are in good used condition or better. You compare your total itemized deductions to your standard deduction and enter the larger amount on line 40 of Form 1040. 77 Itemized Deductions CLASSWORK 1: True or False. 1. You may benefit from itemizing your deductions if you paid mortgage interest and real estate taxes on your home. 2. You cannot deduct general sales tax on your tax return. 3. The standard rate is 20 cents per mile for a medical travel expense. 4. If you are married filing separately and your spouse itemizes his/her deductions, you too must itemize your deductions even if they are below the standard deduction. 5. You can claim a cash charitable donation of $5 even if you do not have a receipt. . 6. Points paid by the seller are deductible by the buyer as interest. 7. The fair market value is determined on the date of the gift. 78 Itemized Deductions CLASSWORK 1: True or False. 8. Your total medical and dental expense must exceed 7.5% of your total income to take the deduction. 9. Real estate taxes are deductible on your return when actually paid. 10. Your total charitable contributions may have limited deductibility if they are over 10% of your AGI. 11. You can deduct a weight loss program as a medical deduction if it is a treatment for a disease diagnosed by your doctor . 12. Credit card interest for personal expenses is a deductible interest. 13. Any meal costs you pay at a hospital are deductible if the principal reason you are there is to receive medical care . 79 Itemized Deductions CLASSWORK 1: True or False. 14. You can deduct what you paid for clothing in good used condition or better that you donate to a qualified charitable organization. 15. You can deduct the mortgage interest you paid on your son’s home even if you are not legally liable for the loan. 16. A church raffle ticket that you purchased can be deducted as a charitable donation. 17. Health insurance premiums paid by your employer are fully deductible as a medical expense . 18. If you used the money to purchase a car, the points paid to refinance your home mortgage are fully deductible in the year you paid them. 19. You can deduct the full cost of a nursing home even if you reside there for personal reasons. 80 Itemized Deductions CLASSWORK 1: True or False. 20. Federal income tax is deductible on Schedule A. 21. State tax withheld from your salary is reported to you in box 17 of Form W-2. 22. Tuition to a nonprofit school is a deductible charitable contribution. 23. Money given to a needy person can be deducted as a charitable contribution. 24. In addition to your state and local income tax withholding, you can deduct on your 2008 Schedule A, any prior year’s state income tax owed that you paid in 2008. 81 Itemized Deductions CLASSWORK 1: True or False. 1. You may benefit from itemizing your deductions if you paid mortgage interest and real estate taxes on your home. T 2. You cannot deduct general sales tax on your tax return. F 3. The standard rate is 20 cents per mile for a medical travel expense. F 4. If you are married filing separately and your spouse itemizes his/her deductions, you too must itemize your deductions even if they are below the standard deduction. T 5. You can claim a cash charitable donation of $5 even if you do not have a receipt. F 6. Points paid by the seller are deductible by the buyer as interest. T 7. The fair market value is determined on the date of the gift. T 82 Itemized Deductions CLASSWORK 1: True or False. 8. Your total medical and dental expense must exceed 7.5% of your total income to take the deduction. F 9. Real estate taxes are deductible on your return when actually paid. T 10. Your total charitable contributions may have limited deductibility if they are over 10% of your AGI. F 11. You can deduct a weight loss program as a medical deduction if it is a treatment for a disease diagnosed by your doctor . T 12. Credit card interest for personal expenses is a deductible interest. F 13. Any meal costs you pay at a hospital are deductible if the principal reason you are there is to receive medical care . T 83 Itemized Deductions CLASSWORK 1: True or False. 14. You can deduct what you paid for clothing in good used condition or better that you donate to a qualified charitable organization. F 15. You can deduct the mortgage interest you paid on your son’s home even if you are not legally liable for the loan. F 16. A church raffle ticket that you purchased can be deducted as a charitable donation . F 17. Health insurance premiums paid by your employer are fully deductible as a medical expense . F 18. If you used the money to purchase a car, the points paid to refinance your home mortgage are fully deductible in the year you paid them. F 19. You can deduct the full cost of a nursing home even if you reside there for personal reasons. F 84 Itemized Deductions CLASSWORK 1: True or False. 20. Federal income tax is deductible on Schedule A. F 21. State tax withheld from your salary is reported to you in box 17 of Form W-2. T 22. Tuition to a nonprofit school is a deductible charitable contribution. F 23. Money given to a needy person can be deducted as a charitable contribution. F 24. In addition to your state and local income tax withholding, you can deduct on your 2008 Schedule A, any prior year’s state income tax owed that you paid in 2008. T 85 Itemized Deductions CLASSWORK 2: Greg K. (SSN 033-21-8196, born 10/10/1942) and Beth M. (SSN 212-63-8338, born 12/11/1951) Smith are filing a joint return and they have no dependents. They live in Colorado City, Texas 79512 and their AGI (line 38 of Form 1040) is $44,000. Greg and Beth have no other income and they did not purchase a motor vehicle or purchase an aircraft, boat, home or home-building materials. They drove 1,030 miles for doctor visits. They drove 600 miles from 1/1/2008 to 6/30/2008 and 430 miles from 7/1/2008 to 12/31/2008. Beth does volunteer work at the church every week and she drove 250 miles for this purpose. They have written records of their automobile mileage. Complete their Schedule A using the following additional information. Texas does not have a personal income tax. The local general sales tax for Colorado City is 2%. 86 Itemized Deductions CLASSWORK 2: Eyeglasses (Greg) $ Medical Insurance 260 Root Canal (Greg) $ $ 2,550 Church donations $ 25/week for 50 weeks Prescription drugs $ Goodwill FMV of clothes in good used condition $ 300 Home mortgage interest $ 4,350 Benefit for a neighbor $ 130 Real estate taxes $ 2,800 State gas tax $ 450 Over-the-counter drugs $ 150 Hip surgery (Beth) *reimbursed $2,850 $ 6,000* Bingo – cost of cards $ 500 185 425 Assuming that their deductions were the same, would they still want to itemize if Beth had been born in 1941? 87 Itemized Deductions CLASSWORK 2 - Answer 88 Itemized Deductions CLASSWORK 2 - Answer 89 Itemized Deductions CLASSWORK 2 - Answer 90 Itemized Deductions 91 Itemized Deductions When both taxpayers are over 65, the standard deduction is $13,000 plus $1,000 for real estate taxes totaling $14,000 which is higher than their itemized deductions. 92 Questions and Answers 93