LO2 - McGraw-Hill Ryerson

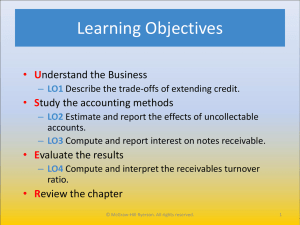

Learning Objectives

After studying the material in this chapter you will be able to do the following:

LO1 Explain and apply criteria for revenue recognition.

LO2 Describe the critical-event and gradual approaches of recognizing revenue.

LO3 Explain the effects that different approaches to recognizing revenue have on the income statement and on financial ratios.

LO4 Describe how multi-deliverables are accounted for.

LO5 Describe expense recognition and the matching principle.

Copyright © 2013 McGraw-Hill Ryerson Limited

1

LO2

Revenue Recognition

• Criteria under IFRS

▫ Significant risks and rewards transferred

▫ Seller has no involvement or control

▫ Amount of revenue can be reasonably measured

▫ Costs can be reasonably measured

▫ Collection is probable

Copyright © 2013 McGraw-Hill Ryerson Limited

2

LO2

Critical Events

When a critical event occurs it triggers recognition of revenue and matching of expenses

• Critical events include:

▫ Delivery of goods or services

▫ Completion of production

▫ Cash collection

▫ Completion of warranty period or right-of-return period

Copyright © 2013 McGraw-Hill Ryerson Limited

3

LO2

Revenue recognition

• Gradual approach – recognizes revenue gradually over the entire earnings process - used when critical event approach not appropriate

• Percentage of completion method

▫ Revenue and expenses recognized in each accounting period

• Completed-contract method

▫ Revenue and expenses only recognized at the end of the contract

• Cost-recovery method

▫ Revenue and expenses recorded with no profit until end of contract

Copyright © 2013 McGraw-Hill Ryerson Limited

4

LO2

Cost-Recovery Method

• Apply where requirements not met for percentage-of-completion method, under

IFRS

• Revenue recognized to the amount of costs incurred each period – zero profit recognized until final year of contract

Copyright © 2013 McGraw-Hill Ryerson Limited

5

LO2

Completed Contract Method

• Apply where Percentage-of-Completion method cannot be used, under Accounting

Standards for Private Enterprises (ASPE).

Copyright © 2013 McGraw-Hill Ryerson Limited

6