Journal Entries (Normal Costs)

advertisement

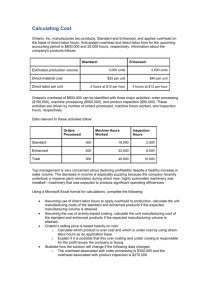

Job Costing Dr. Hisham Madi 1-1 Basic Costing Terminology… Cost objects are anything for which a measurement of cost is desired Direct costs of a cost object are costs that can be traced to that cost object in an economically feasible way Indirect costs of a cost object are costs that cannot be traced in an economically feasible way. Cost pool a grouping of individual indirect cost items Cost-allocation base a systematic way to link an indirect cost or group of indirect costs to cost objects 1-2 Basic Costing Terminology… For example, if indirect costs of operating metal-cutting machines is $500,000 based on running these machines for 10,000 hours, the cost allocation rate is $500,000 ÷ 10,000 hours = $50 per machinehour, where machine-hours is the cost allocation base. If a product uses 800 machine-hours, it will be allocated $40,000, $50 per machine-hour * 800 machine-hours A job order cost system provides product costs for each quantity of product that is manufactured Each quantity of product that is manufactured is called a job Each job generally uses different amounts of resources 1-3 Costing Systems The company assigns costs to each job Each job generally uses different amounts of resources. The objective is to compute the cost per job. At each point in manufacturing a product or providing a service, the company can identify the job and its associated costs. A job order cost system measures costs for each completed job. 1-4 Costing Approaches The difficulty of calculating actual indirect-cost rates on a weekly or monthly basis means managers cannot calculate the actual costs of jobs as they are completed. Managers want to know manufacturing costs (and other costs, such as marketing costs) for ongoing uses, including pricing jobs, monitoring and managing costs, evaluating the success of the job. Because of the need for immediate access to job costs, few companies wait to allocate overhead costs until year-end when the actual manufacturing overhead is finally known a predetermined or budgeted indirect-cost rate is calculated for each cost pool at the beginning of a fiscal year, and overhead costs are allocated to jobs as work progresses 1-5 Costing Approaches Actual costing—allocates: Indirect costs based on the actual indirect-cost rates times the actual activity consumption. Normal Costing—allocates: Indirect costs based on the budgeted indirect-cost rates times the actual activity consumption. Both methods allocate direct costs to a cost object the same way: by using actual direct-cost rates times actual consumption 1-6 Seven-Step Job Costing 1. Identify the job that is the chosen cost object. • The cost object in the Robinson Company example is Job WPP 298, manufacturing a paper-making machine 2. Identify the direct costs of the job. 3. Select the cost-allocation base(s) to use for allocating indirect costs to the job. • some indirect costs such as depreciation and repairs of machines are more closely related to machine-hours. Other indirect costs such as supervision and production support are more closely related to direct manufacturing labor-hours. • supervision, manufacturing engineering, utilities, and repairs. Because these costs cannot be traced to a specific job, they must be allocated to all jobs in a systematic way. 1-7 Seven-Step Job Costing Robinson believes that the number of direct manufacturing labor-hours drives the manufacturing overhead resources (such as salaries paid to supervisors, engineers, production support staff, and quality management staff) required by individual jobs 1-8 Seven-Step Job Costing 4. Identify the Indirect costs associated with each costallocation base. (Determine the appropriate cost pools that are necessary.) • direct manufacturing labor-hours— can be used to allocate indirect manufacturing costs to jobs, Robinson creates a single cost pool called manufacturing overhead costs. 4. Compute the Rate per Unit of each cost-allocate base used to allocate indirect costs to the job (normal costing so use budgeted values) 1-9 Budgeted Manufacturing Overhead Rate = Budgeted Manufacturing Overhead Costs Budgeted Total Quantity of Cost-Allocation Base Seven-Step Job Costing 7. Compute the indirect costs allocated to the job: Budgeted Allocation Rate x Actual Base Activity For the Job 8. Compute total job costs by adding all direct and indirect costs together. Direct Manufacturing Costs Direct Materials Direct Labor Manufacturing Overhead (Indirect Costs) Total Mfg Costs of Job XYZ 1-10 xxxx xxxx xxxx xxxx xxxx Actual Costing Vs. Normal Costing 1-11 Both actual costing and normal costing trace direct costs to jobs in the same way because source documents identify the actual quantities and actual rates of direct materials and direct manufacturing labor for a job as the work is being done. The only difference between costing a job with normal costing and actual costing is that normal costing uses BUDGETED indirect-cost rates where actual costing using ACTUAL indirectcost rates calculated annually at the end of the year. Job Costing Overview 1-12 4.18 P 127 Budgeted indirectcost rate = Budgeted indirect costs (assembly support) $8,300,000 = Budgeted direct labor-hours 166,000 hours = $50 per direct labor-hour Actual indirectcost rate = Actual indirect costs (assembly support) $6,520,000 = Actual direct labor-hours 163,000 hours = $40 per direct labor-hour 1-13 2a. Normal costing Direct costs Direct materials Direct labor 2b. Indirect costs Assembly support ($50 ´ 960; $50 ´ 1,050) Total costs Actual costing Direct costs Direct materials Direct labor Indirect costs Assembly support ($40 ´ 960; $40 ´ 1,050) Total costs 1-14 Laguna Model Mission Model $106,760 36,950 143,710 $127,550 41,320 168,870 48,000 $191,710 52,500 $221,370 $106,760 36,950 143,710 $127,550 41,320 168,870 38,400 $182,110 42,000 $210,870 Journal Entries Journal entries are made at each step of the production process. The purpose is to have the accounting system closely reflect the actual state of the business, its inventories, and its production processes. All product costs are accumulated in the work-in-process control account. Direct materials used Direct labor incurred Factory overhead allocated or applied Actual indirect costs (overhead) are accumulated in the manufacturing overhead control account. 1-15 Journal Entries (Normal Costs) 1. Purchase of materials (direct & indirect) on credit: Materials Control Accounts Payable Control XX XX 2. Usage of direct and indirect (OH) materials into production: Work-in-Process Control Manufacturing Overhead Control Materials Control XX XX XX 3.Manufacturing Payroll (direct & indirect) 1-16 Work-in-Process Control (direct) XX Manufacturing Overhead Control (indirect) Cash Control XX XX Journal Entries (Normal Costs) 4. Other manufacturing overhead costs incurred during the period: Manufacturing Overhead Control XX Cash Control XX Accumulated Depreciation Control XX Other manufacturing overhead costs incurred during February, $75,000, consisting of supervision and engineering salaries, $44,000 (paid in cash); plant utilities, repairs, and insurance, $13,000 (paid in cash); and plant depreciation, $18,000 1-17 Journal Entries (Normal Costs) 5. Allocation (or application) of indirect costs (overhead) to the work-in-process account is based on a predetermined overhead rate. Work-in-Process Control XX Manufacturing Overhead Allocated XX Note: Actual overhead costs are never posted directly into work-in-process 1-18 Journal Entries (Normal Costs) 6. Products are completed and transferred out of production (Work-in-Process) to Finished Goods (in preparation for being sold). Finished Goods Control Work-in-Process Control 1-19 XX XX Journal Entries (Normal Costs) 7. The associated costs are transferred to an expense (cost) account. Cost of goods sold. Cost of Goods Sold Finished Goods Control 1-20 XX XX Journal Entries (Normal Costs) 9. When marketing or customer-service costs are incurred, the appropriate expense account is increased and Cash Control is decreased (or Accounts payable Control would be increased, if the items/services are purchased on account) Marketing Expense Customer-Service Expense Cash Control 1-21 XX XX XX Journal Entries (Normal Costs) Products are sold to customers on credit. Accounts Receivable Control Sales 1-22 XX XX Accounting For Manufacturing Overhead Manufacturing overhead costs are typically pooled together into one account and then allocated to individual jobs based on a relatively arbitrary allocation base. Manufacturing overhead costs, including indirect materials and indirect labor, are usually accumulated in the Manufacturing Overhead Control account Manufacturing Overhead Control, the record of the actual costs in all the individual overhead categories (such as indirect materials, indirect manufacturing labor, supervision, engineering, utilities, and plant depreciation). Manufacturing Overhead Allocated, the record of the manufacturing overhead allocated to individual jobs on the basis of the budgeted rate multiplied by actual direct manufacturing labor-hours 1-23 Accounting For Manufacturing Overhead At the end of the year, the overhead accounts show the following amounts: Manufacturing overhead controls (31/Dec)= 1215000 Manufacturing allocated (31/Dec)= 1080000 Actual costs will almost never equal budgeted costs. Accordingly, an imbalance situation exists between the two overhead accounts. The $135,000 ($1,215,000 – $1,080,000) difference (a net debit) is an underallocated amount because actual manufacturing overhead costs are greater than the allocated amount. 1-24 Accounting For Manufacturing Overhead Underallocated indirect costs occur when the allocated amount of indirect costs in an accounting period is less than the actual (incurred) amount. Overallocated indirect costs occur when the allocated amount of indirect costs in an accounting period is greater than the actual (incurred) amount This difference will be eliminated in the end-of-period adjusting entry process, using one of three possible methods. 1-25 Methods for Adjusting Over/Underapplied Overhead Adjusted Allocation-rate Approach all allocations are recalculated with the actual, exact allocation rate. First, the actual manufacturing overhead rate is computed at the end of the fiscal year. Then, the manufacturing overhead costs allocated to every job during the year are recomputed using the actual manufacturing overhead rate Example, the actual manufacturing overhead ($1,215,000) exceeds the manufacturing overhead allocated ($1,080,000) by 12.5% [($1,215,000 – $1,080,000) ÷ $1,080,000]. 1-26 Methods for Adjusting Over/Underapplied Overhead Proration Approach Proration spreads underallocated overhead or overallocated overhead among ending work-in-process inventory, finished goods inventory, and cost of goods sold. Materials inventory is not included in this proration, because no manufacturing overhead costs have been allocated to it. 1-27 Methods for Adjusting Over/Underapplied Overhead Example End-of-year proration is made to the ending balances in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold. How should Robinson prorate the underallocated $135,000 of manufacturing overhead at the end of 2011 1-28 Methods for Adjusting Over/Underapplied Overhead Robinson prorates underallocated or overallocated amounts on the basis of the total amount of manufacturing overhead allocated in 2011 (before proration) in the ending balances of Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold 1-29 Methods for Adjusting Over/Underapplied Overhead The journal entry to record this proration is as follows: Work in process 2025 Finished Goods Control 3915 Cost of Goods Sold 129060 Manufacturing Overhead Allocated 1080000 Manufacturing Overhead Control 1-30 1215000 Methods for Adjusting Over/Underapplied Overhead Write-Off to Cost of Goods Sold Approach Under this approach, the total under- or overallocated manufacturing overhead is included in this year’s Cost of Goods Sold 1-31 Job Costing In The Service Sector For 2011, Donahue budgets total direct-labor costs of $14,400,000, total indirect costs of $12,960,000, and total direct (professional) labor-hours of 288,000. In this case, Assuming only one indirect-cost pool and total direct-labor costs as the cost-allocation base, 1-32 Job Costing In The Service Sector Suppose that in March 2011, an audit of Hanley Transport, a client of Donahue, uses 800 direct labor-hours. Donahue calculates the direct-labor costs of the Hanley Transport audit by multiplying the budgeted direct-labor cost rate, $50 per direct labor-hour, by 800, the actual quantity of direct labor-hours. The indirect costs allocated to the Hanley Transport audit are determined by multiplying the budgeted indirect-cost rate (90%) by the direct-labor costs assigned to the job ($40,000). Assuming no other direct costs for travel and the like, the cost of the Hanley Transport audit is as follows 1-33 1-34