Consumers, Producers, and the Efficiency of Markets

advertisement

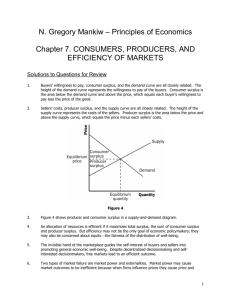

Consumers, Producers, and the Efficiency of Markets Outline: Positive economics: Allocation of scarce resources using forces of demand and supply Normative economics: Whether these allocations are desirable leads to the study of welfare economics Welfare economics is the study of how the allocation of resources affects economic wellbeing Examine the benefits that buyers and sellers receive from participating in the market Willingness to pay is the maximum amount that a buyer will pay for a good Consumer Surplus and Demand Curve Consumer surplus is a buyer’s willingness to pay minus the amount the buyer actually pays Using the willingness to pay of the buyers one can derive the demand schedule and the demand curve The height of the demand curve shows the willingness to pay of the marginal buyer Consumer surplus in a market is measured as the area below the demand curve and above the market price Consumer Surplus P DD Q Consumer Surplus and Demand Curve A lower price raises consumer surplus – Existing buyers see an increase in their consumer surplus due to a reduction in price – New buyers enjoy consumer surplus as they can now enter the market Consumer surplus is a good measure of economic well-being and respects preferences of consumers. Is it always a good measure? Important assumption in economicsconsumers are rational Producer Surplus and Supply Curve Cost is the value of everything a seller must give up to produce. It includes the cost of raw materials and the opportunity cost (value of her time). Cost is a measure of the seller’s willingness to sell. Producer surplus is the amount a seller is paid for a good minus the seller’s cost. It measures the benefit to the sellers for participating in a market. The willingness to sell or cost is used to derive the supply schedule and graph the supply curve. Producer Surplus and Supply Curve The height of the supply curve measures the sellers’ costs. The price on the supply curve denotes the cost of the marginal seller Producer surplus in a market is the area below the price and above the supply curve A higher price raises producers surplus by – Existing producers receive a higher price – New producers enter the market at a higher price Market Efficiency Consumer surplus= value to buyers- amount paid by buyers Producer surplus= amount received by sellers- cost to sellers Therefore, market surplus= value to buyers- cost to sellers If the allocation of resources maximizes total surplus then that allocation is efficient Efficiency is the property of a resource allocation of maximizing the total surplus received by all members of society Equity is the fairness of the distribution of wellbeing among the members of society Market Efficiency Free markets allocate the supply of goods to the buyers who value them most Free markets allocate the demand for goods to the sellers who produce them at least cost Free markets produce the quantity of goods that maximizes total surplus in the market Conclusion: Free markets result in efficient market outcomes but are the market outcomes equitable? Market Failure Efficiency of markets is based on two major assumptions: – Markets are perfectly competitive – Market outcomes matter only to the buyers and sellers in the market Assumptions are invalid in some cases and result in market failure- the inability of some unregulated markets to allocate resources efficiently Causes for market failure – Existence of market power – Presence of externalities