Prepaid Rent

advertisement

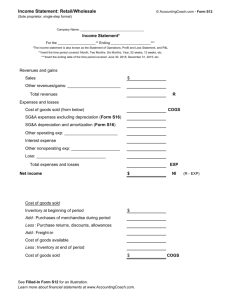

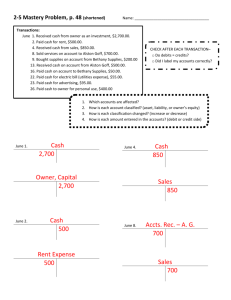

Lecture 4 Income Statement: Cash versus Accrual Accounting Firm of the Day 2 Goals of Today’s Class • Better understanding of Revenues and Expenses • Better understanding of the Income Statement • Better understanding of cash versus accrual accounting Review: Debits and Credits Remember RE is an Owners’ Equity Account Retained Earnings Liability or Owners’ Equity Asset (Debit) + (Credit) - Memorize this for Assets (Debit) (Credit) - + Flip it for Liabs + OE Expenses/Losses An increase in an Expense is a decrease in Retained Earnings. (We decrease Owners’ Equity accounts with a debit.) (Debit) + Revenues/Gains An increase in a Revenue is an increase in Retained Earnings. (We increase Owners’ Equity accounts with a credit.) (Credit) + 4 Review of Shareholders’ Equity • What is “contributed capital”? – The initial investment of owners – e.g., common stock • What is “retained earnings”? – The cumulative net income of the company that has not been distributed as dividends. Peeking Ahead -- Contributed Capital: Common Stock Accounting for initial public issuance of common stock • Very simple if stock has no par value 1. Debit Cash for the amount of the contribution 2. Credit Common Stock for the amount of the contribution Example: Sell 2,000 shares of “no par common” for $8 per share (Debit) Cash $16,000 (Credit) Common Stock $16,000 Peeking Ahead -- Contributed Capital: Common Stock Accounting for initial public issuance of common stock • More complicated if stock has a stated par value 1. Debit Cash for the amount of the contribution 2. Credit Common Stock for par value only 3. Credit Other Paid in Capital for the difference (contribution – par value) Example: Sell 2,000 shares of “$1 par common” for $8 per share (Debit) Cash $16,000 (Credit) Common Stock (2,000 shs. @ $1 par) $2,000 (Credit) Other Paid in Capital $14,000 Balance Sheet Equation At = Lt + SEt At = Lt + CSt + APICt + REt At-1 = Lt-1 + CSt-1 + APICt-1 + REt-1 (At - At-1) = (Lt - Lt-1 ) + (CSt - CSt-1 ) + ( APICt - APICt-1 ) + ( REt - REt-1 ) ∆A = ∆L + ∆CS + ∆APIC + ∆RE ∆A = ∆L + ∆CS + ∆APIC + Net Income - Dividends ∆A = ∆L + ∆CS + ∆APIC + Revenue - Expenses - Dividends Income Statement • Reports Net Income earned by the business over a period of time as a result of its profit-directed activities. • Changes in shareholders’ equity due to profit-directed activities during an accounting period. • Income statement accounts are temporary accounts. • Net Income = Revenues – Expenses Accrual Accounting Goal is to account for all transactions that economically occurred in the pd. To document fundamental economics, we employ the accrual method The accrual method is best contrasted with the cash method of accounting through an example: On December 29th, Best Buy sells and delivers an HDTV worth $2,000 Customer purchases the TV using 6 month financing Best Buy prepares its income statement and balance sheet on December 31st (this assumes a December fiscal year end) Did the sale officially occur in the period even though no cash was received? Cash basis: No. Accrual Basis: Yes. Accrual Accounting (continued) To properly account for periodic income, recognize revenues when earned and expenses when incurred, even though no cash has been exchanged This concept is sometimes called the “matching principle”, where revenues are matched with expenses in the period in which they are incurred e.g., salaries are often not paid to employees until a week or two after employees have provided their services At the end of a period, firms must recognize earned, yet still unpaid, salary expense to correctly match the expense to the period in which the services were actually used To allow for proper accounting of revenues and expenses, we employ two temporary holding accounts called Receivables and Payables When revenues are earned, but no cash is received, we record an increase to a Receivable to reflect cash that we are owed in the future When expenses are incurred, but no cash is paid, we record an increase to a Payable to reflect cash that we owe in the future When and how do we identify and measure revenues and expenses? Timing 1. Cash Basis REVENUES with the increase in cash resulting from the sale of goods or services, and EXPENSES with the decrease in cash associated with sales activities. Period 1 Purchase inventory for resale, on credit, Cost = $10 Period 2 Period 3 Pay supplier $10 Sell and deliver inventory on credit, Price = $20 Period 4 Collect $20 from customer Calculating Net Income using Cash Basis Accounting Period 1 Purchase inventory for resale, on credit, Cost = $10 Period 2 Period 3 Period 4 Pay supplier $10 Sell and deliver inventory on credit, Price = $20 Collect $20 from customer Net Income = Revenues - Expenses = Assets in - Assets out Period 1 0 = 0 - 0 Period 2 -10 = 0 - 10 Period 3 0 = - 0 Period 4 +20 = 0 20 - 0 What is the downside to Cash Basis Accounting? • Reflects the cost and benefit of operating transactions only when cash payments and cash receipts occur: - Delay in recognizing revenues until cash is received, despite the fact that the store has performed its primary mission: sale of inventory. - Poor matching of the true costs of generating revenues to the periods in which they are generated. 2. Accrual Basis - Revenues • Revenues and expenses are not necessarily associated with the cash inflows and cash outflows. • Identification: Revenue is the increase in assets (not necessarily cash) and/or decrease in liabilities resulting from the principal income generating activities of the business -- selling goods or services in the ordinary course of business. • Timing (Recognition): Revenues: Benefits earned by an entity when the following criteria are satisfied: 1. The entity has delivered its goods/services to the customer. 2. There is persuasive evidence of an arrangement for customer payment. 3. The price is fixed or determinable. 4. Collection of cash (or other benefits) is reasonably assured, though there may still be some uncertainty (uncollectible accounts, warranties). The degree of uncollectability should be estimated with reasonable reliability. • Revenue is recorded according to the revenue principles, regardless of when cash is received! 2. Accrual Basis - Expenses • Revenues and expenses are not necessarily associated with the cash inflows and cash outflows. • Identification Expense is a decrease in assets (not necessarily cash) and/or an increase in liabilities, in a period, for the purpose of generating revenue in the period • Timing (matching) Expenses are recognized – When the associated revenue is recognized – Matched to the timing of revenue – Reported in the income statement in the same period as the revenue they gave rise to. • “Matching principle”: recognize costs and/or assets used as expenses in the period in which they produce revenue • Goal of accrual accounting: report inflows of assets when they are earned, and net them against outflows of assets used to generate them Calculating Net Income using Accrual Basis Accounting Period 1 Purchase inventory for resale, on credit, Cost = $10 Period 2 Period 3 Period 4 Pay supplier $10 Sell and deliver inventory on credit, Price = $20 Collect $20 from customer Net Income = Revenues - Expenses = Assets in - Assets out Period 1 0 = 0 - 0 Period 2 0 = 0 - 0 Period 3 10 = 20 - 10 Period 4 0 = - 0 0 Cash vs. Accrual basis of accounting: Summary • Cash basis of accounting: Method of accounting where income is calculated by recording revenues when cash is received and expenses when expenditures occur • Accrual basis of accounting: Method of accounting where income is calculated by recording revenues when benefits are earned and expenses when resources are given up to produce the revenues (expenses are matched to revenues) Please note that… • The aggregate net income over the life of the business is the same for accrual and cash basis accounting, and is equal to cash inflows minus cash outflows. The only difference is one of timing. • Cash basis – recognition of revenues and expenses are associated with the cash flows of the period. • Accrual basis – timing of cash flows is not necessarily associated with the recognition of revenues and expenses. – Cash may be received/paid before, during, or after revenue and expense recognition. Active vs. Passive Journal Entries Generally, two types of journal entries Active: generated by an actual transaction on the transaction date ABC Corp pays $12,000 to prepay 1 year’s rent (Debit) Prepaid Rent $12,000 (Credit) Cash $12,000 Passive: generated by an end-of-period required adjustment to update an account for a change due to passage of time 1 month elapses. ABC Corp must adjust the Prepaid Rent account to reflect time passage. (Debit) Rent Expense $1,000 (Credit) Prepaid Rent $1,000 Notice the difference: Active transactions are those made by the firm in the conduct of business Passive transactions are those made to update the status or balance of accounts that typically were created previously by active transactions Active vs. Passive Journal Entries (continued) If we did not make passive or adjusting entries, our accounts would stay stuck on the original entry and would therefore be inaccurate ABC Corp pays $12,000 to prepay 1 year’s rent Prepaid Rent (Debit) Prepaid Rent $12,000 (Credit) Cash $12,000 12,000 Without an adjustment as time passes, this amount would stay here (and on the balance sheet) forever Active vs. Passive Journal Entries (continued) If we did not make passive or adjusting entries, our accounts would stay stuck on the original entry and would therefore be inaccurate ABC Corp pays $12,000 to prepay 1 year’s rent Prepaid Rent (Debit) Prepaid Rent $12,000 (Credit) Cash $12,000 12,000 1,000 11,000 So at regular time intervals, we make necessary passive adjustments 1 month elapses. ABC Corp must adjust the Prepaid Rent account to reflect time passage. (Debit) Rent Expense $1,000 (Credit) Prepaid Rent $1,000 Active vs. Passive Journal Entries (continued) Typical passive entries include adjustments for: Interest owed but not yet paid Interest earned but not yet received Rent owed but not yet paid Rent earned but not yet received Salaries earned but not yet paid Systematic depreciation of assets through time Systematic use or expiration of assets through time (like prepaid rent or drilling rights) Basic Accounting Flow Example Balance Sheet Accounts Self-Smart Corp receives $100,000 cash from owners to start the business (Debit) Cash $100,000 (Credit) Contributed Capital $100,000 Self-Smart Corp buys one inventory item for $20,000 cash (Debit) Inventory $20,000 (Credit) Cash $20,000 Cash 100,000 40,000 20,000 Contrib Cap 100,000 Inventory 20,000 20,000 Self-Smart Corp sells the inventory item for $40,000 cash (Debit) Cash $40,000 (Credit) Sales Revenue $40,000 (Debit) Cost of Goods Sold (Expense) $20,000 (Credit) Inventory $20,000 End of Period—Prepare Financial Statements Income Statement Accounts Cost of Goods Sold 20,000 Sales Revenue 40,000 Basic Accounting Flow Example Balance Sheet Accounts Income Statement Cash Revenues 40,000 - Expenses = Net Income 20,000 100,000 20,000 40,000 20,000 Contrib Cap 100,000 Inventory 20,000 20,000 Income Statement Accounts Cost of Goods Sold 20,000 Sales Revenue 40,000 Basic Accounting Flow Example Balance Sheet Accounts Balance Sheet Cash Assets Cash 120,000 Inv 0 100,000 Liabilities 0 Owners’ Equity Contrib Cap 100,000 Ret Earns 20,000 40,000 Contrib Cap 100,000 20,000 120,000 100,000 Inventory 20,000 20,000 0 Retained Earns 20,000 40,000 20,000 Income Statement Accounts Cost of Goods Sold 20,000 0 Sales Revenue 20,000 40,000 40,000 0 An Extended Example Balance Sheet Income Statement Assets Liabilities Revenues/Gains Cash 100,000 Expenses/Losses Equity Common 100,000 Jan 1: Received $100,000 in exchange for 10,000 shares of common stock (Debit) Cash $100,000 (Credit) Common Stock $100,000 Balance Sheet Assets Income Statement Liabilities Revenues/Gains Cash 100,000 Expenses/Losses Equity Common 100,000 Jan 1: Hired warehouse/marketing supervisor at salary of $2,000 per month (paid on 7 th of each month after actual work month has elapsed) No journal entry since there was no actual transaction (no services performed by new employee yet) Balance Sheet Assets Cash 100,000 4,500 Income Statement Liabilities Revenues/Gains Prepaid Rent 4,500 Expenses/Losses Equity Common 100,000 Jan 1: Prepaid $4,500 to landlord for 3 months rent on warehouse (Debit) Prepaid Rent $4,500 (Credit) Cash $4,500 Balance Sheet Assets Cash 100,000 4,500 Income Statement Liabilities Prepaid Rent 4,500 Revenues/Gains Accts Paybl 55,000 Inventory 55,000 Expenses/Losses Equity Common 100,000 Jan 10: Purchased $55,000 (10,000 units) of inventory on credit. 1% discount if paid within 10 days (Debit) Inventory $55,000 (Credit) Accounts Payable $55,000 Balance Sheet Income Statement Assets Cash 100,000 4,500 54,450 Liabilities Prepaid Rent 4,500 Accts Paybl 55,000 Revenues/Gains Discount 55,000 550 Inventory 55,000 Expenses/Losses Equity Common 100,000 Jan 19: Paid $54,450 to inventory vendor (Debit) Accounts Payable $55,000 (Credit) Cash (Credit) Gain on Discount $54,450 $550 Balance Sheet Assets Cash 100,000 4,500 54,450 Inventory 55,000 11,000 Income Statement Liabilities Prepaid Rent 4,500 Accts Paybl 55,000 Revenues/Gains Sales 55,000 Discount 26,000 550 Accts Recvbl 26,000 Expenses/Losses COGS Equity 11,000 Common 100,000 Jan 22: Sold 2,000 units of inventory on credit for $26,000. Collect 2% penalty if not paid in 15 days (Debit) Accounts Receivable $26,000 (Credit) Sales Revenue $26,000 (Debit) Cost of Goods Sold $11,000 (Credit) Inventory $11,000 Balance Sheet Assets Cash 100,000 4,500 54,450 Inventory 55,000 11,000 Income Statement Liabilities Prepaid Rent 4,500 Accts Paybl 55,000 Revenues/Gains Sales 55,000 Discount 26,000 550 Accts Recvbl 26,000 Expenses/Losses COGS Equity 11,000 Common 100,000 Jan 30: We are done with active January entries. Now we need to passively adjust some accounts before we prepare the January balance sheet and income statement. Balance Sheet Assets Cash 100,000 4,500 54,450 Inventory 55,000 11,000 Income Statement Liabilities Prepaid Rent 4,500 1,500 Revenues/Gains Accts Paybl 55,000 Sales 55,000 Discount 26,000 550 Accts Recvbl 26,000 Expenses/Losses COGS Equity 11,000 Common 100,000 Jan 30: Passive adjustment to reflect prepaid rent that has been used up (Debit) Rent Expense $1,500 (Credit) Prepaid Rent $1,500 Rent Exp 1,500 Balance Sheet Assets Cash 100,000 4,500 54,450 Inventory 55,000 11,000 Income Statement Liabilities Prepaid Rent 4,500 1,500 Accts Paybl 55,000 Revenues/Gains Sal Paybl 55,000 Sales 2,000 Discount 26,000 550 Accts Recvbl 26,000 Expenses/Losses COGS Equity 11,000 Rent Exp 1,500 Common 100,000 Sal Exp 2,000 Jan 30: Passive adjustment to reflect the liability you now owe your employee for the work performed (Debit) Salary Expense $2,000 (Credit) Salary Payable $2,000 Balance Sheet Income Statement Assets Cash 100,000 4,500 54,450 Liabilities Prepaid Rent 4,500 3,000 1,500 41,050 Inventory 55,000 44,000 11,000 Accts Paybl 55,000 Revenues/Gains Sal Paybl 55,000 Sales 2,000 Discount 26,000 550 0 Accts Recvbl 26,000 Expenses/Losses COGS Equity 11,000 Common 100,000 Sal Exp 2,000 Jan 30: Now we can prepare the financial statements Rent Exp 1,500 Balance Sheet Income Statement Assets Cash 41,050 Inventory 44,000 Liabilities Prepaid Rent 3,000 Accts Paybl Revenues/Gains Sal Paybl 0 Sales 2,000 Discount 26,000 550 Accts Recvbl 26,000 Expenses/Losses COGS Equity 11,000 Common 100,000 Sal Exp 2,000 Jan 30: Now we can prepare the financial statements Rent Exp 1,500 Income Balance Statement Sheet Income Statement Assets Liabilities Sales 26,000 Cash PrepaidDiscount Rent Accts Paybl Sal Paybl + Gain from 550 41,050 3,000 0 = Total Revenues and Gains 26,550 11,000 - Cost of Goods Sold 1,500 - Rent Expense Inventory Accts Recvbl 2,000 Salary26,000 Expense 44,000 12,050 = Net Income Revenues/Gains Sales 2,000 26,000 11,000 Common 100,000 Sal Exp 2,000 Jan 30: Now we can prepare the financial statements 550 Expenses/Losses COGS Equity Discount Rent Exp 1,500 Balance Sheet Income Statement Assets Cash 41,050 Inventory 44,000 Liabilities Prepaid Rent 3,000 Accts Paybl Revenues/Gains Sal Paybl 0 Sales 2,000 Discount 26,000 550 Accts Recvbl 26,000 Expenses/Losses COGS 11,000 Equity Common Rent Exp 1,500 Ret Earns 100,000 Sal Exp 2,000 Jan 30: Now we can prepare the financial statements After the income statement is prepared, we transfer Income Statement accounts into Retained Earnings to allow for balance sheet preparation Balance Sheet Income Statement Assets Cash 41,050 Prepaid Rent 3,000 Inventory 44,000 Liabilities Accts Paybl Revenues/Gains Sal Paybl 0 2,000 Sales 26,000 26,000 Discount 550 0 550 0 Accts Recvbl 26,000 Expenses/Losses COGS 11,000 Equity Common Ret Earns 100,000 26,550 Sal Exp 2,000 Jan 30: Close Revenue Accounts into Retained Earnings (Debit) Sales $26,000 (Debit) Discount $550 (Credit) Retained Earnings 26,550 Rent Exp 1,500 Balance Sheet Income Statement Assets Cash 41,050 Inventory 44,000 Liabilities Prepaid Rent 3,000 Accts Paybl Revenues/Gains Sal Paybl 0 Sales 2,000 Discount 0 0 Accts Recvbl 26,000 Expenses/Losses COGS 11,000 Equity Common 100,000 Ret Earns 14,500 26,550 12,050 11,000 0 Rent Exp 1,500 1,500 0 Sal Exp 2,000 2,000 0 Jan 30: Close Expense Accounts into Retained Earnings (Debit) Retained Earnings $14,500 (Credit) Cost of Goods Sold $11,000 (Credit) Salary Expense $ 2,000 (Credit) Rent Expense $ 1,500 Balance Sheet Income Statement Assets Cash 41,050 Inventory 44,000 Liabilities Prepaid Rent 3,000 Accts Paybl 0 Revenues/Gains Sal Paybl Sales 2,000 Discount 0 0 Accts Recvbl 26,000 Expenses/Losses COGS 0 Equity Common 100,000 Ret Earns 12,050 Sal Exp 0 Jan 30: Now the Balance Sheet is effectively already prepared Total Assets = $114,050 Total Liabs + Equity = $114,050 Rent Exp 0 Balance Sheet Income BalanceStatement Sheet Assets Cash 41,050 Inventory 44,000 Liabilities Prepaid Rent 3,000 Accts Paybl 0 Assets Sal Paybl 2,000 Accts Recvbl Revenues/Gains Cash Sales Prep Rent 0 Inventory Accts Rec Total Assets 41,050 Discount 3,000 0 44,000 26,000 114,050 Liabilities + Owners’ Equity 26,000 Expenses/Losses0 Accts Pay Salaries Pay 2,000 Common 100,000 COGS Stock Rent Exp Retained Earns 0 12,050 0 Total Liabs + OE 114,050 Equity Common 100,000 Ret Earns 12,050 Sal Exp 0 Jan 30: Now the Balance Sheet is effectively already prepared Balance Sheet Income Statement Assets Cash 41,050 Inventory 44,000 Liabilities Prepaid Rent 3,000 Accts Paybl 0 Revenues/Gains Sal Paybl Sales 2,000 Discount 0 0 Accts Recvbl 26,000 Expenses/Losses COGS 0 Equity Common 100,000 Rent Exp 0 Ret Earns 12,050 Sal Exp 0 February: Now we continue to build off of these accounts as the business continues February: Notice the Income Statement accounts are all “clean” to enable a new cumulation period Balance Sheet Income Statement Assets Cash 41,050 39,000 Prepaid Rent 3,000 Inventory 44,000 Liabilities 16,500 Accts Paybl 0 Revenues/Gains Sal Paybl Sales 2,000 Discount 0 39,000 0 Accts Recvbl 26,000 Expenses/Losses COGS 0 Equity Rent Exp 0 16,500 Common 100,000 Ret Earns 12,050 Sal Exp 0 February 3: Sold 3,000 units of inventory for $39,000 cash (Debit) Cash $39,000 (Credit) Sales Revenue $39,000 (Debit) Cost of Goods Sold $16,500 (Credit) Inventory $16,500 Balance Sheet Income Statement Assets Cash 41,050 39,000 Prepaid Rent 3,000 Accts Paybl Revenues/Gains Sal Paybl 0 Sales 2,000 16,500 Discount 0 39,000 2,000 Inventory 44,000 Liabilities 0 Accts Recvbl 26,000 Expenses/Losses COGS 0 Equity Rent Exp 0 16,500 Common Ret Earns 100,000 12,050 Sal Exp 0 February 7: Paid $2,000 cash for radio advertisements (Debit) Advertising Expense $2,000 (Credit) Cash $2,000 Adv Exp 2,000 Balance Sheet Income Statement Assets Cash 41,050 39,000 Prepaid Rent 3,000 Accts Paybl 0 16,500 Revenues/Gains Sal Paybl 2,000 2,000 2,000 Inventory 44,000 Liabilities Sales 2,000 Discount 0 39,000 0 Accts Recvbl 26,000 Expenses/Losses COGS 0 Equity Rent Exp 0 16,500 Common 100,000 Ret Earns 12,050 Sal Exp 0 February 7: Paid $2,000 salary to employee (Debit) Salary Payable $2,000 (Credit) Cash $2,000 Adv Exp 2,000 Balance Sheet Income Statement Assets Cash 41,050 39,000 26,520 Liabilities Prepaid Rent 3,000 Accts Paybl 0 Revenues/Gains Sal Paybl 2,000 2,000 2,000 Sales 2,000 Discount 0 39,000 0 Fee Rev Inventory 44,000 16,500 520 Accts Recvbl 26,000 26,000 Expenses/Losses COGS 0 Equity Rent Exp 0 16,500 Common 100,000 Ret Earns 12,050 Sal Exp 0 February 13: Received payment of $26,520 from Jan 22nd customer (Debit) Cash $26,520 (Credit) Accounts Receivable $26,000 (Credit) Collected Fee Revenue $520 Adv Exp 2,000 Balance Sheet Income Statement Assets Cash 41,050 39,000 26,520 Liabilities Prepaid Rent 3,000 Accts Paybl 0 Revenues/Gains Sal Paybl 2,000 2,000 2,000 Sales 2,000 Discount 0 39,000 0 Fee Rev Inventory 44,000 16,500 520 Accts Recvbl 26,000 26,000 Expenses/Losses COGS 0 Equity Rent Exp 0 16,500 Common 100,000 Ret Earns 12,050 Sal Exp 0 Adv Exp 2,000 Feb 29: We are done with active February entries. Now we need to passively adjust some accounts before we prepare the February balance sheet and income statement. Balance Sheet Income Statement Assets Cash 41,050 39,000 26,520 Liabilities Prepaid Rent 3,000 2,000 2,000 1,500 Accts Paybl 0 Revenues/Gains Sal Paybl 2,000 Sales 2,000 Discount 0 39,000 0 Fee Rev Inventory 44,000 16,500 520 Accts Recvbl 26,000 26,000 Expenses/Losses COGS 0 Equity 16,500 Common Rent Exp 0 1,500 Ret Earns 100,000 12,050 Sal Exp 0 Feb 29: Passive adjustment to reflect prepaid rent that has been used up (Debit) Rent Expense $1,500 (Credit) Prepaid Rent $1,500 Adv Exp 2,000 Balance Sheet Income Statement Assets Cash 41,050 39,000 26,520 Liabilities Prepaid Rent 3,000 2,000 2,000 1,500 Accts Paybl 0 Revenues/Gains Sal Paybl 2,000 Sales 2,000 Discount 0 39,000 2,000 0 Fee Rev Inventory 44,000 16,500 520 Accts Recvbl 26,000 26,000 Expenses/Losses COGS 0 Equity 16,500 Common Rent Exp 0 1,500 Ret Earns 100,000 12,050 Sal Exp 0 2,000 Adv Exp 2,000 Feb 29: Passive adjustment to reflect the liability you now owe your employee for the work performed (Debit) Salary Expense $2,000 (Credit) Salary Payable $2,000 Balance Sheet Income Statement Assets Cash 41,050 39,000 26,520 102,570 27,500 Prepaid Rent 3,000 2,000 2,000 Inventory 44,000 Liabilities 16,500 1,500 1,500 Accts Paybl 0 Revenues/Gains Sal Paybl 2,000 Sales 2,000 2,000 2,000 0 39,000 0 Fee Rev 520 Accts Recvbl 26,000 Discount 26,000 Expenses/Losses 0 COGS 0 Equity 16,500 Common Rent Exp 0 1,500 Ret Earns 100,000 12,050 Sal Exp 0 2,000 Feb 29: Now we can prepare the financial statements Adv Exp 2,000 Balance Sheet Income Statement Assets Cash 102,570 Liabilities Prepaid Rent 1,500 Accts Paybl 0 Revenues/Gains Sal Paybl Sales 2,000 Discount 0 39,000 0 Fee Rev Inventory 27,500 520 Accts Recvbl 0 Expenses/Losses COGS 0 Equity 16,500 Common 100,000 0 1,500 Ret Earns 12,050 Sal Exp 0 2,000 Feb 29: I’ll leave it up to you to: Rent Exp Adv Exp 2,000 (1) Prepare the Income Statement (2) Close the Revenue and Expense accounts to Ret Earns (3) Prepare the Balance Sheet