Document

advertisement

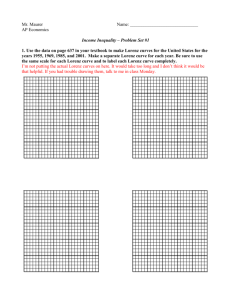

Ch. 28: The Distribution of Income and Poverty Del Mar College John Daly ©2003 South-Western Publishing, A Division of Thomson Learning Who Are the Rich And How Rich Are They? • The lowest fifth (lowest quintile) of households is considered poor, the top fifth is considered rich, and the three-fifths in between are considered middle income. • The income distribution in the United States was less equal (more unequal) in 1998 than in 1967. SOURCE: U.S. Bureau of the Census. Income Distribution, 1967 and 1998 SOURCE: U.S. Bureau of the Census. Income Distribution and Computers • • Some people think that computers explain the increasing income inequity. Problems with this theory are: 1. The increasing income inequality precedes the use of personal computers. 2. Just because income inequality and the use of computers occur at about the same time, it does not follow that one causes the other. 3. Some economists have found that wages and income inequality increased with the use of pencils, but no one is willing to make the case that pencils can shift the income distribution. Can All People Become Better Off as the Income Distribution Becomes More Equal? • An increasingly unequal income distribution is not necessarily a sign of an income group being worse off. • It is possible for everyone to be better off at the same time that the income distribution becomes more unequal. The Income Distribution Adjusted For Taxes And In-Kind Transfer Payments • Government can change the distribution of income through the use of taxes and transfer payments. • Ex ante distribution of income is the before tax and/or transfer payment distribution of income. • Ex post distribution of income is the after-tax-andtransfer-payment distribution of income. • Transfer payments are payments to persons that are not made in return for goods and services currently provided. The Effect of Age on the Income Distribution It is possible that a person in her late twenties, thirties, or forties will have a higher income than another person in her early twenties or sixties, even though their total lifetime income will be identical. A Simple Equation • Individual Income = Labor income + Asset income + Transfer payments – Taxes • Labor income is equal to the wage rate an individual receives times the number of hours he or she works. • Asset income consists of such things as the return to saving, the return to capital investment, and the return to land. Q&A • How can government change the distribution of income? • Income inequality at one point in time is sometimes consistent with income equality over time. Comment. • Smith and Jones have the same income this year, $40,000. Does it follow that their income came from the same sources? Explain your answer. The Lorenz Curve The Lorenz curve represents the distribution of income; it expresses the relationship between cumulative percentage of households and cumulative percentage of income. A Hypothetical Lorenz Curve The data in (a) were used to derive the Lorenz curve in (b). The Lorenz curve shows the cumulative percentage of income earned by the cumulative percentage of households. If all households received the same percentage of total income, the Lorenz curve would be the line of perfect income equality. The bowed Lorenz curve shows an unequal distribution of income. The more bowed the Lorenz curve is, the more unequal the distribution of income. Lorenz Curve for the United States, 1998 The Gini Coefficient is a measurement of the degree of inequality in the income distribution. The Gini Coefficient is equal to the Area between line of perfect income equality and the actual Lorenz Curve, divided by the Entire Triangular are under the line of perfect income equality. A Gini Coefficient of 0 is complete income equality while a Gini Coefficient of 1 means complete income inequality. The Gini Coefficient A Limitation of the Gini Coefficient • The Gini Coefficient cannot tell us what is happening in different quintiles. • We should not jump to the conclusion that because the Gini coefficient is lower in country 2 than in country 21, the lowest fifth of households have a greater percentage of total income, in country 2, than in country 1. By itself the Gini coefficient cannot tell us anything about the income share of a particular quintile. Although there is a tendency to believe that the larger percentage of total income the lower the Gini coefficient, this need not be the case. In the diagram, the Gini coefficient for Lorenz curve 2 is lower than the Gini coefficient for Lorenz curve 1. But the bottom 20 % of households obtains a smaller percentage of total income in the lower Gini Coefficient case. A Limitation of the Gini Coefficient Q&A • Starting with the top fifth of income earners and proceeding to the lowest fifth, suppose the income share o9f each group is 40%, 30%, 20%, 10%, and 5%. Can these percentages be right? • Country A has a Gini coefficient of 0.45. What does that mean? Why Does Income Inequality Exist? Because people do not receive the same labor income, asset income, and transfer payments, or pay the same taxes. Factors Contributing to Income Inequality • Innate Abilities and Attributes: Individuals are not all born with the same abilities and qualities. • Work and Leisure: There is a tradeoff between work and leisure: More work means less leisure, less work means more leisure. • Education and Other Training: Generally, this is human capital – the education, the development of skills, and anything else that is particular to the individual and increases his or her productivity. Factors Contributing to Income Inequality, Part II • Risk Taking: Individuals have different attitude towards risk. • Luck: When individuals can’t explain why something has happened to them, they often say it was the result of good or bad luck. In the long run, such factors as innate ability and attributes, education, and personal decisions are more likely to have a larger sustained effect on income than good or bad luck. • Wage Discrimination: This exists when individuals of equal ability and productivity, as measured by their marginal revenue products, are paid different wage rates by the same employer. Income Differences: Voluntary and Involuntary • Some argue that wage discrimination would be lessened if markets were allowed to be more competitive, more open, and more free. • Others contend that even if the government were to do this, wage discrimination would still exist in vast quantities. Q&A • Jack and Harry work for the same company, but Jack earns more than Harry. Is this evidence of wage discrimination? Explain your answer. • A person decides to assume a lot of risk in earning an income. How could this affect his or her income? Why? Normative Standards of Income Distribution • The marginal Productivity theory of factor prices states that in a competitive setting people tend to be paid their marginal revenue products. • The marginal productivity normative standard of income distribution holds that people should be paid their marginal revenue products. Different Normative Standards of Income Distribution The Marginal Product Normative Standard • Some argue it is just for individuals to receive their contribution to the productive process and individuals should be paid their marginal revenue products. • Critics argue that some persons are innately more productive than others and that rewarding them for innate qualities is unfair. The Absolute Income Equality Normative Standard Some hold that an equal distribution of income will lead to the maximization of total utility in society. Here’s the argument: 1. Individuals are alike when it comes to how much satisfaction they receive from an added increase in income. 2. Receiving additional income is subject to the law of diminishing marginal utility. 3. Redistributing income from the rich to the poor will raise total utility since the poor will gain more utility than the rich will lose. The Absolute Income Equality Normative Standard, Part II Opponents say it is impossible to know if all individuals receive equal utility from an added dollar of income, and that a rich person may receive far more utility from an added dollar of income than a poor person receives. Rawlsian Normative Standard • John Rawls states that individuals will be more likely to argue for a different income distribution if they know what their position is in the current income distribution than if they don’t know what their position is in the current income distribution. • Rawls created the “Veil of Ignorance” – an imaginary veil or curtain behind which a person did not know his or her position in the income distribution. Criticism of Rawls • Individuals behind the veil of ignorance might not reach a consensus on the income distribution that should exist, and they might not be risk avoiders to the degree Rawls assumes they will be. • The size of the income pie might change given different income distributions. • Individuals are likely to consider this information to a greater degree than Rawls assumes they will. Poverty • Poverty exists when the income of a family of four is less than $10,000 per year. • In relative terms, poverty exists when the income of a family of four places it in the lowest 10 percent of income recipients. • The US Government defines poverty in absolute terms: $16,600 per year for a family of four; $8,480 per year for an individual under the age of 65; $7,818 per year for an individual over the age of 65. This is called the Poverty Income Threshold, commonly known as the Poverty Line. Limitations of the Official Poverty Income Statistics • The poverty figures are based solely on money incomes. Many money-poor persons receive inkind benefits. • Poverty figures are not adjusted for unreported income, leading to an overestimation of poverty. • Poverty figures are not adjusted for regional differences in the cost of living, leading to both overestimates and underestimates of poverty. • Government counters are unable to find some poor persons: illegal aliens and some of the homeless which leads to an underestimation of poverty. Poverty in Different Groups of the Population. All data are for 1998 SOURCE: U.S. Bureau of the Census. Who Are The Poor? • Although the poor are persons of all religions, colors, genders, ages, and ethnic backgrounds, some groups are represented in greater number than others. • A greater percentage of families headed by females are impoverished, when compared to percentages of families headed by males. • Families with seven or more persons are more likely to be impoverished than families with fewer than seven members. What is the Justification for Government Redistributing Income? • Some say a government should not play “Robin Hood”. These people are against a government using its powers to take from some and give to others. • Proponents of the Public Good – Free Rider justification say: • Most individuals in society would feel better if there were little or no poverty; therefore, there is a demand to reduce poverty. Government Redistributing Income? (Cont.) • The reduction or elimination of poverty is a nonexcludable public good, a good that if consumed by one person can be consumed by other persons to the same degree and the consumption of which cannot be denied to anyone. • If no one can be excluded from experiencing the benefits of poverty reduction, then individuals will not have any incentive to pay for what they can get for free. Social Insurance? The Social Insurance justification is a different type of justification for government welfare assistance. Individuals currently not receiving welfare think they might one day need welfare assistance and thus are willing to take out a form of insurance for themselves by supporting welfare programs. Q&A • “Poor people will always exist.” Comment. • What percentage of the U.S. population was living in poverty in 1998? • In 1998, what age category had the largest percentage of its group living in poverty?