The HouseholdConsumption Sector

Chapter 05

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

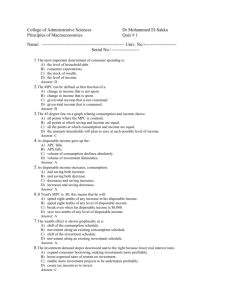

Learning Objectives

After this chapter, you should be able to:

1.

2.

3.

4.

5.

6.

7.

8.

Define and compute the average propensity to consume and

the average propensity to save.

Define and compute the marginal propensity to consume and

the marginal propensity to save.

Explain the consumption function.

Explain the savings function.

Calculate autonomous and induced consumption.

List and discuss the determinants of consumption.

Interpret and assess the permanent income hypothesis.

Explain why we spend so much and save so little.

5-2

GDP and Big Numbers

Gross Domestic Product (GDP) is the nation’s

expenditure on all final goods and services produced

during the year at market prices.

Consumption, investment, and government spending

are the three main sectors of GDP.

GDP for 2009 was $14.2 trillion.

•

•

This can be written as

$14,200,000,000,000

$14,200 billion

$14.2 trillion

Consumption by households was $10.089 trillion in 2009.

10 trillion, 89 billion dollars

5-3

Four Parts of GDP

Consumption ------------ C (this chapter)

•

Investment ---------------- I (Chapter 6)

•

Investment includes business investments in capital and

inventories, as well as residential investment by households.

Government -------------- G (Chapter 7)

•

Consumption includes spending on consumer goods and

services.

Government spending on goods and services.

Net exports --------------- Xn (Chapter 8)

•

Exports minus imports.

5-4

Consumption

C is the largest sector of GDP.

•

C now accounts for 7 out of every 10 dollars spent on final goods

and services.

Americans spend virtually all of their income after taxes,

although savings have increased slightly since 2007.

•

•

Consumers spend 67.7 percent of their disposable income on

services such as medical care, gasoline, eating out, video

rentals, life insurance, and legal fees.

The rest is spent on durable goods, such as television sets and

furniture, or on nondurable goods, such as food and gasoline.

5-5

Consumption Function

A function specifies a relationship between two variables.

•

•

The consumption function states that

•

•

C varies with the level of after-tax income.

John Maynard Keynes noted that consumption was a stable

component of income.

As income rises, consumption (C) rises, but not as quickly.

Therefore, consumption varies with disposable income (DI).

DI increases . . . C increases but by a smaller amount.

DI decreases . . . C decreases but by a smaller amount.

We will look at the mathematical relationships behind this

function and then graph it.

5-6

Example: Consumption and Disposable

Income

(in billions of dollars)

Disposable Income

Consumption

1,000

1,400

2,000

2,200

3,000

3,000

4,000

3,800

5,000

4,600

Note that C > DI at

very low income

levels.

5-7

Consumption and Disposable Income

Disposable Income

Consumption

1,000

1,400

+ 1000

2,000

+ 1000

3,000

+ 800

2,200

3,000

+ 1000

4,000

5,000

+ 800

+ 1000

+ 1000

+ 800

3,800

4,600

+ 800

+ 800

Each time DI increases by $1,000, C increases by $800.

5-8

Saving

Saving is defined as NOT spending.

•

•

DI – C = S

The more we spend, the less we save.

A low savings rate leads to a low productivity growth

rate.

•

Without savings ($) to invest in NEW plant and equipment,

we cannot raise our productivity fast enough!

5-9

Saving as a Percentage of Disposable Income

Source: Economic Report of the President, 2010, Survey of Current Business, March 2010

5-10

Household Saving as a Percentage of Disposable

Income in 2009

Source: OECD

The U.S. saving rate is low compared with other developed economies.

5-11

Questions for Thought and Discussion

Americans spend more on services than on durable and

non-durable goods. Give an example of each category

from your own spending habits.

How is it possible to consume more than your income?

If a country has a negative saving rate, does that mean

that nobody in the country is saving?

5-12

Four Concepts

Average Propensity to Consume: the percentage of

disposable income that is spent

Average Propensity to Save: the percentage of

income that is saved

•

Marginal Propensity to Consume: the percentage of

an increase in disposable income that is spent

•

APC + APS = 100% of DI or 1.00 in decimal form

change in C divided by change in DI

Marginal Propensity to Save: the percentage of an

increase in disposable income that is saved

•

•

change in S divided by change in DI

MPC + MPS = 1.00 in decimal form

5-13

Average Propensity to Consume (APC)

(The Percent of DI Spent)

Consumption

APC =

Disposable Income

5-14

APC values and their meaning

The APC may = 1 signifying all disposable income is

consumed.

The APC may be > 1 signifying you are consuming

more than your disposable income by dipping into your

savings.

The APC may be < 1 indicating you’re a saving a

portion of your disposable income.

5-15

Sample APC Problem

Disposable Income

Consumption Saving

$40,000

$30,000

APC =

C

DI

30000

=

40000

$10,000

3

=

= .75

4

5-16

Sample APC Problem

Disposable Income

Consumption Saving

$40,000

$30,000

5-17

Sample APC Problem

Disposable Income

Consumption Saving

$40,000

$30,000

APC

APS

=

=

C

DI

30000

=

40000

S

DI

10000

40000

=

$10,000

=

3

= .75

4

=

1

= .25

4

5-18

Sample APC Problem

Disposable Income

Consumption Saving

$40,000

$30,000

APC =

C

DI

30000

=

40000

=

$10,000

3

4

= .75

+

APS =

S

DI

=

10000

40000

=

1

4

= .25

1.0

5-19

APCs Greater Than One

Disposable Income

$10,000

Consumption

Saving

$12,000

5-20

APCs Greater Than One

Disposable Income

$10,000

Consumption

$12,000

Saving

– 2000

Where is this going to come from?

5-21

APCs Greater Than One

Disposable Income

Consumption

$10,000

$12,000

C

APC =

DI

$12,000

=

$10,000

Saving

– 2000

12

=

10

= 1.2

5-22

APCs Greater Than One

Disposable Income

Consumption

$10,000

Saving

– 2000

$12,000

C

$12,000

APC =

DI

= $10,000 =

10 = 1.2

APS =

S

DI

-$2,000

$10,000

-2

= –0.2

10

=

12

5-23

APCs Greater Than One

Disposable Income

Consumption

$10,000

$12,000

C

APC = DI

APS =

$12,000

=

$10,000

Saving

– 2000

12

=

10

= 1.2

S

-$2,000

-2

+

DI

= $10,000

= 10

= –0.2

1.0

5-24

Average Propensity to Consume,

Selected Countries, 2009

Source: OECD

5-25

Marginal Propensity to Consume (MPC)

CHANGE in C

MPC

=

CHANGE in DI

5-26

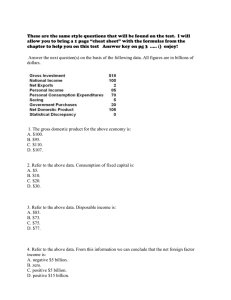

Calculate MPC Using Hypothetical Data

Year

DI

C

S

2000

$30,000

$23,000

$7,000

2001

$40,000

$31,000

$9,000

5-27

Calculating MPC

Change in DI = 40,000 – 30,000 = $10,000

Change in C = 31,000 – 23,000 = $8,000

Change in C = 8,000/10,000 = .8

Change in DI

The MPC is .8

This country consumes 80% of each increase in disposable

income.

5-28

Calculating MPS

Change in DI = 40,000 - 30,000 = $10,000

Change in S = 9,000 – 7,000 = $2,000

Change in S = 2,000/10,000 = .2

Change in DI

MPS = .2

This country saves 20% of each increase in DI.

5-29

Graphing the Consumption Function: The

45- Degree Line

Notice that the scales of the

vertical and horizontal axes

are the same.

At each point along the 45degree line, the measurement

on the two axes is the same.

The line represents every

point where Expenditures

equal Disposable Income.

Example: On the 45-degree

line, when DI = 2,000, what

does Expenditures equal?

Answer: 2,000

Consumption is one category

of expenditures, so start by

graphing C.

5-30

Graphing the Consumption Function

Consumption is the vertical

distance between the

bottom (horizontal) axis and

the “C” line.

If DI = $3 trillion, how much is

C?

•

•

This is where the C function

crosses the 45-degree line.

C = DI = $3 trillion

If DI is $6 trillion, C will be

$4.5 trillion.

If DI is $1 trillion, C is $2

trillion. Some of the C is

financed by borrowing

(Example: Denmark).

Can you use these numbers

to calculate APC and MPC?

5-31

The Saving Function

This graph uses the same

data as the Consumption

Function.

S = DI C.

Can you calculate APS and

APC?

5-32

Autonomous Consumption vs. Induced

Consumption

Autonomous consumption

(AC) is the level of

consumption when

disposable income is “0”.

•

It is called autonomous

because it is independent of

change in disposable

income.

• AC = $2 trillion on graph

Induced consumption (IC) is

that part of consumption that

varies with the level of

disposable income.

•

As disposable income rises,

induced income rises.

• As disposable income fall,

induced income falls.

IC = C – AC for each level of

DI

5-33

Questions for Thought and Discussion

What does the 45-degree line represent? Discuss the

important features of the consumption function in relation

to this line.

How many values for C and DI do you need to calculate

the APC? How many values for C and DI do you need to

calculate the MPC? Explain the difference.

Why does the consumption function have a positive

slope?

5-34

Consumer Spending, 1955 and 2009 ($billions)

The major change in consumer spending has been a

massive shift from nondurables to services.

Source: Survey of Current Business, 2010.

5-35

Expenditures of the Average American

Household, 2009 Bureau of Labor Statistics

Source: www.bea.gov

5-36

Consumption as a Percentage of GDP

1980 - 2010

Between 1982 and early 2008, there was a steady upward trend.

Source: www.bea.gov

5-37

Determinants of the Level of

Consumption

1.

Disposable Income

•

2.

Credit Availability

•

•

3.

Ability to borrow affects spending.

Decrease in home equity loans since 2006 has cut C.

Stock of Liquid Assets in the hands of consumers

•

4.

The most important determinant of consumption.

Stocks, bonds, savings accounts, CDs, money market funds

Stock of Durable Goods in the hands of consumers

•

Market saturation leads to drop in C.

5-38

Determinants of the Level of Consumption

(Continued)

5.

Keeping up with the Jones's

•

•

6.

Maintaining a basic standard of living

•

•

•

7.

Social definition of basic standard of living changes over time.

The bar keeps rising.

Two-income trap?

Consumer Expectations

•

•

8.

Veblen’s theory of conspicuous consumption

Consuming things adds to our social status.

Buy now if expect prices to rise.

Buy later if expect prices to fall in recession.

The Wealth Effect

•

•

When the value of your home or stocks increases, you feel

wealthier and spend more.

Fall in housing prices led to falling C.

5-39

Permanent Income Hypothesis

Idea proposed by Milton Friedman, a prominent

conservative economist in the late 20th century.

People gear their consumption to their expected lifetime

average earnings more than to their current income.

•

Apparently there are quite a few deviations from the behavior

predicted by the permanent income hypothesis.

5-40

Why Do We Spend So Much and Save So

Little?

Americans have been on a spending binge for the last

30 years.

•

•

Government policies encouraged consumption:

Mortgage interest and property taxes are tax-deductable.

The tremendous expansion of bank credit cards, installment

credit, and consumer loans has further fueled the consumer

binge.

Savings as Percentage of GDP, 1959-2009

Source: Survey of Current Business, March 2010.

5-41

Why does it matter?

Every economy depends on saving for capital formation.

Individual saving + business saving + government saving

= Total Saving

•

•

•

Until the recession of 1981–82, as a nation we generally saved

about 20 percent of U.S. GDP.

Declines in household saving has been offset somewhat from

1993 – 2000 by a sharp rise in government saving and business

saving.

Since 2001, government savings have declined.

Since Americans were not saving enough, we have

needed to borrow almost $2 billion a day from foreigners.

5-42

Current Issue: The American Consumer:

World Class Shopper

The consumer is the prime

mover of our economy and

increasingly, that of the world

economy as well.

The American consumer made

the Japanese recovery

possible after World War II.

The American consumer has

made China’s economic growth

of about 10% over the last 20

years possible.

The negative aspect of this is

our tremendous trade deficits

with much of the rest of the

world.

Private Consumption as a Percentage

of GDP, Selected Countries, 2008

Sources: CEIC; OECD; World Bank.

5-43

Questions for Thought and Discussion

What motivates consumption and what do Americans

spend their money on?

How have American savings rates changed overtime?

What would be the consequences of present trends

continuing?

5-44