Applying for Financial Aid 2011-12

advertisement

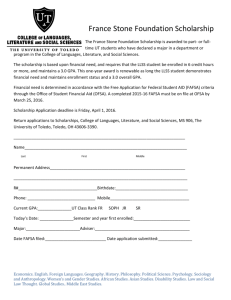

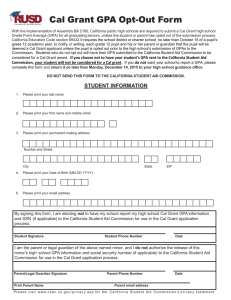

Applying for Financial Aid 2013-2014 What Will You Learn Today? • • • Types and sources of financial aid • Answers to your individual questions Required financial aid application forms How to complete the Free Application for Federal Student Aid (FAFSA) and the Cal Grant GPA Verification Form 2 Types of Financial Aid • Gift Aid - Grants or scholarships that do not need to be repaid • Work - Money earned by the student as payment for a job on or off campus • Loans - Borrowed money to be paid back, usually with interest 3 Sources of Financial Aid • Federal government • State government • • Colleges and universities Private agencies, companies, foundations, and parents’ employers 4 Scholarship Resources Naviance Various Fastweb Under the Search “College” Engines tab Thursday siprep.org/ Scholarship Lunch counseling Workshops Cal Grants • Cal Grant A Entitlement Awards – for high school • Cal Grant B Entitlement Awards – for high school • Cal Grant C Awards - for students from low income • CHAFEE GRANT seniors and recent high school grads with a Grade Point Average (GPA) of at least 3.0, family income and assets below the state ceilings, who demonstrate financial need seniors and recent high school grads with a GPA of at least 2.0, who come from disadvantaged or low income families, whose family income and assets are below the state ceilings, and who demonstrate financial need families pursuing vocational programs of study 6 2013-2014 Cal Grant Application Requirements Free Application for Federal Student Aid (FAFSA) Cal Grant GPA Verification Form Check with your high school or college counselor for more details on how to file the Cal Grant GPA Verification Form 7 Possible Cal Grant and Federal Pell Maximum Awards If you qualify for Cal Grant, amounts vary depending on the school that you attend, your financial need, your year in college and your enrollment status (full or part-time). If you qualify for the Federal Pell Grant, amounts vary depending on your family contribution and your enrollment status (full or part-time). Other eligibility requirements may apply. Cal Grant* (Up to $12,192) 1 FAFSA or California Dream Act Application 2 Your GPA 3 Apply by March 2 + Federal Pell Grant (up to $5,550) 1 FAFSA = Up to $17,742 maximum annually * Check for eligible schools at: www.csac.ca.gov 8 LOANS Direct Subsidized Loan • 3.4% fixed interest rate • 1st Year Max- $3,500 Perkins Loan • 5.5% fixed interest rate • 1st Year Max - $5,500 • Students with exceptional financial need Direct Unsubsidized Loan • 6.8% fixed interest rate PLUS loan • Loan for parents for undergraduates and graduate students • No adverse credit history • 7.9% fixed interest rate • Total Max: Cost of Attendance Forgiveness • Teacher • Public Service Jobs over 120 www.studentloans.gov 9 Loan Limits Direct Stafford Loan Limits (Subsidized and Unsubsidized) Undergraduate students Dependent1 Independ ent2 1st-year $5,500 ($3,500)3 $9,500 ($3,500) 2nd-year $6,500 ($4,500) $10,500 ($4,500) 3rd- and 4thyear $7,500 ($5,500) $12,500 ($5,500) Aggregate $31,000 ($23,000) $57,500 ($23,000) Graduate students $20,500 for each year $138,5005 ($65,500) 1Except those whose parents are unable to borrow a PLUS loan. limits also apply to dependent students whose parents are unable to borrow a PLUS loan. 3The numbers in parentheses represent the maximum amount that may be subsidized. 2These 10 Types of Applications • • • FAFSA Cal Grant GPA Verification Form Other applications or forms as required by the college such as: • • • CSS/Financial Aid PROFILE Institutional Scholarship and/or Financial Aid Application 2012* federal tax returns (along with all schedules and W-2s) or other income documentation *Ok to use 2011 tax returns to estimate 11 CSS PROFILE is an online application REQUIRED by almost 400 colleges and scholarship programs to award financial aid from sources outside of the federal government (campus specific aid). Who Must File Not all colleges and scholarship programs require the PROFILE. Check with the ones you’re interested in at www.profile.collegeboard.corg NOTE *All parental units are required to fill out the CSS Profile *It is a lengthy application with various deadline for submission *It is NOT FREE -- $25 for the application and $16 for each additional school report. *Fee Waivers are available through the CSS Profile – but only covers…the application fee and 6 school reports *Further documents may be requested by individual colleges. 12 SCAM ALERT…. Did I go on the wrong website?! 13 Scholarship Scams Fees No Work Involved Credit Card Info “Exclusive” Scholarships Pressure Tactics 14 Federal PIN • • • • PIN (Personal Identification Number) serves as the electronic signature on ED documents Both student and one parent need PINs to sign the FAFSA electronically May be used to: • Check on FAFSA status • Verify and correct FAFSA data • Add additional schools to receive FAFSA data • Change home and e-mail addresses If an e-mail address is provided, PIN will be e-mailed to the PIN applicant within minutes Apply for student and parent PINs at: www.pin.ed.gov 15 Parent E-mail Address • Provide a parent e-mail address that will be valid at least until the student starts college • If a parent provides an e-mail address, the FAFSA processor will let them know the student’s FAFSA has been processed 16 Student Name • • The FOTW will ask for the student’s first and last names Make sure to report the student’s name exactly as it appears on the student’s Social Security card 17 Student Social Security Number • • Double check the student’s Social Security Number when entering it on the FOTW. Both student name and Social Security Number will be compared through a database match. 18 Student Citizenship Status • • If U.S. citizen, status will be confirmed by Social Security match If eligible noncitizen, status will be confirmed by Department of Homeland Security (DHS) match. This includes: • • U.S. permanent residents with I-551 Conditional permanent residents with I-551C • The holder of an Arrival-Departure Record (I-94) from the Department of Homeland Security showing any of the following designations: “Refugee,” “Asylum Granted,” “Parolee” (I-94 confirms paroled for a minimum of one year and status has not expired), T-Visa holder (T-1, T-2, T-3, etc.) or “Cuban-Haitian Entrant;” or The holder of a valid certification or eligibility letter from the Department of Health and Human Services showing a designation of “Victim of human trafficking.” A resident of the Republic of Palau (PW), the Republic of the Marshall Islands (MH), or the Federated States of Micronesia (FM) • • • Canadian-born Native American under terms of the Jay Treaty 19 Eligible Noncitizen If eligible noncitizen, write in the student’s eight- or nine-digit Alien Registration Number (ARN) • • Precede an eight-digit ARN with a zero Copy of the student’s Permanent Registration Card might be requested by the financial aid office If neither a citizen or eligible noncitizen, the student is ineligible for federal/state aid, but might still be eligible for institutional funds 20 Undocumented Students If the student is undocumented • and is applying to any California public college or university, check to see if he/she might be eligible for in-state tuition/fee costs • visit www.CalDreamAct.org to learn more about the new California Dream Act signed into law in 2011 • check with colleges and universities about CA Dream Act institutional financial aid and private scholarships and the timelines for applying • apply for all other private scholarships for which the student may be eligible • start inquiring in elementary, middle or high school to see if it is possible for younger students to become permanent residents For more information and a list of scholarships, go to www.latinocollegedollars.org http://www.maldef.org/assets/pdf/Scholarship_List_2010_2011.pdf www.finaid.org/otheraid/undocumented.phtml 21 Student Marital Status • The student should check his or her marital status as of the date the FAFSA on the Web is submitted • If the student is married or remarried, he or she will be asked to provide information about his or her spouse 22 Selective Service Registration • Male students who are between the ages of 18 and 25 years must be registered with Selective Service to receive federal and state aid • Answer “Register me” only if you are male, aged 18-25, and have not yet registered. • The student may also register by going to: www.sss.gov 23 Student Aid Eligibility Drug Convictions • Students who have never attended college since high school will not be asked any of the Drug Conviction questions • Students who indicate that they have attended college before will be asked if they have ever received federal student aid • If the answer is “yes,” students will be asked if they were convicted for the possession or sale of illegal drugs. Most students will answer ‘No” to this question and will not be asked any additional questions. • Even students who have been convicted of a drug offense while in college and receiving federal financial aid may still be eligible to receive federal financial aid. 24 Parents’ Educational Level Indicate highest level of schooling completed by the student’s biological or adoptive parents (for state award purposes only) • Use birth parents or adoptive parents - not stepparents or foster parents • This definition of parent is unique to these two questions 25 Grade Level in 2013-14 When the student begins the 2013-2014 school year, what will be his/her grade level? • Never attended college/1st year • Attended college before/1st year • 2nd year/sophomore • 3rd year/junior • 4th year/senior • 5th year/other undergraduate • 1st year graduate/professional • Continuing graduate/professional or beyond 26 Degree or Certificate Objective In the 2013-2014 school year, what degree or certificate will you, the student, be working on? • Some options are: - 1st bachelor’s degree - Associate degree (occupational or technical program) - Associate degree (general education or transfer program) - Graduate or professional degree 27 Determination of Student Dependency Status 28 Parent Demographics Who is considered a parent? – Biological or adoptive parent(s) – In case of divorce or separation, provide information about the parent and/or stepparent the student lived with more in the last 12 months – Stepparent (regardless of any prenuptial agreements) 29 Who is Not a Parent • Do not provide information on: – Foster parents or legal guardians • If the student is in foster care or has a legal guardian, he/she is automatically considered an independent student – Grandparents or other relatives are not considered parents unless they have adopted the student • If this is not the case, the student must attempt to get biological parental information • Colleges may use Professional Judgment to allow the student to file as independent 30 Parents’ Marital Status • Report your parents’ marital status as of today – – – – Married or remarried Single Divorced or separated Widowed • Depending on your parents’ answer to this question, they might be asked about the date of their marital status 31 Parent Household Size • Include in the parents’ household: • • • • the student parent(s) parents’ other dependent children, if the parents provide more than half their support or the children could answer “no” to every question in Section 3, regardless of where they live other people, if they now live with the parents and will continue to do so from 7/1/12 through 6/30/13, and if the parents provide more than half their support now, and will continue to provide support from 7/1/12 through 6/30/13 32 College Students in the Parent Household • • • Always include the student even if he/she will attend college less than half-time in 2013-2014 Include other household members only if they will attend at least half-time in 2013-2014 in a program that leads to a college degree or certificate Never include the parents NOTE: Some financial aid offices will require proof that other family members are attending college 33 Parents’ 2011 Tax Return Filing Status • The parents will be asked to provide information about their tax filing status for 2012: • If parents have completed a 2012 federal income tax return, select “Already completed” • If they have not as yet filed, but plan to file a 2012 federal income tax return, select “Will file” • If they have not, nor will not, file a 2012 federal income tax return and are not required to do so, select “Not going to file” 34 IRS Data Retrieval • This question asks if parents have completed their 2012 IRS income tax return • If parent(s) answer “Already completed,” they will be given the option to transfer their 2012 income tax information directly from IRS records to the FOTW • If parents indicate that they have recently filed their 2012 taxes, they may not be able to access their IRS data if they have filed taxes electronically within the last two weeks or by mail within the last eight weeks • Instead, they should use their actual 2012 IRS tax return to complete the FOTW so the student does not miss any important financial aid deadlines 35 Parent 2012 Adjusted Gross Income • • • If the student’s parents have not yet filed their 2012 federal tax return, use estimated 2011 information for this question The “Income Estimator” on the FOTW may help you calculate this amount If the student’s parents have completed their 2012 federal tax return, use actual 2012 tax return information to complete this item if they are not eligible to use the IRS Data Retrieval process 36 AGI on the 1040 form 37 Money Earned from Work by Parent(s) in 2012 Use W-2 forms and other records to determine all income in 2012 earned from work (including business income earned from self-employment) for father/stepfather and/or mother/stepmother 38 Parent Dislocated Worker • The student will be asked to check if the father/stepfather and/or mother/stepmother is a dislocated worker • A person may be considered a dislocated worker if he or she: • is receiving unemployment benefits due to being laid off or losing a job and is unlikely to return to a previous occupation • has been laid off or received a lay-off notice from a job • was self-employed but is now unemployed due to economic conditions or natural disaster • is a displaced homemaker 39 Parents’ Household 2011 or 2012 Benefits Received Indicate if the student, his/her parents, or anyone in the parents’ household received benefits in 2011 or 2012 from any of the federal programs listed •Supplemental Security Income (SSI) •Food Stamps or SNAP •Free or Reduced Price School Lunch •Temporary Assistance for Needy Families (TANF) •Special Supplemental Nutrition Program for Women, Infants and Children (WIC) •None of the above 40 Parents’ 2012 U.S. Income Taxes • Enter the amount of parents’ income tax for 2012? – Use U.S. income tax paid (or to be paid), not the amount withheld from parents’ paychecks 41 Income Tax info on 1040 42 2012 Additional Financial Information The student will be asked to report if his or her parents received or paid any of the following items in 2012 (check all that apply) • • • • • • American Opportunity, Hope or Lifetime Learning tax credits Child support paid Taxable earnings from work-study, assistantships, or fellowships Taxable grant and scholarship aid reported to the IRS Combat pay or special combat pay Cooperative education program earnings 43 2012 Parent Untaxed Income • The student will be asked to report if his or her parents had any untaxed income in 2012. Check all that apply. Some examples of the most common items are: • Payments to tax-deferred pension and savings plans such as 401K, IRA deductions, and payments to selfemployed SEP and Keogh • Child support received • Tax exempt interest income • Housing, food and other living allowances paid to members of the military and clergy 44 Parent Asset Information Parents may be asked to report their assets. If so: • List the net value of your parents’ assets as of the day you complete the FAFSA • If net worth is one million dollars or more, enter • If net worth is zero, enter 0 999,999 0 NOTE: Some financial aid offices may request supporting documentation for the answers to these questions 45 Parent Assets • • • • Some parents may be asked to report the current balances of their cash, savings, and checking accounts as of the day they complete the FAFSA They may also be asked to provide information about the net value of their investments such as real estate, rental property, money market and mutual funds, stocks, bonds and other securities In addition, they may be asked questions about the net value of their businesses and investment farms They should not include the home in which they live, the value of life insurance and retirement plans, or the value of a family-owned and controlled small business 46 Student Information Wages Assets Untaxed Income 47 School Selection • The student will be asked to select the housing plan that best describes the type of housing the student expects to have while attending each listed school • The choices for housing are: • On Campus • With Parent • Off Campus • The student’s choice of housing may affect the amount of financial aid for which he/she is eligible. It is usually more expensive to live on or off campus than with parents or relatives • Remember, selecting the On Campus housing option is not an application for On Campus housing. Check with the colleges/ universities for housing information when you apply for admission 48 School Selection • FAFSA on the Web allows the student to list up to 10 colleges/universities that will receive his/her student and parent information • The student should list first the California school he/she is most likely to attend • The student may re-order his/her school choices • Then list other schools to which the student is applying for admission • NOTE: Each UC and CSU campus must be listed separately 49 Special Circumstances • Contact the Financial Aid Office if there are circumstances which affect a family’s ability to pay for college such as: – Loss or reduction in parent or student income or assets – Death or serious illness – Natural disasters affecting parent income or assets such as the recent California wind storms, wild fires, floods, or mudslides – Unusual medical or dental expenses not covered by insurance – Reduction in child support, Social Security benefits or other untaxed benefit – Financial responsibility for elderly grandparents, or – Any other unusual circumstances that affect a family’s ability to contribute to higher education 50 What Happens Next? Students and the colleges the student listed receive Student Aid Report (SAR) from federal processor Students who complete FAFSA and Cal Grant GPA Verification Form receive California Aid Report (CAR) Students and families review SAR and CAR for important information and accuracy of data Colleges match admission records with FAFSA and other required financial aid forms to determine aid eligibility Colleges mail notices of financial aid eligibility to admitted students who have completed all required financial aid forms 51 Check Your Cal Grant Open a WebGrants Account and you can: - Check your Cal Grant award status 24/7 - Make changes to your Cal Grant school choices - View how much a Cal Grant is worth at different California colleges and universities - See your Cal Grant payment history Sign up at: webgrants4students.org 52 Budgeting and Comparing Net Price Calculator Studentaid.gov Budget Calculator 53 If You Need Help at Any Time • FAFSA on the Web – Live Help • Phone 1-800-4-FED-AID (1-800-433-3243) • E-mail the U.S. Department of Education at: FederalStudentAidCustomerService@ed.gov • California State Aid Commission 54 Scholarships Apply Broadly Grants Cost of Attendance Exchange Programs WUE Scholar Share Net Price Calculator Student Jobs FREQUENTLY ASKED QUESTIONS & WARNINGS Do I have to file FAFSA, CSS Profile and Cal Grant every year? Do I have to maintain a certain GPA to keep my financial aid? What if my parent(s) do not have a social security number? If I have questions later who do I go to? When can I stop using my parent(s) financial information? Frequent Mistakes ??? Income Tax Paid is different than Taxable Income 56 Application Filing Tips - FAFSA on the Web • Complete a FAFSA on the Web available at: • Allow ample time to complete the online FOTW application for submission by the deadline • • • Check the FAFSA on the Web for accuracy prior to submission • • Print out a copy of the FAFSA before submitting data www.fafsa.ed.gov Save all work periodically Sign the application using student’s and one custodial parent’s PINs Keep a copy of the Submission Confirmation Page 57 Questions and Answers 58 59