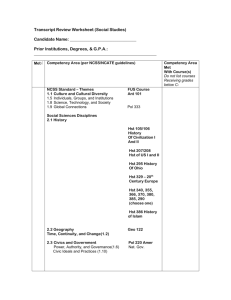

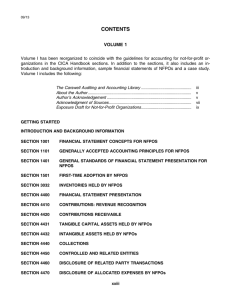

Ex. 5 Journalizing HST – General Journal

advertisement

Journalizing HST – General Journal: Ex. 5 p. 201 (t), p. 103 (w) Journalize these transactions in a twocolumn general journal, using the accounts shown below. The rate for HST is 13%. The next page number in the journal is 7. Transactions 4 Sales Invoice No. 571, to R. Chevrier for photo services, $275.00 plus HST of $35.75, total $310.75 What accounts are affected? • A/R- R. Chevrier will be debit (asset increase) • Fees Earned will be credit (Revenue increase) • HST Payable will be credit (collected from customer) Page 7 2012 Date Account Title & Explanation Nov 4 A/R- R. Chevrier Fees Earned P R Debit 3 1 0 75 Credit 2 7 5- HST Payable To record sale on account 3 5 75 Debit accounts Listed First 6 Purchase Invoice No. 7943, from Black’s Photo for photo supplies, $265.00 plus HST of 34.45, total $299.45 What accounts will be affected? • Photo Supplies will be debited (assets increase) • HST Recoverable will be debited (paid HST on asset) • A/P- Black’s Photo will be credited (purchased on account) Page 7 2012 Date Account Title & Explanation Nov 4 A/R- R. Chevrier Fees Earned P R Debit 3 1 0 75 2 7 5- HST Payable To record sale on account 6 Photo Supplies HST Recoverable A/P- Black's Photo To record purchase of supplies on account Credit 3 5 75 2653 4 45 2 9 9 45 9 Purchase Invoice No. 2332, from Jack’s Auto for regular maintenance of the company car, $175.00 plus HST of $22.75, total 197.75 What accounts will be affected? • Car Expense will be debited (expense increases) • HST recoverable will be debited (recover tax for business) • A/P- Jack’s Auto will be credited (paid on account) Page 7 2012 Date Account Title & Explanation Nov 4 A/R- R. Chevrier Fees Earned P R Debit 3 1 0 75 Credit 2 7 5- HST Payable To record sale on account 3 5 75 6 Photo Supplies HST Recoverable A/P- Black's Photo To record purchase of supplies on account 2653 4 45 9 Car Expense HST Recoverable A/P- Jack's Auto To record car expense on account 1752 2 75 2 9 9 45 1 9 7 75 10 Cheque Copy No. 652, issued to the owner for his own use, $925.00 What accounts will be affected? • W. Seibert, drawings will be debited (owner’s equity decreases) • Bank will be credited (assets decreases) Page 7 2012 Date Account Title & Explanation 10 W. Siebert, Drawings Bank To record owner withdrawal P R Debit 9 2 5- Credit 9 2 5- 12 Cash Sales Slip No. 214, for photo work performed, $145.00, plus HST of $18.85, total $163.85 What accounts will be affected? • Bank will be debit (asset increases) • Fees earned will be credited (Revenue increases) • HST Payable will be credited (Collected from customer) Page 7 2012 Date Account Title & Explanation 10 W. Siebert, Drawings Bank P R Debit 9 2 5- Credit 9 2 5- To record owner withdrawal 12 Bank Fees Earned HST Payable To record sale for cash 1 6 3 85 1 4 51 8 85 15 Bank Debit Memo From Commercial Bank for bank service charges, $35.50, which are HST exempt What accounts will be affected? • Bank Charges Expense (expense increases) • Bank will be credited (asset decreases) Page 7 2012 Date Account Title & Explanation 10 W. Siebert, Drawings Bank P R Debit 9 2 5- Credit 9 2 5- To record owner withdrawal 12 Bank Fees Earned HST Payable To record sale for cash 15 Bank Charges Expense Bank To record bank service charges 1 6 3 85 1 4 51 8 85 3 5 50 3 5 50 22 Cash Receipt Remittance Slip No. 312, showing the receipt of $412.00 from H Walker on account. What accounts will be affected? • Bank will be debited (asset increases) • A/R- H. Walker will be credit (asset decreases) Page 8 2012 Date Account Title & Explanation Nov 22 Bank A/R- H. Walker P R To record payment received from H. Walker Debit 4 1 2- Credit 4 1 2- 23 Memorandum From the owner stating that he had taken $75.00 of photo supplies for his personal work at home What accounts will be affected? • W. Siebert, Drawings will be debited (Drawings increases) • Photo Supplies will be credited (assets decrease) Page 8 2012 Date Account Title & Explanation Nov 22 Bank A/R- H. Walker P R Debit 4 1 2- Credit 4 1 2- To record payment received from H. Walker 23 W. Siebert, Drawings Photo supplies To record photo supplies taken by owner 757 5- 25 Cheque Copy No. 653, paying for the supplies purchased above on November 6. What accounts will be affected? • A/P- Black’s Photo will be debited (liabilities decreases) • Bank will be credited (assets decrease) Page 8 2012 Date Account Title & Explanation Nov 22 Bank A/R- H. Walker P R Debit 4 1 2- Credit 4 1 2- To record payment received from H. Walker 23 W. Siebert, Drawings Photo supplies To record photo supplies taken by owner 75- 25 A/P- Black's Photo Bank To record payment to A/P- Black's Photo 2 9 9 45 7 5- 2 9 9 45 28 Purchase Invoice No. 55521, received from Oakley Motors for body repairs on the business automobile, $750.00 plus HST of $97.50, total $847.50 What accounts will be affected? • Car expense will be debited (expenses increase) • HST Recoverable will be debited (pay HST) • A/P- Oakley Motors will be credited (liabilities increase) Page 8 2012 Date Account Title & Explanation Nov 22 Bank A/R- H. Walker P R Debit 4 1 2- Credit 4 1 2- To record payment received from H. Walker 23 W. Siebert, Drawings Photo supplies To record photo supplies taken by owner 75- 25 A/P- Black's Photo Bank To record payment to A/P- Black's Photo 2 9 9 45 28 Car Expense HST Recoverable A/P- Oakley Motors 7509 7 50 7 5- 2 9 9 45 8 4 7 50