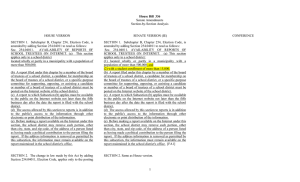

HB26-SAA - Texas Legislature Online

advertisement