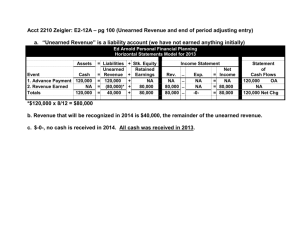

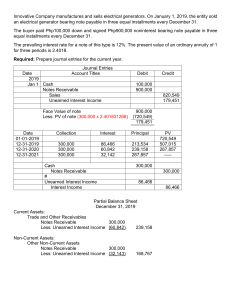

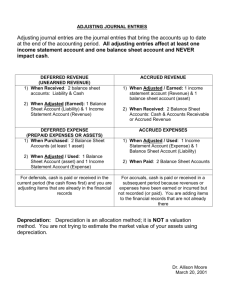

ACCRUED REVENUE AND DEFERRED REVENUE 1. Revenue Earned before Cash Collection Accrued revenue refers to a situation where the goods or services have been delivered to the client but the payment for the same has not been received. Accrued revenue journal entries are passed and accounted under the amount receivables in the balance sheet of the company to reflect the value that their clients owe them. Accrued revenue is income that a company has earned but for which it has not yet received payment. This type of revenue occurs when a company performs a service or delivers a product before it bills the customer. In accounting terms, it is considered to be an asset until the company invoices the customer and receives payment. For example, a company might provide consulting services to a client in December, but not issue an invoice until January of the following year. In this case, the company would record the revenue as “accrued” in December and recognize it as “received” in January, when the invoice is paid. Another example is a SaaS company that offers a subscription-based service for a monthly or annual fee. If a customer subscribes to the service in December, but doesn’t pay the annual fee until January of the following year, the business would record the revenue as “accrued” in December and would not recognize it as “received” until January, when the payment is made. When does Accrued Revenue Occur? Accrued revenue must be booked when there is a mismatch between the time of payment and delivery related goods/services. This can happen in cases such as: Loans: When a company loans money to other businesses or individuals; Long-term Projects: When in long-term projects revenue is booked based on 'percentage of completion' method; Milestones: When there is a large order and revenue is booked based on milestones met. Accounting Treatment of Accrued Revenue Accrued revenue is recognized as an asset on the balance sheet, because it represents revenue that has been earned but not yet received. Since the company has provided goods or services associated with the revenue, its obligation is met, which means it can count the accrued revenue as an asset, rather than a liability. Accrued revenue is considered a current asset because it is expected to be collected within one year or less. And in income statement it is recorded as Revenue or sales. Accrued revenue vs. Accounts receivable Accrued revenue and accounts receivable are both related to revenue that a company has earned but has not yet received payment for, but they represent different stages in the revenue recognition process. Accrued Revenue Accrued revenue is money your company has earned but hasn't yet billed the customer for. It goes on the balance sheet as a current asset. In accrual-basis accounting, companies are allowed to record revenue on their income statement as soon as they have done everything required to earn it. If you do a Rs.100 job for someone, you can "book" the revenue as soon as the job is done, before you even send a bill. Revenue flows from the income statement to the balance sheet, and in the case of unbilled revenue, it flows to accrued revenue. Account Receivable Accounts receivable represents revenue that has been both earned and billed but not yet received. Say you did a Rs.100 job and immediately added Rs.100 to accrued revenue. Now you do your billing and actually send the customer an invoice. Once the customer is billed, the Rs.100 becomes an account receivable. On the balance sheet, Rs.100 shifts from accrued revenue to accounts receivable, another current asset. You still don't have cash in hand, but you're farther along toward getting it. Once the customer pays, you'd shift Rs.100 from accounts receivable to your cash balance. 2. Revenue Earned after Cash Collection Unearned Revenue or Deferred Revenue Unearned Revenue refers to customer payments collected by a company before the actual delivery of the product or service. The recognition of unearned revenue relates to the early collection of cash payments from customers. According to the revenue recognition principle established under accrual accounting, a company is not allowed to recognize revenue on its income statement until the product or service is delivered to the customer. In the case of unearned revenue, since the customer has yet to receive the benefits associated with their payment, the revenue is recorded as “Deferred Revenue” on the company’s balance sheet. Once the transaction is completed – i.e. the company fulfills its obligation to deliver the product or service the customer already paid for – the payment is at that point formally recognized as revenue because it is now “earned”. Per accrual accounting reporting standards, revenue must be recognized in the period in which it has been “earned”, rather than when the cash payment was received. Common examples of scenarios in which unearned revenue is recorded are the following: Unused Gift Cards Annual or Multi-Year Subscription Plans Insurance Premium Payments Prepayment on Rent Future Service Agreements with Product Purchases Implied Rights to Future Software Upgrades Suppose a SaaS company has collected upfront cash payment as part of a multi-year B2B customer contract. Initially, the total amount of cash proceeds received is not allowed to be recorded as revenue, despite the cash being in the possession of the company. From the date of initial payment, the payment is recorded as revenue on a monthly basis until the entirety of the promised benefits is confirmed to have been received by the customer. Any remaining amount of unearned revenue from month to month is recorded on the balance sheet in the “Deferred Revenue” line item, which represents the value of all cash collections ahead of the actual delivery of products/services. Is Unearned Revenue a Liability? Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and thus has unfulfilled obligations to their customers as a result. Unearned revenue is treated as a liability on the balance sheet because the transaction is incomplete. More specifically, the seller (i.e. the company) is the party with the unmet obligation instead of the buyer (i.e. the customer that already issued the cash payment). Current Liability: If the terms associated with the prepayment are expected to be taken care of within twelve months, then the unearned revenue is recorded as a current liability. Non-Current Liability: If the payment is received in advance for delivery after more than twelve months – e.g. a multi-year contract – the amount where delivery is not expected within the current year is recorded in the non-current liability section of the balance sheet. Certain contracts and customer agreements can also contain provisions stating contingencies where an unexpected event can provide the customer with the right to receive a refund or cancel the order. What is the Difference Between Unearned Revenue vs. Accounts Receivable? While unearned revenue refers to the early collection of customer payments, accounts receivable is recorded when the company has already delivered products/services to a customer that paid on credit. The concept of accounts receivable is thereby the opposite of deferred revenue, and A/R is recognized as a current asset. In the case of accounts receivable, the remaining obligation is for the customer to fulfill their obligation to make the cash payment to the company in order to complete the transaction. Unearned Revenue Journal Entry Accounting (Debit, Credit) Unearned revenue is not recorded on the income statement as revenue until “earned” and is instead found on the balance sheet as a liability. Over time, the revenue is recognized once the product/service is delivered (and the deferred revenue liability account declines as the revenue is recognized). For example, imagine that a company has received an early cash payment from a customer of Rs.10,000 payment for future services as part of the product purchase. Debit Credit Cash Rs.10,000 – Unearned Revenue – Rs.10,000 We see that the cash account increases, but the unearned revenue liability account also increases. If the service is eventually delivered to the customer, the revenue can now be recognized and the following journal entries would be seen on the general ledger. Unearned Revenue Revenue Debit Rs.10,000 – Credit – Rs.10,000 The unearned revenue account declines, with the coinciding entry consisting of the increase in revenue. CAPITALIZING AND EXPENSING What is Expensing? A cost is the expenditure required to create and sell products and services, or to acquire assets. When a cost is associated with an expenditure that is consumed at once, then it is charged to expense. When this happens, the expense is reported on the firm’s income statement. This process is referred to as expensing. During the period of expenditure, an expenditure that is expensed will reduce net income by the aftertax amount of the expenditure. No asset will be recorded on the balance sheet and therefore, no depreciation or amortization will occur in subsequent periods. The lower amount of net income is reflected in lower retained earnings on the balance sheet. The expense will appear as an operating cash outflow in the period in which it is made, and there will be no effect on the financial statements of subsequent periods. Expensing a cost in the current period will reduce current period profits but enhance future profitability and the profit trend. Profit trend-enhancing motivations should, therefore, be considered when analyzing financial performance. What is Capitalizing? If an expenditure is expected to be consumed over a longer period of time, then it can be capitalized, in which case it appears as an asset on the company’s balance sheet. Capitalization means that the recognition of a cost as an expense is deferred until a later period. This process is referred to as capitalizing. During the period of expenditure, an expenditure that is capitalized will increase the amount of assets reported on the balance sheet and will appear as an investing cash outflow on the statement of cash flows. In subsequent periods, the company will allocate the capitalized amount over the asset’s useful life as depreciation or amortization expense. This expense will reduce the net income on the income statement. Aside from this, it will reduce the value of the asset reported on the balance sheet. Depreciation and amortization expenses are non-cash in nature and therefore, apart from their effect on taxable income and taxes payable, have no impact on the cash flow statement. Therefore, capitalizing an item of expenditure will enhance current profitability and increase reported cash flow from operations. This profitability-enhancing effect will continue as long as capital expenditures exceed the depreciation expense. Profitability-enhancing motivations for decisions to capitalize should, therefore, be considered when analyzing a company’s financial performance. Comparing Expensing and Capitalizing Expensing is only applied when an expenditure is consumed at once, while capitalizing is applied when consumption occurs over a longer period of time. Another difference is that a lower cap is usually imposed on the amount that can be capitalized, which is not the case when expenditures are charged to expense. A third difference is that the immediate impact of expensing is on the income statement, while the immediate impact of capitalizing is on the balance sheet. Examples of Costs Being Expensed A business pays compensation to its employees in exchange for the work they perform for it. This compensation cost is consumed within the reporting period, and so is expensed. It cannot be capitalized, because there is no discernible future economic value associated with the payments. As another example, the accounting department pays Rs.200 for check stock, which it will use over the next few months to issue payments to its suppliers. Even though there is some future economic value associated with these checks, their cost is so low that they fall below the company’s capitalization limit, and so are charged to expense in the current period. Examples of Costs being Capitalized A business buys a delivery van for Rs.50,000, and for which it expects to have a five-year useful life. Based on this information, the expenditure is recorded as a fixed asset, and is depreciated over five years. As another example, a new wing is built onto a company’s corporate headquarters, at a cost of Rs.2 million. This amount is fully capitalized as a separate fixed asset over the expected 30-year life of the constructed asset, with depreciation occurring over the full 30-year period. In both of the cost capitalization examples, the amount capitalized is gradually being charged to expense, but over a much longer period of time than if they had been expensed at once.